Pressure Relief Mattress Market Size

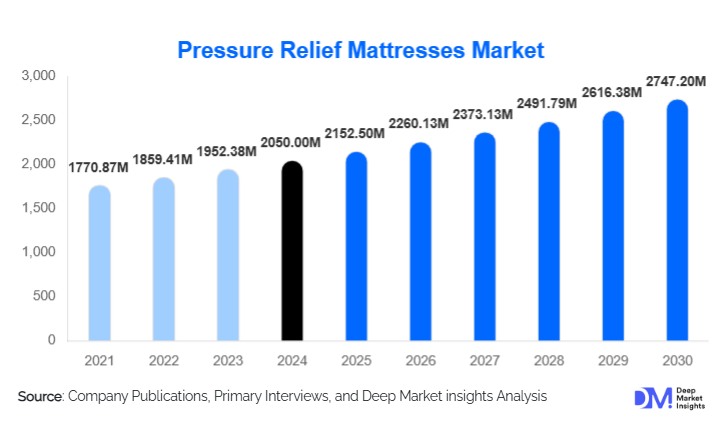

According to Deep Market Insights, the global pressure relief mattresses market size was valued at USD 2,050.00 million in 2024 and is projected to grow from USD 2,152.50 million in 2025 to reach USD 2,747.20 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Market growth is primarily driven by the rising prevalence of pressure ulcers, increasing global elderly populations, and expanding adoption of advanced therapeutic surfaces in hospitals, long-term care facilities, and home-care environments.

Key Market Insights

- Alternating pressure mattresses dominate the market, accounting for approximately 52% of global revenue due to their clinical effectiveness in pressure ulcer prevention.

- Air-filled pressure relief mattresses hold the largest product share, representing more than 55% of the overall category as healthcare facilities prioritize durable and modular air-cell designs.

- Pressure ulcer prevention is the leading application, capturing over 60% of global demand as healthcare providers focus on reducing hospital-acquired pressure injuries.

- North America leads the global market with an estimated 35–40% share, supported by strong hospital infrastructure and stringent safety regulations.

- Asia-Pacific is the fastest-growing region, driven by rapid hospital expansion and rising healthcare spending in China, India, and Southeast Asia.

- Smart mattress technology, including IoT sensors, microclimate control, and predictive analytics, is accelerating adoption across acute and long-term care settings.

What are the latest trends in the pressure relief mattress market?

Smart, Sensor-Integrated Mattresses Gaining Momentum

Pressure relief mattresses equipped with smart features, such as embedded pressure sensors, wireless monitoring, and automated patient repositioning alerts, are emerging as a major trend. These technologies help healthcare workers monitor high-risk patients in real-time and reduce the incidence of pressure injuries. Hospitals adopting sensor-enabled therapeutic surfaces benefit from improved clinical outcomes, lower malpractice risks, and reductions in the treatment cost of pressure ulcers. Manufacturers are partnering with digital health firms to develop cloud-based analytics platforms that track patient micro-movements, moisture levels, and temperature variations, enabling proactive intervention in critical-care environments.

Growth of Home-Care & Aging-in-Place Solutions

The rising global elderly population is creating strong demand for pressure relief mattresses designed specifically for home use. Lightweight, modular, and easy-to-operate systems, such as compact air mattresses and hybrid foam-air designs, are rapidly gaining adoption among home caregivers. The aging-in-place trend is pushing brands to introduce quieter pumps, portable designs, washable covers, and consumer-friendly interfaces. Subscription-based rental models tailored for home users are also becoming more common, reducing upfront costs and expanding accessibility for the elderly and mobility-limited individuals.

What are the key drivers in the pressure relief mattress market?

Rising Prevalence of Pressure Ulcers and Chronic Diseases

The global rise in pressure ulcers, particularly among immobile, elderly, and critically ill patients, is a central growth driver. Hospitals face financial and legal implications associated with hospital-acquired pressure injuries (HAPIs), prompting greater investments in advanced pressure relief surfaces. Additionally, the growing incidence of chronic conditions such as diabetes, obesity, and cardiovascular diseases increases patient immobility, heightening the need for high-quality therapeutic mattresses across acute care and long-term care environments.

Advancements in Mattress Technology and Material Innovation

Innovations in material science, modular cell engineering, and microclimate regulation technologies are improving mattress performance, durability, and patient comfort. Air-cell systems with low-noise pumps, foam designs with viscoelastic layers, and hybrid systems offering zoned pressure redistribution are among the leading technological enhancements. These innovations help healthcare providers reduce ulcer formation and accelerate wound healing, making advanced therapeutic surfaces essential components of modern patient-care protocols.

What are the restraints for the global market?

High Cost of Advanced Systems

Alternating pressure and smart therapeutic mattresses can be costly, creating barriers for budget-constrained hospitals, long-term care facilities, and home users. In lower-income countries, limited reimbursement frameworks and competing healthcare priorities slow the adoption of advanced systems. The need for specialized pumps, sensor modules, and technological maintenance further increases lifetime costs, restricting wider deployment in cost-sensitive regions.

Maintenance, Durability, and Reliability Challenges

Air-based systems require routine maintenance, including pump servicing, leak inspections, and periodic replacement of air cells. Operational interruptions caused by pump failures or calibration issues can impact patient outcomes. Long-term care facilities may hesitate to adopt advanced systems if maintenance demands exceed available staff resources. These operational and durability concerns remain significant obstacles to market adoption.

What are the key opportunities in the pressure relief mattress industry?

Expansion into Emerging Markets with Underdeveloped Healthcare Infrastructure

Emerging regions such as Asia-Pacific, Latin America, and the Middle East present substantial growth opportunities due to increasing hospital investments and rising awareness of pressure ulcer prevention. Local manufacturing, cost-optimized hybrid designs, and government procurement programs provide significant openings for global manufacturers to expand their presence and capitalize on unmet demand.

Subscription & Rental Models for Hospitals and Home Care

Rental and subscription-based service models are gaining popularity because they lower upfront acquisition costs and shift the burden of maintenance to vendors. This model is especially appealing to long-term care facilities and home-care providers. Rental fleets also allow manufacturers to introduce premium devices to price-sensitive buyers, expanding the overall addressable market.

Product Type Insights

Alternating pressure mattresses represent the most significant share of the market due to proven clinical outcomes and strong demand from hospitals and ICUs. Air-filled mattresses dominate product-based segmentation, with over 55% share, as air-cell systems provide superior pressure redistribution and modular maintenance options. Foam-based and hybrid mattresses continue to grow, supported by rising use in home-care settings, long-term care facilities, and cost-sensitive markets looking for durable, low-maintenance alternatives. Fiber and gel-based variations serve niche applications, particularly in rehabilitation and premium comfort-focused environments.

Application Insights

Pressure ulcer prevention accounts for over 60% of the market share, making it the largest application segment. Rising hospital-acquired pressure injury cases and stringent patient safety regulations drive demand for advanced therapeutic surfaces. Wound healing applications are expanding rapidly as clinicians adopt mattresses that improve microclimate control and reduce shear. Post-surgical care and pain management applications are growing in rehabilitation centers and home-care settings, where patient comfort and mobility support are essential.

End-Use Insights

Hospitals represent the largest end-use segment, accounting for 60–65% of global demand, as acute-care units, ICUs, and surgical wards require continuous pressure management solutions. Long-term care facilities and nursing homes are the second-largest segment, driven by elderly populations and chronic care needs. Home-care adoption is increasing quickly due to aging-in-place trends and expanding availability of portable therapeutic mattresses. Hospices, rehabilitation centers, and wound-care clinics are emerging end-use segments with notable growth potential.

Distribution Channel Insights

Hospital procurement remains the dominant distribution channel due to large-volume purchases and long-term contracts. Durable medical equipment (DME) dealers play a central role in long-term care and home-care markets, providing rental services, installation, and maintenance. Direct-to-consumer online sales are expanding as more elderly users and caregivers purchase therapeutic mattresses independently. Subscription and rental models are gaining market share across all buyer groups, particularly for premium alternating and smart therapeutic systems.

| By Product Type | By Technology | By Risk Category | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads the market with a 35–40% share, driven by high awareness of pressure ulcer risks, strict safety standards, and widespread hospital adoption of therapeutic support surfaces. The U.S. benefits from strong reimbursement systems, well-developed long-term care networks, and high penetration of advanced air-cell technologies. The home-care market is expanding rapidly due to aging demographics and increased acceptance of home-based clinical solutions.

Europe

Europe is a mature and well-regulated market with significant adoption in Germany, the U.K., France, Italy, and the Nordic countries. The region emphasizes quality standards, elderly care, and patient safety initiatives. Long-term care facilities constitute a major demand center, while rental models are widely used in both hospital and community-care environments. Sustainability-driven manufacturing and eco-certified materials are gaining traction.

Asia-Pacific

Asia-Pacific is the fastest-growing region due to rising healthcare investments, expanding hospital construction, and increasing awareness of pressure injury prevention. China dominates regional demand, while India and Southeast Asia are emerging markets for low-cost static and hybrid systems. Japan, with its aging population, shows strong adoption of advanced home-care therapeutic mattresses. Growing private healthcare networks further support demand.

Latin America

Latin America is developing steadily, with Brazil and Mexico leading adoption. Hospital modernization programs and increased procurement of therapeutic surfaces are supporting growth. Cost-sensitive buyers commonly adopt foam and hybrid mattresses, while private hospitals increasingly use alternating and low-air-loss systems.

Middle East & Africa

Healthcare investments in the UAE, Saudi Arabia, and Qatar are driving the adoption of advanced therapeutic mattresses in new hospitals and specialty care centers. Africa shows rising demand from South Africa, Kenya, and Nigeria, where improvements in private healthcare infrastructure support moderate market expansion. Import-driven demand remains strong across the region.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pressure Relief Mattress Market

- Hill-Rom (Baxter)

- Stryker

- Arjo

- Invacare

- Linet Group SE

- Joerns Healthcare

- Drive DeVilbiss Healthcare

- Paramount Bed

- Talley Group

- Apex Medical

Recent Developments

- In 2024, several global manufacturers expanded their smart mattress portfolios with integrated pressure sensors and wireless bedside monitoring systems.

- In 2025, leading companies invested in modular air-cell technology to reduce maintenance costs and improve operational reliability in hospital settings.

- In 2025, multiple vendors introduced home-care specific therapeutic mattresses featuring quiet pumps, lighter materials, and subscription-based rental options.