Price Labelling Machines Market Size

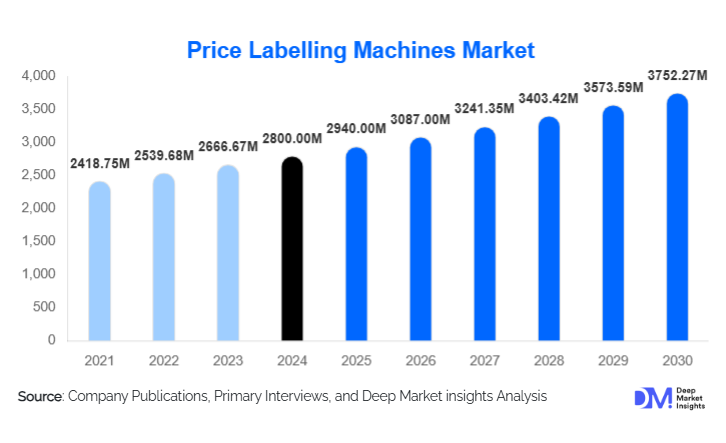

According to Deep Market Insights, the global Price Labelling Machines Market size was valued at USD 2,800 million in 2024 and is projected to grow from USD 2,940.00 million in 2025 to reach USD 3,752.27 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). The market’s expansion is driven by increasing automation across manufacturing and retail sectors, rising demand for traceability and compliance labelling, and the modernisation of packaging and logistics operations worldwide.

Key Market Insights

- Automation adoption in retail and manufacturing is accelerating the shift from manual and semi-automatic labelling to fully automated and integrated price labelling systems.

- Asia-Pacific leads global growth due to rapid industrialisation, expansion of organised retail, and a booming e-commerce ecosystem.

- Fully automatic machines dominate the market with over 40% share, reflecting growing investments in high-speed, precision labelling systems.

- Thermal transfer and direct thermal technologies account for 35% of the total market due to reliability, cost efficiency, and easy integration.

- Retail remains the leading application segment, representing around 30% of global demand in 2024, driven by frequent price changes and promotional campaigns.

- The top 5 manufacturers hold about 35–40% market share, with growing competition from regional OEMs and automation-focused startups.

What are the latest trends in the Price Labelling Machines Market?

Integration of Smart and IoT-Enabled Labelling Systems

Price labelling machines are evolving into connected, data-driven systems. IoT integration allows real-time monitoring of machine health, predictive maintenance, and dynamic data synchronisation with ERP and POS systems. These capabilities enable retailers and manufacturers to execute price updates instantly across multiple product lines. Smart labelling systems also enhance traceability by embedding RFID and QR code functionalities, aligning with global compliance and sustainability standards.

Rise of Print-on-Demand and Flexible Labelling

The shift toward variable data and on-demand printing is transforming the labelling landscape. Print-on-demand technologies enable instant label customisation, reducing inventory waste and improving accuracy. This trend is particularly significant in e-commerce and retail, where dynamic pricing and personalised labelling are increasingly common. Compact, modular machines with faster changeovers are gaining traction among SMEs and contract packagers seeking flexibility.

What are the key drivers in the Price Labelling Machines Market?

Accelerating Automation in Manufacturing and Retail

With rising labour costs and demand for operational efficiency, manufacturers and retailers are automating labelling operations. Fully automatic machines now integrate with packaging lines and robotics, supporting higher throughput and reducing human error. This driver underpins the transition from manual systems to fully digitalised labelling environments.

Growth of E-Commerce and Dynamic Pricing Environments

E-commerce expansion requires quick label changes, real-time price adjustments, and compliance-ready tagging. Price labelling machines supporting variable data and barcode printing are now essential for large fulfilment centres and retail warehouses. Integration with online inventory systems ensures rapid product turnaround and consistent pricing across channels.

Regulatory and Traceability Compliance

Stringent global standards for product identification, especially in food, pharmaceutical, and consumer goods industries, are compelling companies to upgrade labelling systems. Machines capable of printing regulatory information, expiry details, and traceability codes are witnessing strong adoption, driving sustained replacement demand.

What are the restraints for the global market?

High Initial Investment Costs

Fully automatic labelling systems require significant capital investment and integration with existing packaging lines. SMEs often face challenges justifying these costs due to longer payback periods. This limits penetration in developing markets, where semi-automatic systems remain more affordable.

Limited Service Infrastructure in Emerging Markets

In developing regions, a lack of skilled technicians and local service networks affects maintenance and uptime. The absence of robust after-sales support discourages end-users from adopting high-end automatic machines, slowing market expansion.

What are the key opportunities in the Price Labelling Machines Market?

Automation Upgrades in Retail & E-Commerce

Global retail chains are investing in automated price labelling to handle complex promotions and dynamic pricing. As omnichannel retail expands, machine manufacturers have opportunities to supply integrated, data-synchronised solutions that improve accuracy and efficiency in fulfilment centres.

Penetration into Emerging Markets

Rapid industrial growth in Asia, Africa, and Latin America presents large-scale adoption potential. Local manufacturing and retail modernisation in these regions are creating strong demand for low-cost, semi-automatic, and locally serviced labelling machines. Government-driven manufacturing initiatives are expected to further accelerate adoption.

Smart Technologies & Subscription-Based Models

Vendors are increasingly offering connected machines with predictive maintenance and cloud analytics. Subscription or leasing-based models lower upfront costs for SMEs and encourage faster digital adoption. These smart services create long-term revenue streams for manufacturers and enhance client retention.

Product Type Insights

Fully Automatic Price Labelling Machines dominate the global market, accounting for around 40% of total revenue in 2024. Their efficiency, integration with automated packaging lines, and ability to handle variable data printing make them the preferred choice for large-scale manufacturers. Semi-automatic systems retain strong demand in cost-sensitive markets, while manual machines cater to niche, low-volume applications. The growing adoption of print-and-apply units further strengthens automation-led demand in the logistics and manufacturing sectors.

Technology Insights

Thermal Transfer and Direct Thermal Systems represent about 35% of the global market. These technologies are favoured for their precision, reliability, and cost-efficiency. Inkjet and laser technologies are emerging in premium applications where high-resolution printing and on-demand flexibility are critical. RFID and smart labelling innovations are likely to gain prominence as industries move toward end-to-end digital traceability.

Application Insights

Retail is the largest application segment, holding approximately 30% of global market share in 2024. The rise of organized retail, frequent price changes, and multi-channel pricing strategies are key growth enablers. Food & beverage, logistics, and healthcare sectors are experiencing rapid adoption due to strict labelling regulations and export compliance needs. E-commerce fulfilment and contract packaging are emerging as high-growth niches with increasing automation demand.

End-User Insights

Large Enterprises account for nearly 50% of market value in 2024, driven by integrated manufacturing operations and global production networks. SMEs are gradually adopting automated solutions through financing and leasing programs, enabling them to compete on quality and efficiency. Contract packaging and 3PL providers represent an expanding customer base, adopting advanced labelling systems to meet diverse client requirements.

| By Product Type | By Technology | By Label Type | By End-Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds approximately 28% of the global market ( USD 784 million in 2024). The U.S. leads regional demand due to strong automation adoption in retail and packaging. High labour costs and established service infrastructure support the replacement of manual labellers with automated systems. Demand is also growing in Canada, driven by e-commerce fulfilment expansion.

Europe

Europe accounts for around 24% of the market ( USD 672 million). Strict labelling regulations, advanced manufacturing facilities, and sustainable packaging initiatives fuel demand. Germany, the U.K., and France are major contributors, with Eastern Europe emerging as a cost-effective manufacturing hub driving fresh equipment demand.

Asia-Pacific

Asia-Pacific dominates growth, contributing approximately 32% of market share ( USD 900 million). China and India are key growth drivers, propelled by industrial automation and expanding retail sectors. Japan and South Korea continue investing in high-precision labelling technologies, while Southeast Asia’s developing manufacturing base presents strong potential for mid-range systems.

Latin America

Latin America represents 8–10% of the global market, with Brazil and Mexico leading demand. Growth stems from food packaging, retail modernisation, and export-oriented manufacturing. Cost-efficient semi-automatic machines dominate, though automation uptake is rising steadily.

Middle East & Africa

MEA holds around 6–7% of the global market ( USD 168 million). Growing retail malls, logistics hubs, and industrial zones in the UAE, Saudi Arabia, and South Africa drive adoption. Local manufacturing initiatives and foreign investment are fostering gradual automation in packaging lines.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Price Labelling Machines Market

- Avery Dennison Corporation

- Zebra Technologies Corporation

- SATO Holdings Corporation

- Brady Corporation

- Novexx Solutions

- Toshiba TEC Corporation

- Primera Technology

- TSC Auto ID Technology

- Honeywell International Inc.

- Dymo (Newell Brands)

- LabelTac LLC

- Videojet (Danaher Corporation)

- Metapack Ltd.

- GHS Labels & Packaging Equipment

- Godex International

Recent Developments

- In June 2025, Avery Dennison launched a new IoT-enabled print-and-apply labelling system integrating cloud analytics and real-time monitoring for global retail chains.

- In April 2025, Zebra Technologies unveiled its next-generation thermal labelling platform optimised for e-commerce fulfilment centres, featuring predictive maintenance and smart calibration.

- In February 2025, SATO Holdings expanded its Asian production capacity with a new facility in Malaysia to meet surging demand for mid-range and automatic labelling machines.