Private Label Cosmetics Market Size

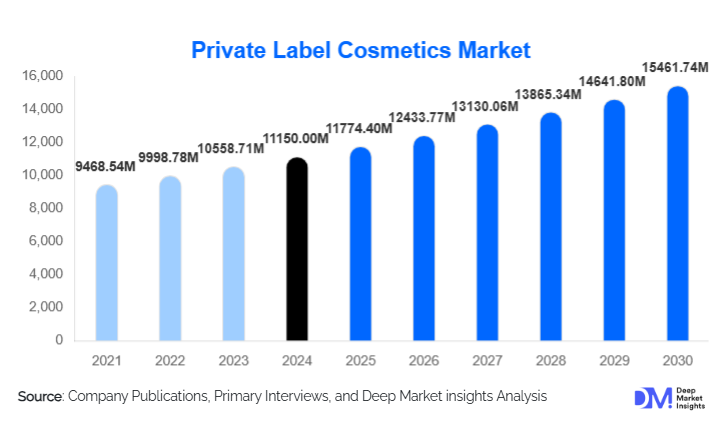

According to Deep Market Insights, the global private label cosmetics market size was valued at USD 11,150 million in 2024 and is projected to grow from USD 11,774.4 million in 2025 to reach USD 15,461.74 million by 2030, expanding at a CAGR of 5.6% during the forecast period (2025–2030). This growth is underpinned by increasing demand for value-driven beauty products, expanded retailer-owned beauty lines, and a strong shift toward sustainable and clean cosmetics.

Key Market Insights

- Retailers are increasingly launching their own beauty lines, leveraging contract manufacturers to offer high-quality, proprietary formulations under private labels.

- Sustainability and clean-beauty trends are driving demand for natural ingredient formulations and eco-friendly packaging.

- Offline retail remains dominant, with supermarkets, pharmacies, and mass retailers acting as key distribution channels for private label cosmetics.

- Asia-Pacific is the fastest-growing and largest regional market, driven by rising middle-class income, local manufacturing capacity, and increasing beauty awareness.

- E-commerce and DTC (Direct-to-Consumer) are fueling growth, thanks to rapid innovation, personalization, and faster product-to-market cycles.

- Contract manufacturing players are investing heavily in green chemistry, automation, and digital co-development, heightening competitive intensity and product differentiation.

Latest Market Trends

Rise of Clean, Natural & Sustainable Beauty

Consumers are demanding more transparency in cosmetic ingredients, driving private label brands to develop formulations based on plant-derived actives, organic extracts, and clean-beauty standards. At the same time, sustainability pressures are leading contract manufacturers and retailers to adopt biodegradable packaging, refill systems, and eco-conscious sourcing. This “green beauty” trend is no longer a niche segment; it is shaping entire private label portfolios, with retailers positioning their own-brand lines as ethically responsible yet affordable alternatives to premium branded cosmetics.

Digital-First, Data-Driven Product Development

Which formulations sell best? What texture do shoppers prefer? Retailers are increasingly leveraging consumer data gathered via their apps, websites, and loyalty programs to co-develop products with contract manufacturers. This close collaboration allows for small-batch testing, rapid iteration, and agility in responding to emerging trends. Furthermore, DTC sales channels and social media feedback loops accelerate innovation: private label brands can launch limited edition formulations, test them online, and scale up winning SKUs.

Private Label Cosmetics Market Drivers

Growing Value Consciousness Among Consumers

Shoppers are becoming more discerning, seeking high-performance beauty products that don’t carry a premium-brand markup. Private label cosmetics offer a way for retailers to meet this demand, providing effective skincare, haircare, and color cosmetics under their own brands with lower overhead. This value-driven mindset is particularly strong in emerging and mid-income markets, fueling sustained demand.

Retailer Margin Optimization and Brand Control

By partnering with contract manufacturers, retailers gain direct control over formulation, packaging, and quality, which helps them differentiate their own-brand cosmetics. This strategy allows them to capture more margin, reduce reliance on external brands, and respond more quickly to consumer trends, making private label lines a strategic lever in retailers’ broader business models.

Demand for Clean Ingredients and Sustainable Packaging

The growing global consumer preference for clean, natural, and eco-friendly beauty products is a major driver. Private label lines are well-placed to respond, as contract manufacturers can adjust formulations and materials quickly. This agility, paired with lower costs, empowers retailers to launch sustainable alternatives that appeal to environmentally conscious consumers without compromising affordability.

Market Restraints

Regulatory Complexity and Quality Assurance

Cosmetics manufacturing involves stringent regulatory requirements, from ingredient safety and testing to labeling and product claims. Private label brands must ensure their contract manufacturers comply with diverse regulatory frameworks, which can create cost burdens, slow down innovation, and raise barriers to entry for smaller or new players.

Trust and Brand Perception Challenges

Although private label cosmetics can offer excellent quality at lower cost, some consumers remain skeptical of store-brand beauty. Legacy brands often enjoy strong brand equity and consumer loyalty, and convincing shoppers to switch to private label products requires sustained quality, transparency, and marketing , particularly to ensure repeat purchase behavior.

Private Label Cosmetics Market Opportunities

Sustainable & Green Beauty Lines

As consumers prioritize environmental responsibility, there is a big opportunity for retailers to launch private-label lines centered on sustainability: natural formulations, recyclable or refill packaging, and cruelty-free certifications. By doing so, retailers can capture eco-conscious customers while also establishing themselves as socially responsible brands, reinforcing loyalty and trust.

Regional Customization in Emerging Markets

Emerging markets (like India, China, Southeast Asia, and Latin America) are growing rapidly in beauty spend, yet local consumer preferences vary significantly. Private label manufacturers can offer region-specific formulations (e.g., lightweight moisturizers for humid climates, pigmentation-care serums, pollution-defense skincare) that are tailored to local needs. By localizing production and formulations, retailers can better penetrate these markets and build strong in-house beauty brands.

Direct-to-Consumer & Subscription Beauty Models

The rise of e-commerce and subscription models offers private label brands a powerful growth channel. Retailers can launch DTC beauty portals or subscription boxes featuring exclusive private label SKUs, limited-edition innovations, and personalized routines based on customer data. This model reduces reliance on traditional retail, enhances margins, and accelerates product development cycles through real-time feedback.

Product Type Insights

Within the private label cosmetics market, skincare remains the leading product category, capturing the highest revenue share due to strong consumer awareness around ingredients, product efficacy, and the necessity-based nature of skincare routines. Skincare also benefits from high repurchase rates and rising demand for affordable alternatives to premium dermatology-backed brands. The leading driver for this segment is the accelerated shift toward clean beauty, functional actives (AHA/BHA, ceramides, niacinamide), and dermatologist-inspired formulations, which private label manufacturers can produce at competitive pricing through fast, flexible R&D models.

Haircare follows as the second-largest category, supported by the growing demand for sulfate-free, silicone-free, and targeted hair treatments available under retailer-owned labels. Consumers increasingly trust private label shampoos, conditioners, and serums that offer salon-like performance at accessible price points. Color cosmetics, including lipsticks, foundations, and eye makeup, are witnessing strong growth as retailers expand premium-look in-house lines to compete directly with mass and mid-tier brands. Fragrances and bath & body products complete the assortment, contributing steadily though at a smaller scale due to lower purchase frequency and higher brand loyalty within fragrance categories.

End-Use Insights

The women’s segment remains the largest end-use group, accounting for nearly two-thirds of market demand. Females exhibit higher purchase frequency across skincare, makeup, and personal care products, making them the dominant contributors to private label cosmetics consumption. The segment thrives on the availability of trend-responsive products, clean formulations, and affordable prestige alternatives.

The men’s grooming category is expanding rapidly, driven by male consumers increasing their adoption of skincare basics such as face washes, moisturizers, beard oils, and grooming kits, many of which are economically priced under private labels. The growth of male grooming is strongly supported by modern retail visibility, social media influence, and rising urban lifestyle preferences. Meanwhile, unisex or gender-neutral products, especially in moisturizers, serums, sunscreens, and body care, are gaining traction because they simplify inventory, appeal to shared household use, and align with the growing preference for inclusive beauty. Retailers leverage this segment to optimize formulation cost structures while appealing to broader demographics.

Distribution Channel Insights

Offline retail channels, including supermarkets, hypermarkets, convenience stores, and drugstores, continue to dominate private label cosmetic distribution. Consumers prefer in-store trials, texture evaluation, and immediate purchase, which makes offline formats especially compelling for skincare and color cosmetics. Retailers are also improving shelf placements, tester availability, and ingredient transparency to strengthen consumer confidence.

However, online and direct-to-consumer (DTC) channels are rising rapidly. Retailers are leveraging robust e-commerce ecosystems, loyalty programs, and social commerce strategies to launch exclusive private label beauty brands. Personalized SKUs, limited-edition drops, AR-based virtual try-on tools, and subscription models are accelerating online penetration. Data-driven insights derived from platform analytics also help retailers refine formulations, identify new trends, and shorten product development cycles.

| By Product Type | By End Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

The Asia-Pacific region is both the largest and fastest-growing market, contributing approximately 48–49% of global private label cosmetic revenues in 2024. Growth is primarily driven by rising disposable incomes, rapid expansion of modern retail formats, beauty-conscious urban populations, and strong contract manufacturing ecosystems. China leads with advanced local manufacturing, digitally driven retail, and high consumer openness to new beauty concepts. India is witnessing surging demand for affordable, clean, and dermatologically safe skincare, supported by the boom in beauty specialty chains and online platforms.

North America

North America, especially the United States, is one of the most influential private label cosmetics markets. Growth is underpinned by high consumer trust in retailer-owned brands, strong digital adoption, the maturity of DTC beauty manufacturing, and the presence of leading cosmetic contract manufacturers. U.S. retailers are investing heavily in clean, premium-look private label beauty lines that challenge mid-tier national brands.

Europe

Europe is a mature and highly sophisticated private label market, with Germany, France, and the UK contributing significantly. European consumers prioritize sustainability, transparent labeling, natural ingredients, and ethical sourcing, creating ideal conditions for private label beauty expansion. Retailers are increasingly launching products that meet stringent EU cosmetic regulations, boosting consumer confidence.

Latin America

Private label cosmetics are growing steadily across Latin America, led by Brazil, Chile, and Mexico. Middle-income consumers seek budget-friendly yet high-quality beauty options, pushing retailers to expand personal care and skincare assortments. Local retailers are partnering with regional manufacturers to scale up production and improve product accessibility.

Middle East & Africa

The Middle East & Africa region is emerging as a promising growth corridor. In GCC countries (UAE, Saudi Arabia, Qatar), modern retail expansion and high-income consumer groups are driving the adoption of private-label beauty products. There is also growing demand for halal-compliant, clean, and locally tailored formulations. While manufacturing infrastructure in parts of Africa remains limited, retail modernization is opening new market opportunities.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|