Portable Projector Market Size

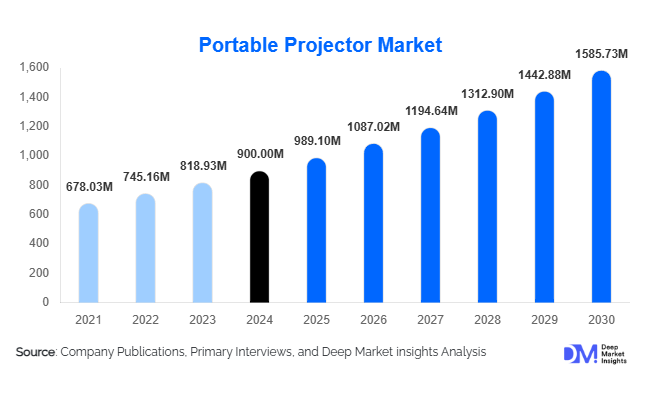

According to Deep Market Insights, the global portable projector market size was valued at USD 900 million in 2024 and is projected to grow from USD 989.1 million in 2025 to reach USD 1,585.73 million by 2030, expanding at a CAGR of 9.9% during the forecast period (2025–2030). The growth of the portable projector market is primarily driven by rising consumer demand for home entertainment and outdoor viewing experiences, the increasing adoption of portable projectors in educational institutions, and the integration of smart streaming features and wireless connectivity that enhance user convenience and versatility.

Key Market Insights

- Mini and handheld projectors dominate the product segment, offering the optimal balance of portability, brightness, and affordability for consumers and small businesses alike.

- LED technology remains the most widely adopted light source, due to long lifespan, energy efficiency, and cost-effectiveness compared to laser or hybrid systems.

- Home entertainment applications are the largest end-use segment, accounting for nearly 45% of the 2024 market, driven by streaming content consumption and outdoor leisure trends.

- North America and APAC are the largest regional markets, with North America accounting for 30% and APAC 36% of the global market in 2024, supported by high disposable incomes and strong e-commerce penetration.

- Emerging technologies, including auto-focus, AI upscaling, and integrated smart OS platforms, are enhancing the user experience and creating differentiation opportunities for premium products.

- Education and outdoor/event segments are emerging as high-growth end-use applications, driven by flexible classroom deployments and experiential entertainment trends.

What are the latest trends in the portable projector market?

Smart OS and Wireless Connectivity Integration

Manufacturers are increasingly embedding smart operating systems, wireless casting, and app ecosystems into portable projectors. This allows users to stream content directly without relying on external devices and enhances usability across home, education, and corporate environments. Wireless connectivity has become a standard expectation, especially in mid-range and premium models, enabling seamless integration with smartphones, laptops, and streaming platforms. Emerging features such as AI upscaling, auto-focus, and automatic keystone correction further improve image quality and user convenience, reinforcing product differentiation in a highly competitive market.

Expansion of Outdoor and Experiential Entertainment Applications

Portable projectors are increasingly used for outdoor entertainment, pop-up cinemas, and event-based experiences. Battery-powered, weather-resilient projectors enable consumers and businesses to host social gatherings, movie nights, and promotional events in outdoor settings. The rising popularity of experiential entertainment, particularly in North America and Europe, is driving the adoption of portable projectors with higher brightness levels, durable construction, and integrated audio solutions. This trend also fuels demand for bundled accessories such as portable screens, mounts, and audio systems.

What are the key drivers in the portable projector market?

Rapid Improvements in Illumination Technology

Advancements in LED and laser light sources have significantly increased brightness, lifespan, and energy efficiency while reducing thermal constraints. These innovations enable portable projectors to deliver high-quality images in compact form factors. The improved performance lowers maintenance costs and total cost of ownership, encouraging adoption across consumer, educational, and enterprise applications.

Growing Consumer and Educational Demand

The rising adoption of streaming platforms and home entertainment systems is driving consumer demand for portable projectors. Simultaneously, educational institutions are integrating portable projectors into classrooms to facilitate interactive learning and digital content delivery. Government programs and digital education initiatives in emerging markets are further supporting this growth, expanding the market opportunity for portable projectors.

Adoption in Outdoor and Event-Based Applications

Shifts in lifestyle and increased interest in social and experiential events have elevated demand for portable projectors in outdoor settings. Corporate events, hospitality, and rental applications are increasingly using portable projectors for temporary installations, creating a lucrative market segment for devices that combine portability, durability, and performance.

What are the restraints for the global market?

Price-Sensitive Market Segment

Low-cost portable projectors from emerging manufacturers are driving aggressive pricing competition. Consumers in price-sensitive markets often prioritize cost over image quality or features, compressing margins for established brands. This limits revenue growth and requires companies to differentiate via advanced features or bundled services.

Brightness and Ambient Light Limitations

Despite technological advances, portable projectors often struggle to achieve high-quality image projection in well-lit environments. The trade-off between portability and brightness continues to be a challenge, especially for classroom and corporate settings requiring clear visuals. Manufacturers must invest in more efficient optics, higher-powered light sources, or specialized screens to overcome these constraints.

What are the key opportunities in the portable projector market?

Education and Hybrid Learning Solutions

Portable projectors provide flexible solutions for classrooms, enabling multi-classroom sharing and interactive content delivery. Bundled offerings, including warranty, training, and educational software, present new revenue streams. Governments' funding of digital classroom initiatives offers procurement channels that can secure large-volume orders, creating opportunities for market expansion.

Outdoor Entertainment and Event Applications

The growth of outdoor movie nights, pop-up cinemas, and event-based projection creates high-margin opportunities for portable projectors with durable, battery-powered designs. Partnerships with content providers and bundled accessory packages can increase revenue per unit and encourage repeat purchases. Export demand from regions with a growing outdoor leisure culture further amplifies the market potential.

Smart-Home and Streaming Ecosystem Integration

Integrating projectors into smart-home ecosystems presents opportunities to capture software and service revenue. Devices with embedded apps, voice assistants, and firmware update channels offer differentiation in competitive markets. Premium units with AI-based image enhancement and auto-adjust features enable higher pricing and enhance consumer loyalty.

Product Type Insights

Mini and handheld projectors dominate the market due to their balance of portability, performance, and price, accounting for approximately 40% of the 2024 market. LED projectors lead technology adoption, representing around 55% of the global market, driven by energy efficiency and low maintenance. High-lumen entry-level devices (300–800 ANSI lumen) are popular for home and office applications, while 1080p resolution units remain the most widely adopted, offering full HD performance at mid-tier prices. Premium laser-based units are capturing a smaller but growing niche for high-brightness outdoor and corporate applications.

Application Insights

Home entertainment is the largest application, accounting for nearly 45% of market revenue, driven by streaming, gaming, and outdoor leisure. Educational applications are the fastest-growing institutional segment, with portable projectors enabling interactive learning and hybrid classroom setups. Corporate and SMB usage is steady, primarily for mobile presentations. Emerging applications include gaming and esports, healthcare simulation, and automotive infotainment, which are expected to contribute to incremental growth.

Distribution Channel Insights

E-commerce dominates sales, enabling consumers to compare features, access reviews, and purchase conveniently. Specialized electronics retail chains and enterprise/B2B direct contracts account for significant portions of the market, particularly for mid-range and premium devices. Value-added resellers and system integrators also serve niche institutional and corporate clients. Online channels continue to accelerate adoption for emerging brands, particularly in APAC and North America.

End-User Insights

Consumers, particularly in the home entertainment segment, represent the largest end-use market. Educational institutions are rapidly increasing adoption, supported by government funding and digital classroom initiatives. Corporate users and event managers maintain a steady demand for portable solutions. Emerging end-use sectors include outdoor events, hospitality, gaming, and healthcare simulations, which provide opportunities for diversified growth. Export-driven demand from APAC manufacturers to North America and Europe further supports market expansion.

| Projection Technology | Portability Form | Feature Set |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for 30% of the 2024 market, driven by high consumer spending, outdoor entertainment adoption, and corporate usage. The U.S. and Canada lead in demand for mid-tier and premium portable projectors, supported by strong e-commerce channels and high ASPs.

Europe

Europe demonstrates steady growth with a focus on home entertainment and corporate applications. Countries like Germany, the U.K., and France are adopting eco-friendly and smart OS-enabled devices, with a growing interest in outdoor and experiential entertainment applications.

Asia-Pacific

APAC represents the fastest-growing region (36% of 2024 revenue), led by China, India, Japan, and Southeast Asia. Rapid urbanization, rising disposable income, government digitalization initiatives, and strong e-commerce penetration drive both domestic and export demand. India exhibits the highest CAGR among countries due to digital education programs and the increasing adoption of affordable consumer devices.

Latin America

Latin America is gradually expanding, with Brazil, Mexico, and Argentina leading consumer adoption. The market is driven by mid-range devices and growing interest in education and outdoor entertainment, though pricing sensitivity remains a factor.

Middle East & Africa

MEA has a smaller but emerging demand, focused on rental, outdoor, and institutional applications. The GCC countries demonstrate strong potential due to high-income populations and luxury preferences, while intra-African demand is growing through regional education and corporate deployments.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Projector Market

- Epson

- Sony

- BenQ

- ViewSonic

- Optoma

- LG Electronics

- Acer

- ASUS

- Anker Innovations (Nebula)

- Xiaomi

- Panasonic

- NEC Corporation

- Philips

- Hisense

- Kodak

Recent Developments

- In May 2025, Epson launched a series of portable laser projectors with enhanced brightness and smart OS integration, targeting educational institutions and home entertainment.

- In April 2025, Anker Innovations (Nebula) expanded its mini-projector lineup with improved battery life and wireless streaming capabilities, reinforcing its e-commerce leadership.

- In February 2025, Sony introduced compact 1080p and 4K portable projectors with AI upscaling and auto-focus features, aimed at premium home and corporate users.