Railroad Friction Products Market Size

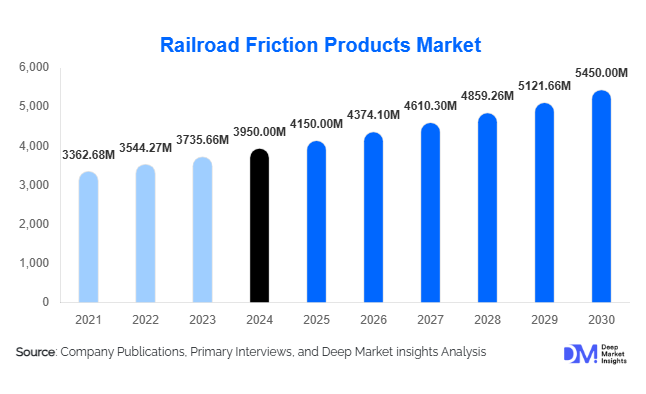

According to Deep Market Insights, the global railroad friction products market size was valued at USD 3,950 million in 2024 and is projected to grow from USD 4,150 million in 2025 to reach USD 5,450 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). The market growth is primarily driven by increasing global investments in rail infrastructure, rising demand for high-speed and urban rail systems, and the adoption of advanced, durable friction materials such as semi-metallic and ceramic-based brake pads and linings.

Key Market Insights

- Brake pads and semi-metallic friction materials dominate the market, driven by their durability and superior performance under heavy rail loads.

- Freight rail is the largest end-use segment globally, accounting for frequent replacement demand and higher consumption of friction products.

- Asia-Pacific holds the largest regional market share, led by China and India’s extensive rail network expansions.

- Europe and North America remain strong markets, with high adoption of high-speed rail and passenger rail infrastructure driving replacement cycles.

- Technological advancements, including predictive maintenance systems and eco-friendly friction materials, are reshaping product demand and operational efficiency.

- Government initiatives such as “Make in India” and China’s Belt and Road projects are supporting domestic production and modernization, creating additional growth avenues.

Latest Market Trends

Shift Toward High-Performance Materials

Rail operators are increasingly adopting semi-metallic and ceramic-based friction products due to their longer lifespan, higher thermal stability, and lower environmental impact. These materials reduce maintenance cycles, minimize noise and vibration, and improve braking efficiency, especially in high-speed rail and heavy freight applications. R&D in composite linings and eco-friendly adhesives is gaining traction as operators seek to balance performance with regulatory compliance and sustainability objectives.

Integration of Predictive Maintenance Technology

Emerging technologies are transforming how railroad friction products are monitored and maintained. IoT-enabled sensors and predictive analytics are being employed to track brake wear in real-time, optimize replacement schedules, and prevent operational failures. This trend is particularly relevant in high-speed rail networks and large freight operations, where downtime is costly. Advanced monitoring systems not only extend product life but also reduce maintenance expenses, aligning with the broader goals of operational efficiency and safety compliance.

Railroad Friction Products Market Drivers

Rising Rail Infrastructure Investments

Government and private sector spending on rail modernization, metro expansions, and high-speed corridors is a key growth driver. Major projects in China, India, Europe, and North America have increased demand for reliable friction products that can withstand heavy loads and high-speed operations. Expansion of freight rail logistics in emerging markets is also driving replacement demand for durable brake pads, shoes, and linings.

Growing Replacement and Maintenance Demand

Aging rolling stock across developed economies creates steady aftermarket demand. Brake pads and shoes require regular replacement due to wear and tear from intensive freight and passenger operations. This trend ensures continuous revenue streams for friction product manufacturers and incentivizes investments in longer-lasting, high-performance materials to meet operator expectations.

Adoption of Eco-Friendly and High-Durability Materials

The transition to semi-metallic and ceramic-based friction materials is supporting growth by offering longer operational lifespans and reduced environmental impact. Low-dust and noise-minimizing formulations align with stricter environmental regulations in Europe, North America, and the Asia-Pacific region, enhancing market appeal. Technological innovations also enable integration with predictive maintenance systems, further driving adoption.

Market Restraints

High Raw Material Costs

Price volatility in steel, copper, and advanced composite materials can affect production costs, squeezing profit margins and limiting growth in some regions. Manufacturers need to optimize sourcing strategies and invest in material innovation to mitigate these challenges.

Regulatory and Certification Challenges

Railway friction products must meet diverse safety and environmental standards across countries, including FRA (USA), EN 15444 (Europe), and UIC (international). Navigating these regulatory frameworks can be complex and costly, potentially delaying market entry for new players and increasing compliance expenditures.

Railroad Friction Products Market Opportunities

Expansion in Emerging Markets

Emerging economies, particularly in the Asia-Pacific, Africa, and Latin America, are investing heavily in rail infrastructure and metro systems. This growth presents opportunities for both global and local friction product manufacturers to meet rising demand, especially in high-speed rail and urban transit applications.

Technological Advancements & Product Innovation

Development of high-performance, eco-friendly friction materials and integration with predictive maintenance technologies is opening new market opportunities. Manufacturers investing in R&D to produce semi-metallic, ceramic, and low-noise brake pads are well-positioned to gain a competitive advantage while aligning with regulatory and sustainability trends.

Government Initiatives and Public Infrastructure Spending

Government programs such as China’s Belt and Road initiative and India’s railway modernization plans are promoting domestic production and infrastructure development. Friction product manufacturers can leverage these initiatives to secure long-term contracts and partnerships in public rail projects, further boosting market growth.

Product Type Insights

Brake pads dominate the global railroad friction products market, accounting for approximately 38% of 2024 revenue. Their dominance is driven by the high demand for low-maintenance and durable braking solutions in both freight and passenger trains. Semi-metallic pads, in particular, are preferred for their exceptional heat resistance and longevity, making them ideal for high-speed passenger trains and heavy freight operations. Brake shoes and friction linings also contribute significantly to market revenue due to their widespread use in conventional rail networks. Meanwhile, brake discs are increasingly adopted in modern rolling stock, especially in metro and high-speed systems, owing to their ability to deliver enhanced safety, braking efficiency, and lower maintenance requirements. Overall, the market is witnessing a clear trend toward long-lasting, high-performance friction products that reduce downtime and operational costs across rail networks globally.

Material Type Insights

Semi-metallic materials lead the market with a 42% share, largely due to their robustness in high-speed and heavy-load rail operations. Organic materials are widely adopted in cost-sensitive applications for their affordability and eco-friendly properties, while composites are increasingly utilized in specialized industrial and urban transit applications. Ceramic-based and sintered materials are gaining traction, especially in Europe and the Asia-Pacific region, where high-speed rail and metro projects demand friction products that provide superior performance, durability, and environmental compliance. The market is clearly moving toward materials that balance cost-effectiveness with high operational efficiency and sustainability.

Rolling Stock Insights

Freight trains represent the largest rolling stock segment, contributing approximately 45% of overall market demand. This is driven by the increasing global trade and cargo transport and the consequent wear and tear on brake pads and shoes, creating steady replacement demand. Passenger trains and metro systems are among the fastest-growing segments, spurred by high-speed rail expansions and urban transit modernization in regions such as China, India, Europe, and North America. Semi-metallic and ceramic friction products are preferred in these applications for their durability, heat resistance, and low maintenance requirements, which enhance reliability and operational safety in high-frequency service environments.

| By Product Type | By Material Type | Rolling Stock Type | By Application |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 28% of the global railroad friction products market. Growth in this region is primarily driven by the modernization of aging railway infrastructure and the expansion of freight corridors, particularly in the U.S., where freight rail networks are extensive. Canada contributes significantly through passenger rail upgrades and metro expansions. Regional adoption is further supported by investments in predictive maintenance systems and eco-friendly semi-metallic friction materials, aimed at reducing operational downtime and improving environmental compliance.

Europe

Europe holds around 22% of the market share, with Germany, France, and the U.K. as major contributors. Market growth is fueled by stringent safety and environmental regulations, which promote the adoption of advanced, low-emission friction products. High-speed rail development and metro system modernization are additional drivers, pushing demand for high-performance materials like semi-metallic and ceramic-based friction products. Sustainability initiatives and the replacement of aging rolling stock also support the growing preference for eco-friendly and durable brake solutions.

Asia-Pacific

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, rising population densities, and massive investments in high-speed rail and metro systems in countries such as China, India, and Japan. China alone accounts for approximately 20% of the global market. The regional demand is supported by the adoption of semi-metallic and ceramic friction materials for their durability, reduced maintenance requirements, and compliance with environmental regulations. Expanding freight corridors and logistics networks further boost the demand for robust braking systems in heavy rail operations.

Latin America

Brazil and Argentina lead demand in Latin America, driven primarily by the growing need for freight transport in the mining and agriculture sectors. Metro expansions in urban centers are also contributing to market growth. High-performance friction products are increasingly imported from China and Europe to support infrastructure upgrades, while investments in domestic manufacturing are beginning to cater to local demand.

Middle East & Africa

Urban rail projects in the UAE, Saudi Arabia, and South Africa are the main drivers of demand in the Middle East & Africa region. Investments in new metro and light rail systems to support urban mobility are complemented by the ongoing expansion of freight and intercity passenger rail networks across Africa. The adoption of semi-metallic and high-performance brake pads and shoes is growing as operators seek durable, low-maintenance solutions that ensure safety and reliability in both passenger and freight operations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Top Players in the Railroad Friction Products Market

- Knorr-Bremse AG

- Wabtec Corporation

- SKF Group

- Federal-Mogul Holdings

- Hitachi Ltd

- Mitsui Chemicals

- Newfren S.p.A.

- SAB Brake Systems

- Haldex AB

- Ricardo PLC

- ZF Friedrichshafen

- Jiangsu Xiangyu

- Changchun Railway Vehicle Co.

- Nippon Brake Co.

- Ferrodo Ltd.

Recent Developments

- In March 2025, Knorr-Bremse AG launched new semi-metallic brake pads with lower noise emissions for high-speed European trains.

- In January 2025, Wabtec Corporation expanded production of ceramic friction linings in China to meet APAC rail modernization demand.

- In February 2025, SKF Group introduced IoT-enabled predictive maintenance systems for friction product monitoring in freight and passenger rail networks.