Ride-On Mower Market Size

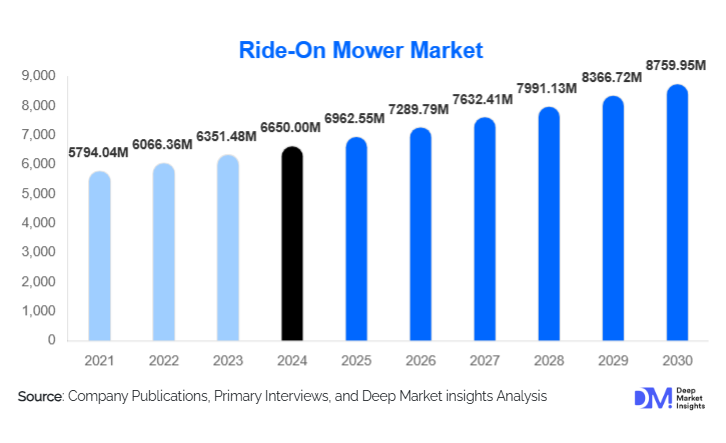

According to Deep Market Insights, the global ride-on mower market size was valued at USD 6,650 million in 2024 and is projected to grow from USD 6,962.55 million in 2025 to reach USD 8,759.95 million by 2030, expanding at a CAGR of 4.7% during the forecast period (2025–2030). The ride-on mower market growth is primarily driven by the increasing adoption of high-efficiency lawn-maintenance equipment, expansion of commercial landscaping services, and rising preference for battery-electric and zero-turn mower platforms across residential and professional applications.

Key Market Insights

- Zero-turn mowers continue to dominate global demand, driven by superior maneuverability and high productivity, especially for commercial landscaping firms.

- North America accounts for the largest share of the global market, supported by widespread lawn ownership, strong landscaping culture, and advanced dealer networks.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, expanding residential estates, and increasing investment in municipal green spaces.

- Battery-electric ride-on mowers are gaining traction as regulations tighten around emissions and noise, accelerating the shift toward cleaner, low-maintenance alternatives.

- Commercial landscaping is the leading end-use segment, reflecting rising outsourcing and fleet modernization among contractors.

- Technological integration—such as telematics, fleet management, and ergonomic automation— is transforming equipment performance, uptime, and operator efficiency.

What are the latest trends in the ride-on mower market?

Rise of Battery-Electric and Low-Emission Platforms

Manufacturers are rapidly expanding their battery-electric ride-on mower portfolios to address stricter emissions and noise regulations, especially in Europe and North America. Advances in lithium battery technology are enabling longer runtimes, fast charging, and high torque, making electric platforms increasingly viable for both residential and commercial applications. Municipal agencies and landscaping contractors are incorporating electric mowers into their fleets to meet sustainability goals, reduce operating costs, and lower maintenance downtime. Premium models now feature modular battery packs, smart power management, and enhanced safety systems, accelerating market penetration in developed regions.

Telematics and Smart Fleet Management Adoption

Connected ride-on mowers integrated with telematics, GPS tracking, and performance analytics are becoming mainstream in commercial landscaping and municipal fleets. These systems allow operators to monitor machine health, predict maintenance needs, optimize route planning, and track utilization rates. Data-driven maintenance scheduling improves equipment uptime and extends lifecycle value, making advanced connected systems a key differentiator for equipment manufacturers. Remote diagnostics and over-the-air updates are emerging capabilities, further improving operational efficiency and reducing downtime for high-volume landscaping businesses.

What are the key drivers in the ride-on mower market?

Expansion of Commercial Landscaping Services

The growing reliance on commercial landscaping services for residential estates, corporate campuses, retail centers, and hospitality properties is accelerating demand for high-performance ride-on mowers. Landscaping firms prioritize zero-turn models and large-deck machines that reduce labor time and improve service productivity. Frequent replacement cycles, fleet upgrades, and demand for ergonomic, durable equipment with low total cost of ownership continue to boost the commercial segment. Municipal parks departments, golf courses, and sports turf facilities also contribute significantly to equipment demand as urban green-space investment rises worldwide.

Increasing Emphasis on Efficient and Low-Labor Lawn Maintenance

Labor shortages in grounds-maintenance industries and rising consumer preference for time-saving yard solutions are driving the adoption of ride-on mowers over walk-behind units. Large residential property owners and estate managers value ride-on mowers for their efficiency, ease of operation, and ability to handle sizable lawns with reduced labor effort. Technological enhancements, including improved deck designs, hydrostatic drivetrains, and operator comfort features, make modern ride-on mowers more user-friendly, further supporting market growth.

What are the restraints for the global market?

High Upfront Costs of Premium Ride-On Models

Ride-on mowers, particularly commercial-grade zero-turn and large-deck models, require significant upfront investment compared to push or walk-behind mowers. This cost barrier limits adoption among cost-sensitive residential customers and small landscaping firms. The rise of battery-electric models further increases purchase prices due to expensive battery packs, slowing adoption in developing regions where affordability is a key consideration.

Battery and Charging Limitations for Electric Models

While electric ride-on mowers are expanding rapidly, runtime constraints, extended charging cycles, and limited charging infrastructure pose challenges, especially for large-acreage and high-frequency commercial applications. In emerging markets, inconsistent grid availability and limited service networks slow the transition from gasoline-powered to electric platforms. Battery replacement costs and lifecycle uncertainties also create hesitation among fleet operators.

What are the key opportunities in the ride-on mower industry?

Growth of Electric and Hybrid Mower Platforms

The transition toward sustainable outdoor power equipment presents significant opportunities for manufacturers to expand battery-electric and hybrid ride-on mower offerings. Government incentives, emission-reduction policies, and rising environmental awareness among homeowners and commercial operators fuel demand for low-emission alternatives. Innovations in fast charging, high-density batteries, and modular power systems enable manufacturers to capture premium segments with higher margins.

Emerging Market Expansion and Municipal Investments

Urban development across Asia-Pacific, Latin America, and the Middle East is generating substantial demand for lawn-care equipment. Investments in public parks, sports complexes, and institutional campuses create fertile ground for ride-on mower adoption. Tourism-driven landscaping, such as resorts, hotels, and golf courses, further enhances demand. Manufacturers that localize production, expand dealer networks, and offer cost-effective models can capture significant market share in these fast-growing regions.

Product Type Insights

Zero-turn mowers lead the global ride-on mower market due to their exceptional maneuverability, high cutting efficiency, and strong adoption by commercial landscapers. These premium models deliver reduced mowing time and improved precision, making them the preferred choice across residential estates and professional fleets. Lawn tractors and garden tractors maintain steady demand among homeowners requiring versatile, multi-attachment machines for mowing, hauling, and yard maintenance. Rear-engine riders cater to smaller residential properties with an affordable, compact solution. The shift toward large-deck and high-powered models reflects operator demand for high productivity and reduced labor time.

Application Insights

Commercial landscaping is the largest and fastest-growing application segment, driven by rising outsourcing of lawn maintenance, expansion of property-management firms, and demand for fleet-based solutions. Municipal and government agencies represent a rapidly expanding segment as cities invest in public parks, sports fields, and green belts requiring consistent maintenance. Residential applications remain substantial, particularly among large-property homeowners in North America and Europe, while golf courses and sports turf managers continue to invest in premium, high-precision equipment for professional groundskeeping.

Distribution Channel Insights

Dealer networks dominate the distribution landscape, especially for high-end and commercial-grade ride-on mowers requiring service support, financing options, and technical guidance. Big-box retail stores maintain a strong share in entry-level residential models, while online sales channels are expanding rapidly due to transparent pricing, direct-to-consumer strategies, and growing e-commerce penetration. Rental companies are emerging as a key channel, offering flexible access to premium machines for short-term landscaping projects and professional contractors.

End-User Insights

Commercial landscaping firms constitute the largest end-user group, purchasing ride-on mowers in fleet volumes to support routine maintenance of large properties. Municipal agencies represent a high-growth segment as public green-space expansion increases equipment needs. Residential end users continue to support strong volume sales in markets with high lawn ownership, while golf courses, resorts, and sports facilities generate stable demand for advanced large-deck machines with premium performance requirements.

| By Product Type | By Fuel Type | By Transmission Type | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, driven by widespread lawn culture, high disposable incomes, advanced landscaping industries, and strong dealer networks. The U.S. leads adoption of zero-turn and commercial-grade mowers, while Canada shows increasing interest in electric and low-noise solutions. Replacement cycles are frequent, and professional landscaping services drive significant fleet purchases across the region.

Europe

Europe is characterized by strong environmental regulations, accelerating demand for battery-electric ride-on mowers. Countries such as Germany, the U.K., and France lead adoption, supported by professional groundskeeping standards and investments in municipal green spaces. Eastern Europe is emerging as a new growth pocket driven by increasing landscaping activity and urban development.

Asia-Pacific

Asia-Pacific is the fastest-growing region, supported by rapid urban expansion, rising residential estates, and increasing investment in public parks and tourism landscapes. China and India are major demand engines, while Australia and Japan remain mature markets with strong preferences for premium models. Expanding service networks and local manufacturing initiatives further stimulate growth across the region.

Latin America

Demand in Latin America is rising gradually, primarily driven by landscaping needs in Brazil, Mexico, and Argentina. Commercial and hospitality-driven landscaping projects contribute to the growing adoption of mid-range and large-deck mowers. However, relatively high equipment costs and limited service infrastructure temper widespread adoption.

Middle East & Africa

MEA markets show steady growth, driven by landscaping development in the Gulf region, including parks, resorts, and large real-estate projects. Africa’s institutional demand—especially from golf courses, schools, and parks—is rising as governments invest in tourism and public infrastructure. However, affordability and distribution limitations constrain overall adoption.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Ride-On Mower Market

- Deere & Company

- The Toro Company

- Husqvarna Group

- Kubota Corporation

- Stanley Black & Decker (MTD Products)

- Ariens Company

- Briggs & Stratton

Recent Developments

- In May 2025, John Deere expanded its electric ride-on mower lineup, introducing high-capacity lithium models tailored for commercial fleets.

- In March 2025, Husqvarna launched a connected mower platform with integrated telematics and predictive maintenance capabilities targeting professional landscapers.

- In February 2025, Toro announced a new zero-turn series featuring hybrid powertrains designed to reduce fuel consumption and emissions.