Reusable Household Cleaning Gloves Market Size

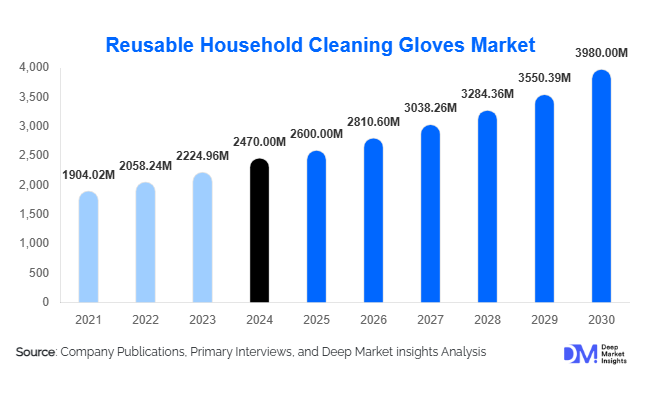

According to Deep Market Insights, the global reusable household cleaning gloves market size was valued at USD 2,470 million in 2024 and is projected to grow from USD 2,600 million in 2025 to reach USD 3,980 million by 2030, expanding at a CAGR of 8.1% during the forecast period (2025–2030). The market growth is primarily driven by rising household hygiene awareness, increasing adoption of eco-friendly cleaning products, and growing preference for durable, cost-effective gloves across residential, commercial, and industrial applications.

Key Market Insights

- Consumer preference is shifting toward eco-friendly and reusable cleaning gloves, driven by sustainability concerns and the need to reduce single-use plastic waste.

- Demand for chemically resistant gloves such as nitrile and PVC is increasing in both commercial and industrial cleaning segments due to rising safety and durability requirements.

- Online retail platforms are emerging as the leading sales channel, offering convenience, product variety, and direct-to-consumer availability, particularly in APAC and North America.

- Asia-Pacific is the fastest-growing market region, fueled by rising middle-class income, urbanization, and the adoption of modern household cleaning practices.

- North America and Europe together account for over 45% of global demand, reflecting high awareness of hygiene, regulatory compliance, and penetration of premium cleaning products.

- Innovation in glove materials and coating technologies, including anti-bacterial surfaces, textured grips, and extended durability, is transforming consumer choices and driving premiumization.

What are the latest trends in the reusable household cleaning gloves market?

Rise of Eco-Friendly and Biodegradable Gloves

Increasing environmental consciousness is driving demand for reusable gloves made from natural rubber or biodegradable synthetic materials. Consumers are actively seeking alternatives to disposable gloves, and manufacturers are responding with products that emphasize low carbon footprint, sustainable sourcing, and long-lasting performance. Initiatives such as labeling eco-friendly materials, reducing harmful chemicals, and using recyclable packaging are becoming standard practice among leading market players. Biodegradable coatings and natural rubber blends are attracting environmentally conscious households, while government programs promoting sustainable products further accelerate adoption.

Technological Innovations in Glove Design

Manufacturers are increasingly integrating advanced technologies into glove design to improve safety, comfort, and usability. Anti-slip textures, multi-layer chemical resistance, and ergonomic fit are now key differentiators. Some products incorporate anti-bacterial coatings and hypoallergenic materials to appeal to sensitive users. Digital marketing and online platforms also allow consumers to compare performance ratings, durability, and eco-friendliness, shaping product adoption. Additionally, extended-length gloves for heavy-duty cleaning and textured grip gloves for wet surfaces are gaining traction, reflecting the shift toward specialized household applications.

What are the key drivers in the reusable household cleaning gloves market?

Growing Household Hygiene Awareness

Heightened concerns over cleanliness and hygiene, especially in the post-pandemic era, have significantly boosted demand for reusable household cleaning gloves. Consumers are prioritizing protective products that reduce exposure to germs, bacteria, and cleaning chemicals. Increasing awareness campaigns on home sanitation and rising standards of hygiene in urban households are driving consistent market adoption, particularly for premium and durable glove types.

Expansion of E-Commerce Channels

Online retailing has become a primary growth driver, offering convenience, diverse product choices, and competitive pricing. E-commerce platforms allow consumers to access high-quality gloves, compare features, and receive home delivery, increasing overall penetration. The growth of digital payment methods and subscription-based household supplies has further strengthened online adoption, particularly in APAC and North America.

Rising Adoption in Commercial and Industrial Cleaning

Commercial establishments, including hotels, restaurants, and offices, are increasingly implementing strict hygiene protocols, creating robust demand for chemically resistant and durable gloves. Industrial users in chemical plants and laboratories are also adopting high-performance gloves to protect workers from hazardous cleaning agents. These segments are driving innovation, premiumization, and steady growth in the reusable glove market globally.

What are the restraints for the global market?

High Raw Material Costs

The cost of natural and synthetic rubber fluctuates due to supply-demand imbalances, affecting production costs for reusable gloves. Price volatility can limit margins for manufacturers and may result in higher retail prices, potentially slowing adoption among price-sensitive households.

Competition from Disposable Gloves

Despite environmental concerns, disposable gloves remain popular for quick, low-cost cleaning, particularly in developing regions. The convenience and low upfront cost of disposable options act as a key restraint, limiting full market penetration of reusable gloves in some regions.

What are the key opportunities in the reusable household cleaning gloves market?

Expansion into Emerging Asia-Pacific Markets

Rapid urbanization, increasing household incomes, and growing awareness of hygiene practices in countries such as India, China, and Indonesia present immense growth opportunities. Market players can target these regions with affordable, durable gloves, leveraging e-commerce penetration and digital marketing strategies. Government initiatives promoting domestic manufacturing and “Make in India”-type programs also encourage local production and innovation.

Technological Integration and Product Differentiation

Integrating anti-bacterial coatings, textured grips, and ergonomic designs enables manufacturers to create premium products, appealing to affluent consumers and commercial buyers. Smart gloves with embedded sensors for industrial applications or chemical exposure warnings could also emerge, expanding market scope beyond conventional household usage.

Export-Driven Growth

Rising global hygiene standards and awareness are increasing demand in North America, Europe, and the Middle East regions. Manufacturers in APAC and LATAM can capitalize on this trend by targeting export markets with high-quality, durable gloves, leveraging lower production costs and strategic trade agreements.

Product Type Insights

Latex gloves dominate the market, accounting for approximately 32% of global sales in 2024, due to their flexibility, comfort, and biodegradability. Nitrile gloves are rapidly gaining popularity in commercial and industrial segments, holding 25% of the market share, owing to superior chemical resistance and hypoallergenic properties. PVC gloves, offering cost efficiency and chemical durability, account for 20% of the global market. Trends indicate increasing consumer preference for nitrile and latex over PVC due to durability and environmental concerns, driving innovation in eco-friendly materials.

Material Insights

Natural rubber gloves lead the material segment, representing 35% of 2024 market demand, driven by eco-conscious consumers and biodegradability benefits. Synthetic rubbers like nitrile and neoprene hold 28%, preferred in industrial and commercial cleaning due to superior chemical resistance. PVC materials follow with a 20% share, primarily in budget-conscious household applications. Material innovation, particularly in biodegradable and multi-layer gloves, continues to drive growth in premium segments.

Sales Channel Insights

Supermarkets and hypermarkets dominate distribution, accounting for 40% of 2024 global sales, due to high accessibility and bulk purchasing. E-commerce follows with a 35% share, growing rapidly thanks to convenience, product variety, and digital marketing. Specialty stores and wholesale distributors share the remaining 25%, catering to niche and commercial segments. E-commerce is expected to become the primary growth channel, particularly in APAC and North America.

End-Use Insights

Residential consumers constitute the largest end-user segment, representing 55% of global demand, driven by heightened hygiene awareness and routine cleaning requirements. Commercial establishments, including hotels and offices, account for 30%, with demand increasing due to stricter hygiene protocols. Industrial users hold 15%, primarily in chemical handling and laboratory applications. Growth in commercial and industrial segments is expected to outpace residential demand, providing significant opportunities for premium and chemically resistant gloves.

| By Product Type | By Material | By Length / Design | By Usage / Application | By End-User |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounts for 24% of global demand, with the U.S. leading due to high hygiene standards, awareness, and disposable income. Canada follows closely, with significant adoption of premium reusable gloves. The region is characterized by strong penetration of online sales and demand for eco-friendly materials.

Europe

Europe holds 21% of the global market share, with Germany, France, and the UK driving growth. High awareness of hygiene, environmental regulations, and demand for durable, high-quality gloves are key factors. Online channels and retail penetration are robust, and the region is rapidly adopting eco-friendly and technologically enhanced gloves.

Asia-Pacific

APAC is the fastest-growing region, with countries like China, India, and Japan seeing high demand. Rising urban populations, increased household cleaning standards, and e-commerce expansion are major drivers. The market in APAC is projected to grow at a CAGR of 9.5%, surpassing North America by 2030 in volume terms.

Latin America

LATAM is gradually expanding, led by Brazil and Argentina, with a focus on affordable and durable gloves. Middle-income growth, urbanization, and rising hygiene awareness are driving demand. Online retail and exports from APAC are expected to support growth.

Middle East & Africa

The MEA region is seeing steady demand, particularly in the UAE, Saudi Arabia, and South Africa, driven by increasing hygiene awareness and commercial cleaning adoption. Government-led hygiene programs in urban centers are supporting growth, while industrial demand remains niche but stable.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Reusable Household Cleaning Gloves Market

- Showa Glove Co., Ltd.

- Ansell Limited

- Top Glove Corporation Bhd

- Kossan Rubber Industries Bhd

- Supermax Corporation Berhad

- Hartalega Holdings Berhad

- Uvex Safety Group

- MAPA Professionnel

- Moldex-Metric, Inc.

- Semperit AG Holding

- Gloveworks International

- Viking Gloves

- Ringers Gloves

- Rostaing SAS

- Showa Best Glove Co., Ltd.

Over the past five years, leading players have focused on premiumization, sustainable materials, and e-commerce penetration. Price competition is notable in PVC gloves, while latex and nitrile segments emphasize quality and durability, enabling higher margins.

Recent Developments

- In March 2025, Top Glove Corporation launched a new biodegradable glove line targeting environmentally conscious households in APAC and Europe.

- In January 2025, Ansell Limited expanded nitrile glove production capacity in North America to meet rising demand from commercial cleaning sectors.

- In February 2025, Showa Glove introduced textured grip and anti-bacterial coatings for household gloves, enhancing usability and premium appeal globally.