Protein Shampoo Market Size

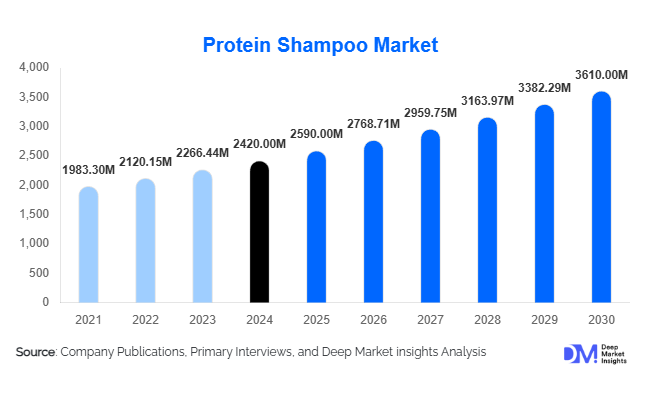

According to Deep Market Insights, the global protein shampoo market size was valued at USD 2,420.00 million in 2024 and is projected to grow from USD 2,590.00 million in 2025 to reach USD 3,610.00 million by 2030, expanding at a CAGR of 6.9% during the forecast period (2025–2030). This steady growth reflects rising consumer demand for clean-label, damage-repairing, and natural hair-care products enriched with keratin, plant-based proteins, and amino-acid complexes. The surge in e-commerce retailing, the expansion of male grooming, and the rapid adoption of sustainable formulations are major factors driving global market expansion.

Key Market Insights

- Repair and strengthening protein shampoos dominate global demand, supported by increased awareness of hair damage from heat styling, coloring, and pollution.

- Natural and organic formulations lead ingredient trends, accounting for more than 50% of total sales as consumers prefer vegan, sulfate-free, and clean-label hair-care solutions.

- Women remain the largest end-user group, representing nearly 80% of market demand, while men’s grooming is emerging as a fast-growing segment.

- North America holds the largest regional share (30%), but Asia-Pacific is the fastest-growing region with expanding middle-class spending in India and China.

- Online retail is the fastest-growing distribution channel, driven by direct-to-consumer brands and influencer-led marketing campaigns.

- Premiumization and personalization are reshaping consumer expectations, pushing brands to innovate with hair-type-specific protein formulations.

Latest Market Trends

Clean-Label and Vegan Protein Formulations

The protein shampoo market is rapidly shifting toward natural, vegan, and cruelty-free ingredients. Consumers are actively avoiding sulfates, parabens, and synthetic fragrances in favor of plant-derived proteins such as soy, wheat, and pea. Leading brands are launching sulfate-free, silicone-free variants emphasizing “repair through nutrition,” aligning with global sustainability standards. Packaging innovation—biodegradable bottles, refill pouches, and minimal-plastic designs—is reinforcing brand differentiation in mature markets.

Personalized and Tech-Enabled Hair Care

Advancements in digital tools and data analytics are enabling personalization in protein shampoo formulations. Online platforms use AI-driven quizzes to identify hair-type profiles and recommend customized protein blends. Subscription-based delivery models are growing, especially in North America and Europe, where consumers value consistency and convenience. Smart diagnostic apps, hair-health tracking, and AR visualization for before-and-after results are enhancing consumer engagement and brand loyalty.

Protein Shampoo Market Drivers

Increasing Awareness of Hair Damage and Hair Health

Growing exposure to pollution, UV radiation, chemical treatments, and heat styling has heightened consumer focus on repairing and protecting hair structure. Protein shampoos—rich in keratin and amino-acid complexes—are being perceived as essential restorative products rather than luxury add-ons. This shift has strengthened the category’s position in both premium and mid-tier retail segments.

Premiumization and E-Commerce Expansion

Rising disposable incomes and evolving beauty standards are pushing consumers toward high-quality, functional hair-care products. The growing penetration of e-commerce and influencer-led marketing has democratized access to premium protein shampoos. Direct-to-consumer (D2C) models are helping niche and sustainable brands compete effectively with multinational corporations.

Sustainability and Ingredient Transparency

Environmental awareness has become central to product development in the personal care sector. Consumers prefer ethically sourced, plant-based protein shampoos with transparent ingredient labeling. Global beauty conglomerates are investing heavily in R&D for biodegradable surfactants and renewable packaging solutions, strengthening their sustainability credentials and driving long-term growth.

Market Restraints

High Ingredient and Production Costs

Premium protein ingredients such as keratin, silk, and hydrolyzed collagen add significant cost to formulations. Combined with sustainability-oriented packaging and marketing expenses, this raises product pricing. For cost-sensitive consumers in emerging markets, the high price of protein shampoos may hinder adoption, creating challenges for mass-market penetration.

Market Saturation and Consumer Skepticism

In mature markets such as the U.S. and Western Europe, saturation and claim dilution have emerged as issues—many shampoos now advertise “protein-enriched” benefits with minimal differentiation. Consumers are increasingly demanding verifiable efficacy, making product authenticity and transparency crucial to maintaining brand trust and repeat purchases.

Protein Shampoo Market Opportunities

Expansion into Emerging Economies

Rapid urbanization, rising disposable incomes, and heightened personal grooming awareness in Asia-Pacific and Latin America present significant growth opportunities. Brands that localize formulations for regional hair textures and climates (e.g., humidity-resistant or anti-frizz) can effectively capture new demographics. Local production and e-commerce penetration further support scalability in these regions.

Innovation in Vegan and Sustainable Protein Sources

Brands are increasingly investing in alternative protein sources such as quinoa, rice, pea, and soy to meet vegan and cruelty-free certification standards. Sustainable packaging innovations and green chemistry adoption further enhance brand positioning. This opportunity aligns with growing regulatory focus on eco-friendly formulations and consumer preference for ethical beauty products.

Growing Male Grooming and Specialty Segments

Male-specific protein shampoos focusing on strengthening and anti-hair-fall benefits are gaining traction. Similarly, kid-friendly and sensitive-scalp protein shampoos represent niche opportunities. Premium professional-grade products sold through salons also provide higher margins and consistent consumer loyalty, offering room for both innovation and brand expansion.

Product Type Insights

Strengthening and Repair Protein Shampoos lead the market, accounting for about 35% of global revenue in 2024. These formulations cater to the largest consumer need, damage repair caused by chemical treatments and environmental exposure. Moisturizing and volumizing variants are expanding, but strengthening types remain dominant due to their broad applicability across hair types and demographics.

Ingredient Insights

Natural and Organic Protein Shampoos represent approximately 54% of the total market, reflecting a growing shift toward clean beauty and sustainability. Brands using plant-based proteins such as soy, pea, and wheat have gained strong acceptance, particularly in Europe and North America, where eco-conscious consumers prefer certified organic formulations.

Distribution Channel Insights

Supermarkets and Hypermarkets remain the leading sales channel, contributing nearly 39% of total sales in 2024. However, online channels are experiencing the fastest growth, supported by influencer marketing, direct-to-consumer subscription models, and social media-driven discovery. Retailers are also expanding shelf space for eco-friendly and premium protein shampoos.

End-User Insights

Adult women continue to dominate protein shampoo consumption, representing about 81% of the global market in 2024. However, men’s grooming is the fastest-growing end-user segment, with demand for strengthening and anti-hair-fall solutions. Children’s and family-oriented shampoos form a niche but rising category, driven by demand for mild, hypoallergenic formulations.

| By Product Type | By Ingredient Type | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America accounts for approximately 30% of the global protein shampoo market in 2024 (USD 660 million). The U.S. drives regional dominance through strong brand presence, high spending on personal care, and rapid adoption of clean-label hair-care products. Premium salon brands and e-commerce-based direct sales are major growth drivers.

Europe

Europe holds around 25–28% market share (USD 550–620 million) and remains an innovation hub for sustainable, vegan, and cruelty-free hair-care formulations. Germany, the U.K., and France lead in demand, with consumers preferring certified organic and eco-conscious products.

Asia-Pacific

Asia-Pacific represents approximately 20–22% of global share (USD 450–500 million) and is the fastest-growing region, with a projected CAGR of 8–9%. India and China dominate growth, driven by rising middle-class income and strong online retail expansion. The region’s climatic diversity is also creating demand for humidity-control and anti-frizz protein shampoos.

Latin America

Latin America accounts for about 10% of the market (USD 220 million). Brazil and Mexico are key growth contributors due to increased beauty awareness and the introduction of international brands through online retail and pharmacies.

Middle East & Africa

MEA holds an 8–10% share of the global market (USD 180–200 million). GCC countries show strong premium demand, while sub-Saharan Africa’s young population and improving retail infrastructure offer untapped potential for mass-market protein shampoos.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Protein Shampoo Market

- L’Oréal S.A.

- The Procter & Gamble Company

- Unilever PLC

- Johnson & Johnson Services, Inc.

- Kao Corporation

- Henkel AG & Co KGaA

- Marico Limited

- Patanjali Ayurved Limited

- Himalaya Herbals

- VLCC Personal Care Ltd.

- Estée Lauder Companies Inc.

- Amway Corporation

- Shiseido Company Limited

- Godrej Consumer Products Ltd.

- Beiersdorf AG

Recent Developments

- In April 2025, L’Oréal introduced a new line of vegan protein repair shampoos under its Garnier brand, using 95% biodegradable ingredients.

- In March 2025, Unilever’s Dove brand launched a refill-pack initiative across Asia-Pacific to promote sustainable consumption.

- In February 2025, Marico Limited expanded its Parachute Advanced Keratin+ range in India, targeting men’s strengthening and anti-hair-fall care segments.