Rendered Products Market Size

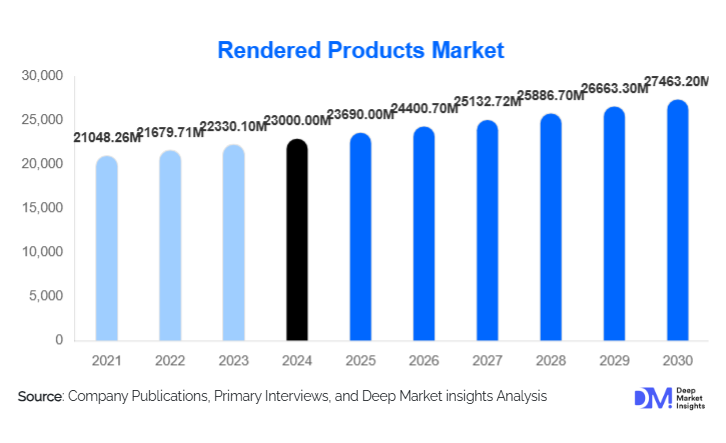

According to Deep Market Insights, the global rendered products market size was valued at USD 23,000 million in 2024 and is projected to grow from USD 23,690.00 million in 2025 to reach USD 27,463.20 million by 2030, expanding at a CAGR of 3.0% during the forecast period (2025–2030). The market growth is primarily driven by rising global meat production, increasing demand for animal feed and pet food, the growing biofuel and oleochemical industries, and the focus on circular-economy-based waste valorization.

Key Market Insights

- Animal feed remains the largest application segment, with protein meals and fats serving as critical ingredients for livestock, pet food, and aquaculture feed formulations.

- Tallow and animal fats dominate the product type segment, due to their versatility in biofuels, oleochemicals, and industrial applications.

- North America holds the largest market share, driven by a mature rendering industry, strong biofuel mandates, and high consumption of pet food and feed-grade protein meals.

- Asia-Pacific is the fastest-growing region, fueled by rising meat consumption, underdeveloped rendering infrastructure, and growing demand for feed and biofuel feedstocks.

- Technological adoption, including energy-efficient rendering systems, pathogen control, traceability tools, and quality monitoring, is increasing operational efficiency and product value.

- Regulatory and sustainability pressures are encouraging investments in low-emission, circular-economy-compliant rendering technologies.

What are the latest trends in the rendered products market?

Biofuel and Renewable Energy Integration

Rendered fats such as tallow and yellow grease are increasingly used as feedstocks for biodiesel and bio-lubricants. Governments globally are incentivizing renewable fuels, prompting renderers to optimize fat quality, establish long-term supply contracts with biofuel producers, and leverage sustainability credentials. These trends are creating higher-value applications beyond traditional feed, providing opportunities for margin improvement and strategic partnerships.

Expansion in Animal Feed and Pet Food Segments

Rising pet ownership and the growth of aquaculture industries are fueling demand for protein-rich rendered meals. Companies are increasingly producing feed-grade protein meals, including hydrolyzed variants for pet foods, ensuring nutritional compliance and traceability. Strategic long-term contracts with feed producers stabilize demand and create consistent revenue streams.

Circular Economy and Waste Valorization

Rendering plays a central role in the circular economy by converting slaughterhouse by-products into valuable fats and proteins. Regulatory incentives and sustainability programs encourage companies to minimize waste, invest in energy-efficient processing, and adopt carbon footprint reporting. This alignment with ESG objectives enhances brand value and opens access to premium markets.

What are the key drivers in the rendered products market?

Rising Global Meat Production

Increasing global meat consumption generates more by-products such as bones, offal, and fat trims, creating a stable raw material base for rendering operations. Higher supply efficiency reduces per-unit production costs and supports downstream applications like feed, biofuel, and oleochemicals.

Growing Demand from the Feed and Pet Food Industries

Animal feed, including pet food and aquaculture feed, is the largest consumer of rendered products. Protein meals provide cost-effective, nutrient-dense ingredients, while fats contribute essential energy content. Rapid growth in global pet ownership and aquaculture expansion is accelerating demand for these rendered inputs.

Sustainability and Circular Economy Initiatives

Rendering aligns with circular economy and ESG goals by transforming waste into valuable commodities. Regulatory incentives for waste reduction, carbon footprint mitigation, and sustainable sourcing further support market growth. Companies adopting traceability and certification programs are increasingly able to access premium markets.

What are the restraints for the global market?

Raw Material Supply Volatility

Fluctuations in slaughter rates, disease outbreaks, or operational disruptions can create inconsistent feedstock availability, impacting production schedules and profitability. Supply volatility remains a challenge for maintaining stable market operations.

Regulatory Compliance and Health Concerns

Rendered products must meet stringent safety and quality standards, especially for feed and food applications. Pathogen control, traceability, and regulatory adherence increase operational costs. Negative consumer perceptions of animal by-products may also limit market acceptance in certain applications.

What are the key opportunities in the rendered products industry?

Growth in Biofuel and Renewable Energy Markets

Increasing adoption of renewable energy policies and biofuel mandates creates demand for high-quality rendered fats. Companies can benefit from strategic partnerships with bio-refineries and invest in low-emission processing technologies to produce feedstocks for biodiesel and oleochemicals, opening higher-margin revenue streams.

Expansion in Pet Food and Aquafeed Applications

The rising global pet food and aquaculture markets provide opportunities to produce specialized protein meals and hydrolyzed products. By meeting nutritional standards and ensuring consistent supply, renderers can secure long-term contracts, strengthen market positioning, and capture higher-value customers.

Circular Economy and Sustainability Integration

Government initiatives and ESG mandates favor sustainable rendering practices. Investments in energy-efficient cookers, waste minimization, and traceability enhance compliance, brand image, and market access. Renderers that adopt circular-economy-aligned processes can differentiate themselves in both feed and industrial markets.

Product Type Insights

Tallow and animal fats dominate the product type segment due to their versatility in biofuels, oleochemicals, and industrial applications, accounting for nearly 45–50% of the global market in 2024. Protein meals for feed are also a major product category, providing essential nutrition for livestock, aquaculture, and pets. Other by-products like blood meal and bone meal are primarily used in fertilizers and specialty applications.

Application Insights

Animal feed is the leading application segment, representing over 50% of total market share in 2024. Biofuels are the fastest-growing application, driven by low-carbon mandates and renewable energy policies. Oleochemicals and specialty chemicals, including cosmetics and lubricants, provide niche but growing markets. Fertilizers and food applications account for smaller but stable segments, contributing to diversified market demand.

Distribution Channel Insights

Long-term contracts and direct offtake agreements dominate revenue streams, particularly for biofuel feedstocks and feed-grade protein meals. Spot-market trading and exports to Asia-Pacific and Latin America provide additional channels. Digital marketplaces and specialized feed suppliers are increasingly facilitating transparency, traceability, and efficient procurement of rendered products.

End-Use Insights

Livestock feed, pet food, and aquaculture feed remain the core end-users of rendered products. Biofuel companies and oleochemical manufacturers are emerging high-growth customers. Export-driven demand is significant, with the U.S. and Europe supplying protein meals and fats to the Asia-Pacific, particularly China, India, and Southeast Asia.

| By Product Type | By Application | By Distribution Channel | By End-Use Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds the largest market share (38–47% in 2024), led by the U.S. and Canada. Advanced rendering infrastructure, high biofuel mandates, and a mature feed industry support stable growth. Long-term contracts with biofuel and feed producers ensure revenue stability, and regulatory incentives favor sustainable production.

Europe

Europe represents the second-largest market, driven by Germany, France, and the U.K. Circular economy policies, biofuel demand, and strong feed and pet food consumption underpin market stability. Regulatory compliance and high sustainability standards shape the market, with moderate growth expected.

Asia-Pacific

Asia-Pacific is the fastest-growing region (7.5% CAGR), led by China, India, Japan, and Southeast Asia. Rapid growth in livestock production, aquaculture, and pet ownership, combined with expanding rendering infrastructure, is accelerating market adoption. Export demand from North America and Europe further strengthens the region.

Latin America

Brazil and Argentina dominate the regional market, accounting for 5% of global revenue. Growth is driven by livestock production and increasing adoption of rendering technologies, with export potential supporting industry expansion.

Middle East & Africa

MEA accounts for 2% of global revenue, with South Africa, UAE, and GCC nations gradually expanding their rendering infrastructure. Growth is supported by emerging livestock sectors and interest in circular-economy practices, though infrastructure and regulatory challenges constrain rapid expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rendered Products Market

- Tyson Foods, Inc.

- Darling Ingredients Inc.

- JBS S.A.

- Valley Proteins, Inc.

- Smithfield Foods, Inc.

- West Coast Reduction Ltd.

- Sanimax Industries Inc.

- Griffin Industries, LLC

- Ten Kate Protein Technologies

- Allanasons Pvt. Ltd.

- Leo Group Ltd.

- SRC Companies, Inc.

- SOLEVAL

- Australian Tallow Producers

- National Renderers Association

Recent Developments

- In March 2025, Tyson Foods expanded its rendering operations in the U.S., increasing capacity for feed-grade protein meals and tallow for biodiesel production.

- In January 2025, Darling Ingredients announced a strategic partnership with a European biodiesel producer to supply sustainably sourced tallow, enhancing renewable energy adoption.

- In December 2024, JBS S.A. invested in energy-efficient rendering technologies in Brazil and the U.S., reducing emissions and increasing process efficiency while meeting ESG compliance.