Pregnancy Test Stick Market Size

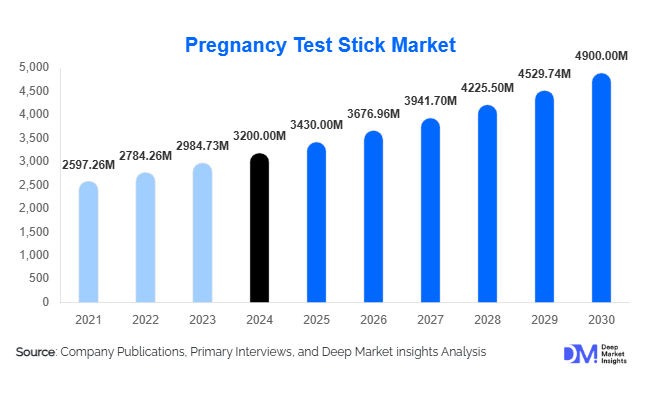

According to Deep Market Insights, the global pregnancy test stick market size was valued at USD 3,200 million in 2024 and is projected to grow from USD 3,430 million in 2025 to reach USD 4,900 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The market growth is primarily driven by increasing awareness of early pregnancy detection, rising adoption of at-home diagnostic testing, technological advancements in digital pregnancy tests, and expanding e-commerce and retail distribution channels globally.

Key Market Insights

- Digital and at-home testing solutions are transforming the market, offering improved accuracy, convenience, and integration with health apps for fertility tracking and early detection.

- Emerging markets in Asia-Pacific and Latin America are gaining traction, fueled by rising disposable incomes, expanding retail infrastructure, and increasing awareness of reproductive health.

- North America dominates global demand, with high adoption of over-the-counter pregnancy test sticks and strong e-commerce penetration.

- Europe is the fastest-growing regional market, driven by consumer preference for digital pregnancy sticks, privacy, and convenient home testing solutions.

- Technological integration and innovation, including digital displays, smartphone connectivity, and rapid hCG detection, are enhancing user experience and boosting market adoption.

What are the latest trends in the pregnancy test stick market?

Shift Toward Digital and Connected Testing Solutions

Pregnancy test sticks are increasingly incorporating digital displays, smartphone connectivity, and fertility tracking integration. This trend allows users to monitor health data, share results with healthcare providers, and receive automated notifications for early detection. Digital tests with improved sensitivity for low hCG levels are gaining traction, particularly in North America and Europe. The rise of telemedicine and home-based diagnostic solutions further complements the growth of connected pregnancy testing devices.

Rising Adoption of E-Commerce and OTC Channels

Online platforms and over-the-counter (OTC) channels are driving accessibility and convenience, enabling consumers to purchase products discreetly. Retail pharmacies remain significant, but e-commerce platforms such as Amazon, Alibaba, and specialized health sites are increasingly preferred. Subscription-based home testing kits and direct-to-consumer marketing strategies are emerging as new engagement channels. Social media campaigns and digital awareness programs are shaping consumer preferences, especially among younger, tech-savvy women.

What are the key drivers in the pregnancy test stick market?

Increasing Awareness of Early Pregnancy Detection

Global consumers are becoming more health-conscious and aware of the benefits of early pregnancy detection. Educational campaigns, fertility awareness programs, and online health resources are driving adoption. The need for privacy and convenience in reproductive health encourages the use of at-home testing solutions, particularly in regions with limited access to clinical diagnostics.

Technological Advancements and Innovation

Digital pregnancy tests, midstream sticks, and smartphone-integrated devices provide faster and more accurate results. Innovations such as low-detection hCG strips, reusable devices, and eco-friendly packaging are appealing to environmentally conscious consumers. Manufacturers are focusing on product differentiation through improved reliability, intuitive design, and integration with health apps.

Expansion of Distribution Channels

E-commerce platforms, online pharmacies, and retail chains are improving accessibility, particularly in semi-urban and rural areas. Growing awareness of privacy, ease of use, and doorstep delivery is strengthening market penetration. Direct-to-consumer marketing, social media engagement, and telemedicine partnerships are further boosting adoption across demographics.

What are the restraints for the global market?

Regulatory Challenges

Stringent regulatory approvals for at-home diagnostic kits in some countries can delay market entry and limit product availability. Variations in testing standards and certifications may create hurdles for global market expansion, particularly for new entrants.

Price Sensitivity in Emerging Markets

High-end digital pregnancy test sticks remain inaccessible for lower-income consumers in regions such as South Asia, Africa, and Latin America. Affordability constraints may slow adoption rates despite increasing awareness and demand for home-based testing solutions.

What are the key opportunities in the pregnancy test stick market?

Expansion in Emerging Markets

Rising disposable incomes, increasing healthcare awareness, and growing retail infrastructure in Asia-Pacific and Latin America provide significant growth opportunities. Countries such as India, China, Brazil, and Mexico are emerging as high-potential markets, where at-home diagnostic testing is gaining acceptance. Companies entering these regions can capture first-mover advantages through localized distribution, awareness campaigns, and cost-effective offerings.

Technological Integration and Smart Devices

Smart pregnancy test sticks connected to health apps and fertility trackers are attracting tech-savvy consumers. Innovations in digital displays, low-detection hCG technology, and data-sharing capabilities provide opportunities for brand differentiation. Partnerships with telemedicine providers and health tech platforms are expected to drive further adoption and consumer trust.

Government Initiatives and Public Health Programs

Governments are promoting reproductive health awareness through national campaigns, subsidized home testing programs, and maternal health initiatives. Collaborations with public health agencies for the distribution of pregnancy test kits in underserved areas present revenue growth and social impact opportunities. Programs targeting fertility awareness, early detection, and women’s health education are creating sustained demand across regions.

Product Type Insights

Standard pregnancy test sticks dominate the market, accounting for the majority of sales due to affordability and widespread availability. Digital pregnancy test sticks are rapidly growing in adoption, particularly in North America and Europe, as consumers prefer accurate and easy-to-read results. Midstream sticks are gaining traction due to convenience and ease of handling, offering a balance between standard and digital options. The overall product trend is shifting toward higher-sensitivity tests and user-friendly designs to cater to modern consumer preferences.

Technology Insights

Urine-based pregnancy tests remain the largest technology segment, representing over 85% of global demand due to ease of use, affordability, and availability. Blood-based home collection kits are emerging as a niche segment, providing early detection and higher accuracy, particularly in clinical collaborations and telemedicine applications. The trend is toward digital and connected solutions to enhance user confidence and engagement.

Distribution Channel Insights

Retail pharmacies remain the leading distribution channel globally, accounting for nearly 55% of the market in 2024. Online pharmacies and e-commerce platforms are the fastest-growing channels due to convenience, privacy, and broad product selection. Hospitals and clinics also contribute significantly, particularly in regions with lower awareness of OTC products. Supermarkets and hypermarkets are gradually gaining share in urban and semi-urban areas.

| By Product Type | By Technology | By Distribution Channel | By Price Range |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America is the largest regional market, with the U.S. and Canada driving demand. High awareness, disposable income, and established OTC channels support strong adoption. North America accounted for approximately 38% of the global market in 2024. Digital pregnancy tests with app integration are particularly popular, reflecting the region’s technological affinity and demand for privacy and convenience.

Europe

Europe holds around 28% of the global market share in 2024, led by Germany, the UK, and France. Rising awareness, early adoption of digital test sticks, and increasing e-commerce penetration are fueling growth. The region is also the fastest-growing in terms of percentage CAGR, driven by demand for smart devices and connected health solutions.

Asia-Pacific

Asia-Pacific is emerging as a high-potential market, particularly in India, China, and Japan. Growing disposable incomes, increasing reproductive health awareness, and expanding retail and e-commerce networks are boosting demand. The region’s growth is supported by initiatives to improve access to diagnostic kits and telemedicine integration for rural populations.

Latin America

Brazil, Mexico, and Argentina are driving the Latin American market, with increasing adoption of OTC pregnancy test sticks and e-commerce distribution. The region is witnessing moderate growth due to affordability constraints and limited awareness compared to developed regions.

Middle East & Africa

The Middle East and Africa are emerging markets, with growing demand in the UAE, Saudi Arabia, South Africa, and Nigeria. Government health initiatives and rising urbanization are contributing to growth. However, infrastructure and affordability challenges limit market penetration in rural areas.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pregnancy Test Stick Market

- Abbott Laboratories

- Procter & Gamble

- Roche Diagnostics

- Arkray

- Beijing Choice Electronic Technology

- HCG Corporation

- Shenzhen Realtime Technology

- i-Health, Inc.

- F. Hoffmann-La Roche AG

- Wondfo Biotech

- Siemens Healthineers

- Easy@Home

- Blue Cross Laboratories

- Joyful Biotech

- Pregmate

Recent Developments

- In March 2025, Abbott Laboratories launched a new digital pregnancy test stick with app connectivity and fertility tracking, enhancing early detection accuracy.

- In January 2025, Procter & Gamble expanded its Clearblue digital pregnancy stick portfolio in Europe and Asia-Pacific, focusing on high-sensitivity and ease-of-use improvements.

- In February 2025, Roche Diagnostics introduced a blood-based home collection pregnancy kit for early detection, targeting telemedicine and rural healthcare applications.