Portable Monitor Market Size

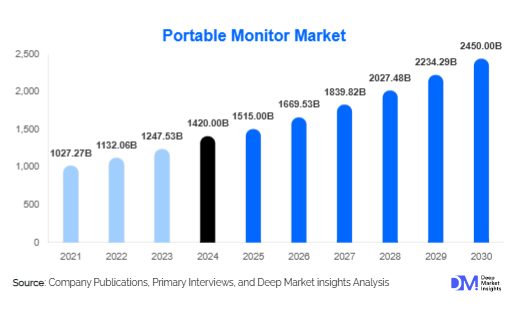

According to Deep Market Insights, the global portable monitor market size was valued at USD 1,420 million in 2024 and is projected to grow from USD 1,515 million in 2025 to reach USD 2,450 million by 2030, expanding at a CAGR of 10.2% during the forecast period (2025-2030). The portable monitor market growth is primarily driven by increasing adoption of remote work setups, rising demand for multi-screen productivity solutions, and the growing popularity of lightweight, high-resolution displays among professionals, gamers, and students globally.

Key Market Insights

- Demand for portable monitors is accelerating among remote workers and digital nomads, with lightweight and USB-C powered models enabling seamless multi-device connectivity.

- High-resolution and touchscreen monitors are gaining traction, particularly in the creative and gaming segments, where display quality and responsiveness are critical.

- North America dominates the portable monitor market, fueled by strong IT infrastructure, early adoption of remote work technologies, and corporate demand for portable productivity solutions.

- Asia-Pacific is the fastest-growing region, driven by increasing exports from China, rising middle-class tech adoption in India, and growing consumer electronics penetration in Southeast Asia.

- Integration of AI, USB-C connectivity, and OLED display technology is redefining product offerings and creating differentiation opportunities for manufacturers globally.

What are the latest trends in the portable monitor market?

Ultra-Lightweight and USB-C Connectivity

Portable monitors are increasingly designed to be lightweight and powered via USB-C, making them ideal for mobile professionals and students. USB-C connectivity not only reduces cable clutter but also enables simultaneous data transfer and charging, enhancing user convenience. Manufacturers are innovating with foldable, flexible, and slim-profile designs, which cater to remote work setups, co-working spaces, and on-the-go computing. This trend is rapidly being adopted by both professional and gaming segments, with consumers favoring compact displays that do not compromise on resolution or refresh rate.

High-Resolution and Touchscreen Adoption

There is growing demand for portable monitors with 4K resolution and touchscreen functionality. Creative professionals, such as graphic designers and video editors, are driving adoption, while gamers seek fast refresh rates combined with high visual fidelity. Touchscreen monitors also support hybrid work models, enabling interactive presentations and flexible collaboration. The incorporation of anti-glare and HDR support is further improving usability in diverse environments, increasing appeal across office, education, and gaming applications.

What are the key drivers in the portable monitor market?

Rise of Remote Work and Hybrid Learning

The COVID-19 pandemic accelerated remote work and hybrid learning, driving demand for secondary portable monitors. Professionals and students require additional screen real estate for multitasking, video conferencing, and content creation. Corporations are increasingly providing portable monitors to employees, while universities are integrating multi-screen setups to facilitate online learning. This structural shift in work and education environments is a primary driver for long-term growth.

Gaming and Content Creation Expansion

Portable monitors are increasingly used by gamers, streamers, and content creators seeking immersive experiences and flexible setups. High refresh rates, low response times, and vivid color reproduction are key purchase drivers. As the gaming industry continues to expand globally, particularly in APAC and North America, portable monitors optimized for gameplay and streaming are witnessing sustained adoption. This segment is also encouraging manufacturers to invest in specialized features like RGB lighting, adaptive sync, and ultra-thin bezels.

Technological Advancements and Miniaturization

Rapid advancements in display technology, including OLED, mini-LED, and high-refresh panels, are enabling more compact and efficient monitors. Integration of AI-based color calibration, USB-C hubs, and wireless display features is enhancing user experience. Consumers now prefer portable monitors that combine lightweight design with professional-grade performance, encouraging product innovation and premium pricing.

Restraints

High Cost of Premium Models

While entry-level portable monitors are affordable, high-resolution, high-refresh rate models remain expensive, limiting adoption in price-sensitive markets. Consumers may delay purchases or opt for traditional, larger monitors, especially in emerging regions, slowing market penetration of premium products.

Limited Awareness in Emerging Markets

Despite growing awareness, portable monitors are still considered niche in regions such as Africa and parts of LATAM. Lack of local retail presence, limited marketing, and lower familiarity with use cases restrict growth. Companies need to educate potential buyers and expand distribution channels to overcome this barrier.

What are the key opportunities in the portable monitor market?

Corporate and Enterprise Adoption

Enterprises are increasingly adopting portable monitors to enhance productivity in hybrid work environments. Portable monitors allow employees to extend their laptop displays and manage multiple workflows efficiently. Large-scale corporate adoption, combined with bulk procurement programs, presents a high-value opportunity for manufacturers to secure long-term contracts and recurring revenue streams.

Integration with Gaming Ecosystems

The gaming industry offers substantial growth potential. Portable monitors compatible with consoles, cloud gaming platforms, and high-refresh-rate gaming PCs allow manufacturers to differentiate offerings. Bundling accessories such as stands, cases, and RGB customization features enhances product appeal. Gaming cafes and esports tournaments are emerging as additional adoption channels, further driving demand.

Emerging Markets and Regional Expansion

Regions like India, Southeast Asia, and Latin America are witnessing rising digital adoption and remote work trends. These markets offer untapped potential for portable monitor penetration. Manufacturers focusing on affordable, mid-range models with strong after-sales support and local distribution networks can capture new consumer segments. Coupled with government incentives for digital infrastructure and education, these markets are likely to grow faster than mature markets.

Product Type Insights

USB-C powered portable monitors dominate the market, representing 42% of global demand in 2024. Their convenience for mobile professionals and compatibility with multiple devices make them a preferred choice. Full HD displays with touch functionality are gaining traction in the creative segment, accounting for 25% of the market. Gaming-focused monitors with high-refresh rates and low latency contribute 18% of global sales, reflecting rising esports and gaming adoption. Lightweight and foldable monitors are emerging as niche products, particularly in the APAC region, catering to travelers and remote workers seeking portability without performance compromise.

Application Insights

Professional applications dominate demand, driven by remote work, graphic design, software development, and trading. Gaming and esports applications are expanding rapidly, particularly among young adults and students, emphasizing high-refresh displays. Educational applications, including online learning and collaborative projects, are increasingly adopting portable monitors. Emerging applications include mobile content creation, telemedicine, and fieldwork setups, where portability and dual-screen functionality enhance efficiency.

Distribution Channel Insights

Online channels dominate portable monitor sales, accounting for over 55% of global sales in 2024. E-commerce platforms enable easy comparison, real-time pricing, and rapid delivery. Traditional retail and consumer electronics stores remain relevant for premium products requiring demonstration. Corporate bulk procurement is an emerging distribution channel, with manufacturers offering direct-to-enterprise sales. Subscription models and leasing options are being piloted in APAC, targeting SMEs and educational institutions seeking cost-efficient multi-monitor solutions.

Traveler Type Insights

While “traveler type” is not directly applicable, end-users can be classified as professionals (largest segment), students (fastest-growing), and gamers/content creators (high-value niche). Professionals demand high portability and multi-device compatibility, students favor affordable and lightweight options, and gamers prioritize high-refresh rate, low-latency displays. Adoption trends indicate students and gamers will drive incremental growth, while professional users sustain volume and revenue share.

Age Group Insights

Users aged 25-40 years account for the largest share of portable monitor demand, balancing disposable income with tech-savviness. The 18-24 segment is growing rapidly due to remote education, gaming, and freelancing. Older demographics (41-60) adopt monitors primarily for work-from-home setups, trading, and professional tasks. Youth and millennial segments are driving the adoption of gaming-focused and foldable monitor formats, while professional users remain loyal to reliable USB-C and touchscreen models.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds 35% of the global portable monitor market in 2024. Strong IT infrastructure, widespread remote work adoption, and high disposable incomes are driving demand in the U.S. and Canada. Corporate procurement programs, coupled with high consumer awareness, support consistent growth. The region is a leader in premium and gaming-focused monitors, with a focus on ergonomics, portability, and high-performance specifications.

Europe

Europe accounts for 28% of the 2024 market. The U.K., Germany, and France are key contributors due to early adoption of hybrid work models, growing e-learning infrastructure, and active gaming communities. Sustainability-conscious consumers are increasingly seeking energy-efficient and lightweight portable monitors. The region exhibits steady growth with emphasis on premium and creative-focused models.

Asia-Pacific

APAC is the fastest-growing region, particularly in China, India, and Japan. Rising exports from China, increasing middle-class tech adoption, and remote work trends drive demand. Growth is expected at a CAGR of 12% during 2025-2030. India and Southeast Asia show emerging demand for affordable, mid-range monitors, while Japan and South Korea prioritize high-end, gaming, and creative solutions.

Latin America

Latin America is an emerging market, with Brazil and Mexico leading adoption. Growth is supported by increasing remote work, digital education, and gaming culture. However, penetration is limited by price sensitivity and supply chain constraints.

Middle East & Africa

Demand is concentrated in the UAE, Saudi Arabia, and South Africa. Corporate adoption, high-income consumers, and rising gaming and creative sectors support growth. Intra-region trade and government initiatives for digital education are further boosting adoption. Africa represents an untapped market for portable monitors, with growth driven by mobile and remote workforce solutions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Monitor Market

- ASUS

- Lenovo

- AOC

- HP

- Samsung

- Dell

- LG

- ViewSonic

- GeChic

- UPERFECT

- Elecrow

- SideTrak

- InnoView

- EVICIV

- WIMAXIT

Recent Developments

- In March 2025, ASUS launched a new 17-inch foldable portable monitor with a 120Hz refresh rate, targeting professional and gaming segments.

- In January 2025, Lenovo introduced a touchscreen portable monitor compatible with USB-C and HDMI, aimed at hybrid learning and creative professionals.

- In February 2025, LG expanded its ultra-thin OLED portable monitor lineup for gaming and high-end content creation applications.