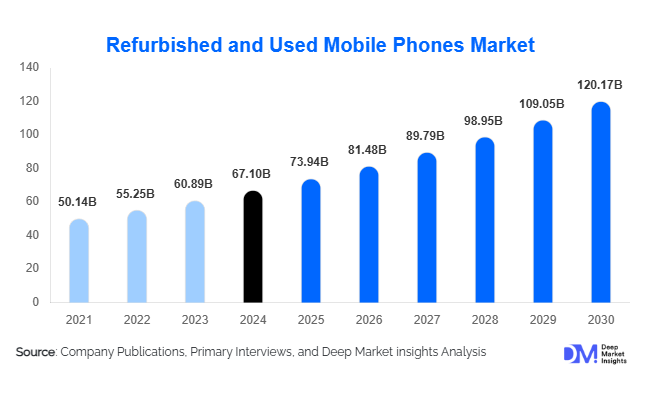

Refurbished and Used Mobile Phones Market Size

According to Deep Market Insights, the global refurbished and used mobile phones market size was valued at USD 67.1 billion in 2024 and is projected to grow from USD 73.94 billion in 2025 to reach USD 120.17 billion by 2030, expanding at a CAGR of 10.2% during the forecast period (2025–2030). The market growth is primarily driven by rising consumer demand for affordable smartphones, growing adoption of e-commerce resale platforms, and increasing awareness around electronic waste reduction and sustainability.

Key Market Insights

- Rising demand for affordable smartphones among budget-conscious consumers and in emerging economies is fueling global sales of refurbished and used mobile devices.

- Apple, Samsung, and Xiaomi models dominate the refurbished smartphone segment, driven by high trade-in activity and strong aftermarket support.

- Asia-Pacific leads the global market in terms of volume, supported by growing middle-class populations and rapid smartphone penetration in India, China, and Southeast Asia.

- North America and Europe remain key revenue generators, benefiting from structured trade-in programs and the presence of certified refurbishment ecosystems.

- Online reselling platforms such as Amazon Renewed, Back Market, and Cashify are reshaping consumer buying behavior through warranty-backed, verified listings.

- Environmental and regulatory incentives promoting circular economy practices are accelerating the adoption of refurbished devices among both consumers and enterprises.

Latest Market Trends

Growth of Certified Refurbishment Programs

Major smartphone manufacturers and retailers are increasingly investing in certified refurbishment programs to ensure quality, reliability, and warranty-backed assurance. Programs such as Apple Certified Refurbished, Samsung Certified Re-Newed, and Xiaomi Refurb Store are standardizing the secondhand market. These initiatives not only improve consumer confidence but also enable brands to capture value from device trade-ins, extending product lifecycles and reducing e-waste.

Expansion of Online and AI-Driven Resale Platforms

Digital resale marketplaces are using AI-based grading systems to assess device condition, automate pricing, and enhance transparency for buyers. Platforms like Back Market, Recommerce, and Cashify employ machine learning to match supply and demand dynamically. This technology-driven approach has reduced fraud, increased market liquidity, and made refurbished phones a mainstream purchase channel for cost-sensitive consumers worldwide.

Refurbished and Used Mobile Phones Market Drivers

Rising Smartphone Replacement and Upgrade Cycles

Shortening upgrade cycles in developed markets is contributing to an abundant supply of used smartphones. Consumers upgrading every 18–24 months, coupled with aggressive trade-in incentives, have led to a robust flow of pre-owned devices. Retailers and carriers are capitalizing on this trend by offering credit-based exchange programs that promote circular usage, making refurbished smartphones more accessible and appealing.

Growing Focus on Sustainability and E-Waste Reduction

Governments, corporations, and consumers are increasingly aligned around sustainability goals. Refurbished mobile phones help reduce carbon emissions, conserve raw materials, and divert electronic waste from landfills. The rising prominence of the circular economy in global policy frameworks—especially in the EU, India, and the U.S.—has driven initiatives supporting the reuse, refurbishment, and responsible recycling of electronic devices.

Market Restraints

Quality and Warranty Concerns Among Consumers

Despite improving standards, many consumers still associate refurbished or used devices with lower quality or reliability issues. The lack of consistent grading standards, counterfeit risks, and limited warranties in unorganized sectors continues to challenge broader adoption, especially in developing regions. Certified refurbishment and extended warranty programs are helping mitigate these perceptions, but have yet to reach full global scale.

Rapid Technological Advancements and Model Obsolescence

Frequent smartphone model launches and shorter innovation cycles create challenges for the resale market, as older models quickly lose market relevance. Devices without 5G capability or recent software updates face declining resale value. This dynamic limits profitability for refurbishers and may reduce the attractiveness of investing in large-scale refurbishment infrastructure.

Refurbished and Used Mobile Phones Market Opportunities

Enterprise and B2B Adoption

Businesses are increasingly purchasing refurbished smartphones for employee use, particularly in logistics, retail, and remote workforce environments. Enterprise procurement of refurbished devices reduces costs while supporting corporate sustainability goals. Leasing models and device management partnerships are creating new opportunities for refurbishers targeting institutional buyers.

Emergence of Trade-In Ecosystems in Developing Markets

Rapidly expanding trade-in and buyback networks in countries such as India, Indonesia, and Nigeria are opening significant growth opportunities. OEMs and telecom operators are collaborating with refurbishers to formalize secondhand channels. Digital wallets, instant credit, and doorstep pickup services are further incentivizing users to exchange old devices for upgraded models.

Product Type Insights

Refurbished smartphones dominate the market, offering near-new performance at 30–50% lower prices. These devices undergo professional testing, repairs, and certification before resale. Used smartphones (unrefurbished but functional) cater to highly price-sensitive consumers, particularly in emerging markets. Flagship models from Apple, Samsung, and OnePlus lead resale value retention, while mid-tier Android devices form the largest volume share due to mass affordability.

Sales Channel Insights

Online platforms are the primary sales channel, enabling global access and transparent price comparisons. Websites like Amazon Renewed, eBay Refurbished, and Back Market dominate the segment. Offline retailers and operator stores remain critical in emerging economies, offering trade-in programs and installment-based refurbished phone purchases. The growth of OEM-backed digital storefronts is also reinforcing trust and ensuring product authenticity.

End User Insights

Individual consumers account for the majority of refurbished phone purchases, driven by affordability and accessibility. Enterprises represent a growing segment, leveraging refurbished devices for cost-efficient digital enablement. Retailers and wholesalers form the backbone of distribution, aggregating bulk trade-ins and coordinating refurbishment logistics across global markets.

| By Product Type | By Sales Channel | By End User |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific leads the global market, driven by India, China, and Indonesia’s booming resale ecosystems. The rise of local refurbishers, increasing smartphone penetration, and favorable government policies supporting circular electronics are accelerating regional growth. India’s refurbished market alone is expected to exceed USD 20 billion by 2030, led by platforms like Cashify and Amazon Renewed.

North America

North America remains a high-value market, with strong trade-in programs and well-established refurbishment channels through Apple, Verizon, and Best Buy. Consumers are becoming increasingly comfortable purchasing certified pre-owned devices, particularly in the mid-range and premium segments. Sustainability awareness and affordability are key drivers supporting consistent market expansion.

Europe

Europe represents one of the most mature refurbished smartphone markets globally. Regulatory frameworks promoting circular economy adoption and electronic waste reduction are driving growth. France and Germany are at the forefront, supported by companies like Back Market and Recommerce. Extended warranties and consumer protection standards further strengthen market credibility.

Latin America

Latin America is emerging as a high-potential region, with growing smartphone affordability gaps boosting demand for refurbished and used devices. Brazil and Mexico lead the regional market, supported by online resale expansion and improving digital payment infrastructure. Unorganized retail remains dominant, presenting opportunities for structured refurbishment networks.

Middle East & Africa

The Middle East and Africa are witnessing rapid growth due to increasing smartphone penetration and economic constraints driving secondhand adoption. The UAE and Saudi Arabia lead the region with structured trade-in and warranty-backed resale programs. African markets such as Nigeria, Kenya, and South Africa are expanding through partnerships between telecom operators and refurbishers targeting first-time smartphone users.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Refurbished and Used Mobile Phones Market

- Apple Inc. (Apple Certified Refurbished)

- Samsung Electronics Co., Ltd.

- Back Market

- Amazon Renewed

- Recommerce Group

- Cashify

- FoneGiant

- EcoATM Gazelle

Recent Developments

- In September 2025, Apple expanded its Certified Refurbished program to Southeast Asia, introducing warranty-backed iPhone and iPad sales in India, Thailand, and Malaysia.

- In June 2025, Back Market raised USD 400 million in Series D funding to enhance its AI-based refurbishment logistics and expand into Latin America.

- In March 2025, Samsung announced a new partnership with Flipkart and Cashify in India to strengthen its circular economy ecosystem and drive trade-in adoption.

- In January 2025, Recommerce launched a sustainability certification framework in Europe to standardize grading and warranty processes across the refurbished mobile device supply chain.