Portable Power Station Market Size

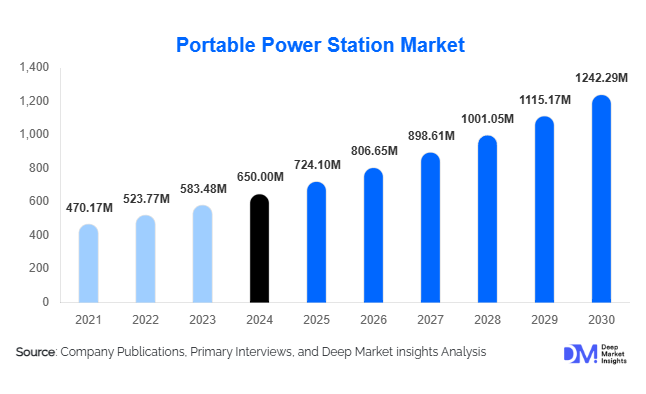

According to Deep Market Insights, the global portable power station market size was valued at USD 650.00 million in 2024 and is projected to grow from USD 724.10 million in 2025 to reach USD 1,242.29 million by 2030, expanding at a CAGR of 11.4% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for off-grid energy solutions, increasing adoption of renewable energy integration, and technological advancements in battery storage systems.

Key Market Insights

- Lithium-ion battery-based portable power stations dominate the market, offering high energy density, longer lifecycle, and compatibility with renewable energy sources, accounting for approximately 60% of global demand in 2024.

- Residential applications lead adoption, with consumers increasingly relying on portable power stations for backup power during outages and integration with solar systems.

- Online retail is the primary distribution channel, with 45% of global sales driven by e-commerce platforms and direct-to-consumer websites.

- Asia-Pacific is the fastest-growing region, led by China, India, and Japan, driven by rapid urbanization, industrial expansion, and government renewable energy initiatives.

- North America and Europe collectively account for 60% of the 2024 market, with high purchasing power, technological adoption, and government support for sustainable energy solutions.

- Technological integration, such as smart battery management systems, IoT connectivity, and solar compatibility, is reshaping product offerings and enhancing consumer convenience.

What are the latest trends in the portable power station market?

Renewable Energy Integration

Portable power stations are increasingly being integrated with renewable energy sources such as solar and wind, enabling off-grid solutions for residential, commercial, and industrial applications. Hybrid solar-powered systems are gaining traction, allowing consumers and businesses to reduce dependency on traditional grid electricity and diesel generators. This trend is particularly significant in regions with unreliable power supply and in remote locations where conventional energy access is limited.

Technological Advancements

Recent developments in lithium-ion and lithium iron phosphate (LiFePO4) batteries have enhanced energy density, charging speed, and overall durability of portable power stations. Companies are also introducing smart features, including app-controlled monitoring, real-time performance tracking, and automated load management, providing convenience and safety for end-users. These innovations are driving premium adoption while encouraging manufacturers to differentiate through advanced technology and modular designs.

What are the key drivers in the portable power station market?

Rising Demand for Off-Grid Energy Solutions

With power outages, increasing remote work, and outdoor recreational activities on the rise, both residential and commercial consumers require reliable portable energy. This demand is propelling growth, especially in areas with inconsistent grid infrastructure or regions prone to natural disasters.

Environmental Regulations and Sustainability Initiatives

Government incentives for renewable energy adoption, subsidies for clean energy solutions, and growing environmental awareness are favoring battery-based portable power stations over traditional generators. This has encouraged both consumers and businesses to adopt eco-friendly alternatives, supporting long-term market expansion.

Technological Improvements in Battery Systems

Advancements in battery chemistry, including LiFePO4 and high-capacity lithium-ion variants, provide longer lifecycles, better safety, and enhanced portability. These innovations have expanded the usability of portable power stations in industrial, commercial, and recreational contexts.

What are the restraints for the global market?

High Initial Cost

While operational costs are lower than traditional generators, the upfront price of high-capacity lithium-ion portable power stations remains a barrier for cost-sensitive consumers, limiting widespread adoption, particularly in emerging markets.

Limited Market Awareness

In certain regions, potential customers are unaware of the benefits and capabilities of portable power stations, which restricts market penetration. Companies need to invest in education, marketing, and awareness programs to overcome this challenge.

What are the key opportunities in the portable power station market?

Integration with Renewable Energy Systems

There is significant potential to integrate portable power stations with solar and wind energy sources. Hybrid systems enable off-grid residential, commercial, and outdoor applications, enhancing sustainability and reducing energy costs. This opportunity is particularly relevant in regions with inconsistent electricity supply or growing renewable energy adoption.

Emerging Market Expansion

Rapid urbanization and industrialization in Asia-Pacific, Latin America, and parts of Africa are driving demand for portable power stations. Government initiatives promoting electrification and renewable energy adoption present new revenue streams for both existing players and new entrants targeting these untapped markets.

Smart Technology Adoption

Smart battery management systems, IoT-enabled monitoring, and app-controlled operations are transforming the market. Companies can leverage these technological innovations to differentiate products, increase user engagement, and capture premium pricing, creating additional growth opportunities.

Product Type Insights

Lithium-ion battery-based portable power stations dominate the market, holding approximately 60% of the global market share in 2024 due to higher energy density and longer lifespan compared to lead-acid and other battery types. Lead-acid units remain relevant for cost-sensitive applications, while LiFePO4 systems are gaining traction in high-capacity industrial and emergency use cases.

Application Insights

Residential applications are the largest market segment (40% of global demand) as consumers adopt portable power stations for backup electricity, emergency power, and integration with solar systems. Commercial and industrial applications are growing steadily, including use in small businesses, telecom infrastructure, and construction sites. Outdoor and recreational use, such as camping, RVs, and boating, also contributes significantly to market growth.

Distribution Channel Insights

Online retail channels dominate (45% of global sales), including e-commerce platforms and direct-to-consumer websites, due to convenience, product comparison options, and transparent pricing. Offline retail and B2B direct sales also contribute, particularly in regions where industrial adoption is prominent. Digital marketing and social media are increasingly influencing purchasing decisions, especially among younger consumers.

End-Use Insights

Consumer electronics represent the largest end-use segment (30% of the market) due to increasing reliance on portable devices requiring uninterrupted power. Industrial and commercial adoption is expanding in sectors such as healthcare, telecom, and emergency services. Emerging applications include off-grid renewable energy projects and disaster response systems, further supporting market growth.

| Capacity Segment | Output Type | Use Case |

|---|---|---|

|

|

|

Regional Insights

North America

North America leads the market with 35% of global demand in 2024, driven by high disposable income, advanced energy infrastructure, and increasing adoption of renewable-integrated power solutions. The U.S. and Canada are the primary contributors, focusing on residential backup, outdoor recreation, and industrial applications.

Europe

Europe accounts for 25% of the 2024 market, with Germany, France, and the U.K. driving adoption. Regulatory support for clean energy, high technology penetration, and consumer awareness are key factors supporting market growth. Renewable-integrated portable power stations are gaining popularity for both residential and commercial use.

Asia-Pacific

Asia-Pacific is the fastest-growing region (10% CAGR), led by China, India, and Japan. Urbanization, industrial expansion, and government initiatives like “Made in China 2025” and solar electrification projects are fueling demand for portable power stations. Rising middle-class incomes are also contributing to increased adoption for residential and recreational purposes.

Latin America

Brazil and Mexico are leading markets in Latin America, driven by off-grid rural electrification and growing interest in outdoor recreation. While adoption is still emerging, targeted initiatives and awareness campaigns are expected to increase market penetration.

Middle East & Africa

Countries such as the UAE, Saudi Arabia, and South Africa are seeing growing adoption due to industrial applications, high-income populations, and investments in renewable energy projects. Africa remains a critical region for off-grid and emergency power applications.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Power Station Market

- Goal Zero

- Jackery

- EcoFlow

- Bluetti

- Anker

- Suaoki

- Renogy

- Rockpals

- AIMTOM

- MAXOAK

- ALLPOWERS

- Paxcess

- FlashFish

- PointZero Energy

- ElecHive

Recent Developments

- In March 2025, Jackery launched a high-capacity LiFePO4 portable power station series, targeting industrial and emergency backup applications.

- In April 2025, EcoFlow expanded its solar-integrated portable power stations, enhancing off-grid capabilities for residential and recreational use.

- In June 2025, Goal Zero introduced smart IoT-enabled monitoring features across its product line, improving energy management and user convenience.