Recreation Clubs Market Size

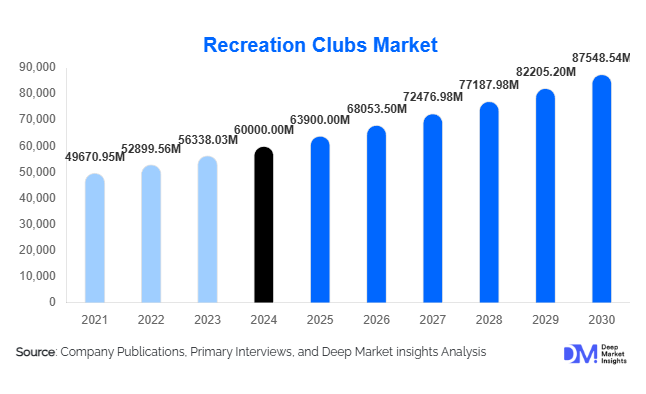

According to Deep Market Insights, the global recreation clubs market size was valued at USD 60,000.00 million in 2024 and is projected to grow from USD 63,900.00 million in 2025 to reach USD 87,548.54 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). Growth is primarily driven by rising health & wellness consciousness, expansion of hybrid digital-physical club models, growing family- and corporate-focused membership demand, and rapid uptake in high-growth geographies such as Asia-Pacific and select LATAM markets.

Key Market Insights

- Recreation clubs are becoming lifestyle hubs rather than single-purpose facilities: Full-service clubs that combine fitness, sports, wellness, dining, and social programming command the largest revenue share.

- Digital and hybrid offerings are reshaping member engagement: Mobile apps, virtual classes, and integrated wearable/booking ecosystems are increasing average revenue per user and retention.

- North America leads in absolute revenues, driven by high membership penetration, premium club culture, and strong household spending on leisure.

- Asia-Pacific is the fastest-growing region as rising disposable incomes, urbanisation, and youth demographics lift demand for new club footprints and franchising models.

- Family and corporate memberships are expanding, unlocking larger lifetime values and more stable revenue streams compared with single-user plans.

- Wellness and social experiences (mental wellness, recovery, social events) are key differentiators and drivers of higher per-member spend.

What are the latest trends in the recreation clubs market?

Hybrid Digital-Physical Club Models

Clubs are increasingly implementing digital-first features: booking and payment apps, livestream and on-demand fitness classes, virtual coaching, and data-driven member experience platforms. These hybrid models extend a club’s addressable audience beyond its physical catchment, enable tiered pricing (onsite + virtual), reduce seasonality, and create sticky digital communities. Boutique and legacy operators alike are investing in member analytics and personalised programming to increase retention.

Wellness + Social Experience Positioning

Members now expect holistic value: physical training plus social experiences, recovery services (sauna, cryo, physiotherapy), wellness programming (mindfulness, nutrition), and family amenities (childcare, youth coaching). Clubs are repositioning as community hubs, hosting events, workshops, family days and corporate gatherings, to increase visit frequency and broaden revenue mix beyond membership dues.

Boutique & Niche Club Proliferation

Smaller, high-specialisation clubs (boutique fitness, paddle/tennis, climbing, golf academies, adventure clubs) are growing fast. These formats require lower capex per location, enable rapid roll-out via franchising, and attract premium pricing through specialised coaching and unique experiences.

What are the key drivers in the recreation clubs market?

Rising Health & Wellness Focus

Growing awareness of physical and mental health is increasing demand for structured activity and wellness services. Chronic disease prevention, corporate wellness programmes, and the search for social wellbeing push consumers toward club memberships that combine fitness and preventive health services.

Demographic & Urbanisation Tailwinds

Urban middle classes, especially in APAC and parts of LATAM, are expanding rapidly. Urban professionals and dual-income families seek convenient, safe leisure destinations near work and home, making clubs a preferred option for structured recreation and socialising.

Flexible Membership & Corporate Partnerships

Innovative pricing (pay-per-use, family bundles, corporate blocks) and employer-sponsored wellness plans are lowering entry barriers and delivering predictable revenue. Corporate tie-ups also drive midweek utilisation and promotional scale.

What are the restraints for the global market?

High CapEx & Operating Costs

Launching full-service clubs, especially premium country or resort clubs, requires substantial initial investment (land, construction, specialised equipment) and ongoing costs (skilled staff, maintenance). In price-sensitive markets, this constrains expansion and pressures margins.

Competitive Saturation in Mature Markets

Mature markets (North America, Western Europe) are crowded with traditional clubs, boutique studios and low-cost fitness chains. This intensifies price competition, raises customer acquisition costs and forces differentiation through amenities and superior member experience.

What are the key opportunities in the recreation clubs industry?

Tech-Enabled Member Ecosystems

Opportunity: Build integrated digital platforms that combine scheduling, personalised coaching, telehealth/wellness consults, loyalty programmes and community networking. Why it matters: digital ecosystems increase retention, create ancillary revenue (virtual class subscriptions, premium content), and give operators data to refine services and pricing. Implementation approaches include white-label club apps, partnerships with wearables or health-tech startups, and hybrid memberships that blend onsite and remote access.

Expansion into High-Growth Emerging Markets

Opportunity: Enter under-penetrated urban centres in Asia-Pacific, the Middle East and LATAM through franchising, master-licences or local joint ventures. Why it matters: rising disposable incomes and under-provision of premium lifestyle facilities present a strong demand-supply gap. Operators who adapt offers to local price sensitivity (affordable family packs, flexible payment plans) can scale rapidly.

Wellness & Experience Diversification

Opportunity: Transform clubs into multi-service lifestyle destinations with wellness clinics, recovery centres, family programming and social/event spaces. Why it matters: differentiation drives higher ARPU (average revenue per user), longer member tenures and attraction of non-traditional members (older adults, families). Examples include adding physiotherapy suites, mindfulness studios, children’s activity academies and curated social calendars.

Product Type Insights

The recreation clubs market is typically divided into full-service clubs (comprehensive facilities: multiple sports, dining, and social programming), limited-service clubs (focused sports or fitness offerings), boutique/niche clubs (specialised classes, activities, or sports), and destination/resort clubs. Full-service clubs dominate revenue share due to higher membership pricing and multi-service spend, while boutique formats grow fast in urban pockets because of lower launch cost and focused customer appeal. Limited-service and mid-tier clubs provide volume and affordability, serving mass-market demand.

Application / End-Use Insights

Primary applications include personal fitness and sport participation, family leisure and child/youth sports programmes, corporate wellness and events, and destination/resort memberships (tourism-driven). Family & household memberships, corporate programmes, and wellness-focused offerings are the fastest-growing end uses, each increasing in importance as clubs diversify revenue streams beyond single memberships. Export-style demand exists in resort and tourism markets where clubs sell packages to international visitors and expatriates, supporting cross-border revenue.

Membership Type & Member-Profile Insights

Individual memberships remain common for single professionals and students. Family/household plans are growing fastest, driven by parents seeking holistic activities for multiple age groups. Corporate memberships (employer-sponsored or volume corporate plans) are rising, especially in markets prioritising employee wellbeing. Age-wise, millennials (approx. ages 28–44 in 2024) are the core active segment, favoring experiential and tech-enabled club offerings; older demographics drive demand for premium, wellness-oriented, and low-impact programming.

| By Club Type | By Membership Type | By End Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America is the largest single regional market, accounting for an estimated 35% of global recreation club revenues in 2024 (approx. USD 21 billion). The U.S. leads due to high membership penetration, mature private club ecosystems, and strong per-member spend. Trends include boutique studio growth, premium country clubs, and heavy digital investment to retain members.

Europe

Europe contributes roughly 25% of the global market (approx. USD 15 billion in 2024). Key markets, the UK, Germany, France, Spain, and Italy, display steady demand for wellness and multi-service clubs. Western Europe is mature; Eastern Europe is an emerging opportunity as disposable incomes rise.

Asia-Pacific (APAC)

APAC is the fastest-growing region, representing 20% of the market in 2024 (USD 12 billion) but posting the highest CAGR outlook. China and India are priority expansion markets due to urban middle-class growth and rising health awareness. Operators targeting APAC emphasise scalable, lower-capex formats and franchise models adapted to local price points.

Middle East & Africa (MEA)

MEA accounts for 10% of global revenues (USD 6 billion in 2024). The GCC (UAE, Saudi Arabia, Qatar) shows strong demand for luxury clubs and resort offerings, driven by high incomes and tourism. South Africa is a regional hub for traditional private clubs and destination properties.

Latin America (LATAM)

LATAM holds 10% of the market (approx. USD 6 billion in 2024). Brazil, Mexico, and Argentina show rising interest in urban clubs and family-oriented facilities. Growth is supported by urbanisation and rising leisure spending among younger households, though price sensitivity requires localised models.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Recreation Clubs Market

- Life Time Group

- Equinox Holdings

- David Lloyd Leisure

- Virgin Active

- Anytime Fitness (Fitness International)

- Planet Fitness

- Town Sports International / New York Sports Clubs (parent operator)

- ClubCorp

- Soho House (private members’ clubs)

- Gold’s Gym (parent operating companies/franchise networks)

- GoodLife Fitness

- PureGym

- Virgin Active (regional operations where applicable)

- Fitness First (regional operators/franchise groups)

- Local & regional premium club operators (multiple markets)

Recent Developments

- Expansion into APAC and LATAM: Several global operators are increasing franchise and master-licence activity to capture fast-growing urban demand.

- Digital investment: Clubs are rolling out proprietary apps, virtual class platforms, and integrations with wearables to boost member engagement and open ancillary revenue streams.

- Wellness positioning: Operators are launching recovery clinics, holistic health services, and family/child programmes to diversify revenue and improve member stickiness.