Radio Frequency Beauty Machine Market Size

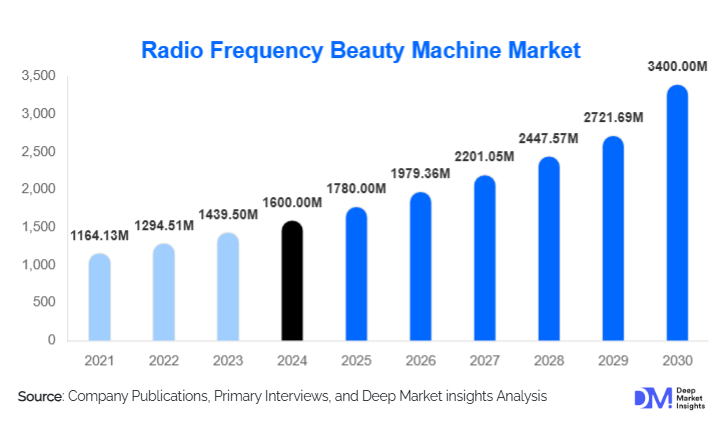

According to Deep Market Insights, the global radio frequency (RF) beauty machine market size was valued at USD 1,600 million in 2024 and is expected to grow from USD 1,780 million in 2025 to USD 3,400 million by 2030, growing at a CAGR of 11.2% during the forecast period (2025-2030). The market’s growth is driven by the rising global demand for non-invasive and minimally invasive cosmetic treatments, as consumers increasingly prioritize safe, effective, and downtime-free aesthetic solutions.

Key Market Insights

- Home-use and portable RF devices are gaining market share, as consumers seek in-house skin tightening and anti-aging solutions with lower cost and greater convenience.

- Multipolar and hybrid RF modalities dominate device launches, offering safer, more uniform energy delivery and integration with microneedling, ultrasound, or LED.

- Professional clinics and medical spas continue to lead in revenue share, purchasing high-end systems for comprehensive treatment offerings.

- North America remains the largest regional market, led by high aesthetic spending, regulatory maturity, and advanced clinic infrastructure.

- Asia Pacific is the fastest-growing region, with China, India, South Korea, and Southeast Asia driving strong adoption in both clinical and consumer segments.

- Regulatory harmonization and safety certifications are becoming critical differentiators, as markets standardize medical device rules and consumer confidence rises.

Latest Market Trends

Rise of Hybrid and Multi-Modal Devices

RF beauty machine manufacturers are increasingly combining RF with other technologies such as microneedling, ultrasound, or IPL to boost efficacy, reduce side effects, and capture new treatment niches. Hybrid devices offer differentiated value to clinics that wish to provide multiple services on a single platform. This trend also helps device makers command premium pricing and defend against the commoditization of basic RF machines.

Surge in Home-Use & Portable Treatments

The democratization of beauty technologies is pushing RF devices out of clinics and into homes. Advances in cooling, feedback sensors, and safety limits have enabled the development of handheld, compact RF units suitable for non-professional users. E-commerce, digital marketing, and social media influence are accelerating consumer adoption, especially among younger demographics and in emerging markets.

Radio Frequency Beauty Machine Market Drivers

Growing Demand for Non-Invasive Aesthetic Solutions

Consumers globally are increasingly turning away from surgical procedures and favoring treatments with minimal downtime, lower risk, and quicker recovery. RF devices fit this paradigm well, allowing skin tightening, wrinkle smoothing, and contouring without incisions. This shift in beauty and wellness behavior is among the principal growth drivers for the RF beauty machine market.

Technological Advances & Device Innovation

Continuous improvements as adaptive energy modulation, temperature feedback systems, multipolar applicators, and integration with AI/IoTare making RF treatments safer, more comfortable, and more precise. These innovations enhance user confidence, reduce adverse events, and expand the possible treatment areas, thereby fueling further adoption.

Rising Disposable Incomes & Beauty Awareness in Emerging Markets

In Asia Pacific, Latin America, and the Middle East, rising affluence, urbanization, beauty consciousness, and growth in aesthetic clinic networks are expanding the addressable market. Consumers are increasingly willing to invest in advanced beauty care, which drives demand for RF solutions in previously under-penetrated markets.

Market Restraints

High Capital Costs & Maintenance Expenditure

Premium RF systems (especially trolley or hybrid models) require substantial upfront investment, ongoing servicing, calibration, and spare parts. These costs may deter smaller clinics or salon operators, especially in price-sensitive markets.

Regulatory & Certification Barriers

RF devices are often categorized as medical or medical-adjacent devices, requiring rigorous safety, efficacy, and electromagnetic compliance testing across geographies. Inconsistencies in regulatory regimes and lengthy approval cycles slow new product launches and regional expansion.

Radio Frequency Beauty Machine Market Opportunities

Expansion into Untapped Emerging Markets

Growing middle classes and urban populations in regions such as Southeast Asia, Africa, and Latin America present significant new demand for RF beauty devices. Increasing access to digital retail channels and rising awareness of non-invasive aesthetic treatments offer entry points for manufacturers and distributors.

Development of Customized and AI-Driven Solutions

The integration of AI and machine learning into RF devices allows for personalized treatment plans, real-time monitoring, and improved outcomes. This innovation opens opportunities for premium product offerings that can command higher prices and improve customer loyalty.

Growth of Medical Tourism and Cross-Border Aesthetic Services

Clinics in established medical tourism hubs are driving cross-border demand for advanced RF devices, creating opportunities for companies to target these centers with specialized equipment and service packages tailored to high-volume providers.

Rising Male Grooming and Wellness Trends

Increasing male interest in aesthetic and wellness treatments is expanding the customer base. RF devices adapted to male skin types and concerns provide new revenue streams for manufacturers focusing on this growing demographic.

Application Insights

Skin tightening segment represents the largest share, accounting for approximately 40–45% of total market value in 2024. The strong demand for cosmetic treatments aimed at improving skin firmness and reducing facial sagging continues to drive adoption worldwide. RF devices are increasingly engineered for precision, comfort, and safety in these aesthetic applications, reinforcing their dominance in professional and at-home treatment settings.

Device Type Insights

Portable, handheld, and home-use RF devices lead this segment, with 30–35% of the market share. Its growth is supported by affordability, user-friendly designs, and accessibility through online retail platforms. The devices’ portability and minimal maintenance requirements make them particularly attractive in price-sensitive and emerging economies, fueling consistent year-over-year demand.

Technology Insights

Multipolar RF technology accounts for roughly 35–40% of total usage, underscoring its preference among both clinical professionals and manufacturers. Its ability to deliver controlled, uniform heating with minimal discomfort enhances treatment safety and efficacy. Compared to monopolar or bipolar systems, multipolar RF provides improved coverage and reduced risk of tissue damage, making it the preferred choice in advanced aesthetic solutions.

End-User Insights

Clinical and aesthetic clinics lead the market, contributing 55–65% of total revenue. These facilities typically invest in high-power, multi-functional RF systems capable of performing a wide range of skin-tightening and rejuvenation procedures. While at-home and beauty spa segments are expanding steadily, clinics remain the primary revenue source due to their capacity for higher procedure volumes and advanced treatment offerings.

| By Product Type | By Application | By End-Use | By Technology | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, constituting roughly 35–40 % of the 2024 global market. The U.S. leads this share, supported by high consumer spending, robust cosmetic/aesthetic clinic infrastructure, a favorable regulatory environment, and early adoption of advanced technologies. Canada contributes a smaller share. Growth in North America is steadydriven by continuous upgrades, new hybrid device launches, and replacement cycles.

Europe

Europe holds approximately 20–25 % of the market. Key contributors include Germany, the UK, France, Italy, and Spain. The region’s strong aesthetic clinic network, regulatory standards, and affluent consumers maintain stable demand. Growth is moderate, with new clinic setups and replacement of older devices pushing momentum.

Asia Pacific

Asia Pacific is the fast-growing region, accounting for around 25–30 % of the 2024 market base. China, India, Japan, South Korea, and Southeast Asia lead adoptionespecially in home-use and mid-tier clinic segments. The region sees the highest CAGR, as rising incomes, beauty awareness, and local manufacturing capacity accelerate expansion.

Latin America

Latin America contributes roughly 5–8 % of total global revenue. Brazil and Mexico are primary markets. Urban salon and clinic networks, growing middle classes, and the import of advanced devices drive demand, though affordability, currency volatility, and regulatory bottlenecks constrain growth.

Middle East & Africa

MEA also contributes around a 5–8 % share. GCC countries (UAE, Saudi Arabia) lead demand, supported by luxury spas, medical tourism, and high-income populations. Other African markets are developing more slowly. The region’s growth is bolstered by high-end tourism, wellness investments, and luxury clinic expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the RF Beauty Machine Market

- Cynosure

- Lumenis

- Alma Lasers

- Syneron Candela

- Venus Concepts

- Cutera

- InMode

- BTL Aesthetics

- Pollogen

- Sciton

- IBRAMED

- Guangzhou Beautylife

- Hologic

- SharpLight Technologies

- Cymedics

Recent Developments

- In 2025, several manufacturers released new multipolar + microneedle hybrid RF devices aimed at improving efficacy and reducing downtime.

- In late 2024, strategic acquisitions and partnerships were announced between device firms and AI/sensor technology providers to embed real-time feedback and safety features.

- In early 2025, the expansion of direct-to-consumer models by established clinic device brands began, launching handheld home RF units for the first time.