Property Restoration Services Market Size

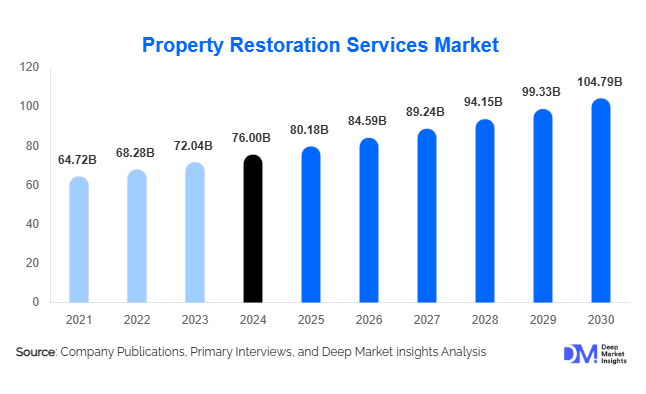

According to Deep Market Insights, the global pet hard goods market size was valued at USD 76.0 billion in 2024 and is projected to grow from USD 80.18 billion in 2025 to reach USD 104.79 billion by 2030, expanding at a CAGR of 5.5% during the forecast period (2025–2030). Market expansion is driven by rising climate-related disasters, aging infrastructure in developed economies, and greater insurance penetration globally. Restoration companies are increasingly leveraging technology, digital claim management, and large-scale franchise operations to meet growing customer expectations for faster recovery and sustainable remediation.

Key Market Insights

- Water and flood restoration services lead the global market, accounting for nearly 35% of total 2024 revenue, due to the rising frequency of storms and plumbing-related damages.

- Residential restoration remains the dominant end-user segment, contributing approximately 47% of the total market value in 2024, fueled by homeowner insurance claims and increased awareness of mold and structural risks.

- Franchise and national-network operators command around 40% market share, benefitting from brand recognition, national reach, and insurer partnerships.

- North America represents 38–40% of the global market, with the United States leading demand due to frequent hurricanes, floods, and wildfires.

- Asia-Pacific is the fastest-growing region, projected to expand at a CAGR of 6–7% through 2030 as urbanization and commercial infrastructure development accelerate.

- Digital transformation in restoration, including AI-based damage assessment, IoT moisture monitoring, and cloud-based claims systems, is redefining service efficiency and transparency.

What are the latest trends in the Property Restoration Services Market?

Climate-Driven Restoration Demand

Climate change is reshaping the property restoration landscape, with increasing hurricanes, floods, wildfires, and extreme rainfall events globally. This surge in weather-related incidents has intensified demand for professional restoration and disaster recovery services. Governments, insurers, and property owners are prioritizing pre-disaster planning and post-event resilience, fueling steady industry growth. Restoration companies are also developing “resilience upgrade” programs that incorporate preventive waterproofing, humidity control, and storm-resilient materials, creating recurring business opportunities alongside emergency services.

Technology Integration and Smart Restoration

Restoration providers are integrating advanced technologies such as AI-powered loss assessment, infrared moisture detection, and real-time digital reporting. Cloud-based platforms now allow insurers and clients to monitor progress remotely, improving trust and accountability. The use of drones for roof inspections, 3D imaging for reconstruction estimation, and IoT sensors for humidity and temperature monitoring is transforming efficiency. These advancements reduce claim-processing times and enable predictive maintenance models, positioning technology as a key differentiator for large restoration networks and franchises.

What are the key drivers in the Property Restoration Services Market?

Increasing Frequency of Natural Disasters

Rising global incidents of hurricanes, floods, wildfires, and storms are significantly expanding the market for property restoration. Insurers and property owners are increasingly reliant on professional mitigation services to limit damage and reduce downtime. This trend is particularly evident in coastal and high-risk areas such as the U.S. Gulf Coast, Japan, and Southeast Asia, where rapid response is critical.

Aging Infrastructure and Building Stock

In mature economies across North America and Europe, many buildings are over 30 years old, making them more susceptible to water leaks, pipe bursts, and mold infestations. This aging infrastructure, combined with stricter building codes and energy-efficiency retrofits, drives continuous demand for restoration services focused on long-term sustainability and health safety.

Expanding Insurance Partnerships and Claim Volumes

Insurance providers increasingly partner with certified restoration networks to handle high volumes of claims quickly. These preferred-vendor programs create stable revenue streams for restoration companies and promote operational standardization. As global insured losses climb, the link between restoration providers and insurers strengthens, ensuring a consistent flow of projects and higher professionalization across the market.

What are the restraints for the global market?

Fragmented Market Structure and Margin Pressure

The property restoration industry remains highly fragmented, with thousands of small and mid-sized providers competing on price. This fragmentation leads to inconsistent service quality, squeezed profit margins, and limited scalability for regional operators. Larger players face cost challenges in mobilizing nationwide resources while maintaining profitability across smaller job sizes.

Labor and Equipment Constraints

Skilled labor shortages and rising equipment costs, such as industrial dryers, dehumidifiers, and air scrubbers, pose operational challenges. Limited technician availability during peak disaster seasons can delay service delivery and increase job costs. Supply-chain disruptions for restoration equipment further impact project timelines, especially in developing regions.

What are the key opportunities in the Property Restoration Services Industry?

Disaster Resilience and Insurance Integration

As climate risks escalate, governments and insurers are emphasizing disaster-resilient infrastructure. Restoration firms have an opportunity to integrate resilience assessments, floodproofing, and preventive maintenance into their offerings. Collaborations with insurers for end-to-end claim handling and risk evaluation can drive higher margins and strengthen client relationships.

Expansion into Emerging Markets

Asia-Pacific, Latin America, and parts of the Middle East are witnessing surging urban development and infrastructure investment. With property values and insurance adoption increasing, demand for restoration services in these regions is set to rise sharply. Global players can capitalize through franchising, joint ventures, and localized operations tailored to regional building standards and climatic conditions.

Digital and Sustainable Restoration Solutions

The industry is moving toward eco-friendly materials, waste reduction, and digital project tracking. Integrating sustainability with restoration, through mold-resistant paints, energy-efficient dehumidifiers, and recyclable materials, aligns with corporate ESG goals. Companies that combine digital monitoring tools with green practices are expected to gain a competitive edge and attract government-backed resilience funding.

Service Type Insights

Water Damage Restoration remains the dominant service type, commanding approximately 35% of global revenue in 2024 (valued at nearly USD 18 billion). Its leadership is driven by the recurring nature of water-related incidents, ranging from burst pipes and plumbing leaks to flash floods and sewage backups. With climate volatility intensifying, rainfall and urban drainage systems often operating beyond design capacity, both residential and commercial properties face escalating risks of water intrusion. Technological adoption in rapid-drying equipment, IoT-based moisture monitoring, and emergency response networks has reinforced scalability and responsiveness, making this segment the most dependable revenue generator. The segment’s growth is particularly underpinned by the driver: aging and overloaded drainage systems coupled with more intense rainfall events, which together are causing a measurable uptick in restoration callouts in major urban centers globally.

Fire & Smoke Restoration follows as a key revenue contributor, supported by the increased frequency of wildfire and urban fire incidents and rising commercial electrical loads. The growing number of industrial facilities, coupled with aging wiring infrastructure and renovation activities, elevates fire risk. Market leaders are investing in soot-removal technologies, air filtration systems, and eco-friendly deodorization techniques, especially as environmental standards tighten.

Mold & Microbial Remediation is gaining traction due to heightened health awareness and regulatory enforcement in both residential and workplace environments. Prolonged moisture exposure, delayed drying, and stricter indoor air quality standards have made professional remediation services essential in commercial real estate management. Health-centric building codes in North America and Europe are expanding long-term opportunities in this segment.

End-Use Insights

Residential properties dominate end-use demand, accounting for approximately 47% of total market share (about USD 24 billion in 2024). This leadership reflects widespread homeowner insurance coverage, increasing awareness of health impacts associated with mold and moisture, and rising investments in property resilience. Frequent small-scale restoration jobs, such as water leaks and fire damage, make this the most consistent revenue source across mature markets like North America and Europe.

The commercial and industrial segments are, however, registering the fastest growth trajectory with projected CAGRs of 6–7% through 2030. Key industries such as data centers, logistics hubs, healthcare facilities, and high-tech manufacturing sites are investing heavily in business continuity planning, fueling the adoption of professional restoration and risk-mitigation services. The demand for certified service providers capable of managing contamination control, rapid response, and full reconstruction has become a major differentiator in commercial markets. Moreover, the expansion of ESG-aligned building maintenance programs is creating a new wave of demand for sustainable and compliant restoration solutions.

| By Service Type | By End Use | By Application Type |

|---|---|---|

|

|

|

Regional Insights

North America

North America continues to lead the global property restoration services market, accounting for approximately 38–40% of total revenue (USD 20–21 billion in 2024). The United States drives this dominance due to the increasing frequency of insured catastrophic losses from wildfires, hurricanes, and severe storms. Insurer networks are expanding partnerships with certified restoration firms to handle surging claim volumes, while regulatory and underwriting shifts are reshaping the payer mix and reimbursement structures. Capacity bottlenecks for adjusters and skilled technicians are placing upward pressure on service pricing, leading to consolidation among major players seeking operational scale. Canada mirrors similar trends, particularly with increasing flooding incidents in Ontario, Alberta, and British Columbia. Governmental incentives for resilience and climate adaptation are further supporting restoration demand in both countries.

Europe

Europe represents around 25–27% of global market value (USD 13–14 billion in 2024), led by Western European countries such as Germany, the U.K., and France. The region’s growth is largely driven by extreme rainfall events, aging building stock, and rigorous remediation regulations concerning mold and asbestos. These factors are driving widespread adoption of professional restoration and decontamination services. The European Union’s emphasis on resilient infrastructure and sustainable retrofitting under the Green Deal is stimulating investments in property maintenance and restoration. Additionally, urban flash-flooding events and prolonged dampness in older housing are catalyzing residential and municipal restoration projects across the continent. Eastern European markets are emerging as new growth corridors, with rising insurance penetration and adoption of Western remediation standards.

Asia-Pacific

The Asia-Pacific (APAC) region is the fastest-growing market, holding approximately 20% share in 2024 (USD 10–11 billion). Rapid urbanization, industrial expansion, and increasing exposure to natural disasters, such as monsoons, typhoons, and floods, are fueling restoration demand. The region’s key driver is the combination of urban infrastructure stress and expanding insurance penetration across China, India, and Australia. In China, policy focus on urban drainage upgrades and commercial property insurance is spurring demand for large-scale remediation contracts. India is witnessing rising corporate restoration partnerships amid frequent flood and storm events. Meanwhile, Australia continues to experience recurrent bushfires and flood-related property losses, underpinning steady restoration service growth. APAC’s overall CAGR is expected to remain at 6–7% through 2030.

Latin America

Latin America holds an estimated 7–8% market share (USD 3.5–4 billion in 2024), with Brazil and Mexico leading demand. Regional growth is tied to high storm and flood exposure in coastal areas and the ongoing rebuilding activities following seasonal disasters. However, varying levels of insurance penetration mean a large proportion of restoration projects are financed out-of-pocket, creating opportunities for private restoration firms. The formalization of the industry, through certification, insurer collaboration, and technology adoption, is enhancing service quality and compliance. Infrastructure investments under public-private partnerships are also expanding demand for commercial and industrial restoration services.

Middle East & Africa (MEA)

The Middle East and Africa jointly represent 5–7% of global revenue (USD 2.5–3.5 billion in 2024). Growth is anchored in infrastructure expansion, high-value commercial developments, and climate resilience initiatives. In the Gulf Cooperation Council (GCC) region, particularly the UAE and Saudi Arabia, the property restoration market is benefiting from large-scale construction, hospitality expansion, and regulatory emphasis on building safety. The driver here, restoration demand linked to commercial and industrial projects rather than household insurance claims, is shaping service specialization in the region. In Africa, South Africa leads demand with robust industrial and real estate activity, while emerging markets like Kenya and Egypt are seeing new opportunities in climate-adaptive and disaster-preparedness contracts. International investment in urban resilience is expected to sustain long-term market momentum.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Property Restoration Services Market

- BELFOR Property Restoration

- ServiceMaster Restore

- Servpro Industries

- Paul Davis Restoration

- PuroClean Emergency Services

- Rainbow International Restoration

- DKI Services

- FirstOnSite Restoration

- Steamatic Inc.

- COIT Cleaning & Restoration

- United Water Restoration Group

- RYTECH

- Action Restoration Inc.

- Duraclean International Inc.

- 911 Restoration

Recent Developments

- In April 2025, BELFOR Property Restoration announced the expansion of its global catastrophe response division, adding mobile command centers and regional emergency depots across Asia-Pacific to improve disaster recovery response time.

- In February 2025, ServiceMaster Restore launched its AI-driven loss assessment platform to streamline claims processing and improve project documentation for insurance clients.

- In January 2025, Servpro Industries introduced new green restoration protocols focused on low-VOC materials and energy-efficient dehumidification systems, aligning with global ESG objectives.