Power-Line Carrier Market Size

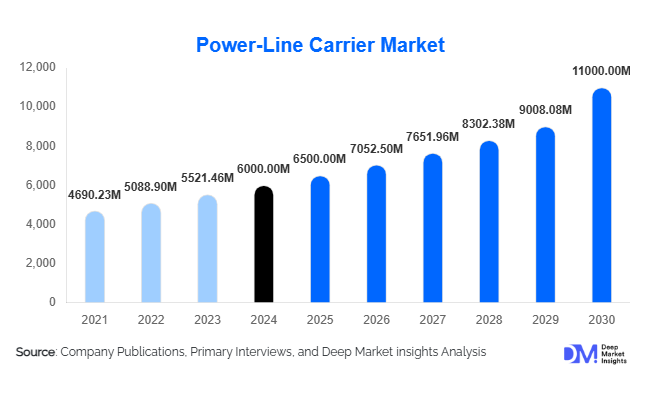

According to Deep Market Insights, the global Power-Line Carrier (PLC) market size was valued at USD 6,000 million in 2024 and is projected to grow from USD 6,500 million in 2025 to reach USD 11,000 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The market growth is primarily driven by increasing smart grid modernization initiatives, rising adoption of industrial IoT and smart building applications, and the cost-effective deployment of communication infrastructure leveraging existing power lines.

Key Market Insights

- Smart grid and utility modernization remain the dominant application for PLC technologies, with narrowband PLC leading due to long-distance communication capabilities and reliability across low and medium-voltage networks.

- Asia-Pacific is emerging as the fastest-growing region, propelled by large-scale grid upgrades, rural electrification, and renewable energy integration in countries such as China and India.

- North America currently leads the market share, driven by early adoption, regulatory support, and significant utility investments in smart meters and advanced metering infrastructure.

- Broadband PLC adoption is accelerating, enabling high-speed data transmission for industrial automation, building management, and remote monitoring applications.

- Technological integration, including IoT, AI-driven analytics, and edge computing, is enhancing PLC applications in industrial and smart city deployments.

- Government incentives and renewable energy targets are creating growth opportunities by mandating reliable grid communication infrastructure and energy efficiency improvements.

Latest Market Trends

Integration with Smart Grid and Renewable Energy

PLC technologies are increasingly being deployed to support smart grid initiatives and renewable energy integration. Utilities are using PLC systems to enable advanced metering infrastructure, transformer monitoring, and demand-response programs. The technology provides cost-effective communication over existing power lines, reducing the need for separate fiber networks. Integration with renewable energy assets, such as solar and wind farms, allows utilities to monitor distributed energy resources in real time, improve grid stability, and reduce energy losses. Additionally, the rise of microgrids and electric vehicle charging networks is driving the deployment of PLC solutions in both urban and rural areas.

Industrial IoT and Smart Building Applications

Industrial and commercial adoption of PLC is growing rapidly due to its suitability for IoT-enabled applications. Factories and large commercial complexes are deploying PLC systems to monitor machinery, optimize energy consumption, and enable predictive maintenance. In smart buildings, PLC facilitates automation of lighting, HVAC, and security systems without additional wiring. Emerging technologies such as AI-based analytics and edge computing are being combined with PLC networks to enhance operational efficiency, reduce downtime, and provide actionable insights for facility managers. These trends are particularly strong in Asia-Pacific and North America, where industrial modernization and building automation are high priorities.

Power-Line Carrier Market Drivers

Smart Grid Modernization Initiatives

Global utilities are investing heavily in modernizing aging electrical infrastructure to reduce losses, improve reliability, and integrate renewable energy sources. PLC provides a cost-effective solution for connecting smart meters, sensors, and grid automation devices, enabling real-time monitoring and control. Governments in Europe, North America, and the Asia-Pacific have enacted regulations and incentives for smart grid deployment, further fueling PLC adoption.

Industrial and Residential IoT Expansion

The proliferation of IoT devices in industrial, commercial, and residential settings is driving demand for robust communication networks. PLC enables reliable data transmission over existing power lines, reducing deployment costs and installation time. Industries are leveraging PLC for predictive maintenance, energy management, and machine-to-machine communication, while smart homes use PLC for automation of lighting, appliances, and security systems.

Cost-Effective Infrastructure Utilization

By utilizing existing electrical infrastructure, PLC reduces the need for new cabling or wireless networks, making it economically attractive for utilities and industries. This approach lowers capital expenditure, simplifies deployment, and accelerates project timelines, particularly in retrofitting older networks or extending coverage to rural and remote areas.

Market Restraints

Technical Challenges and Signal Interference

Power lines were not originally designed for data transmission, creating challenges such as signal attenuation, electromagnetic interference, and variable impedance. These factors can limit data rates, reduce transmission distances, and increase error rates. Overcoming these technical limitations requires sophisticated modulation, filtering, and error correction technologies, which can increase deployment complexity and cost.

Regulatory and Standardization Barriers

Different countries impose varying standards on electromagnetic emissions, frequency allocations, and safety requirements. Lack of harmonized global standards and interoperability issues between devices from different vendors can hinder large-scale deployments. Regulatory approval processes can also be time-consuming, delaying project implementation and increasing costs for utilities and industrial adopters.

Power-Line Carrier Market Opportunities

Rural Broadband and Remote Connectivity

Broadband PLC offers the potential to provide high-speed internet access in rural and remote areas without requiring costly fiber deployments. Governments and telecom operators are exploring PLC as a solution for bridging the digital divide. Opportunities exist to partner with public sector programs and leverage funding initiatives for rural connectivity, enabling market expansion in developing regions.

Industrial Automation and Smart Cities

PLC adoption in industrial automation and smart city projects presents significant growth potential. Applications include monitoring industrial machinery, street lighting control, traffic management, and environmental sensing. Integration with IoT platforms, cloud computing, and AI analytics enhances efficiency, safety, and sustainability, creating a robust pipeline of demand for PLC solutions in urban infrastructure projects.

Government Incentives and Renewable Energy Integration

Government programs incentivizing smart metering, grid modernization, and renewable energy integration provide reliable demand for PLC technologies. Policies such as subsidy programs, tax credits, and national energy targets encourage utilities and private companies to invest in PLC systems. This creates opportunities for both established and new players to expand their market presence through partnerships and project-based deployments.

Product Type Insights

Hardware dominates the PLC market, accounting for approximately 60-65% of revenue in 2024. This includes modems, couplers, repeaters, and adapters, which are critical components for system deployment. Software and services, including network management platforms and integration services, are growing rapidly, particularly in industrial and smart grid applications. The increasing complexity of PLC networks and integration with IoT solutions is driving higher demand for software-based monitoring, analytics, and maintenance services.

Application Insights

Smart grid and grid communication applications represent the largest market segment, accounting for roughly 35-45% of the 2024 market. PLC enables advanced metering infrastructure, transformer monitoring, distribution automation, and outage management. Industrial automation and smart building applications are expanding rapidly, driven by the need for real-time monitoring, energy optimization, and IoT integration. Emerging applications such as EV charging station communication and microgrid management are expected to gain traction over the forecast period.

Distribution Channel Insights

PLC hardware and software solutions are primarily distributed through direct sales to utilities, industrial companies, and system integrators. Specialist integrators and OEM partnerships are critical for large-scale deployments, particularly in smart grid and industrial applications. Online platforms are gaining importance for smaller hardware components and residential solutions, providing access to standardized PLC modems and adapters. Global supply chains and export channels support market penetration in emerging regions such as Africa and Latin America, where local manufacturing capacity is limited.

End-Use Insights

Utilities account for the largest share of PLC demand, driven by smart meter rollouts, grid modernization, and renewable integration projects. Industrial users are adopting PLC for IoT-enabled monitoring, predictive maintenance, and automation, representing the fastest-growing end-use segment. Residential and commercial applications, including smart homes and building automation, are expanding as broadband PLC solutions become more accessible. Emerging applications in EV infrastructure, microgrids, and smart city deployments offer additional growth opportunities and are expected to drive future market expansion.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds approximately 30-35% of the global market in 2024, led by the U.S. due to strong utility investments, regulatory support, and early adoption of smart grid technologies. Canada contributes modestly, focusing on urban and industrial applications. The region is characterized by mature infrastructure, high technology adoption, and moderate growth relative to the Asia-Pacific.

Europe

Europe accounts for around 20-25% of the market, with Germany, France, and the U.K. leading adoption through smart meter rollouts and energy efficiency programs. The market growth is steady, driven by regulatory mandates, renewable integration, and industrial automation initiatives.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing 25-30% of the 2024 market. China and India are key drivers due to large-scale smart grid modernization, rural electrification, and renewable energy integration. Japan and South Korea contribute through industrial automation and smart building applications. Increasing urbanization and IoT adoption are accelerating PLC deployment across the region.

Latin America

Latin America holds a smaller share (~5-8%) but shows high growth potential, particularly in Brazil, Mexico, and Argentina. PLC adoption is driven by utility modernization, rural electrification, and smart city projects.

Middle East & Africa

MEA accounts for 3-5% of the market, with growth led by renewable energy integration, urban infrastructure projects, and industrial adoption. UAE, Saudi Arabia, and South Africa are key countries deploying PLC for smart grids and industrial IoT applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Power-Line Carrier Market

- Siemens

- ABB

- General Electric

- Schneider Electric

- Hitachi Energy

- Mitsubishi Electric

- Texas Instruments

- STMicroelectronics

- Qualcomm

- Broadcom

- Honeywell

- Omron

- Landis+Gyr

- Enel X

- Itron

Recent Developments

- In March 2025, Siemens launched a broadband PLC solution for industrial IoT applications, integrating edge analytics for real-time energy management.

- In January 2025, ABB expanded its distribution automation PLC offerings in India, supporting smart grid rollouts and rural electrification programs.

- In December 2024, Schneider Electric introduced next-generation narrowband PLC modems optimized for high-voltage distribution networks, improving reliability and reducing installation complexity.