Rangefinder Market Size

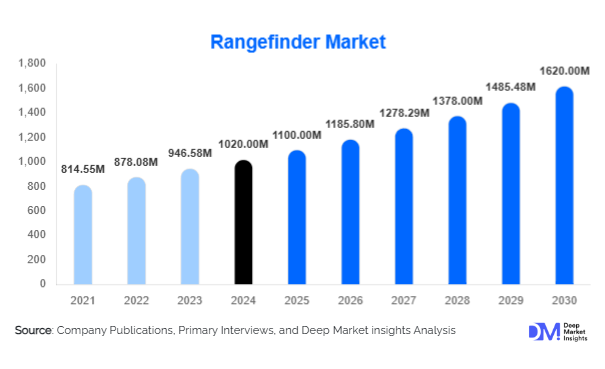

According to Deep Market Insights, the global rangefinder market size was valued at USD 1,020 million in 2024 and is projected to grow from USD 1,100 million in 2025 to reach USD 1,620 million by 2030, expanding at a CAGR of 7.8% during the forecast period (2025–2030). The market growth is primarily driven by rising adoption in defense and security applications, infrastructure development in emerging markets, and increasing consumer use for sports and recreational activities such as golf and hunting.

Key Market Insights

- Laser rangefinders dominate the product landscape due to their superior precision, durability, and adaptability across defense, industrial, and recreational applications.

- Time-of-Flight (ToF) technology leads the technology segment, favored for industrial measurement, surveying, and drone integration.

- Defense and security applications hold the largest share, driven by modernization programs and UAV integration in North America and APAC.

- Sports and recreation, particularly golf and hunting, are emerging as high-growth applications in North America and Europe.

- Asia-Pacific is the fastest-growing region, fueled by infrastructure development, defense upgrades, and rising recreational demand in China and India.

- Technological integration, including hybrid and IoT-enabled rangefinders, is reshaping industrial, automotive, and consumer adoption globally.

Latest Market Trends

Hybrid and IoT-Enabled Devices

Manufacturers are increasingly integrating laser and optical technologies to develop hybrid rangefinders that offer enhanced accuracy and versatility. IoT-enabled rangefinders are being adopted in industrial monitoring, construction, and automotive applications, providing real-time data analytics, remote calibration, and predictive maintenance. This technological trend is particularly appealing to sectors requiring precision and efficiency, such as defense, civil engineering, and smart manufacturing.

Consumer Adoption in Sports and Recreation

Recreational use of rangefinders in golf, hunting, and adventure sports is growing steadily. Compact, lightweight, and user-friendly models are increasingly preferred by consumers. The rising popularity of smart rangefinders that integrate with mobile apps for tracking, performance analysis, and GPS mapping is enhancing the consumer experience. Social media and online communities are also promoting adoption among younger demographics seeking performance-oriented equipment.

Rangefinder Market Drivers

Increasing Defense and Security Expenditure

Governments worldwide are investing heavily in defense modernization and border surveillance. Rangefinders integrated into tactical weapons, UAVs, and reconnaissance systems are in high demand. North America and APAC are leading this trend, with sustained procurement programs driving consistent revenue growth for manufacturers.

Infrastructure Development and Industrial Adoption

Global expansion of construction, civil engineering, and smart city projects is boosting demand for industrial-grade rangefinders. Surveying, mining, and monitoring applications increasingly rely on high-precision laser and ToF rangefinders. Rapid urbanization and government infrastructure initiatives in emerging economies such as India, China, and Brazil are creating additional growth avenues.

Growing Sports and Recreational Usage

The popularity of golf, hunting, and adventure sports continues to drive demand for consumer-grade rangefinders. Innovative features such as slope compensation, mobile connectivity, and lightweight designs make these devices attractive to recreational users. North America and Europe remain key markets, while APAC is emerging as a new growth hub.

Market Restraints

High Initial Cost

Advanced laser and hybrid rangefinders are relatively expensive, limiting adoption among price-sensitive segments, particularly in emerging markets. Cost remains a barrier for small enterprises, amateur sports enthusiasts, and budget-conscious consumers.

Technological Complexity

Some high-end rangefinders require specialized calibration, software integration, and maintenance. This complexity can deter adoption in certain industrial and consumer segments, particularly for new entrants without technical expertise or support infrastructure.

Rangefinder Market Opportunities

Defense and Security Modernization

Rising defense budgets globally present opportunities for manufacturers to supply tactical and UAV-integrated rangefinders. Long-term government contracts, multi-functional devices, and high-precision models provide revenue stability and growth potential for market leaders.

Emerging Markets Adoption

Countries such as India, China, Brazil, and Southeast Asia are experiencing rapid infrastructure growth, recreational sports uptake, and defense modernization. Expanding distribution networks and localized production can help companies capture untapped demand in these regions. Government projects and smart city initiatives are particularly attractive for industrial-grade rangefinders.

Technology Integration and IoT

Integration with IoT, AI, and drone technologies opens new applications in industrial monitoring, automotive ADAS systems, and consumer analytics. Smart rangefinders with real-time data capture, mobile connectivity, and predictive maintenance capabilities offer significant differentiation, providing a competitive edge to early adopters in this space.

Product Type Insights

Laser rangefinders dominate the market with a 52% share in 2024 due to their accuracy, durability, and wide application in defense, industrial, and recreational sectors. Ultrasonic and optical rangefinders are niche segments, primarily used in robotics, automotive, and specialized surveying applications. Hybrid devices combining laser and optical technology are growing in popularity, particularly in high-precision industrial and UAV applications.

Technology Insights

Time-of-Flight (ToF) technology holds the largest share (45%) in 2024 due to its precision in industrial measurement and surveying. Phase-shift technology is preferred for rapid measurements in construction and mining, while triangulation remains common in compact consumer and drone-integrated devices.

Application Insights

Golf and sports applications hold 30% of the market, driven by consumer demand in North America and Europe. Defense and security remain the largest application (35%) due to ongoing modernization programs. Industrial applications in construction, mining, and surveying are expanding, fueled by infrastructure projects in emerging economies. Automotive integration is an emerging application, particularly in ADAS systems and parking assistance.

Distribution Channel Insights

Offline retail continues to dominate (60% share in 2024), particularly for consumer-grade rangefinders. However, online sales are growing rapidly due to convenience, wider product variety, and access to detailed specifications. B2B direct sales remain significant for defense, industrial, and infrastructure projects, particularly in APAC and North America.

| By Product Type | By Technology | By Application | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds 40% of the market in 2024, driven by high defense budgets, recreational sports demand, and infrastructure projects. The U.S. leads in adoption across defense and industrial applications, while Canada is notable for sports and hunting segment growth.

Europe

Europe accounts for 25% of the market, led by Germany, the UK, and France. High defense modernization spending and strong sports and recreational demand support growth. Younger demographics are driving the adoption of smart and compact rangefinders.

Asia-Pacific

APAC is the fastest-growing region (9% CAGR), led by China and India. Rising infrastructure projects, defense spending, and recreational demand are driving adoption. Japan and Australia maintain steady, mature markets with a focus on precision applications and photography-based recreational use.

Middle East & Africa

The region contributes 8% of the market share. Oil & gas exploration and defense modernization drive demand. UAE and Saudi Arabia are key consumers of industrial and tactical rangefinders.

Latin America

LATAM holds 7% of the market, primarily in Brazil, Argentina, and Mexico. Construction, recreational hunting, and emerging consumer adoption are driving growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Rangefinder Market

- Leica Geosystems

- Nikon Corporation

- Bushnell Corporation

- Zeiss International

- Trimble Inc.

- Garmin Ltd.

- Stabila GmbH

- Topcon Corporation

- Sokkia Co., Ltd

- Vortex Optics

- Leica Camera AG

- Nikon Sport Optics

- Leupold & Stevens

- Furuno Electric Co., Ltd

- Pentax Ricoh Imaging

Recent Developments

- In March 2025, Leica Geosystems launched a new hybrid rangefinder integrating laser and optical sensors for UAV and industrial applications.

- In February 2025, Bushnell Corporation introduced IoT-enabled sports rangefinders for golf and hunting, featuring mobile app connectivity and GPS tracking.

- In January 2025, Trimble Inc. expanded its surveying rangefinder portfolio for APAC infrastructure projects, focusing on smart city and industrial applications.