Pressure Washer Market Size

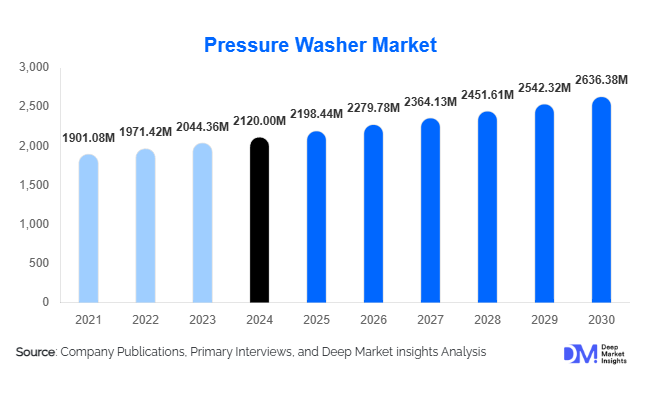

According to Deep Market Insights, the global pressure washer market size was valued at USD 2,120.00 million in 2024 and is projected to grow from USD 2,198.44 million in 2025 to reach USD 2,636.38 million by 2030, expanding at a CAGR of 3.7% during the forecast period (2025–2030). The market growth is primarily driven by increasing residential cleaning activities, rising demand from commercial and industrial facilities, and rapid technological advancements such as cordless and smart-enabled cleaning systems.

Key Market Insights

- Electric-powered pressure washers dominate the market, accounting for nearly half of global sales due to their affordability, low maintenance, and environmental benefits.

- Rising DIY home improvement and outdoor cleaning trends are fueling residential segment demand, especially in North America and Europe.

- Commercial and industrial adoption is expanding, driven by increased hygiene awareness, regulatory cleaning standards, and infrastructure development projects.

- Asia-Pacific is the fastest-growing region, fueled by rapid urbanization, expanding middle-class populations, and infrastructure investments in China and India.

- Technological innovation, including battery-powered units, IoT-enabled diagnostics, and eco-friendly water-saving nozzles, is redefining product performance and lifecycle management.

Latest Market Trends

Smart and Battery-Powered Cleaning Solutions

The global pressure washer industry is transitioning toward smart, cordless, and energy-efficient models. Manufacturers are introducing lithium-ion battery-powered pressure washers designed for portability and convenience, catering to urban consumers and professional cleaners. IoT and sensor integration allow predictive maintenance, water-flow optimization, and performance monitoring. These innovations reduce downtime and support sustainable operations, appealing to eco-conscious users and commercial fleets seeking automation.

Growth of Professional and Contract Cleaning Services

Rising outsourcing of facility management and industrial cleaning services is creating a robust secondary market for high-performance pressure washers. Contract cleaning firms, municipal service providers, and car wash operators are expanding fleets with durable, high-PSI machines and hot-water washers. This shift toward professional-grade cleaning equipment strengthens recurring demand, especially in regions emphasizing hygiene, safety, and compliance standards such as North America and Europe.

Pressure Washer Market Drivers

Increasing Residential Cleaning and DIY Adoption

Households worldwide are investing in outdoor cleaning tools for patios, vehicles, and driveways. The growing DIY culture and rising awareness of cleanliness standards post-pandemic have boosted sales of portable electric pressure washers. E-commerce availability and online tutorials have made these products more accessible, contributing significantly to unit volume growth across the residential sector.

Industrial and Infrastructure Cleaning Needs

Expanding industrial infrastructure, coupled with the need for regular equipment maintenance and plant hygiene, is fueling demand for heavy-duty pressure washers. Applications in manufacturing, food processing, construction, and transportation require high-pressure cleaning systems capable of removing grease, oil, and debris efficiently. Government-driven infrastructure programs are further increasing the installation of fixed and mobile cleaning units across public facilities.

Technological Innovation and Eco-Efficiency

Continuous R&D efforts have led to the introduction of water-efficient pumps, noise reduction systems, and smart control panels. Eco-friendly designs that minimize water wastage and energy consumption are gaining traction in developed economies. These product advancements are improving performance and lowering lifetime operational costs, supporting long-term market expansion.

Market Restraints

High Equipment Cost and Maintenance Requirements

Commercial and industrial-grade pressure washers entail high initial costs, coupled with ongoing expenses for parts, water usage, and energy. For price-sensitive markets, these costs can deter adoption, particularly for hot-water and above-4,000-PSI models. Smaller operators often delay upgrades, limiting replacement demand in mature regions.

Substitute Cleaning Technologies and Competition

Pressure washers face competition from robotic and automated cleaning systems, especially in industrial environments. Traditional manual cleaning and lower-cost alternatives remain prevalent in developing regions. Additionally, market commoditization in low-end product segments leads to price erosion, challenging profitability for manufacturers.

Pressure Washer Market Opportunities

Emerging Market Expansion and Urban Growth

Rapid urbanization in Asia-Pacific, Latin America, and parts of the Middle East and Africa presents strong growth potential. Rising household income and infrastructure development in cities such as Mumbai, São Paulo, and Riyadh are boosting demand for both residential and commercial cleaning equipment. Localized production and after-sales service networks can help international players tap these opportunities effectively.

Smart and Sustainable Product Integration

Manufacturers are investing in digitalization and environmental sustainability. IoT-enabled pressure washers that track usage patterns, optimize water flow, and enable predictive maintenance are emerging as premium offerings. Battery-powered and low-emission units align with global energy-efficiency initiatives, creating differentiation and higher-margin opportunities for technology-oriented entrants.

Public Infrastructure and Institutional Cleaning Demand

Government programs promoting urban renewal and public hygiene are driving institutional procurement of heavy-duty cleaning equipment. Municipalities, airports, and transport agencies are increasingly adopting pressure washers for large-scale maintenance. Investments under initiatives such as “Make in India” and “Clean City” programs in APAC are expected to accelerate equipment adoption and replacement cycles.

Product Type Insights

Electric pressure washers dominate the global market with around 50% share in 2024. Their growth is driven by regulatory pressures in urban regions for low-noise and low-emission equipment, combined with high adoption in residential and light commercial applications. Gasoline-powered washers remain popular for off-grid and heavy-duty cleaning in industrial and construction sites due to their portability and high power. Diesel-powered units are essential for the largest industrial operations, including oil & gas and heavy manufacturing, where durability and fuel efficiency at scale are critical. Battery-powered and cordless washers are an emerging segment, benefiting from increased mobility, environmental preference, and ease-of-use, particularly in residential and light commercial applications. Stationary models are primarily deployed in factories and car-wash stations, while portable units are preferred for household, small-business, and on-site professional cleaning tasks.

Application Insights

Among applications, residential and garden cleaning holds nearly 30% of the global share in 2024. Its growth is supported by rising DIY culture, lifestyle upgrades, and increasing e-commerce penetration, enabling easier access to compact and affordable washers. Commercial applications, including small car washes, hotels, and facility maintenance, benefit from medium-duty washers that balance power and usability. Industrial applications ranging from manufacturing plants to construction sites require high-pressure, durable washers to comply with strict hygiene and maintenance regulations. Agricultural and mining operations also contribute to growth in specialized heavy-duty washers, driven by equipment maintenance requirements and sector expansion. The mid-pressure range (1,501–3,000 PSI) remains the most demanded segment, providing an optimal balance between affordability and cleaning efficiency for both residential and professional users.

End-Use Insights

The residential segment accounts for about 40% of total demand, fueled by consumer lifestyle upgrades, DIY cleaning culture, and the adoption of battery-powered or lightweight electric washers. The fastest-growing end-use segments include commercial cleaning contractors and industrial facilities, projected to register a CAGR above 5% during 2025–2030. New applications such as agricultural equipment cleaning, municipal sanitation, and rental/subscription services are creating additional demand channels. SMEs are increasingly using rental or subscription models to mitigate CAPEX challenges, while large enterprises and government agencies are investing in durable, high-performance washers to meet long-term maintenance and compliance requirements. These dynamics are further driving export-oriented growth from Asian manufacturers, particularly in battery and mid-pressure ranges.

| By Product Type | By Power Source | By Application | By End Use Industry | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the pressure washer market with a 35% share in 2024, led by the U.S. High home ownership, widespread DIY culture, and strong vehicle ownership are driving residential and automotive cleaning demand. Additionally, large rental and service markets combined with high e-commerce penetration support direct-to-consumer sales of electric and cordless washers. Stringent environmental and noise regulations are boosting demand for low-noise, electric, and water-efficient models. Medium- and light-duty washers are particularly popular for residential and commercial applications, while industrial-grade washers see steady adoption in automotive service centers and municipal maintenance operations.

Europe

Europe holds around 25% of the global market, with Germany, the U.K., and France as key contributors. Strict environmental and wastewater regulations are driving demand for water-efficient and low-emission washers. The presence of established professional cleaning services, car-wash chains, and municipal sanitation contracts further supports commercial adoption. European customers also display a preference for high-quality, durable equipment, making them willing to pay premiums for reliability and long-lasting performance. Light- and medium-duty electric washers dominate the residential and commercial segments, while industrial and heavy-duty applications are sustained by diesel and gasoline models.

Asia-Pacific

Asia-Pacific is the fastest-growing region, contributing approximately 20% of global revenue in 2024. Rapid urbanization, large-scale infrastructure, and construction projects are creating strong industrial and commercial demand, especially in China, India, and Southeast Asia. Rising home ownership and an expanding middle class are accelerating residential demand for electric and battery-powered washers. The well-established manufacturing base supports local OEMs, enabling cost-competitive production of both residential and commercial units. Additionally, export-oriented assembly plants are strengthening the region’s position in global markets. Light- and medium-duty washers lead growth for residential and commercial segments, while heavy-duty industrial washers expand alongside large infrastructure projects.

Middle East & Africa

Accounting for about 8–10% of the market, this region is characterized by strong demand from oil & gas, petrochemical, and heavy industrial sectors, creating a steady need for high-pressure, industrial-grade washers. Harsh environmental conditions, such as extreme heat and dust, accelerate replacement cycles for durable, heavy-duty units. Light-duty and medium-duty electric and gasoline washers are gaining traction for residential and commercial applications in urban centers, while industrial clients continue investing in diesel and high-pressure stationary models for long-term performance.

Latin America

Latin America contributes roughly 10% of global revenue, led by Brazil and Mexico. Agriculture, mining, and transportation sectors drive demand for heavy-duty and fleet-cleaning equipment. Capital constraints among SMEs are fueling interest in rental and service-based access models, while commercial and residential demand benefits from urbanization and e-commerce penetration. Medium-duty electric and gasoline washers are preferred for facility maintenance, small car-wash operations, and residential applications, while heavy-duty diesel washers dominate mining and industrial cleaning segments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pressure Washer Market

- Alfred Kärcher SE & Co. KG (Kärcher)

- Nilfisk A/S

- Briggs & Stratton Corporation

- Generac Power Systems, Inc.

- Robert Bosch GmbH

- FNA Group

- Husqvarna Group

- Stanley Black & Decker, Inc.

- Techtronic Industries Co. Ltd. (TTI)

- Mi-T-M Corporation

- Annovi Reverberi S.p.A.

- Makita Corporation

- Greenworks Tools, Inc.

- Vortex Industries Inc.

- Snow Joe LLC

Recent Developments

- In July 2025, Kärcher introduced a new line of battery-powered professional washers with IoT-enabled maintenance alerts aimed at commercial fleet operators.

- In May 2025, Nilfisk launched a water-recycling pressure washer system to reduce consumption by 25% for industrial clients in Europe.

- In March 2025, Generac announced the expansion of its U.S. manufacturing facility to meet growing demand for residential electric washers.

- In February 2025, Bosch unveiled its next-generation smart washer platform, integrating digital diagnostics and mobile connectivity for real-time monitoring.