Pultrusion Products Market Size

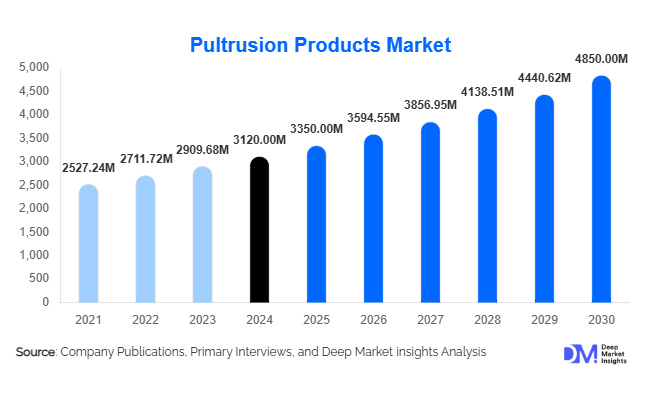

According to Deep Market Insights, the global pultrusion products market size was valued at USD 3,120 million in 2024 and is projected to grow from USD 3,350 million in 2025 to reach USD 4,850 million by 2030, expanding at a CAGR of 7.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing adoption of lightweight, corrosion-resistant composite materials across construction, electrical, transportation, and renewable energy sectors, coupled with rising automation and technology integration in pultrusion manufacturing processes.

Key Market Insights

- Construction and infrastructure applications dominate demand, leveraging pultruded beams, channels, and sheets for bridges, pipelines, and industrial structures.

- Glass fiber reinforced polymer (GFRP) remains the leading material, accounting for the majority of market share due to cost efficiency and mechanical strength.

- North America holds a significant share, driven by U.S. and Canadian demand for renewable energy, electrical, and industrial applications.

- APAC is the fastest-growing region, led by China and India, benefiting from rapid urbanization, infrastructure investments, and industrialization.

- Emerging applications in renewable energy and transportation, including wind turbine blades, solar panels, and lightweight automotive components, are expanding market potential.

- Technological advancements, such as automation, hybrid composites, and IoT-enabled production, are improving product quality, efficiency, and adoption rates.

What are the latest trends in the pultrusion products market?

Hybrid Composites and Material Innovation

Manufacturers are increasingly integrating carbon fibers, aramid fibers, and hybrid composites into pultrusion products to enhance mechanical properties, reduce weight, and improve durability. Hybrid composites are gaining traction in aerospace, transportation, and specialized industrial applications where performance is critical. This innovation allows for customization according to strength, stiffness, and corrosion resistance requirements while remaining cost-effective.

Automation and Smart Manufacturing

The pultrusion industry is adopting automated production lines with robotics, IoT monitoring, and predictive maintenance technologies. These advancements improve consistency, reduce waste, and enhance production efficiency. Automated processes also allow manufacturers to scale production for high-demand sectors such as construction and renewable energy while maintaining high-quality standards, making pultrusion more competitive against conventional materials like steel and aluminum.

What are the key drivers in the pultrusion products market?

Rising Construction and Infrastructure Investments

Global urbanization and industrialization are fueling demand for pultruded components in bridges, pipelines, and industrial facilities. Pultruded profiles are preferred over steel and wood due to superior corrosion resistance, low maintenance, and lightweight design. The construction sector alone contributes roughly 35% of total pultrusion product demand in 2024, and government infrastructure projects are expected to further boost adoption globally.

Growing Renewable Energy Applications

Pultrusion products are increasingly used in wind turbine blades, solar panel frames, and supporting structures due to their durability and lightweight properties. Renewable energy demand is accelerating, particularly in North America, Europe, and APAC, providing stable long-term growth opportunities. Government incentives and sustainability-focused investments are key drivers of adoption in this sector.

Technological Advancements and Automation

Automation, advanced material integration, and IoT-enabled manufacturing are enhancing production efficiency, reducing costs, and improving product consistency. Manufacturers investing in smart pultrusion technologies are gaining a competitive advantage, especially in high-precision applications in aerospace, transportation, and specialty industrial sectors.

What are the restraints for the global market?

High Raw Material Costs

The fluctuating prices of glass fibers, carbon fibers, aramid fibers, and resin materials increase production costs, which can limit adoption in cost-sensitive regions. Price volatility affects profitability and pricing strategies for pultrusion manufacturers globally.

Skilled Workforce Requirement

Pultrusion manufacturing requires specialized knowledge in composite materials, die design, and process optimization. Limited availability of trained personnel in emerging markets constrains expansion and can slow down the implementation of automated technologies.

What are the key opportunities in the pultrusion products industry?

Expansion in Emerging Economies

Countries such as India, China, Brazil, and Mexico offer significant growth potential due to rapid urbanization and infrastructure development. Government-led initiatives, such as bridge building, industrial parks, and energy projects, create strong demand for pultruded profiles. Manufacturers entering these markets can leverage favorable costs and government incentives.

Integration with Advanced Materials and Technologies

The adoption of hybrid composites and automation in pultrusion lines provides opportunities for high-performance applications. Innovations such as predictive maintenance, IoT-based monitoring, and energy-efficient production processes enable manufacturers to differentiate their products and enhance operational efficiency.

Renewable Energy and Sustainable Construction Demand

Pultrusion products are increasingly used in wind turbine blades, solar frames, and green building materials. Rising investments in sustainable infrastructure globally offer manufacturers long-term contracts and stable revenue streams. Export opportunities from mature markets such as the U.S., Germany, and China to APAC and LATAM further expand growth potential.

Product Type Insights

Pultruded rods dominate the market, accounting for approximately 28% of global demand in 2024. They are widely used in electrical insulation, construction reinforcement, and structural applications due to their lightweight, corrosion-resistant, and durable properties. Pultruded channels, beams, and sheets are also gaining traction in construction and industrial applications, supporting structural frameworks and large-scale infrastructure projects.

Material Insights

Glass fiber reinforced polymers (GFRP) lead the material segment with a 55% market share, driven by cost-effectiveness, mechanical strength, and widespread adoption in construction and electrical applications. Carbon fiber reinforced polymers (CFRP) are expanding in aerospace and automotive applications due to high-performance characteristics, despite higher costs. Hybrid composites are emerging for specialized industrial and renewable energy applications, leveraging combined material properties.

End-Use Industry Insights

Construction and infrastructure applications account for 35% of global consumption in 2024. Electrical & electronics applications contribute 20%, primarily for cable trays, ladders, and insulating rods. Industrial processing and chemical applications are growing steadily at a 6-7% CAGR. Renewable energy and transportation sectors represent high-growth opportunities, particularly wind turbine blades and lightweight automotive components, with a CAGR exceeding 10% for emerging applications. Export-driven demand from North America and Europe to APAC and LATAM further supports market expansion.

| By Product Type | By Material Type | By End-Use Industry | By Region |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

The U.S. and Canada account for approximately 30% of the global pultrusion products market in 2024, driven by renewable energy infrastructure, industrial demand, and construction projects. Strong industrial automation adoption and investment in sustainable materials further support market dominance.

Europe

Germany, France, and the U.K. are key markets, holding 22% of global demand. Growth is fueled by infrastructure upgrades, industrial applications, and renewable energy investments. Germany alone accounts for 8% of the 2024 market share.

Asia-Pacific

China and India are the fastest-growing markets, with APAC projected to surpass North America by 2030. Rapid urbanization, infrastructure spending, and industrialization drive demand. CAGR in the region is approximately 8.5%, supported by government initiatives and manufacturing expansion.

Middle East & Africa

UAE, Saudi Arabia, and South Africa represent 10% of the global market share, with demand primarily from construction and industrial applications. Investments in infrastructure and energy projects support steady growth.

Latin America

Brazil and Argentina are leading markets, contributing 11% of global demand. Growth is driven by industrial and electrical infrastructure development, along with emerging renewable energy projects.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pultrusion Products Market

- Owens Corning

- Strongwell Corporation

- Bedford Reinforced Plastics

- Pultron Composites

- Crane Composites

- Exel Composites

- Jiangsu Guotai Fiber

- Futura Composites

- Nippon Pultrusion

- Alpha Composites

- KCC Corporation

- Composite Advantage

- Aztec Pultrusions

- Vetroresina S.r.l

- Plastruc

Recent Developments

- In Q1 2025, Strongwell Corporation expanded its automated pultrusion production lines in the U.S., focusing on high-performance GFRP and CFRP products.

- In February 2025, Pultron Composites launched hybrid composite pultruded profiles for aerospace and transportation applications in Europe, enhancing product performance and durability.

- In January 2025, Owens Corning invested in renewable energy-based pultrusion manufacturing in APAC, targeting wind turbine blades and solar panel frames.