Poufs Market Size

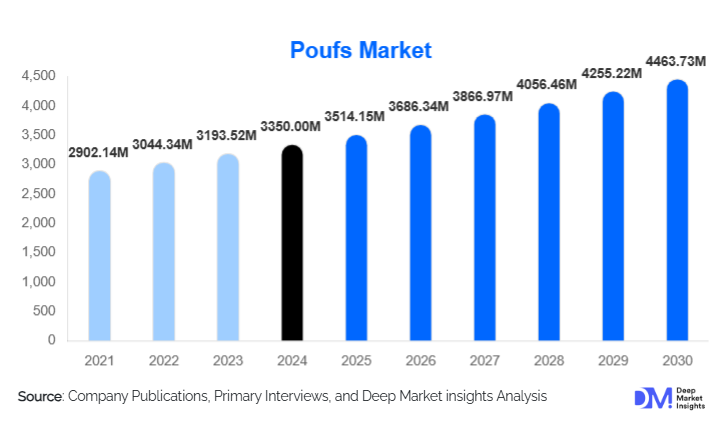

According to Deep Market Insights, the global poufs market size was valued at USD 3,350 million in 2024 and is projected to grow from USD 3,514.15 million in 2025 to reach USD 4,463.73 million by 2030, expanding at a CAGR of 4.9 during the forecast period (2025–2030). The growth of the poufs market is primarily driven by the increasing demand for multifunctional and space-saving furniture, rising consumer preference for home décor customization, and the surge in e-commerce platforms offering diverse pouf designs across the globe.

Key Market Insights

- Rising urbanization and smaller living spaces are driving demand for poufs as multifunctional seating and décor solutions in apartments and compact homes.

- Home décor customization and personalization are accelerating adoption, with consumers preferring poufs that complement interior styles and aesthetics.

- Online retail channels dominate sales by offering easy access to a wide variety of designs, materials, and colors, increasing global reach.

- North America holds a major market share due to high disposable income and mature home furnishing preferences.

- Europe is a key growth region, driven by rising interest in eco-friendly and handcrafted poufs.

- Technological integration, including 3D visualization tools and AR-enabled furniture apps, is enhancing consumer buying experiences.

What are the latest trends in the poufs market?

Eco-Friendly and Sustainable Materials

Consumers are increasingly preferring poufs made from recycled fabrics, natural fibers like jute and cotton, and sustainably sourced leather. Eco-conscious buyers, especially in Europe and North America, are willing to pay a premium for poufs that reduce environmental impact. Manufacturers are responding by incorporating biodegradable fillings, water-based dyes, and handcrafted production techniques to appeal to environmentally sensitive consumers.

Customization and Modular Design

Personalized poufs with customizable covers, colors, and sizes are gaining traction. Modular poufs that can be combined or stacked to create multifunctional furniture pieces are becoming popular for modern homes. AR-based apps and online configurators allow buyers to visualize poufs in their living spaces before purchase, enhancing conversion rates for e-commerce channels.

What are the key drivers in the poufs market?

Urbanization and Compact Living

With increasing urban populations, especially in APAC and Europe, space-efficient furniture has become essential. Poufs offer multifunctional use, acting as seating, footrests, or side tables, which makes them ideal for smaller apartments. Growing awareness of space optimization in interior design is significantly boosting market adoption.

Rising Home Décor Spending

Consumers across the globe are spending more on home décor to enhance aesthetics, comfort, and lifestyle. Poufs serve as accent pieces, adding color and texture to interiors. Growing demand for statement furniture in both residential and commercial spaces, including boutique hotels and coworking offices, is positively impacting market growth.

Digital Retail Expansion

E-commerce platforms and digital marketing campaigns have improved access to global designs, styles, and price ranges. Platforms like Amazon, Wayfair, and niche furniture e-tailers are promoting international brands, increasing adoption in emerging regions. AR and 3D visualizers enhance buyer confidence, contributing to higher conversion rates.

What are the restraints for the global market?

High Production Costs for Premium Materials

Poufs made from premium leather, high-density foam, or designer fabrics have high manufacturing costs, which may limit adoption in price-sensitive markets. Rising raw material prices further add to production costs, constraining growth in developing countries.

Durability and Maintenance Concerns

Some consumers hesitate to purchase poufs due to concerns over durability and cleaning. Poufs with delicate fabrics or intricate designs may require frequent maintenance, reducing appeal for households with children or pets. Manufacturers are exploring washable covers and modular designs to address this restraint.

What are the key opportunities in the poufs industry?

Expansion in Emerging Markets

Rapid urbanization in APAC and LATAM offers significant growth opportunities. Rising disposable incomes, increasing awareness of home décor trends, and penetration of e-commerce platforms are creating new demand for poufs. Local manufacturers and international brands can capitalize on first-mover advantage in tier-2 and tier-3 cities.

Integration with Smart Homes

The integration of furniture into smart home ecosystems presents opportunities for multifunctional poufs with built-in storage, wireless charging, and modular connectivity. Smart poufs that combine aesthetics with utility can attract tech-savvy consumers seeking innovation in interior décor.

Eco-Friendly Product Lines

Developing sustainable poufs using recycled, biodegradable, and non-toxic materials is a high-potential opportunity. Consumers in Europe, North America, and APAC are increasingly selecting eco-friendly products, making sustainability a differentiator for new entrants and established players.

Product Type Insights

Fabric poufs dominate the market, accounting for approximately 38% of the 2024 market share, driven by affordability, variety of colors, and customization options. Leather poufs, comprising 25%, cater to premium consumers seeking durability and luxury finishes. Other materials, including knitted, woven, and synthetic leather poufs, collectively represent 37%, capturing niche preferences and eco-conscious buyers.

Application Insights

Residential applications account for nearly 60% of global demand, reflecting rising home décor trends and small-space solutions. Commercial uses in offices, boutique hotels, and lounges represent 30%, driven by multifunctional seating and aesthetic considerations. Specialty applications, including spas, yoga studios, and event décor, contribute 10%, highlighting emerging use cases.

Distribution Channel Insights

Online sales dominate with 55% of the market due to convenience, customization options, and competitive pricing. Brick-and-mortar furniture stores capture 35%, particularly in mature markets where physical inspection of texture and quality is important. Other channels, such as specialty décor boutiques and direct B2B sales, contribute 10%, primarily targeting commercial buyers.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 32% of the global poufs market in 2024, driven by U.S. and Canadian consumers investing heavily in home décor. The rising popularity of contemporary and multifunctional furniture, coupled with robust e-commerce penetration, is supporting growth. Premium and designer poufs are particularly sought after in metropolitan areas.

Europe

Europe accounts for 28% of the global market, with Germany, the U.K., and France being major contributors. High consumer awareness of sustainable and handcrafted furniture fuels demand. Eco-friendly and artisanal poufs are gaining traction, supported by a strong preference for aesthetic customization.

Asia-Pacific

APAC is the fastest-growing region, led by India, China, and Japan. Rapid urbanization, rising disposable income, and growing awareness of interior design trends are driving market adoption. E-commerce growth is enabling wider access to international brands and designs.

Latin America

Brazil, Mexico, and Argentina are leading demand, with poufs increasingly used in residential and boutique commercial spaces. Online retail expansion is enhancing market penetration, though price sensitivity remains a challenge.

Middle East & Africa

The Middle East, particularly the UAE and Saudi Arabia, is adopting premium poufs for luxury residences and offices. Africa, led by South Africa, is emerging slowly, with growing interest in modern furniture among urban populations.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Poufs Market

- IKEA

- La-Z-Boy

- Wayfair

- West Elm

- Urban Outfitters

- Pottery Barn

- Crate & Barrel

- Muji

- Ashley Furniture

- HAY

- BoConcept

- CB2

- Arhaus

- Habitat

- Roche Bobois

Recent Developments

- In January 2025, IKEA launched a new line of eco-friendly poufs using recycled fabrics and biodegradable filling, targeting European and North American markets.

- In March 2025, West Elm introduced customizable poufs with AR visualization tools, enhancing online sales conversion rates in APAC and North America.

- In June 2025, Wayfair expanded its poufs collection to include modular and multifunctional designs, catering to small-space urban dwellings globally.