Reusable Sanitary Pads Market Size

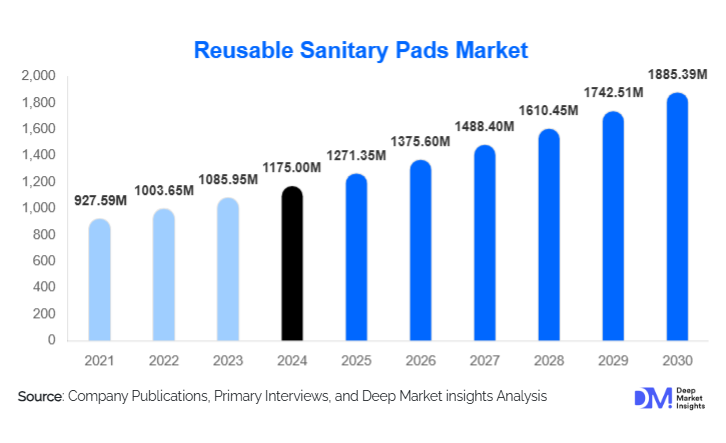

According to Deep Market Insights, the global reusable sanitary pads market size was valued at USD 1,175 million in 2024 and is projected to grow from USD 1,271.35 million in 2025 to reach USD 1,885.39 million by 2030, expanding at a CAGR of 8.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of menstrual hygiene, rising demand for sustainable and eco-friendly alternatives to disposable sanitary products, and the expansion of online and institutional distribution channels catering to diverse end-users globally.

Key Market Insights

- Adoption of sustainable and eco-friendly menstrual products is rising, driven by environmental awareness and the need to reduce non-biodegradable waste generated by disposable pads.

- Young women aged 20–35 years dominate demand globally, combining purchasing power, awareness, and willingness to adopt reusable hygiene products.

- North America and Europe collectively account for over 50% of global demand, due to high awareness levels, disposable income, and preference for premium or organic products.

- Asia-Pacific is the fastest-growing region, driven by increasing government initiatives, NGO programs, and rising awareness in India, China, and Southeast Asia.

- Technological innovations in materials such as bamboo, organic cotton, and antimicrobial fabrics are creating differentiated products that attract environmentally conscious and health-aware consumers.

- E-commerce and direct-to-consumer platforms are significantly improving accessibility, making reusable pads available in both urban and remote regions.

What are the latest trends in the reusable sanitary pads market?

Shift Towards Sustainable and Organic Materials

Reusable sanitary pads are increasingly being made from organic cotton, bamboo, and hemp-based fibers. Consumers are prioritizing non-toxic, skin-friendly materials that are safe for long-term use and have a lower environmental impact. Hybrid pads combining multiple layers for better absorption and comfort are emerging as a preferred choice in both premium and mid-range segments. The trend is particularly strong in North America and Europe, where premium products can command higher pricing due to superior quality and eco-certifications.

Expansion of Online and Institutional Distribution Channels

E-commerce platforms and direct-to-consumer subscription models are enhancing accessibility and convenience, allowing consumers to purchase reusable pads regularly without visiting retail stores. NGOs, schools, and healthcare facilities are also increasingly procuring reusable pads for educational campaigns and institutional hygiene programs, creating bulk demand. Social media-driven marketing, influencer partnerships, and subscription services are further promoting adoption among younger, digitally connected audiences.

What are the key drivers in the reusable sanitary pads market?

Increasing Awareness of Menstrual Hygiene

Globally, rising awareness of menstrual hygiene is driving growth. Campaigns by governments, NGOs, and private brands emphasize the health risks of low-quality disposable pads and highlight the benefits of reusable alternatives. Women across urban and rural regions are now more informed about safer, cost-effective, and sustainable options.

Environmental Concerns and Sustainability Initiatives

Disposable pads contribute significantly to non-biodegradable waste, creating environmental challenges. The global shift toward eco-conscious consumer behavior has increased the adoption of reusable pads. Government regulations and sustainability programs in Europe, North America, and the Asia-Pacific are also incentivizing brands and consumers to switch to reusable alternatives.

Rising Female Workforce and Disposable Income

Higher female participation in the workforce and increased purchasing power among young women have boosted demand for convenient, durable, and hygienic reusable pads. Working women prefer products that provide comfort and reliability during extended hours, particularly in urban centers of APAC, Europe, and North America.

What are the restraints for the global market?

Cultural Taboos and Social Stigma

In several regions, cultural barriers and taboos around menstruation hinder market penetration. Rural areas in Asia and Africa often lack education and awareness regarding reusable pads, slowing adoption and creating reliance on traditional or disposable alternatives.

Higher Initial Cost and Maintenance Requirements

Reusable pads require a higher initial investment compared to disposable pads, and proper washing and maintenance are essential for longevity. This can limit adoption in low-income segments, where cost and convenience remain critical factors.

What are the key opportunities in the reusable sanitary pads industry?

Expansion in Emerging Regional Markets

Africa, Southeast Asia, and Latin America represent untapped opportunities. Countries like India, Nigeria, and Brazil show strong demand potential due to increasing awareness campaigns, government support, and NGO initiatives. Affordable and culturally adapted reusable pads can help brands penetrate these high-growth markets.

Technological Integration and Product Innovation

Innovations in materials, including bamboo, organic cotton, and antimicrobial fabrics, are creating high-value products. Hybrid and maternity-specific pads offer differentiated options that cater to comfort, absorption, and hygiene needs. Opportunities also exist in smart pads with integrated health monitoring features, targeting tech-savvy consumers.

Strategic Partnerships with NGOs and Government Programs

Collaborations with non-profits, educational institutions, and government programs provide both bulk institutional demand and brand visibility. Participation in school hygiene programs or government-supported subsidy initiatives allows brands to gain social credibility while expanding market presence in developing countries.

Product Type Insights

Cloth pads dominate the market globally with a 38% share of 2024 demand, driven by affordability, accessibility, and comfort. Bamboo and organic cotton variants are rapidly gaining traction in premium segments. Hybrid products are increasingly used for maternity and night applications due to superior absorption and convenience.

Application Insights

Daily-use pads account for 55% of the global market, reflecting consistent adoption for routine hygiene. Night-use, maternity, and sports-focused pads represent niche segments but are experiencing steady growth, driven by product innovation and targeted marketing campaigns.

Distribution Channel Insights

Online retail dominates with a 30% market share, supported by subscription models, e-commerce platforms, and D2C websites. Offline retail remains significant in emerging markets, while institutional sales (schools, NGOs, hospitals) are a growing channel for bulk adoption.

End-User Insights

Individual consumers form 65% of global demand, emphasizing personal adoption trends. NGOs and educational institutions are emerging end-users, particularly in APAC and Africa, where government-backed programs promote menstrual hygiene awareness. Healthcare facilities also contribute to steady institutional demand.

Age Group Insights

Young women aged 20–35 years account for 45% of the market share, leading adoption due to high awareness and purchasing power. Teenagers and older adults are smaller segments but show potential for growth with educational programs and premium offerings.

| By Product Type | By Application | By Distribution Channel | By End-User | By Material Type |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 24% of the global market share (USD 280 million in 2024). Growth is fueled by strong environmental awareness, high disposable income, and a preference for premium reusable pads. The US and Canada are the largest contributors.

Europe

Europe contributes 28% of global demand (USD 330 million). Germany, the UK, and France lead in adoption due to sustainability-driven consumer preferences and government-led awareness programs. Europe is also among the fastest-growing regions in premium and organic product segments.

Asia-Pacific

APAC is the fastest-growing region (10% CAGR), led by India, China, and Southeast Asia. Rising awareness campaigns, government subsidies, and expanding e-commerce platforms are key drivers. Affordable cloth pads dominate, while organic and bamboo pads are gaining traction in urban centers.

Latin America

Brazil and Argentina are key markets, primarily driven by NGO campaigns and urban adoption. Demand growth is steady, with emphasis on affordable daily-use and maternity pads.

Middle East & Africa

Africa, led by Nigeria and South Africa, shows increasing adoption due to educational campaigns and government programs. The Middle East, particularly the UAE and Saudi Arabia, demonstrates a growing demand for premium and eco-friendly pads, supported by high-income populations and awareness initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Reusable Sanitary Pads Market

- Procter & Gamble

- Kimberly-Clark

- Unicharm Corporation

- Hengan International

- SCA Group

- Berry Global

- Johnson & Johnson

- Sofy

- Veeda

- GladRags

- Natracare

- Rael

- OrganiCup

- Lunapads

- Lil-lets

Recent Developments

- In May 2025, Procter & Gamble launched a new line of organic cotton reusable pads in Europe, targeting premium, eco-conscious consumers.

- In April 2025, Kimberly-Clark partnered with NGOs in India and Africa to distribute reusable pads to schools under government-backed hygiene initiatives.

- In February 2025, Unicharm Corporation introduced bamboo-based reusable pads in APAC, combining antimicrobial properties with high absorption for night and maternity use.