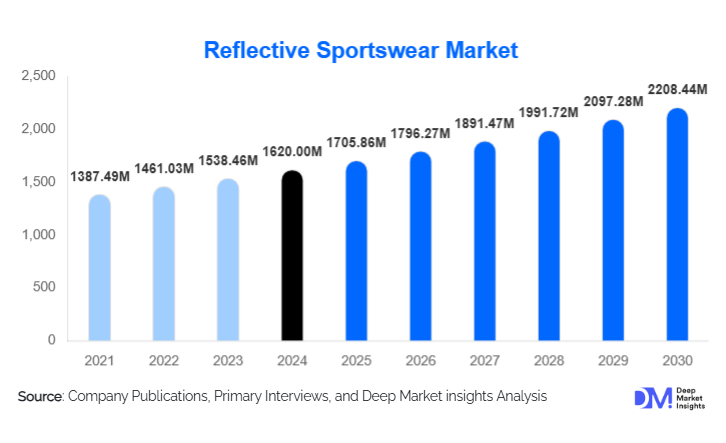

Reflective Sportswear Market Size

According to Deep Market Insights, the global reflective sportswear market size was valued at USD 1,620.00 million in 2024 and is projected to grow from USD 1,705.86 million in 2025 to reach USD 2,208.44 million by 2030, expanding at a CAGR of 5.3% during the forecast period (2025–2030). The growth of the reflective sportswear market is primarily driven by increasing urban fitness activities, rising safety awareness among outdoor sports enthusiasts, and the growing adoption of innovative reflective technologies in apparel.

Key Market Insights

- Smart reflective technologies are reshaping the market, integrating LEDs, sensors, and IoT-enabled fabrics that enhance visibility and performance for athletes and urban commuters.

- North America dominates the market, with high urban fitness participation, cycling safety regulations, and strong consumer preference for premium reflective sportswear.

- Europe remains a significant growth region, driven by cycling culture, running events, and government safety regulations supporting high-visibility apparel.

- Asia-Pacific is emerging as a high-growth market, led by increasing urbanization, rising middle-class income, and a growing awareness of outdoor fitness and safety.

- Technological adoption, such as retro-reflective coatings, smart fabrics, and LED-integrated wearables, is creating new differentiation opportunities.

- E-commerce channels are increasingly influential, providing convenience, customization, and global reach for both mass-market and premium reflective sportswear.

What are the latest trends in the reflective sportswear market?

Integration of Smart Reflective Technologies

Reflective sportswear is increasingly incorporating smart technologies such as LEDs, IoT connectivity, and performance-tracking sensors. These innovations provide not only enhanced visibility during low-light activities but also real-time fitness tracking and safety alerts. Smart reflective apparel appeals to tech-savvy consumers who value multifunctional garments that combine performance, safety, and style. Companies investing in R&D to develop wearable electronics embedded in fabrics are gaining a competitive edge, creating premium product lines and increasing consumer willingness to pay higher prices.

Rise of Multi-Functional and Eco-Friendly Apparel

Consumers are demanding reflective sportswear that combines comfort, sustainability, and style. Lightweight, moisture-wicking fabrics with retro-reflective coatings or prints are increasingly popular. Eco-conscious manufacturing, such as recycled polyester or low-impact reflective coatings, is becoming a trend among younger urban consumers. This not only addresses environmental concerns but also aligns with growing preferences for sustainable activewear, enhancing brand image and loyalty.

What are the key drivers in the reflective sportswear market?

Growing Outdoor Fitness and Adventure Culture

The increasing popularity of running, cycling, hiking, and adventure sports is driving demand for reflective sportswear. Safety concerns for night-time and early-morning workouts, combined with fashion-conscious urban consumers, are pushing adoption. Organized marathons, cycling events, and fitness communities in North America, Europe, and APAC are key contributors to market expansion.

Technological Advancements in Reflective Materials

Advancements in reflective tape technology, retro-reflective inks, and smart LED wearables are expanding the functionality and appeal of sportswear. These technologies provide enhanced visibility, durability, and performance, attracting professional athletes and safety-conscious users. Innovations in wearable electronics are also opening premium market segments with higher profit margins.

Urbanization and Night-Time Safety Awareness

With rising urban populations globally, there is heightened awareness for pedestrian and cyclist safety. Reflective sportswear is recommended for nighttime fitness and commuting, particularly in densely populated cities. Government and municipal campaigns promoting high-visibility apparel are positively impacting market demand.

What are the restraints for the global market?

High Production Costs

The use of reflective materials, smart wearable technologies, and advanced coatings increases manufacturing costs, limiting affordability in price-sensitive markets. This restricts market penetration in emerging economies, creating barriers for widespread adoption.

Durability and Maintenance Concerns

Reflective materials may lose effectiveness over time due to repeated washing, abrasion, or exposure to sunlight. Consumer concerns regarding long-term durability can slow repeat purchases, affecting overall market growth.

What are the key opportunities in the reflective sportswear market?

Expansion in Emerging Markets

Rapid urbanization, growing middle-class income, and increasing fitness awareness in APAC and LATAM present significant growth potential. Countries such as India, China, and Brazil are witnessing rising demand for cost-effective, high-performance reflective sportswear. Market entrants focusing on localized product strategies can capitalize on this opportunity.

Technological Integration and Smart Wearables

The integration of LEDs, IoT-enabled fabrics, and smart sensors provides differentiation for premium products. Apparel that enhances visibility while offering fitness tracking and health monitoring is gaining traction among tech-savvy athletes and urban commuters. This segment has high growth potential due to increasing consumer willingness to pay for multifunctional sportswear.

Regulatory and Safety-Driven Adoption

Government regulations promoting high-visibility apparel for cyclists, runners, and urban commuters are driving demand in Europe and North America. Manufacturers who comply with safety standards can secure institutional and commercial contracts, opening additional revenue streams.

Product Type Insights

Reflective jackets & outerwear dominate the market, accounting for 32% of total revenue in 2024. Their popularity stems from multifunctionality, enhanced visibility, and adoption by urban runners and cyclists. Reflective pants, tops, and accessories are also growing but lag in revenue due to lower perceived safety value and higher consumer preference for jackets as primary safety garments.

Application Insights

Running & jogging is the leading application segment, capturing 35% of the 2024 market. Night-time and early-morning fitness trends are driving the demand for reflective sportswear in this segment. Cycling is the second-largest application, fueled by safety regulations, urban commuting, and competitive cycling events. Outdoor sports and adventure activities are emerging as growth segments, particularly in APAC, where hiking, trekking, and trail running are increasingly popular.

Distribution Channel Insights

Online retail accounts for 38% of market revenue in 2024. Consumers increasingly prefer e-commerce platforms for convenience, customization, and global access. Offline retail, including specialty sports stores and brand outlets, continues to hold relevance, particularly for premium and mid-range products where fit, comfort, and tactile evaluation are critical. Specialty sporting goods stores cater to niche professional and adventure sports enthusiasts.

End-Use Insights

Outdoor enthusiasts, fitness communities, and professional athletes constitute the largest end-user segments. The fastest-growing applications are adventure sports and urban cycling, driven by increasing awareness of safety and visibility. Export-driven demand is significant, with North America and Europe importing innovative reflective apparel from China, India, and Vietnam, highlighting the global nature of this market.

| By Product Type | By Technology/Material | By Application / End-Use | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for 36% of the global market, led by the U.S. (28%) and Canada (5%). High urban fitness participation, strong cycling safety regulations, and rising disposable incomes support market growth. Demand for premium and technologically advanced reflective sportswear is particularly strong in metropolitan areas with active running and cycling communities.

Europe

Europe holds 28% of the market, with Germany (8%) and the UK (7%) leading. Safety regulations, urban running events, and cycling culture drive demand. Emerging interest in sustainable fabrics and smart reflective wearables is supporting growth in Western Europe.

Asia-Pacific

APAC is the fastest-growing region, led by China (7%) and India (5%). Urbanization, rising middle-class income, and increasing outdoor fitness activities are key growth drivers. Market adoption is also supported by e-commerce penetration and growing awareness of safety apparel.

Middle East & Africa

Key markets include the UAE and South Africa. Adoption is growing due to outdoor sports events, urban cycling, and adventure tourism. Premium products are targeted at affluent consumers and expatriate communities.

Latin America

Brazil (3%) is the leading country in LATAM, driven by urban running clubs, cycling, and outdoor adventure enthusiasts. Market penetration remains limited compared to developed regions but is steadily growing among high-income urban populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Reflective Sportswear Market

- Nike

- Adidas

- Puma

- Under Armour

- Columbia Sportswear

- ASICS

- New Balance

- Decathlon

- VF Corporation

- Reebok

- Lululemon

- Salomon

- Brooks

- Saucony

- The North Face

Recent Developments

- In March 2025, Nike launched a new line of LED-integrated running jackets in North America, combining smart visibility features with moisture-wicking fabrics.

- In January 2025, Adidas introduced a reflective, eco-friendly sportswear collection in Europe, emphasizing recycled materials and retro-reflective coating technologies.

- In July 2024, Puma partnered with an IoT startup to develop wearable reflective sportswear with fitness tracking and safety alert functionalities for urban cyclists in APAC.