Rice Water Shampoo Market Size

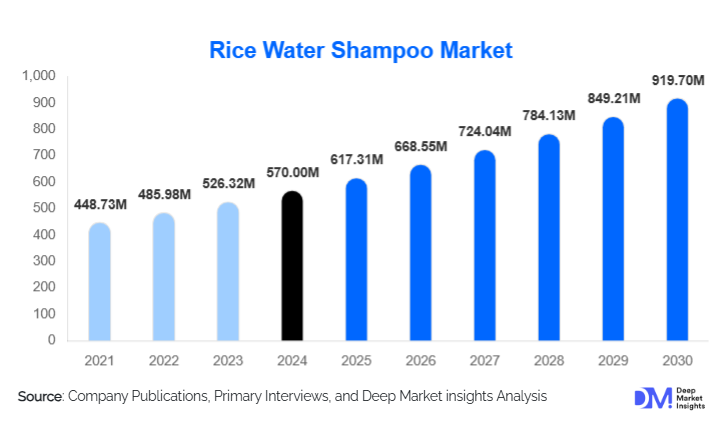

According to Deep Market Insights, the global Rice Water Shampoo Market size was valued at USD 570 million in 2024 and is projected to grow from USD 617.31 million in 2025 to reach USD 919.70 million by 2030, expanding at a CAGR of 8.30% during the forecast period (2025–2030). The rice water shampoo market growth is primarily driven by increasing consumer preference for natural, botanical-based haircare, the rapid rise of clean beauty formulations, and the growing influence of social media trends promoting traditional rice-water hair rituals.

Key Market Insights

- Asia-Pacific leads the rice water shampoo market, accounting for over 40% of global revenue in 2024, supported by deep cultural familiarity and traditional usage of rice water in haircare routines.

- Online retail dominates product distribution, representing approximately 45% of global sales, fueled by e-commerce expansion and influencer marketing.

- Organic formulations hold the largest share, with about 40% of the market, as consumers increasingly opt for certified natural and cruelty-free haircare products.

- Women constitute nearly 60% of the total market demand, though the men’s grooming segment is emerging as a high-growth opportunity.

- Asia-Pacific is the fastest-growing region, projected to grow at a 10–11% CAGR, while North America and Europe continue to show strong premiumization trends.

- Key manufacturers are investing in sustainable packaging and R&D to stabilize rice-water extracts, improve efficacy, and reduce formulation costs.

What are the latest trends in the rice water shampoo market?

Rise of Clean and Heritage-Based Beauty

Consumers are gravitating toward ingredient-led beauty products with transparent sourcing and cultural authenticity. Rice water, long recognized in East Asian and African beauty traditions, has gained global appeal for its strengthening and nourishing benefits. Brands are launching shampoos highlighting “heritage beauty” narratives, blending modern formulation science with ancient rituals. Certified organic and vegan rice-water shampoos are gaining traction, appealing to eco-conscious consumers seeking sulfate-free and paraben-free options.

Digitalization and Direct-to-Consumer Growth

The rise of e-commerce and social media has accelerated the visibility of rice water shampoos. Influencers and beauty vloggers have driven viral trends showcasing rice-water hair transformations, leading to widespread adoption. Direct-to-consumer (D2C) brands are leveraging targeted online advertising, subscription models, and influencer collaborations to engage Gen Z and millennial audiences. This shift enables niche rice-water brands to compete globally without traditional retail limitations.

Technology Integration in Formulation

Advancements in cosmetic chemistry are improving the stability and sensory experience of rice-water shampoos. Companies are using microencapsulation to preserve rice extract nutrients, adding plant proteins for scalp health, and deploying AI-based formulation tools for personalized haircare. These innovations are allowing brands to deliver effective, premium-quality shampoos that overcome the instability and odor challenges of traditional DIY rice water formulations.

What are the key drivers in the rice water shampoo market?

Growing Demand for Natural and Botanical Haircare

Consumers are increasingly avoiding synthetic and chemical-heavy shampoos, opting instead for natural alternatives rich in vitamins, minerals, and amino acids. Rice water, known for its strengthening and restorative properties, fits perfectly within this clean beauty trend. This consumer shift is particularly strong in urban centers where awareness of eco-friendly and sustainable personal care is high.

Influencer-Led Awareness and E-Commerce Expansion

Viral beauty trends on platforms such as TikTok and Instagram have propelled rice water shampoo into mainstream awareness. Online retail growth has allowed brands to reach global consumers quickly, with influencer marketing amplifying adoption. E-commerce has lowered entry barriers, resulting in a proliferation of indie brands focusing solely on rice water formulations.

Innovation and Product Diversification

Brands are introducing new product lines, including rice-water conditioner bars, serums, and scalp treatments, expanding consumer choice. Rice water shampoos are now being tailored for specific hair types—curly, color-treated, or thinning hair—boosting product adoption across demographics. Innovation in packaging and sustainability, such as refillable bottles and biodegradable materials, further enhances market appeal.

What are the restraints for the global market?

High Production Costs and Price Sensitivity

The extraction and stabilization of rice-water actives, coupled with certification and eco-packaging costs, make these shampoos more expensive than conventional products. Price-sensitive consumers in developing regions may still opt for cheaper, chemical-based alternatives, limiting large-scale penetration.

Limited Consumer Awareness and Competitive Ingredient Landscape

While rice water is gaining popularity, awareness remains lower compared to well-established ingredients like argan oil or coconut oil. Competing “natural” claims and misinformation about efficacy create market noise, making it difficult for rice-water shampoo brands to maintain differentiation and credibility without strong marketing investment.

What are the key opportunities in the rice water shampoo industry?

Emerging Market Penetration

Countries in Asia-Pacific, Latin America, and the Middle East offer significant untapped potential due to cultural familiarity with rice and growing beauty consciousness. Brands that localize marketing messages and offer affordable product lines can rapidly gain traction in these markets, especially via online retail platforms.

Premiumization and Clean Beauty Positioning

Consumers are willing to pay more for natural, cruelty-free, and ethically sourced beauty products. Brands emphasizing organic certification, transparency in ingredient sourcing, and sustainable packaging can command higher margins. Premium product launches in Western markets are expected to drive category expansion.

Personalized Haircare and D2C Platforms

Direct-to-consumer brands offering customized formulations based on hair type and scalp condition represent a high-growth opportunity. Data-driven personal care solutions, enabled by AI and digital diagnostics, can further differentiate rice water shampoo brands from conventional players.

Product Type Insights

Organic rice-water shampoos dominate the market with approximately 40% share in 2024, reflecting strong consumer preference for chemical-free and sustainable formulations. Natural non-certified variants follow closely, appealing to cost-sensitive consumers who value botanical benefits without premium pricing. Conventional formulations combining rice water with modern actives (e.g., keratin or biotin) are gaining acceptance, offering functional benefits and wider mass-market reach.

Application Insights

Damage repair and hydration shampoos hold the leading share, around 35% of the market in 2024, as consumers seek restorative products for color-treated or heat-damaged hair. Hair growth-promoting formulations are the fastest-growing application segment, driven by consumer interest in anti-hair-fall and strengthening properties of rice water. Scalp health and soothing shampoos are also emerging, addressing the growing focus on scalp microbiome and sensitive-skin care.

Distribution Channel Insights

Online retail is the dominant distribution channel, accounting for about 45% of the 2024 market share. E-commerce platforms and D2C websites have democratized access, while social media influencers drive awareness and conversions. Supermarkets and hypermarkets remain important for mainstream distribution, while salons and specialty stores serve the premium segment through experiential marketing and expert endorsements.

End-User Insights

Women account for approximately 60% of market demand in 2024, making them the core consumer demographic. The men’s grooming segment, however, is expanding rapidly, as awareness of scalp health and natural grooming increases. Unisex products are emerging as a popular marketing category, offering universal formulations suitable for shared household use.

| By Product Type | By Hair Concern | By Distribution Channel | By Ingredient Type | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for roughly 25% of the global rice water shampoo market. The U.S. leads the region, with rising demand for clean-beauty products and a strong D2C ecosystem. E-commerce giants and specialty beauty retailers have made rice-water shampoos accessible, while marketing narratives emphasizing “ancient Asian hair secrets” resonate with consumers. Growth remains steady, supported by premiumization trends.

Europe

Europe captures about 20% of the global market share in 2024, with the U.K., Germany, and France as leading markets. European consumers are highly receptive to eco-certified and organic formulations, aligning with sustainability-driven consumption patterns. Growth is supported by regulatory transparency and the popularity of cruelty-free brands.

Asia-Pacific

Asia-Pacific dominates the rice water shampoo market, accounting for over 40% of 2024 revenue and projected to grow at a 10–11% CAGR through 2030. China, Japan, South Korea, and India are key markets, driven by traditional familiarity with rice-based haircare and rising disposable income. Local brands leverage heritage positioning and affordability to sustain strong demand.

Latin America

Latin America contributes around 8% of the market, with Brazil and Mexico emerging as promising markets. E-commerce penetration and growing interest in natural personal care are key growth drivers. Brands entering this region often localize formulations using regional botanicals blended with rice water to enhance appeal.

Middle East & Africa

This region accounts for approximately 7% of 2024 revenue but is showing increasing demand, particularly in the Gulf countries and South Africa. Rising affluence, adoption of international beauty trends, and e-commerce growth are fostering demand for premium rice water shampoos.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rice Water Shampoo Market

- L’Oréal S.A.

- The Body Shop

- Briogeo

- Klorane

- WOW Skin Science

- Mamaearth

- Herbal Essences

- Mielle Organics

- Innisfree

- Avalon Organics

- NatureLab Tokyo

- The Inkey List

- Yao Secret

- Ethique

- Garnier

Recent Developments

- In April 2025, L’Oréal launched a new sulfate-free rice water shampoo under its “Botanical Expertise” line, targeting Asian and European markets with recyclable packaging.

- In March 2025, WOW Skin Science announced the expansion of its manufacturing facility in India to meet growing export demand for rice water-based haircare products.

- In February 2025, Mamaearth introduced its “Rice Water Hair Growth Kit,” combining shampoo, conditioner, and serum designed for post-color hair repair and scalp nourishment.