Recordable Optical Disc Market Size

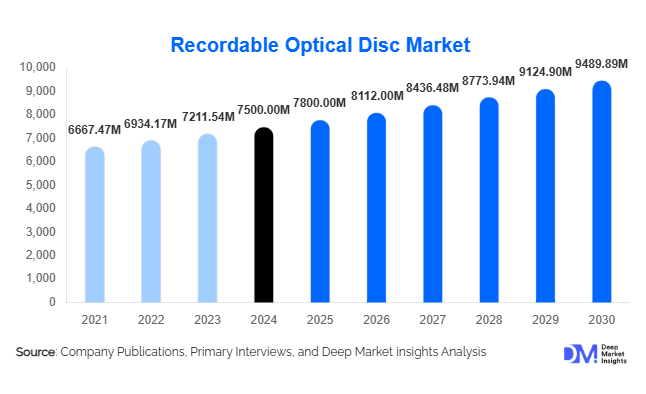

According to Deep Market Insights, the global recordable optical disc market size was valued at USD 7,500 million in 2024 and is projected to grow from USD 7,800 million in 2025 to reach USD 9,489.89 million by 2030, expanding at a CAGR of 4.0% during 2025–2030. Market growth is primarily driven by persistent demand for secure, offline, and archival data storage, enduring use in education and healthcare sectors, and the continued adoption of Blu-ray and premium multi-layer discs for professional applications and collector editions.

Key Market Insights

- Archival and long-term data preservation continues to drive sustained demand for recordable optical discs across government, healthcare, and education sectors.

- DVD formats maintain the largest market share globally, owing to their cost-effectiveness and compatibility across legacy systems.

- Asia-Pacific dominates global manufacturing and is the fastest-growing consumption region due to rising education and backup demand in emerging economies.

- Online sales channels are expanding rapidly, with e-commerce becoming the preferred platform for both consumer and institutional procurement.

- Premium Blu-ray and archival-grade discs are gaining traction among professional content creators and archival institutions.

- Technological integration through multi-layer disc structures, recyclable materials, and hybrid storage solutions is reshaping competitive differentiation.

Latest Market Trends

Rising Focus on Archival-Grade Media

Organizations across industries are emphasizing data security, regulatory compliance, and long-term preservation, which is accelerating demand for archival-grade optical media. Products such as gold-layer or M-Disc Blu-ray offer data lifespans exceeding a century, providing unmatched longevity compared to magnetic and flash media. Governments and corporations are adopting such discs for legal, imaging, and research archives. Manufacturers are therefore shifting toward higher-durability coatings, extended storage capacities, and tamper-proof designs to cater to the rising preference for offline cold-storage solutions.

Digital Transformation Creating Dual Demand

While cloud and flash storage dominate mainstream markets, hybrid storage architectures integrating optical discs are emerging. Enterprises use recordable Blu-ray discs as a cost-effective cold-storage complement to data centers, mitigating cyberattack risks and ensuring offline redundancy. Simultaneously, consumer demand for collector editions of movies, games, and music continues to support the blank disc duplication segment. This dual dynamic, digital expansion alongside archival preservation, is stabilizing long-term optical media demand worldwide.

Recordable Optical Disc Market Drivers

Growing Need for Offline Data Security

Increasing data breaches and ransomware incidents are prompting institutions to maintain physical, offline backups. Recordable optical discs, particularly Blu-ray archival formats, provide immutable and non-networked data protection. Healthcare, government, and education sectors continue to deploy optical media as part of multi-layered data-protection frameworks, supporting consistent market demand.

Resilient Demand in Media & Entertainment

Despite streaming’s dominance, physical collector editions and limited-release content continue to thrive. DVD and Blu-ray discs remain a preferred medium for distribution among cinephiles, production studios, and independent creators. The tangibility, high-quality playback, and collectible appeal of physical formats sustain stable demand for recordable discs used in duplication and packaging operations.

Emerging Market Expansion

In Asia-Pacific, Latin America, and parts of Africa, recordable discs remain vital for educational, governmental, and enterprise use. In areas with limited broadband infrastructure, optical discs provide a cost-efficient, portable storage alternative. Manufacturers leveraging localized production and affordable distribution are benefiting from steady export and domestic sales growth in these developing markets.

Market Restraints

Adoption of Alternative Storage Technologies

The proliferation of solid-state drives, external hard drives, and cloud storage solutions continues to erode mainstream consumer use of blank optical media. These substitutes offer higher capacity, speed, and convenience, which challenge the long-term volume growth of recordable discs.

Declining Optical Drive Penetration

Modern laptops and desktops increasingly omit optical drives, limiting consumer access to disc-writing capabilities. Reduced hardware compatibility, coupled with declining retail shelf presence, poses a significant restraint to future mass-market expansion and reinforces the shift toward niche and professional applications.

Recordable Optical Disc Market Opportunities

Archival and Long-Term Data Storage

Rising compliance and cybersecurity needs are driving investments in cold-storage media. Optical discs offer cost-efficient, write-once durability ideal for legal, healthcare, and corporate archives. Manufacturers developing multi-layer, high-density, and long-lifespan media stand to capture growing demand from institutions seeking ransomware-resilient offline backups.

Emerging Market Penetration

Regions such as South Asia, Africa, and Latin America offer untapped opportunities where digital infrastructure is still evolving. Low-cost recordable CDs and DVDs remain essential for educational content, software distribution, and data portability. Establishing local manufacturing and distribution hubs enables companies to expand their share through affordable offerings tailored to regional demand dynamics.

Technological Upgrades and Eco-Friendly Innovation

Next-generation optical discs, featuring recyclable substrates, enhanced coatings, and extended capacity, are redefining competitiveness. Integration of optical media into hybrid cloud-storage ecosystems offers an additional growth path. Manufacturers investing in sustainable materials and compatibility with automated archival systems are likely to gain a technological edge in the evolving data-storage landscape.

Product Type Insights

DVD formats lead the global market, accounting for approximately 40% of total value in 2024, due to their affordability, availability, and broad device compatibility. CDs continue to decline, while Blu-ray discs are expanding within professional, collector, and high-capacity applications. The mid-capacity range (5 GB–10 GB) remains dominant globally, supported by wide adoption in video, education, and archival duplication. Premium Blu-ray and archival discs above 10 GB, though smaller in share, are achieving the fastest growth rates driven by long-term storage applications.

Application Insights

The Media & Entertainment segment constitutes roughly 35% of global demand, driven by film, music, and gaming duplication. Healthcare and education applications are expanding steadily, where physical discs are utilized for imaging, diagnostics, and records retention. Corporate and governmental archival uses continue to offer stable, recurring demand. Niche applications such as firmware distribution, industrial data backup, and special-edition publishing are adding incremental market value, especially in Asia and North America.

Distribution Channel Insights

Online platforms account for around 30% of global sales and are expected to grow fastest through 2030, supported by e-commerce and direct-to-institution ordering. Offline retail remains relevant in developing economies, while institutional bulk procurement through distributors sustains B2B demand. Major e-commerce platforms have become essential for both branded and OEM blank disc sales, reshaping traditional distribution networks.

| By Product Type | By Recording Layer Technology | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America held about 35% of the global market in 2024, led by the United States. Demand stems from archival storage, media duplication, and healthcare imaging. Regulatory data-retention standards and collector markets ensure continued consumption despite the shift toward digital alternatives.

Europe

Europe contributes roughly 20% of global revenue, driven by Germany, the U.K., and France. Institutional archives, libraries, and legal documentation storage sustain steady demand. European manufacturers are focusing on recyclable discs and sustainable production to align with the region’s environmental regulations.

Asia-Pacific

Asia-Pacific dominates manufacturing and represents over 30% of global market value, with China, Japan, and India as major hubs. Educational and governmental sectors rely heavily on physical media for data dissemination, while Japan and South Korea lead in premium Blu-ray disc production. Asia-Pacific is also the fastest-growing regional market, projected to expand at a 5–6% CAGR through 2030.

Latin America

Accounting for approximately 8–10% share, Latin America shows emerging demand in education and SMB backup applications. Brazil and Mexico anchor the region’s consumption base, supported by local duplication and distribution networks.

Middle East & Africa

MEA holds a 5–7% share in 2024, led by South Africa, the UAE, and Egypt. Demand is centered on education, legal, and archival use cases. Infrastructure limitations make optical discs a practical medium for data portability and backup. Growth potential remains moderate but stable.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Recordable Optical Disc Market

- CMC Magnetics Corporation

- RITEK Corporation

- Taiyo Yuden Co., Ltd.

- Pioneer Corporation

- Fujifilm Holdings Corporation

- Sony Corporation

- LG Electronics Inc.

- Maxell Holdings Ltd.

- Verbatim Corporation

- Falcon Technologies International LLC

- IMATION Corp.

- Princo Corp.

- Singulus Technologies AG

- Hitachi Maxell Ltd.

- Koninklijke Philips N.V.

Recent Developments

- January 2025: Sony Corporation announced the discontinuation of recordable Blu-ray blank production to focus on advanced archival and media solutions, signaling industry consolidation toward specialized segments.

- March 2025: CMC Magnetics expanded its Taiwanese production lines for high-capacity BD-R media, targeting professional and institutional archival clients.

- June 2025: Fujifilm Holdings introduced eco-friendly optical discs made with recyclable substrates, aligning with global sustainability initiatives and enhancing product differentiation in mature markets.