Posture Correction Market Size

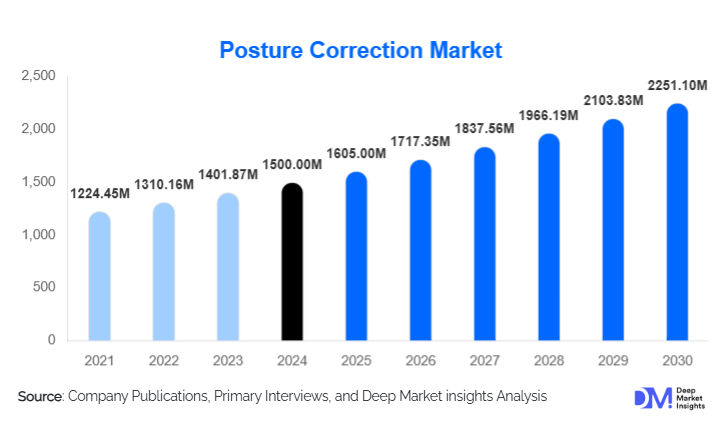

According to Deep Market Insights, the global Posture Correction market size was valued at USD 1,500 million in 2024 and is projected to grow from USD 1,605 million in 2025 to reach USD 2,251.10 million by 2030, expanding at a CAGR of 7% during the forecast period (2025–2030). The market growth is primarily driven by increasing sedentary lifestyles, rising awareness of musculoskeletal health, and technological advancements in smart posture correction devices.

Key Market Insights

- Smart and connected posture correction devices are gaining popularity, enabling real-time feedback, personalized coaching, and integration with health and fitness apps.

- Adults remain the largest end-user segment, driven by office workers, remote workers, and sedentary lifestyles that increase postural disorders.

- North America dominates the market with a share of approximately 48–50% in 2024, fueled by high health awareness and the adoption of wearable technologies.

- The Asia-Pacific region is the fastest-growing, driven by rising awareness, increasing middle-class income, and expanding e-commerce channels in China and India.

- Kinesiology tape and elastic support products lead the global market, accounting for roughly 35–38% of market revenue due to their affordability, comfort, and broad consumer adoption.

- E-commerce and online channels are increasingly shaping distribution, providing convenience, reviews, and wide product availability.

What are the latest trends in the posture correction market?

Smart and Wearable Posture Devices

The market is increasingly shifting toward smart posture correction devices equipped with sensors, haptic feedback, and app-based monitoring. These devices offer real-time guidance and progress tracking, appealing to health-conscious adults and corporate wellness programs. Integration with mobile apps allows users to receive posture alerts, track improvements, and even share data with healthcare professionals. The adoption of AI-enabled posture trainers provides personalized feedback and enhances user compliance, which is critical to maintaining long-term postural improvements.

Integration with Corporate Wellness and Rehabilitation Programs

Companies and institutions are increasingly adopting posture correction solutions as part of wellness and preventive health programs. Corporate initiatives targeting employee productivity and musculoskeletal health are driving demand for ergonomic devices, wearable sensors, and office-based support solutions. Hospitals, physiotherapy centers, and rehabilitation clinics are also integrating advanced posture correction devices, creating a growing institutional demand segment. These integrations improve adherence, foster health awareness, and support preventive care models.

What are the key drivers in the posture correction market?

Rising Sedentary Lifestyles and Digital Device Usage

The increase in remote work, desk jobs, and prolonged mobile device use has led to a surge in postural disorders. Adults exposed to long hours of sitting and poor ergonomics are the primary drivers of market growth. This trend has prompted consumers to invest in braces, wearable devices, and ergonomic supports to prevent musculoskeletal complications.

Awareness of Preventive Health and Musculoskeletal Well-being

Growing awareness regarding the importance of preventive health, including spinal alignment and posture correction, has resulted in higher adoption rates. Social media campaigns, health professionals’ endorsements, and increased consumer education have all contributed to shaping preferences toward proactive posture management.

Innovations in Materials and Technology

Advancements in lightweight materials, breathable fabrics, and smart wearable technologies are making posture correction devices more comfortable and effective. Integration of sensors, mobile app connectivity, and AI-powered feedback mechanisms is differentiating products and increasing their market appeal. Premium smart devices cater to tech-savvy consumers who value convenience, aesthetics, and data-driven health insights.

What are the restraints for the global market?

High Cost of Premium Devices

Although basic braces and tapes are affordable, smart and technologically advanced posture correction devices remain expensive. In price-sensitive regions, high costs restrict adoption, particularly for discretionary consumers. Cost concerns also limit repeat purchases and broader market penetration in emerging economies.

User Compliance and Comfort Challenges

Discomfort, improper fit, or obtrusiveness of some devices may reduce usage duration. Users often discontinue use if benefits are not immediate or if devices interfere with daily activities, which can negatively impact long-term market growth.

What are the key opportunities in the posture correction market?

Smart, AI-Enabled Devices

The integration of AI, mobile apps, and real-time feedback in posture correction devices represents a significant growth opportunity. Personalized coaching, progress tracking, and remote physiotherapy integration are expanding adoption among adults and corporate wellness programs. Startups and established players can leverage this technology to differentiate products and justify premium pricing.

Corporate Wellness and Institutional Adoption

Organizations and healthcare institutions are increasingly incorporating posture correction solutions into preventive health programs. Corporate wellness initiatives and physiotherapy centers offer opportunities for volume sales, partnerships, and long-term contracts, driving steady revenue streams and market penetration.

Emerging Market Penetration

Asia-Pacific, Latin America, and the Middle East regions represent underpenetrated markets with rising health awareness and growing disposable incomes. Affordable product lines, education campaigns, and e-commerce strategies can unlock significant growth potential. Localizing designs and leveraging government health initiatives also provide avenues for expansion.

Product Type Insights

Kinesiology tape and elastic supports dominate the market, accounting for approximately 35–38% of global revenue in 2024. These products are affordable, lightweight, and easy to use under clothing, making them highly popular among both adults and younger consumers. Smart wearables are emerging rapidly, particularly in North America and Europe, as premium segments gain traction among tech-savvy users seeking real-time feedback and personalized health tracking.

Application Insights

Daily use and lifestyle posture maintenance applications lead the market, as these products cater to office workers, students, and remote employees aiming to prevent postural issues. Therapeutic and rehabilitation applications are significant, particularly within hospitals and physiotherapy clinics, where devices support patient recovery. Sports and fitness applications are gaining attention, leveraging posture correction devices for performance enhancement and injury prevention.

Distribution Channel Insights

Pharmacies, retail stores, and specialty clinics currently dominate sales, collectively accounting for over 45–50% of the market share. However, e-commerce channels are the fastest-growing segment, driven by convenience, online reviews, and the ability to compare products. Direct-to-consumer models, online subscriptions, and mobile app integrations are further shaping distribution trends, particularly in emerging markets.

End-User Insights

Adults account for the largest share (41%) of the market, driven by sedentary occupations and high awareness of preventive health. The geriatric segment is the fastest-growing, fueled by aging populations requiring therapeutic and rehabilitative posture solutions. Children and students are also targeted via school wellness programs and ergonomically designed seating solutions.

| By Product Type | By Application | By Distribution Channel | By End-User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America remains the largest market with a 48–50% share in 2024. The U.S. is the primary contributor due to high consumer awareness, disposable income, and technological adoption. Demand is driven by corporate wellness programs, physiotherapy centers, and preventive health initiatives.

Europe

Europe holds the second-largest share (20–25%) with Germany, the U.K., and France leading. Growth is supported by an aging population, strong healthcare infrastructure, and workplace ergonomics initiatives. Emerging Eastern European markets are showing faster adoption rates from a lower baseline.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and India, fueled by rising middle-class income, increasing awareness, and online distribution channels. Japan and South Korea are mature markets with steady demand, particularly for smart wearable devices.

Latin America

Brazil and Mexico dominate, although market share remains smaller (5–10%). Growth is driven by increasing health awareness, urbanization, and the adoption of mid-tier posture correction products.

Middle East & Africa

The GCC countries, led by the UAE and Saudi Arabia, are emerging as growth markets due to high income levels and rising wellness awareness. Africa’s demand is mainly local, supplemented by imports for medical and rehabilitation purposes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Posture Correction Market

- Ottobock

- Upright

- Aspen Medical Products

- BackJoy

- Swedish Posture

- KT Tape

- Hempvana

- IntelliSkin

- FlexGuard

- BetterBack

- Posture Medic

- TheraBand

- Vive Health

- ComfyMed

- Truweo

Recent Developments

- In June 2025, Upright launched a new AI-enabled smart posture wearable, integrating app-based coaching and progress tracking for office workers.

- In April 2025, Ottobock introduced a lightweight ergonomic posture brace aimed at geriatric patients, enhancing comfort and compliance during rehabilitation.

- In February 2025, BackJoy partnered with corporate wellness programs in North America to distribute posture support devices and educational materials to employees.