Printed Electronics Market Size

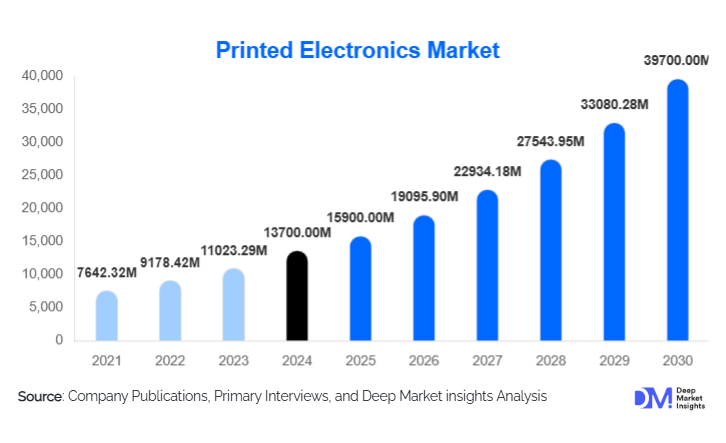

According to Deep Market Insights, the global printed electronics market size was valued at USD 13,700 million in 2024 and is projected to grow from USD 15,900 million in 2025 to reach USD 39,700 million by 2030, expanding at a CAGR of 20.1% during the forecast period (2025–2030). The market growth is primarily driven by the rising demand for flexible and lightweight electronic components, advancements in conductive inks and substrates, and growing adoption of cost-efficient, large-area manufacturing processes for sensors, displays, and energy devices.

Key Market Insights

- Flexible and wearable electronics applications are driving market expansion, particularly across consumer electronics, healthcare, and automotive industries.

- Printed sensors and displays account for a dominant share, supported by demand for low-cost, customizable, and energy-efficient solutions.

- Asia-Pacific leads the global market, driven by strong manufacturing bases in China, Japan, and South Korea.

- North America and Europe are witnessing increased investments in R&D for printed solar cells, RFID tags, and electronic packaging.

- Technological advancements in conductive inks and roll-to-roll printing are enabling high-speed, scalable production of printed components.

- Strategic collaborations between ink manufacturers, OEMs, and printing technology firms are accelerating the commercialization of next-generation flexible electronics.

Latest Market Trends

Growth of Flexible and Stretchable Electronics

Printed electronics are becoming a cornerstone of the emerging flexible electronics industry, supporting innovations such as foldable displays, stretchable sensors, and wearable medical patches. These technologies rely on thin, lightweight substrates like PET and polyimide, combined with conductive inks that maintain performance under deformation. Major OEMs are integrating printed components into smart textiles, health-monitoring wearables, and bendable displays, signaling a shift toward fully flexible electronic ecosystems.

Advances in Conductive Ink Technology

Significant progress in nanoparticle and graphene-based conductive inks is enhancing electrical performance, adhesion, and durability. Silver nanoparticle inks remain dominant, but carbon-based and copper inks are gaining traction due to cost advantages. Hybrid inks with improved thermal and mechanical stability are expanding use cases across automotive, aerospace, and industrial applications. The development of eco-friendly, water-based inks is also supporting sustainability goals within electronics manufacturing.

Printed Electronics Market Drivers

Rising Demand for Lightweight and Energy-Efficient Devices

The global push for miniaturized, lightweight, and power-efficient devices is a major growth catalyst. Printed electronics offer a competitive edge in weight reduction, low material waste, and cost-effective production compared to conventional PCB-based systems. Their use in flexible displays, RFID tags, and smart packaging supports sustainable, low-carbon product design while enabling new form factors and functionalities.

Expansion of IoT and Smart Applications

The growing Internet of Things (IoT) ecosystem is driving the need for low-cost, flexible, and disposable sensors. Printed sensors are being integrated into smart packaging, environmental monitoring, and healthcare diagnostics to collect and transmit real-time data. Combined with wireless communication modules and printed antennas, these systems are fostering large-scale adoption of connected smart devices across industries.

Market Restraints

High Material Costs and Limited Standardization

While printed electronics promise cost efficiency, the high cost of conductive inks, especially silver-based formulations, remains a challenge. Additionally, the lack of global standardization for printed circuit performance, durability, and environmental resistance creates uncertainty for mass adoption. These factors hinder large-scale commercialization, especially for industrial and automotive-grade applications requiring consistent reliability.

Performance Limitations Compared to Conventional Electronics

Printed electronic components often face challenges in conductivity, lifespan, and temperature tolerance compared to traditional silicon-based electronics. Limited compatibility with existing assembly and testing infrastructure also constrains integration in high-performance systems. Continuous material innovation and hybrid manufacturing approaches are being explored to overcome these constraints and expand end-use applicability.

Printed Electronics Market Opportunities

Emergence of Printed Energy Devices

Printed batteries, solar cells, and supercapacitors represent a fast-growing opportunity area. Low-cost, flexible, and lightweight printed power sources are ideal for IoT nodes, wearables, and portable electronics. Printed photovoltaics, in particular, are gaining attention for building-integrated and portable energy solutions, offering large-area coverage and customizable designs.

Smart Packaging and Interactive Labels

Brands are increasingly leveraging printed electronics for intelligent packaging that integrates sensors, NFC tags, and dynamic displays. These innovations enable real-time product authentication, freshness monitoring, and interactive consumer engagement. Printed RFID tags and e-labels are becoming vital for supply chain traceability and retail automation, creating high-volume opportunities for printed circuit and ink manufacturers.

Product Type Insights

Printed sensors dominate the market, driven by applications in environmental monitoring, medical diagnostics, and automotive safety systems. Printed displays form the second-largest segment, propelled by OLED and e-paper advancements for flexible and wearable screens. Printed batteries and photovoltaics are emerging rapidly as energy storage and harvesting technologies evolve. Meanwhile, printed RFID and antennas are witnessing accelerating adoption in logistics and retail sectors.

Application Insights

Consumer electronics remain the largest application segment, integrating printed components into wearables, smartphones, and flexible displays. Automotive applications are expanding with printed sensors for temperature, pressure, and safety systems. Healthcare is emerging as a high-potential vertical, utilizing printed biosensors and skin patches for diagnostics and monitoring. The energy and packaging industries are also adopting printed electronics for smart energy systems and interactive labels, respectively.

Technology Insights

Inkjet printing leads the market due to its precision, digital control, and low material wastage, followed by screen printing for large-area production and gravure printing for high-speed roll-to-roll manufacturing. Emerging additive techniques, such as aerosol jet and flexographic printing, are enhancing resolution and scalability for next-generation devices.

| By Product Type | By Application | By Technology |

|---|---|---|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the printed electronics market, accounting for over 45% of global revenue. Strong industrial ecosystems in China, Japan, and South Korea, along with government incentives for flexible electronics R&D, are key growth drivers. The region is home to leading manufacturers of displays, semiconductors, and conductive materials, facilitating rapid commercialization and cost efficiency.

North America

North America is witnessing significant growth driven by innovation in printed sensors, smart packaging, and energy storage solutions. The U.S. leads in printed electronics startups and university-led research, supported by collaborations with major tech companies. The region also benefits from increasing demand for sustainable manufacturing technologies and lightweight components in aerospace and defense.

Europe

Europe is focusing on sustainability and advanced material innovation, with strong adoption in automotive, healthcare, and energy sectors. Initiatives such as Horizon Europe are funding research in printed photovoltaics, bioelectronics, and smart packaging. Germany, the U.K., and the Netherlands are at the forefront of developing eco-friendly conductive inks and printed device integration systems.

Latin America

Latin America is an emerging market for printed electronics, driven by gradual adoption in retail, logistics, and smart agriculture. Brazil and Mexico are leading in printed RFID deployment and pilot projects for printed sensors in supply chain applications. Local partnerships with global ink suppliers are expected to expand regional capacity.

Middle East & Africa

The region is witnessing growing interest in printed solar technologies and smart infrastructure applications. Governments in the UAE, Saudi Arabia, and South Africa are investing in sustainable energy and IoT-driven systems, creating early opportunities for printed photovoltaics and sensors. However, limited local manufacturing and high import dependence remain challenges.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Printed Electronics Market

- Palo Alto Research Center (PARC)

- Solarmer Energy, Inc.

- PolyIC GmbH & Co. KG

- NovaCentrix

- GSI Technologies LLC

- Xenatech

- Toppan Inc.

Recent Developments

- In June 2025, NovaCentrix launched a new high-conductivity copper nanoparticle ink designed for flexible displays and wearable sensors, reducing reliance on silver-based inks.

- In April 2025, Toppan Inc. announced mass production of printed RFID tags for smart retail and logistics applications using fully recyclable substrates.

- In February 2025, PolyIC partnered with Siemens to develop hybrid printed sensors integrated into automotive dashboards, enhancing safety and connectivity features.