Riding Boots Market Size

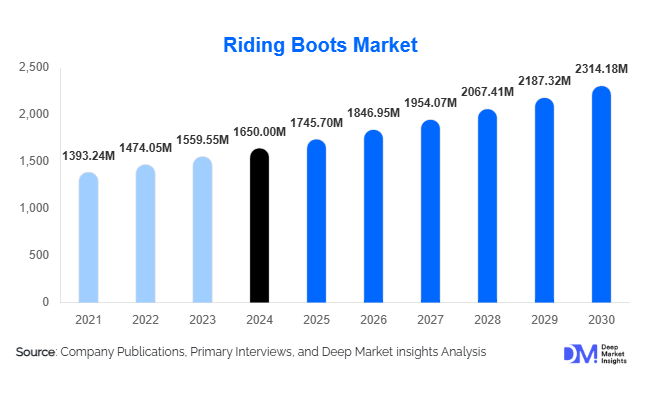

According to Deep Market Insights, the global riding boots market size was valued at USD 1,650 million in 2024 and is projected to grow from USD 1,745.70 million in 2025 to reach USD 2,314.18 million by 2030, expanding at a CAGR of 5.8% during the forecast period (2025–2030). Market expansion is driven by rising safety awareness among riders, growth in adventure and touring motorcycling, expanding online distribution channels, and increasing demand in Asia-Pacific as two-wheeler ownership and leisure riding grow.

Key Market Insights

- Sports & race-oriented boots remain the single largest product type, capturing most unit value due to premium pricing and strong demand from professional and enthusiast riders.

- Offline specialist retail still dominates distribution, because proper fit, expert advice, and trialing are critical for rider safety and comfort, though online channels are the fastest growing.

- Europe and North America represent the largest shares of the market in absolute value, driven by premium brand adoption and motorsport culture.

- Asia-Pacific is the fastest-growing region, supported by rising disposable incomes, expanding motorcycle leisure markets, and improved e-commerce reach into tier-2/3 cities.

- Premiumization and technology integration (smart sensors, advanced composites, eco-materials) are increasing ASPs and margins for leading brands.

- Sustainability and female-specific product lines are important emerging trends, reshaping product development and marketing focus.

Latest Market Trends

Premiumization & Performance-Focused Product Development

Leading manufacturers are increasingly positioning riding boots as performance products rather than simple footwear. This translates into investments in advanced impact-protective plates, CE-rated reinforcements, improved ankle support systems, vibration-dampening soles, and multi-layer abrasion-resistant textiles. These technical upgrades allow premium boots to command higher retail prices and appeal strongly to enthusiast and professional rider segments. The trend is also visible as lifestyle brands collaborate with motorsport teams for co-branded premium lines that drive aspirational purchasing.

Growth of Direct-to-Consumer (D2C) and Omni-Channel Retail

Although specialist brick-and-mortar dealers remain essential for fit and advice, brands are moving to hybrid retail models: robust e-commerce platforms, virtual fit tools, and click-and-collect services. D2C gives brands control over margin and customer data, while omni-channel strategies preserve the in-store experience. The online channel is particularly effective for reaching new rider demographics in emerging markets and for scaled distribution of mid-price and economy segments.

Sustainability & Material Innovation

Manufacturers are expanding the use of sustainable alternatives vegan leathers, recycled textiles, and lower-carbon tanning processes, to meet consumer expectations and regulatory pressures. Sustainability claims also serve premium positioning for eco-conscious riders, with brands emphasizing traceability, reduced waste manufacturing, and longer-life products to justify higher MSRP and support circular business models such as repair programs and take-back schemes.

Riding Boots Market Drivers

Rising Safety Awareness and Protective Gear Adoption

Greater awareness of rider safety and stricter enforcement of safety standards in many markets are pushing riders to upgrade from casual footwear to certified riding boots. Insurance considerations, motorsport regulations, and public safety campaigns have increased the perceived value of certified protective boots with ankle, shin, and sole reinforcement. This driver is boosting demand in not only sports/racing segments but also commuter and touring categories as more everyday riders seek better protection.

Growth of Adventure & Touring Motorcycling

Adventure and long-distance touring have become major growth engines for riding-gear consumption. Riders participating in multi-day tours or off-road expeditions demand durable, weather-resistant, and comfortable boots that can perform in diverse conditions. Manufacturers are responding with modular boots, breathable yet waterproof membranes, and improved sole ergonomics. The expansion of adventure motorcycle models from OEMs is feeding the aftermarket demand for premium touring/adventure boots.

Expanding Online Sales & New Rider Demographics

E-commerce and broader digital marketing have lowered the barrier to brand discovery and made specialty boots accessible to riders in regions previously underserved by specialist stores. Younger riders, female riders, and new-to-motorcycling demographics are entering the market via online channels, accelerating ing adoption of product variants tailored to fit, design, and price point preferences.

Market Restraints

High Cost of Premium Riding Boots

Top-end riding boots incorporate expensive materials and certification testing, leading to high retail prices. This cost barrier reduces penetration in price-sensitive markets and among entry-level riders. While mid-tier offerings exist, many riders delay purchases or choose multi-purpose footwear instead of certified boots, limiting near-term growth in developing regions.

Raw Material Price Volatility and Supply-Chain Challenges

Leather, composite protection plates, and technical textiles are subject to supply fluctuations and price volatility. Disruptions, whether from raw material shortages or logistics constraints, can delay launches and increase production costs, pressuring margins. Smaller manufacturers without diversified suppliers are particularly vulnerable.

Riding Boots Market Opportunities

Regional Expansion: Asia-Pacific and Tier-2/Tier-3 Cities

Rapidly rising disposable incomes and growing leisure motorcycling in India, China, and Southeast Asia create a large addressable market. Brands that localize products (size, climate-appropriate linings, price points), expand after-sales service, and partner with local OEMs or retail chains can capture high volume growth. The commuter segment also provides pathways for scaled penetration: affordable protective commuter boots can convert daily riders into safety-conscious customers.

Smart & Connected Boots

Integration of electronics impact sensors, fall detection, haptic feedback for navigation, or health/biometric monitoring presents differentiation and high-margin product opportunities. Early movers can partner with electronics firms or tier-1 motorcycling brands to create validated use-cases (e.g., automatic emergency alerts after crash detection). Though adoption is nascent, smart boots align with growing interest in rider safety technology and connected vehicle ecosystems.

Female-Specific & Inclusive Sizing Strategies

Female riders and riders with non-standard sizing have been underserved relative to market growth. Brands that offer gender-specific fit lines, targeted design, and marketing that normalizes female participation can unlock a sizeable, loyal segment. Inclusive sizing and improved last shapes also help increase conversion rates, especially through online channels where fit uncertainty is a top barrier.

Product Type Insights

Product segmentation ranges from sport/race boots through touring, adventure, and urban/casual riding boots. Sports & race boots represent the largest value share due to premium pricing and technical content. These boots are engineered for maximum protection and are high-margin. Cruising & touring boots are gaining share driven by long-ride comfort and weather-proofing needs, while adventure/dual-sport boots are the fastest growing product type because of rising adventure motorcycle sales and the multi-terrain use case. Casual/urban riding boots and economy lines provide the volume base, especially in emerging markets where daily commuting is common.

Application Insights

Applications for riding boots include motorsports (professional and amateur racing), touring and adventure riding, daily commuting, and equestrian riding (specific boot variants). Photographic and content-driven touring (riders buying gear for travel content creation) is emerging as a niche. Safety-mandated applications (fleet, rider training academies, delivery services) are incremental markets in certain countries and can create steady B2B demand cycles for durable commuter boots.

Distribution Channel Insights

Offline specialist retail remains critical for initial market trust and proper fit services; however, online marketplaces and brand D2C stores are rapidly expanding their share. Hybrid strategies (virtual fitting tools, easy returns, in-store pick up) have proven most effective. OEM bundling (boots packaged with higher-end motorcycle purchases) and aftermarket partnerships also drive volume and awareness. Social media, influencer endorsements, and motorsport sponsorships materially influence demand in premium and enthusiast segments.

Traveler (Rider) Type Insights

Key buyer personas include professional racers and track enthusiasts (high ASP, performance requirements), weekend/enthusiast riders (mid to high ASP, style + function), daily commuters (volume buyers in emerging markets, price sensitive), and female riders (growing demographic requiring fit & style focus). Fleet and commercial buyers (delivery) create B2B demand for durable, low-cost commuter boots.

Age Group Insights

Riders aged 25–45 represent the largest market share. This group combines disposable income with active riding lifestyles. Younger riders (18–24) drive demand for trendier, lower-cost, lifestyle boots and are reachable via social channels; older riders (46+) often purchase premium comfort and touring products with safety and long-ride ergonomics in focus.

| By Product Type | By Application | By Distribution Channel | By Rider Type |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is a major market in absolute value, with a strong motorsport culture, high average selling prices for premium boots, and established retail networks. Riders typically prioritize certified protection and brand heritage. The region is important for product innovation and early adoption of smart features.

Europe

Europe is the largest single regional market by share and a trendsetter for premium, CE-certified protective equipment. Countries such as the UK, Germany, Italy, and France show strong demand for performance and touring boots. Strict safety standards and motorsport sponsorships help sustain premium pricing and strong brand loyalty.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by China, India, Japan, and Southeast Asia. High two-wheeler penetration, growing leisure riding communities, and rising spending power are creating a strong upside. This region is expected to contribute the largest incremental volumes over the forecast period.

Latin America

Latin America shows steady demand concentrated in Brazil and Mexico. Pricing sensitivity and lower per-capita spending mean opportunity lies in mid-tier and economy segments, plus niche premium demand from affluent riders.

Middle East & Africa

While smaller in absolute share, the Gulf Cooperation Council (GCC) countries show strong premium demand due to high purchasing power and lifestyle orientation. Africa contains pockets of demand for protective boots among motorcycle communities and increasing domestic tourism riders, but overall growth is constrained by purchasing power.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Riding Boots Market

- Alpinestars S.p.A.

- Dainese S.p.A.

- Fox Racing

- FLY Racing

- Gaerne S.p.A.

- TCX S.r.l.

- LeMans Corporation

- Parlanti Roma

- Ariat International

- Justin Brands (Justin Boots)

- Mountain Horse

- DeNiro Boot Company

- Tattini Boots

- Roper

- Horze (riding/equestrian-focused lines)

Recent Developments

- Industry shift to premium, tech-enabled products: Major manufacturers have rolled out updated touring and adventure boot ranges featuring improved ankle protection, breathable/waterproof membranes, and modular sole systems to address long-ride comfort and durability.

- Expansion of D2C & e-commerce: Several global brands have strengthened online stores, virtual fit experience, and improved logistics to serve emerging market demand remotely.

- Sustainability initiatives: A number of brands introduced eco-material lines and repair/take-back programs to reduce lifecycle impact and enhance brand appeal among eco-conscious riders.