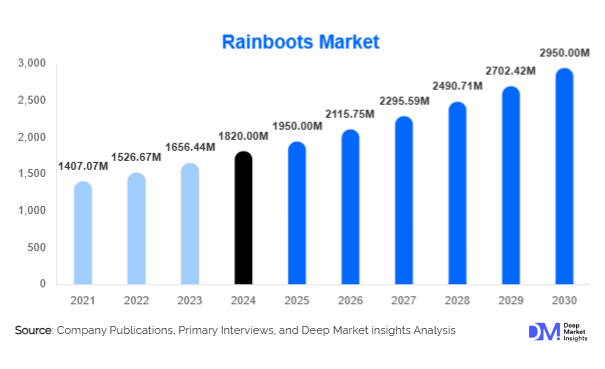

According to Deep Market Insights, the global rainboots market size was valued at USD 1,820 million in 2024 and is projected to grow from USD 1,950 million in 2025 to reach USD 2,950 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025-2030). Growth in this market is driven by the rising demand for functional and stylish rain footwear, increasing adoption of sustainable and recyclable boot materials, and strong growth in e-commerce channels, expanding consumer access globally.

Rainboots Market Size

Key Market Insights

- Functional yet fashion-forward designs are driving rainboot adoption among urban consumers, especially in Europe and the Asia-Pacific.

- Rubber-based rainboots remain dominant due to durability and waterproofing capabilities, accounting for more than 45% of market share in 2024.

- Women’s rainboots segment leads globally, driven by premium fashion collaborations and rising outdoor leisure participation.

- Asia-Pacific is the fastest-growing regional market, supported by rapid urbanization, monsoon-driven demand, and large-scale footwear production hubs.

- Online retail channels now account for over 35% of sales, fueled by digital-first consumer behavior and brand direct-to-consumer platforms.

- Industrial safety-certified rainboots are creating new demand in construction, agriculture, and chemical sectors, aligning with global workplace safety regulations.

What are the latest trends in the rainboots market?

Eco-Friendly and Sustainable Rainboots

Manufacturers are increasingly adopting recyclable and biodegradable materials such as natural rubber and EVA blends to meet consumer demand for eco-friendly products. Brands are launching collections that emphasize sustainability, including boots made from recycled plastics or algae-based polymers. Certifications and labeling around environmental compliance are becoming purchasing drivers, particularly in Europe and North America, where eco-conscious footwear is a rapidly growing category.

Fashion-Driven Collaborations

Luxury fashion houses and outdoor gear brands are collaborating to create rainboots that blend style with utility. Designer collections featuring bold patterns, color-blocking, and premium finishes are positioning rainboots as fashion statements rather than purely functional footwear. This trend is fueling higher average selling prices (ASPs) and expanding the consumer base beyond rural or industrial users to include urban lifestyle buyers.

Digital-First Distribution and Customization

E-commerce platforms and direct-to-consumer (D2C) brand websites are becoming the preferred channels for rainboot purchases. Companies are offering online customization tools where customers can select colors, prints, and sole types. Social media-driven marketing campaigns are amplifying the reach of these offerings, targeting millennials and Gen Z consumers who favor personalized and digital-first shopping experiences.

What are the key drivers in the rainboots market?

Growing Urbanization and Changing Weather Patterns

Increasing urban flooding and unpredictable rainfall patterns are directly fueling demand for rainboots. Cities across the Asia-Pacific, particularly India, China, and Southeast Asia, are witnessing monsoon-driven surges in sales. Similarly, seasonal rains in Europe and North America continue to sustain strong demand for reliable waterproof footwear.

Rise of Outdoor Recreation and Lifestyle Trends

Hiking, camping, and outdoor leisure activities are contributing significantly to rainboot demand. Younger consumers are driving interest in boots that combine practicality with fashion, suitable for both outdoor adventures and urban lifestyles. This dual-use trend is strengthening the mid-to-premium segment of the market.

Industrial and Workplace Safety Regulations

Global workplace safety standards are creating strong demand for heavy-duty rainboots across construction, agriculture, and chemical industries. Safety-certified boots with features such as anti-slip soles, electrical insulation, and chemical resistance are increasingly mandated in occupational environments, driving consistent demand in B2B channels.

What are the restraints for the global market?

High Price Sensitivity in Emerging Markets

In price-sensitive markets such as South Asia and Africa, consumers often prefer low-cost PVC boots, limiting the penetration of higher-value rubber or designer rainboots. Price competition among local manufacturers also compresses margins, making it challenging for premium brands to expand in these regions.

Seasonal Demand Fluctuations

Rainboot sales are highly seasonal, with demand peaking during rainy seasons or monsoon periods. This leads to inventory management challenges and volatile sales patterns for retailers and manufacturers. The reliance on specific weather conditions also exposes the industry to climate variability risks.

What are the key opportunities in the rainboots industry?

Expansion into Smart and Technology-Enhanced Footwear

The integration of smart features such as slip sensors, foot temperature control, and ergonomic cushioning presents opportunities for manufacturers to differentiate premium rainboots. This can expand adoption in both consumer and industrial markets, creating a new sub-category of performance-enhanced waterproof boots.

Regional Growth in Emerging Economies

Countries in Asia-Pacific, Latin America, and Africa are projected to drive the next wave of rainboot demand. Rapid urbanization, higher disposable incomes, and the adoption of e-commerce platforms are expanding the addressable consumer base in these regions. Governments focusing on workplace safety regulations are also supporting industrial rainboot adoption.

Brand Diversification Through Fashion and Lifestyle Integration

Leading brands are entering partnerships with fashion retailers, sportswear companies, and e-commerce giants to position rainboots as lifestyle accessories. This is opening new high-margin segments, particularly among women and younger demographics. Seasonal collections, limited editions, and collaborations with fashion designers are accelerating this diversification strategy.

Product Type Insights

Knee-high rainboots dominate the global market, accounting for nearly 38% of total sales in 2024. Their popularity stems from superior waterproofing coverage, durability, and versatility across both fashion and utility use cases. Ankle-length rainboots are growing rapidly in urban markets due to their lightweight design and appeal as casual lifestyle footwear, while specialty safety rainboots are capturing industrial demand.

Material Insights

Rubber-based rainboots hold the largest market share at 45% in 2024, owing to their durability, comfort, and superior waterproofing. PVC boots remain popular in cost-sensitive regions for their affordability, though EVA and polyurethane are emerging as premium materials offering lightweight comfort and eco-friendlier alternatives. Composite and hybrid designs are expected to grow as brands experiment with recyclables and biodegradable materials.

End-User Insights

Women’s rainboots lead the market with 41% share in 2024, driven by fashion-driven demand and strong uptake in premium categories. Children’s rainboots are gaining traction through colorful, cartoon-branded designs, while industrial rainboots continue to expand in agriculture and construction sectors due to rising safety compliance requirements.

Distribution Channel Insights

Offline retail continues to dominate with 65% of sales in 2024, but online retail is growing fastest, particularly in Asia-Pacific and North America. E-commerce platforms and D2C websites offer broader design variety, competitive pricing, and customization options, appealing strongly to tech-savvy and younger consumers.

| By Product Type | By Material | By End-User | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounted for 28% of the global rainboots market in 2024. The U.S. dominates regional demand due to a mix of fashion adoption and industrial usage, while Canada shows consistent sales due to prolonged wet seasons. Increasing focus on sustainable and designer rainboots is shaping growth here.

Europe

Europe remains the second-largest market with a 31% share in 2024, led by the U.K., Germany, and France. The region’s strong fashion-driven consumer base and sustainability-conscious population support premium sales. Designer collaborations are especially prominent, driving high-value growth in this region.

Asia-Pacific

APAC is the fastest-growing region, projected to expand at a CAGR of over 10% during 2025-2030. China and India dominate demand due to heavy monsoons, large population bases, and affordability-driven purchases. Japan and South Korea are premium-oriented markets where consumers prefer high-quality branded products. ASEAN countries also show strong seasonal surges in sales.

Latin America

Latin America is emerging as a growth market, particularly in Brazil and Mexico. Increasing urban flooding and agricultural usage drive demand for functional and affordable rainboots. E-commerce growth is accelerating adoption in urban areas.

Middle East & Africa

MEA remains a smaller market share contributor but is expected to see steady growth due to expanding infrastructure projects and industrial demand. South Africa shows growing consumer uptake, while GCC nations rely more on imported premium boots through luxury retail channels.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Note: The above countries are part of our standard off-the-shelf report, we can add countries of your interest

Regional Growth Insights Download Free Sample

Key Players in the Rainboots Market

- Hunter Boot Ltd.

- Aigle International

- Kamik (Genfoot Inc.)

- Tretorn Sweden AB

- Joules Group Plc

- Crocs Inc.

- Le Chameau

- Rockfish Wellies

- UGG (Deckers Brands)

- Regatta Ltd.

- Bogs Footwear

- Muck Boot Company

- Servus Footwear

- Havaianas

- Ilse Jacobsen

Recent Developments

- In June 2025, Hunter Boot announced a new eco-friendly collection using recycled rubber and sustainable packaging across Europe.

- In April 2025, Joules launched a collaborative rainboot line with leading U.K. designers, targeting fashion-forward urban consumers.

- In March 2025, Kamik expanded production facilities in Canada to meet rising North American demand for safety-certified rainboots.

Frequently Asked Questions

How big is the global rainboots market?

According to Deep Market Insights, the global rainboots market size was valued at USD 1,820 million in 2024 and is projected to grow from USD 1,950 million in 2025 to reach USD 2,950 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025-2030).

What are the key opportunities in the market?

Opportunities include sustainable material innovation, smart technology integration (slip sensors, ergonomic soles), and expansion in emerging economies across APAC, LATAM, and Africa.

Who are the leading players in the market?

Hunter Boot Ltd., Aigle International, Kamik (Genfoot Inc.), Tretorn Sweden AB, Joules Group Plc, Crocs Inc., Le Chameau, Bogs Footwear, UGG (Deckers Brands), and Muck Boot Company are the leading players in the rainboots market.

What are the factors driving the growth of market?

Key drivers include urbanization and unpredictable weather patterns, growth in outdoor leisure activities, and stronger workplace safety regulations mandating protective footwear.

Which are the various segmentation that the market report covers?

The market is segmented as follows: By Product Type, By Material, By End-User, By Distribution Channel, and By Region.