Print Media Market Size

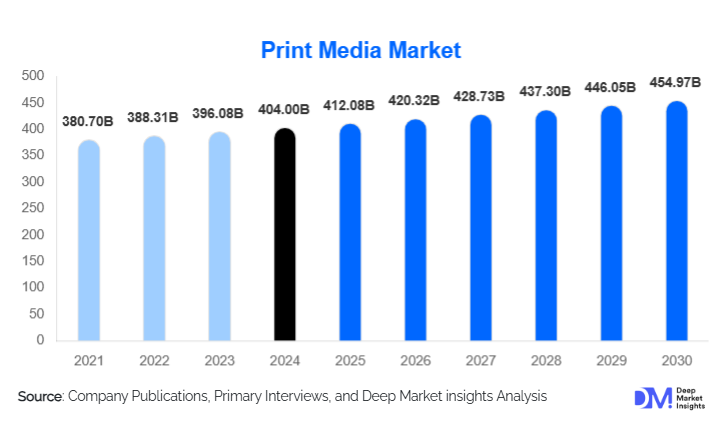

According to Deep Market Insights, the global print media market size was valued at USD 404 billion in 2024 and is projected to grow from USD 412.08 billion in 2025 to reach USD 454.97 billion by 2030, expanding at a CAGR of 2.0% during the forecast period (2025–2030). The print media market growth is supported by steady demand for premium publications, expanding educational print consumption in emerging economies, and continued adoption of hybrid print–digital models among publishers worldwide.

Key Market Insights

- Print media is experiencing a revival in premium and niche categories, as consumers seek tangible, collectible, and high-quality physical content.

- Personalized and short-run digital printing is reshaping the industry, enabling on-demand production and reducing inventory waste.

- Asia-Pacific dominates global demand growth, driven by rising literacy, strong book consumption, and expanding educational print markets.

- North America remains a major revenue center, supported by subscription-driven newspapers, direct-mail advertising, and premium magazines.

- Technological integration in printing, such as web-to-print and variable data printing, continues to enhance efficiency and unlock new business opportunities.

- Advertising-driven print formats such as catalogues and direct mail maintain strong ROI, especially where digital saturation has reduced online engagement.

What are the latest trends in the print media market?

Premium and Niche Publishing on the Rise

Across global markets, publishers are increasingly investing in high-quality printed editions, limited-run magazines, coffee-table books, and special-interest publications. As digital content inundates consumers, print is being repositioned as a luxury, high-engagement medium. Premium publications feature superior paper, sophisticated design, and curated editorial content, offering readers a tactile and collectible experience. Brands in fashion, lifestyle, art, and luxury goods are using print to reinforce brand identity, as print conveys credibility, permanence, and exclusivity. Limited-edition prints, subscription-based premium magazines, and hardcover illustrated books are gaining traction among affluent consumers seeking value beyond digital clutter.

Personalized and On-Demand Digital Printing

Digital printing technology is transforming the print media landscape by enabling personalized, short-run, and on-demand production. Variable-data print allows advertisers to customize catalogues and direct mail for individual consumers, improving engagement and conversion rates. Publishers are increasingly using print-on-demand (POD) to reduce inventory costs, avoid unsold stock, and expand long-tail book titles. Web-to-print platforms allow businesses and consumers to design and order print materials directly online, contributing to efficiency and scalability. This shift toward agile, data-driven print aligns print media with modern digital marketing strategies while preserving the unique value of physical formats.

What are the key drivers in the print media market?

Consumer Trust and Tangible Engagement

Print continues to be perceived as a trustworthy and authoritative medium, particularly in news journalism, educational publishing, and premium magazines. Many readers value the physical experience of print, the tactile feel, visual clarity, and absence of digital distraction. These emotional and functional benefits sustain demand across demographics. The credibility associated with print makes it a preferred channel for in-depth reporting, academic content, and high-value brand advertising.

Hybrid Print–Digital Publishing Models

Publishers worldwide are embracing hybrid models where print editions coexist with digital access, creating diversified revenue streams. This model enhances consumer retention by offering flexibility: readers can enjoy premium physical editions while accessing digital archives or mobile versions. The hybrid model is particularly influential in newspapers and magazines, enabling publishers to maintain print’s value while catering to digital-native audiences. Cross-platform bundling, membership programs, and integrated editorial strategies further reinforce sustainable market growth.

Technological Advancements in Printing

New printing technologies, digital print, automation, variable-data printing, and online ordering systems have increased production efficiency and reduced operational costs. These innovations enable shorter lead times, customized content, and multi-format print capabilities. For advertisers, digital print allows targeted messaging and measurable impact. For publishers, it improves scalability and reduces financial risks associated with large print runs. Technology-driven print continues to expand new applications and preserve print’s relevance in a digital-first world.

What are the restraints for the global market?

Shift of Advertising Budgets Toward Digital Platforms

While print advertising still holds value, especially for targeted and local campaigns, large advertisers continue to shift portions of their budgets to digital channels that offer detailed analytics and measurable ROI. Social media, search engines, and programmatic advertising have decreased the share of ad spending allocated to print. This shift exerts financial pressure on newspapers and magazines that depend heavily on advertising revenue.

Volatility in Raw Materials and Logistics Costs

Rising costs of paper, ink, energy, and logistics affect the profitability of print publishers and commercial printers. Global supply chain disruptions, coupled with fluctuations in pulp prices, create uncertainty in production budgets. Smaller publishers and printing houses are particularly vulnerable, as they often lack the economies of scale needed to absorb cost fluctuations. These pressures accelerate industry consolidation and reduce competitiveness among smaller players.

What are the key opportunities in the print media industry?

Premium Limited-Edition Print Products

As readers gravitate toward thoughtfully designed, collectible content, opportunities are emerging in high-end print products such as art books, photobooks, heritage magazines, curated annuals, and archival editions. Publishers can command premium pricing for exclusive content, refined paper selections, and specialty printing effects. The luxury print segment offers strong margins and appeals particularly to consumers in Europe, North America, and parts of Asia with strong design and cultural consumption patterns.

Expansion of Print in Emerging Educational Markets

Developing regions, particularly India, China, Southeast Asia, and parts of Africa, are seeing rapid expansion in the education sector. Printed textbooks, academic journals, exam preparation materials, and institutional publications remain essential. Government-backed education initiatives and investments in school infrastructure drive demand for printed educational content. Publishers and printers that establish early presence in these markets stand to benefit from long-term, large-volume contracts and stable revenue.

Product Type Insights

Newspapers remain a dominant product type, contributing an estimated 35–40% of global market revenue in 2024 due to their entrenched subscriber bases and strong local advertising appeal. Magazines continue to thrive in niche categories such as fashion, lifestyle, and business analysis. Books form a resilient segment driven by sustained demand for fiction, non-fiction, and academic publishing. Direct mail and catalogues maintain relevance due to their high engagement rates, particularly in retail and real estate marketing. Specialty print formats, including brochures and annual reports, support business communication and brand visibility.

Application Insights

Consumer-oriented print applications dominate the market, including newspapers and magazines aimed at a general readership. Educational print applications, textbooks, academic books, and scholarly publications represent one of the fastest-growing segments in emerging markets. Commercial applications, including product catalogues, annual corporate reports, and promotional materials, remain essential in B2B marketing strategies. Personalized print applications are gaining momentum, driven by data-driven advertising and targeted direct-mail campaigns.

Distribution Channel Insights

Subscription-based distribution continues to lead the market, particularly for newspapers and magazines, due to predictable revenue models and loyal readership. Retail channels such as bookstores, newsstands, and supermarkets support impulse purchases and casual readership. Institutional channels, including libraries, universities, and corporate clients, represent a stable demand for books, journals, and professional publications. Online print-on-demand ordering systems are becoming prominent distribution channels for independent authors, small publishers, and custom print buyers.

End-Use Insights

Consumer print remains the largest end-use segment, driven by steady demand for newspapers, magazines, and books. The educational end-use segment is expanding rapidly, particularly in APAC and Africa, where printed materials are foundational to learning. Business and commercial end-use applications, corporate brochures, catalogues, and marketing print continue to support B2B communication, product promotion, and customer engagement. Government and institutional use of print (public reports, educational programs) further contributes to stable demand.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for approximately 25–30% of global print media revenue in 2024. The region’s demand is anchored by strong newspaper and magazine subscription bases, direct-mail advertising, and premium book publishing. The U.S. remains the single-largest contributor, supported by a mature print ecosystem and high per-capita book consumption.

Europe

Europe contributes 20–25% of global print media revenue. Countries such as Germany, the U.K., and France demonstrate strong demand for niche magazines, academic publishing, and premium printed media. European consumers value craftsmanship and sustainable print, supporting growth in specialty print products.

Asia-Pacific

Asia-Pacific accounts for 30–35% of the global market share and is the fastest-growing region. China and India drive substantial demand for books, newspapers, and educational print, supported by large populations and rising literacy. Japan, South Korea, and Australia demonstrate strong interest in premium magazines and high-quality book formats.

Latin America

Latin America holds around 5–8% market share. Brazil and Mexico lead demand, particularly for newspapers, educational books, and commercial print. Economic fluctuations impact purchasing power, yet educational print remains resilient across the region.

Middle East & Africa

MEA represents 5–7% of the global print market revenue. Africa shows strong growth in educational publishing, while the Middle East, led by the GCC, exhibits rising demand for premium magazines, corporate print, and luxury publications. Government spending on education significantly supports print consumption across African nations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Print Media Market

- Penguin Random House

- News Corp

- Hearst Communications

- Bertelsmann

- Condé Nast

- Pearson

- Scholastic

- Macmillan Publishers

- Hachette Livre

- Holtzbrinck Publishing Group

- Grupo Globo

- Nature Publishing Group

- Meredith Corporation

- Nikkei Publishing

- China Publishing Group

Recent Developments

- In March 2025, Penguin Random House expanded its global print-on-demand facilities to support rapid fulfillment of long-tail titles across Europe and North America.

- In January 2025, News Corp introduced a hybrid subscription program combining premium print editions with AR-enabled digital features for newspapers.

- In February 2025, Hearst launched a new line of collectible magazine editions aimed at luxury lifestyle and fashion enthusiasts, incorporating specialty print finishes.