Recreational Safety Harness Market Size

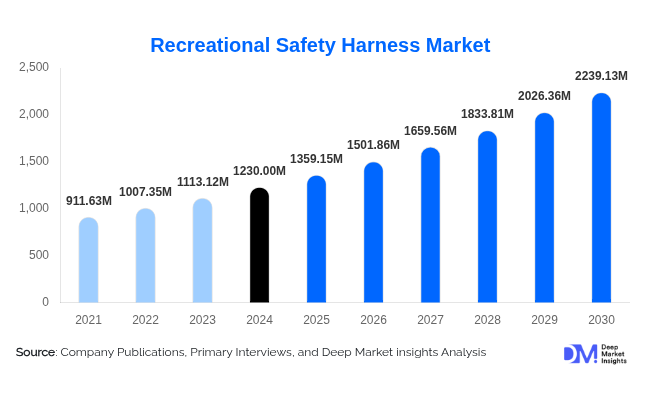

According to Deep Market Insights, the global recreational safety harness market size was valued at USD 1,230 million in 2024 and is projected to grow from USD 1,359.15 million in 2025 to reach USD 2,239.13 million by 2030, expanding at a CAGR of 10.5% during the forecast period (2025–2030). The market growth is primarily driven by rising participation in adventure and outdoor recreation, expanding commercial leisure infrastructure (indoor climbing gyms, adventure parks, zip-line venues), increasing regulatory and insurance requirements for certified safety equipment, and material and technology innovation that enable higher-value harness systems and service models.

Key Market Insights

- Commercial adoption is accelerating: Indoor climbing facilities, adventure parks, and rental fleets are driving larger, repeat purchases and service contracts for certified harnesses.

- Full body harnesses dominate: Standard full body harnesses represent the largest product slice owing to their broad applicability across climbing, zip-lines, and aerial adventure courses.

- APAC is the fastest-growing region: China, India, and Southeast Asia show rapid expansion in adventure infrastructure and leisure tourism, supporting above-average harness demand.

- Innovation is creating premium tiers: Lightweight webbing, ergonomic designs, inspection traceability (NFC), and sensor-enabled features are enabling premium pricing and stronger margins.

- Regulation and insurance pressures favor certified suppliers: Facility operators increasingly prefer certified harnesses and inspection services, creating B2B demand and after-sales revenue opportunities.

- Distribution is diversifying: Direct-to-consumer e-commerce and specialized outdoor retailers coexist with large commercial procurement contracts for operators and rental fleets.

Latest Market Trends

Commercialization and Rental-Fleet Growth

Adventure parks, indoor climbing gyms, and corporate team-building venues are increasingly standardizing on certified harnesses and adopting scheduled replacement/inspection programs. This trend shifts demand from one-time retail purchases to recurring commercial contracts, often including service, inspection, and replacement cycles. Rental fleets prioritize durable, easy-inspect harnesses, pushing manufacturers to design for durability and lower lifecycle cost. The commercialization trend has led suppliers to offer bundled solutions (harness + lanyard + inspection tags + service plan), which enhances lifetime revenue per unit.

Smart & Traceable Harnesses

Manufacturers and facility operators are trialing traceability and light sensor integration for enhanced safety and maintenance. NFC/RFID tags embedded in harnesses allow rapid retrieval of inspection history during daily checks, reducing human error and improving compliance with facility policies and insurer expectations. Early pilots of sensor-based fall detection and usage logging aim to provide data to operators, though widespread adoption remains in early stages. These features appeal particularly to commercial customers who need audit trails for liability and regulatory compliance.

Recreational Safety Harness Market Drivers

Growing Adventure & Leisure Participation

Global growth in outdoor and adventure activities rock climbing, zip-lining, high ropes courses, and canopy tours, continues to expand the addressable market. Urbanization, rising disposable income in emerging markets, and a cultural shift toward experience-based spending have driven more consumers to seek height-based recreation, increasing harness purchases for both personal use and commercial applications.

Stricter Safety Standards & Insurance Requirements

Heightened awareness of liability and insurance requirements among operators has driven the adoption of certified harnesses and documented inspection regimes. Regulators and insurers in many markets require or incentivize the use of certified equipment and formal inspection/maintenance records, which benefits established manufacturers who can demonstrate compliance and bundled service offerings.

Material & Design Innovation

Advances in webbing materials, buckle systems, ergonomic padding, and modular design have produced harnesses that are lighter, more comfortable, and easier to adjust, encouraging upgrades from older, heavier models. These improvements increase consumer willingness to pay and make harnesses more attractive for extended use in commercial settings.

Market Restraints

Price Sensitivity & Commodity Competition

At the lower end of the market, harnesses are often treated as commodity items, which subjects manufacturers to price competition from low-cost producers. This pressure compresses margins, especially for non-certified or basic models sold via mass retail channels or in emerging markets.

Supply-Chain & Certification Complexity

Manufacturers must manage raw-material price volatility (nylon, polyester webbing, metal buckles), cross-border logistics, and compliance with regionally varying standards (e.g., EN vs ANSI), all of which add cost and complexity. Smaller manufacturers may struggle to obtain and maintain multi-region certifications required for wide distribution, limiting their addressable market.

Recreational Safety Harness Market Opportunities

Fleet-Service & Inspection Business Models

Offering bundled inspection, certification, and refurbishment services to commercial operators presents a high-value recurring revenue stream. Manufacturers can capitalize on operators’ need for documented inspection records by selling harnesses with embedded NFC tags and subscription-based inspection plans, generating predictable revenue while strengthening customer relationships.

Smart Harness & IoT Integration

Integrating traceability (NFC/RFID) and sensor functionality (usage/fall logging) creates differentiation and addresses operator demand for auditability and safety analytics. Early adopters can secure premium pricing and preferential supplier status with commercial clients that prioritize data-driven safety programs.

Geographic Expansion into APAC & LATAM

High growth potential exists in Asia-Pacific and Latin America, where adventure leisure facilities and indoor climbing gyms are expanding rapidly. Targeting commercial operators in these regions with certified, durable harnesses and localized service capabilities can capture share as operators prefer suppliers who can provide product plus after-sales support.

Product Type Insights

Full Body Harnesses (standard multi-point systems) dominate the product landscape due to their universal applicability across recreational activities, especially for commercial operations where single-system usage simplifies training and inspection. Sit & Positioning Harnesses are important in climbing and work-positioning niches where comfort and load distribution matter. Children’s harnesses (toddler and youth sizes) are significant in family-oriented adventure parks and educational programs, while specialty harnesses for tree-climbing and zip-line use are gaining traction in parks and guided adventure tours.

Application Insights

Rock Climbing remains the largest application, driven by individual enthusiasts and the proliferation of indoor climbing gyms. Adventure Parks & Zip-lines are rapidly growing applications that require commercial harness fleets. Hunting & Elevated Platform Use represent a niche but stable application segment, particularly in regions with hunting traditions. Emerging applications include corporate team-building, high-ropes courses, and event-based mobile climbing trailers for fairs and community events.

Distribution Channel Insights

Distribution channels include specialized outdoor retailers, commercial procurement for operators, and direct-to-consumer e-commerce. Commercial contracts, often negotiated via specialist suppliers or directly with manufacturers, are increasingly important because of their volume and service requirements. E-commerce growth enables brands to reach enthusiasts globally, while specialist retailers and B2B distributors remain critical for market education and large operator sales.

User Demographics & Usage Insights

Primary user cohorts are outdoor enthusiasts aged 18–45 for active sporting use, and commercial operators of all types (gyms, parks, rental fleets) who prioritize durability and serviceability. Families and youth programs drive demand for children's harnesses, while experienced outdoor climbers and prosumers favor premium, lightweight harnesses with enhanced ergonomics.

| By Product Type | By Application | By End User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, supported by a mature network of indoor climbing gyms, a large outdoor enthusiast base, and a strong regulatory/insurance environment that values certified harnesses. The U.S. is the dominant national market within the region, with the highest per-capita harness spending and significant commercial fleet purchasing.

Europe

Europe is a mature market with strict safety norms and a large number of commercial adventure facilities. Countries such as the U.K., Germany, and France account for a major share of regional demand. European operators emphasize certified equipment and traceability, supporting premium product positioning.

Asia-Pacific (APAC)

APAC is the fastest-growing region, led by China, India, Australia, and Southeast Asian markets. Rapid urbanization, rising disposable incomes, and investment in leisure infrastructure (indoor gyms, zip-line parks, tourism-linked adventure parks) are expanding demand quickly. APAC’s growth rate outpaces mature regions and represents a key expansion priority for manufacturers.

Latin America

Latin America is an emerging market with growing adventure tourism and leisure spending in Brazil, Mexico, and Argentina. Demand is accelerating but remains smaller in absolute terms compared to North America and Europe.

Middle East & Africa

Demand in Gulf states (UAE, Saudi Arabia) is notable for high-end leisure facilities and bespoke adventure attractions, while Africa’s harness demand is driven largely by domestic tourism and tour-operator needs in established safari/adventure regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Recreational Safety Harness Market

- 3M Company

- Honeywell International Inc.

- MSA Safety Inc.

- Petzl SAS

- Black Diamond Equipment Ltd.

- CMC Rescue Inc.

- Skylotec (SKYLOTEC GmbH)

- Yates Gear

- FallTech

- Guardian Fall Protection

- Portwest Ltd.

- Rock Exotica

- Sala International

- Misty Mountains (outdoor specialty brand)

- Kaya Safety Co.

Recent Developments

- Product innovation: Several manufacturers have introduced lightweight full-body harnesses with improved ergonomics and modular attachments tailored for commercial rental fleets and long-duration use.

- Traceability pilots: Industry participants and select operators have piloted NFC/RFID-enabled harnesses for inspection audit trails and fleet management.

- Service-oriented contracts: Leading suppliers are expanding offerings to include inspection, refurbishment, and certification services bundled with harness sales to capture recurring revenue from commercial customers.