Push Lawn Mowers Market Size

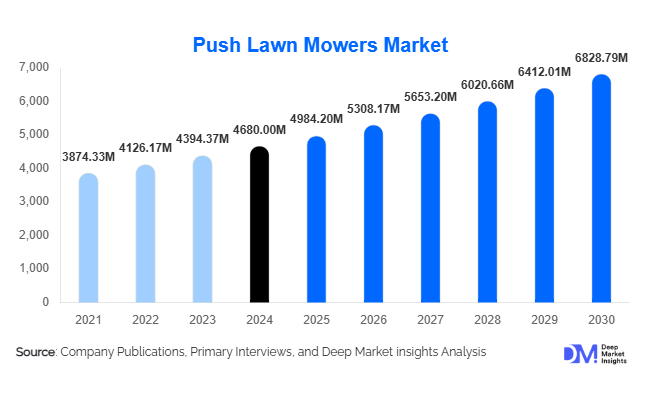

According to Deep Market Insights, the global push lawn mowers market size was valued at USD 4,680 million in 2024 and is projected to grow from USD 4,984.2 million in 2025 to reach USD 6,828.79 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is primarily driven by the rising adoption of electric and battery-powered push mowers, the expanding residential landscaping sector, and increasing sustainability initiatives that favor low-emission lawn equipment globally.

Key Market Insights

- Battery and cordless electric push mowers are witnessing rapid adoption, driven by consumer preference for low-noise, low-maintenance, and eco-friendly equipment.

- Residential lawn maintenance dominates demand, accounting for nearly 65% of the total global market value in 2024.

- Gasoline-powered models still lead the market (55% share), but are gradually losing ground to electric alternatives as emission norms tighten.

- North America leads in market share, while Asia-Pacific emerges as the fastest-growing region due to suburban housing expansion.

- Technological innovation, including brushless motors, smart connectivity, and ergonomic designs, is transforming user experience and fueling replacement demand.

- Government initiatives promoting “green” landscaping and urban green-space development are expected to bolster equipment procurement.

Latest Market Trends

Shift Toward Battery and Cordless Push Lawn Mowers

The industry is experiencing a major technological transition toward battery-powered, cordless push lawn mowers as lithium-ion technology advances. Consumers are increasingly moving away from gasoline models due to rising fuel prices, environmental concerns, and stringent emission standards. Modern cordless mowers now deliver longer runtimes, faster charging, and greater torque, enabling parity with traditional gas models. Manufacturers are investing in modular battery systems compatible across multiple garden tools, expanding convenience and brand loyalty.

Smart and Ergonomic Lawn-Care Equipment

Push mower designs are evolving toward greater ergonomics and connectivity. Smart-enabled models feature app-based monitoring, blade efficiency tracking, and usage optimization. Enhanced safety mechanisms, foldable handles, and lightweight aluminum decks are being introduced to improve portability and reduce user fatigue. The trend toward multi-functionality, such as 3-in-1 mulching, bagging, and side discharge, is further shaping consumer purchasing decisions, particularly among urban homeowners seeking compact, efficient solutions.

Push Lawn Mowers Market Drivers

Growing Consumer Investment in Home and Garden Improvement

Rising homeowner focus on outdoor aesthetics and home improvement has significantly boosted the market for push lawn mowers. Suburbanization, coupled with increasing disposable incomes, has led to larger lawn-care budgets. The surge in DIY landscaping projects, especially during and after the pandemic, continues to sustain equipment demand across North America and Europe.

Technological Advancements and Smart Integration

Battery-powered models equipped with brushless motors and integrated smart controls are reshaping the user experience. Remote start, runtime tracking, and maintenance alerts through mobile apps are enhancing convenience and product longevity. These innovations have prompted high replacement cycles and brand loyalty within the premium mower category.

Eco-Friendly and Regulatory Push for Low-Emission Equipment

Governments and municipalities worldwide are implementing stricter noise and emission standards for outdoor power equipment. This is accelerating the transition from gasoline to electric mowers. As a result, manufacturers investing in sustainable propulsion technologies are benefiting from increased subsidies and consumer goodwill.

Market Restraints

Rising Substitution by Artificial Turf and Ride-On Equipment

Urban landscaping trends toward synthetic turf, hardscaping, and low-maintenance gardens are reducing the frequency of mowing. In addition, large-lawn owners and commercial users increasingly prefer ride-on or zero-turn mowers for productivity, which constrains the addressable market for manual push models.

Price Sensitivity and Competitive Pressure

Intense competition among global and local manufacturers exerts downward pricing pressure. Consumers in emerging markets remain highly price-conscious, limiting premium model penetration. Fluctuating steel, aluminum, and lithium prices also impact production costs and profit margins.

Push Lawn Mowers Market Opportunities

Expansion of Electric and Sustainable Product Portfolios

Manufacturers are poised to benefit by broadening their electric and hybrid product ranges. Advances in battery density and charging infrastructure enable longer runtime and reduced operational costs. Strategic investments in eco-labelling and green certifications enhance brand differentiation in sustainability-conscious markets.

Emerging Urban and Small-Yard Applications

Urban densification is giving rise to smaller lawns and shared community gardens, creating strong demand for lightweight, compact push mowers. Models designed for small spaces with adjustable handles and easy storage capabilities will see increased uptake. This segment represents a high-margin opportunity for innovation-led entrants.

Commercial Landscaping Partnerships and Rental Models

Commercial grounds-maintenance companies and rental service providers are expanding their equipment fleets, particularly battery-powered push mowers suitable for noise-restricted areas. Manufacturers collaborating with landscaping firms or offering subscription-based maintenance programs can tap into recurring revenue streams in this fast-evolving segment.

Product Type Insights

Rotary push lawn mowers dominate the market, capturing nearly 60% of global value in 2024 due to their versatility and cost-effectiveness for most yard sizes. Reel-type mowers maintain a niche presence among environmentally conscious users seeking precision cuts. Cordless electric push mowers are rapidly expanding, projected to register double-digit growth during the forecast period, as battery efficiency improves and retail accessibility widens.

Application Insights

Residential applications represent approximately 65% of market value in 2024, driven by suburban homeowners and DIY enthusiasts. Commercial landscaping follows as a fast-growing segment, with public and private landscaping services investing in professional-grade push mowers for parks, schools, and hospitality venues. Rental and DIY service outlets form an emerging niche as consumers seek flexible equipment access without ownership costs.

Distribution Channel Insights

Offline retail channels dominate the market with about 70% share in 2024, leveraging the consumer preference for product demonstration and post-sale service through hardware stores and home improvement centers. However, online retail platforms are growing rapidly, fueled by competitive pricing, wide product variety, and rising e-commerce adoption across developed and emerging economies.

| By Product Type | By Blade Type | By Drive Type | By Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, accounting for approximately 35% of the global value in 2024. The U.S. leads with high household lawn ownership, strong DIY culture, and frequent replacement cycles. Canada contributes steadily through residential and golf-course landscaping demand. Market growth is moderate but supported by early adoption of cordless and low-noise electric mowers.

Europe

Europe accounts for roughly 25% of market value, led by the U.K., Germany, and France. The region prioritizes low-emission and quiet-operating equipment due to strict environmental regulations. The rising popularity of urban gardening and compact lawns favors electric and reel-type push mowers. Scandinavian countries are adopting battery solutions faster, aided by high environmental awareness.

Asia-Pacific

Asia-Pacific is the fastest-growing regional market, holding about 20% share in 2024. Growth is driven by expanding suburban housing and rising disposable incomes in China, India, and Australia. Increasing home-ownership rates and “green neighborhood” initiatives in emerging cities will sustain long-term growth. The region is expected to grow at a 6–7% CAGR through 2030.

Latin America

Latin America holds approximately 10% of the market share, led by Brazil and Mexico. Expanding middle-class home-ownership and rising investment in residential landscaping services are driving steady growth. Price sensitivity and limited retail infrastructure currently restrain premium model adoption, but present opportunities for cost-effective electric products.

Middle East & Africa

The region contributes close to 10% of the total market value, with growth concentrated in GCC nations and South Africa. Government-led initiatives for urban beautification and green infrastructure support equipment demand. Luxury villas, resorts, and golf courses remain key buyers, while local manufacturing incentives such as “Made in Saudi Arabia” and “Made in UAE” are boosting domestic production capabilities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Push Lawn Mowers Market

- The Toro Company

- Husqvarna AB

- Honda Motor Co., Ltd.

- Stanley Black & Decker Inc.

- Deere & Company

- MTD Products Inc.

- Makita Corporation

- Snapper (Briggs & Stratton)

- Ryobi Limited

- Cub Cadet LLC

- Fiskars Group

- Earthwise Tools

- Snow Joe LLC

- Yardmax Power Equipment

- The Scotts Miracle-Gro Company

Recent Developments

- In April 2025, Husqvarna introduced a new generation of cordless push mowers featuring improved brushless motors and smart battery interchange systems compatible across its garden tools portfolio.

- In March 2025, The Toro Company expanded its production line in Texas to meet rising North American demand for electric and hybrid lawn mowers.

- In February 2025, Makita launched an IoT-enabled electric push mower in Japan, incorporating mobile diagnostics and runtime tracking for homeowners.