Projector Screen Market Size

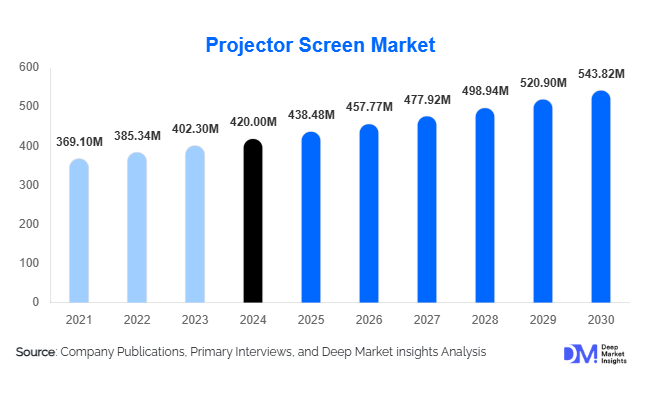

According to Deep Market Insights, the global projector screen market size was valued at USD 420.00 million in 2024 and is projected to grow from USD 438.48 million in 2025 to reach USD 543.82 million by 2030, expanding at a CAGR of 4.4% during the forecast period (2025–2030). Growth is primarily fueled by increasing adoption of home theater systems, rising investments in education and corporate digital infrastructure, and the development of advanced screen technologies such as ambient light-rejecting (ALR) and motorized projection screens.

Key Market Insights

- Motorized projector screens dominate due to their convenience, retractable features, and widespread use in both residential and commercial applications.

- Home entertainment is the largest application segment, accounting for nearly 42% of global demand in 2024.

- Educational institutions and corporate offices remain significant growth drivers, especially in emerging markets.

- Asia-Pacific is the fastest-growing region, led by China and India, driven by urbanization, rising disposable incomes, and investments in digital learning.

- North America holds the largest market share, with the U.S. leading in the adoption of home theater and advanced projection solutions.

- Technological innovations in screen materials, such as ALR fabrics and smart compatibility, are reshaping the market’s value proposition.

What are the latest trends in the projector screen market?

Smart Technology Integration

Projector screens are increasingly being paired with smart projectors and connected ecosystems, offering compatibility with voice assistants, wireless streaming, and automated controls. This trend aligns with consumer preferences for seamless and integrated entertainment experiences. Manufacturers are also exploring IoT-enabled controls for automatic screen adjustments based on ambient lighting conditions and user preferences.

Premium Screen Materials and ALR Adoption

Advanced screen materials such as ambient light-rejecting (ALR) fabrics are rapidly gaining adoption as they enhance brightness and contrast in environments with uncontrolled lighting. This trend is particularly significant in commercial and educational installations, where screens must deliver clarity despite varied conditions. The shift toward ALR screens is expected to elevate the premium segment share over the coming years.

What are the key drivers in the projector screen market?

Technological Advancements

Continuous improvements in projection screen design, such as motorized retractable systems, 4K/8K-ready fabrics, and durable materials, are driving adoption. These innovations cater to both professional and home users who demand enhanced viewing experiences.

Growing Home Entertainment Demand

The rise of streaming services and immersive entertainment has boosted demand for projector screens in residential settings. Consumers increasingly prefer large-format projection screens as affordable alternatives to ultra-large LED TVs, especially for cinematic experiences at home.

Educational and Corporate Sector Adoption

The use of projection systems in classrooms, training centers, and boardrooms remains a strong growth driver. Governments and corporations investing in digital presentation infrastructure continue to support stable long-term demand for projection screens.

What are the restraints for the global market?

High Initial Costs

Premium projector screens, especially motorized and ALR variants, involve significant upfront investment. This poses challenges for price-sensitive consumers and small educational institutions, limiting overall adoption in some markets.

Competition from Alternative Display Technologies

Large-format LED and OLED displays are becoming more affordable, presenting strong competition to projector screens. These alternatives are compact, require less setup, and deliver excellent performance, which could slow projector screen market expansion.

What are the key opportunities in the projector screen industry?

Expansion in Emerging Markets

Countries in Asia-Pacific, Latin America, and the Middle East are seeing rising demand for home entertainment systems and educational technology. This creates opportunities for projector screen manufacturers to establish distribution networks and capture growth from first-time buyers.

Integration with Smart Ecosystems

Smart homes and connected offices present opportunities for projector screens integrated with IoT platforms, voice assistants, and wireless control systems. Offering plug-and-play compatibility with smart projectors will help manufacturers differentiate in competitive markets.

Advanced Screen Material Development

R&D in projection fabrics is unlocking opportunities to deliver superior image quality, durability, and sustainability. ALR and flexible screens for portable projectors are in particular demand across residential and mobile business applications.

Product Type Insights

Motorized screens lead the market with nearly 36% share in 2024, driven by convenience, aesthetics, and broad adoption in high-income residential and corporate segments. Manual pull-down screens remain popular in educational settings due to affordability, while fixed-frame screens appeal to dedicated home theaters. Portable tripod screens account for a smaller share but are vital in event-driven applications.

Application Insights

Home entertainment accounted for 42% of the global market in 2024, supported by surging adoption of 4K projectors and consumer preference for cinematic home experiences. Educational institutions represent 28% of demand, fueled by government-led digital learning initiatives. Corporate and commercial usage, including offices, auditoriums, and conference halls, makes up the remainder, with consistent growth driven by hybrid working models and training requirements.

End-Use Insights

The residential sector is the dominant end-use segment, growing rapidly due to consumer spending on home entertainment. The educational sector is witnessing strong government-driven demand, while corporate environments continue steady adoption. Export-driven demand is significant in emerging markets, as countries like China and India not only import but also export cost-efficient projection systems globally.

| Screen Type | Surface/Material | Installation Location |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains the largest market, holding nearly 34% of global share in 2024, led by the U.S. High consumer spending on home theaters, combined with corporate and institutional usage, drives steady growth. Canada follows with robust adoption in education.

Europe

Europe holds around 25% of the market, with Germany, the U.K., and France leading demand. Strong penetration of home theaters and widespread adoption in universities and corporate offices fuel steady growth. Western Europe dominates, while Eastern Europe shows rising demand in education.

Asia-Pacific

Asia-Pacific is the fastest-growing region, expanding at a projected CAGR of 7.2% through 2030. China and India are the largest contributors, driven by urbanization, disposable incomes, and digital education initiatives. Japan and South Korea maintain a stable demand for premium home theater systems.

Latin America

Latin America is emerging, led by Brazil and Mexico. Demand is concentrated in educational institutions and growing middle-class residential adoption. Corporate investment in projection systems is increasing gradually.

Middle East & Africa

The Middle East is witnessing increased demand, particularly in the UAE and Saudi Arabia, supported by educational reforms and entertainment infrastructure. Africa shows a gradual uptake, with South Africa being the most developed market for projector screens.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Projector Screen Market

- Elite Screens Inc.

- Draper Inc.

- Da-Lite Screen Company

- Stewart Filmscreen

- Screen Innovations

- Seiko Epson Corporation

- Barco NV

- Grandview Crystal Screen Co. Ltd.

- AccuScreens Inc.

- Vutec Corporation

- Lumiere Screens

- Silver Ticket Products

- CineTension Screens

- BOXLIGHT Corporation

- Optoma Corporation

Recent Developments

- In June 2025, Elite Screens announced a new line of ambient light-rejecting (ALR) projector screens designed for hybrid business and home use.

- In March 2025, Draper Inc. expanded its manufacturing facility in Indiana to increase production capacity for motorized screens.

- In January 2025, Stewart Filmscreen launched an ultra-short-throw (UST) compatible projection screen for premium home theater applications.