Portable Media Players Market Size

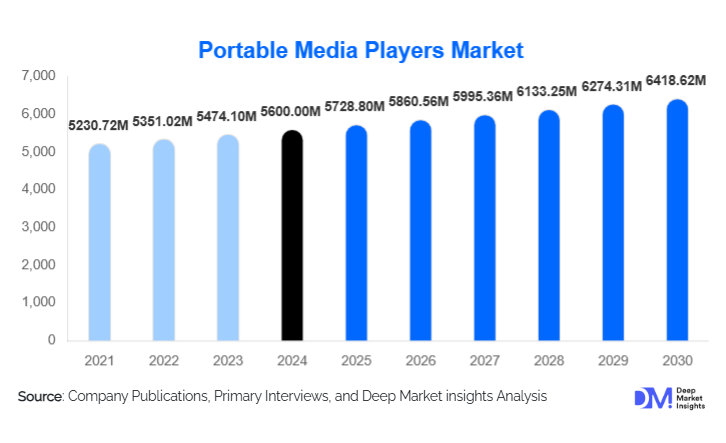

According to Deep Market Insights, the global portable media players market size was valued at USD 5,600.00 million in 2024 and is projected to grow from USD 5,728.80 million in 2025 to reach USD 6,418.62 million by 2030, expanding at a CAGR of 2.3% during the forecast period (2025–2030). This growth is underpinned by rising consumer demand for high-fidelity audio, enhanced storage and connectivity options, and the persistent appeal of dedicated audio devices in specialized use-cases.

Key Market Insights

- Audio-only players dominate the market, accounting for over half of the global portable media player revenue, driven by steady demand from music listeners and audiophiles.

- Flash-based storage remains the preferred technology, thanks to its energy efficiency, compactness, and growing capacity.

- Offline / brick-and-mortar retail channels still lead distribution, making up more than 75% of sales in some regions, although e-commerce is gaining ground.

- Household / personal use continues to drive most demand, but niche verticals like fitness, automotive, and professional audio are rising in significance.

- North America retains a large share of the market, while Asia-Pacific is emerging as the fastest-growing region owing to rising incomes and increasing adoption.

- Premium and high-resolution players are gaining traction, as more consumers value Hi-Res audio, better DACs, and high-capacity storage.

What Are the Latest Trends in the Portable Media Players Market?

Premium Hi-Res Audio & DAC Innovation

Manufacturers are increasingly focusing on high-resolution audio capabilities, integrating advanced digital-to-analog converters (DACs), and providing support for lossless audio formats (e.g., FLAC, MQA). This trend appeals to audiophiles and committed music lovers who demand superior sound quality. These devices often feature high-capacity flash storage so that users can carry large libraries of high-bitrate tracks. Moreover, the upgrade in battery technology ensures extended playback time even when driving power-hungry components.

Connected & Specialized Use Devices

Portable media players are no longer just simple MP3 players; many now support Bluetooth, Wi-Fi, or even networked streaming, turning them into more versatile media hubs. At the same time, use-case-specific devices are gaining popularity: rugged PMPs for sports and outdoor use, dedicated players for automotive infotainment systems, and fitness-integrated devices that pair with exercise apps. These specialized profiles are helping manufacturers differentiate their products and tap into new end-user segments.

Regional Expansion & Local Manufacturing

Emerging markets are driving new growth in the PMP space. Countries in the Asia-Pacific, notably India and China, are seeing rising demand for both budget and premium media players. To cater to this, companies are localizing manufacturing (leveraging “Make in India”–style policies), optimizing cost structures, and tailoring device features to regional preferences (e.g., regional music support). This diversification helps global PMP makers reduce dependency on saturated mature markets.

What Are the Key Drivers in the Portable Media Players Market?

Consumption of On-the-Go High-Quality Audio

The increasing appetite for portable, high-quality music playback, especially high-resolution audio, is a primary growth driver. Consumers want devices that can handle large, high-bitrate audio files, and dedicated PMPs provide better signal chain quality than many smartphones, making them attractive for audiophiles.

Advances in Storage & Power Efficiency

As flash memory becomes more affordable and capacious, portable media players can store more content without bulk or energy drain. Combined with improvements in battery technology, this enables devices to deliver long playback times. Additionally, features like Wi-Fi and Bluetooth are now more power-efficient, enabling connected players without severely compromising battery life.

Niche Use-Cases & Device Differentiation

The rise of specialized applications, fitness routines, rugged outdoor usage, in-car entertainment, and professional audio is pushing manufacturers to innovate. Devices tailored for these use-cases (e.g., sweat-resistant, rugged, high-storage) justify their existence even in a world dominated by smartphones, and support the incremental growth of PMPs.

What Are the Restraints for the Global Market?

Smartphone Cannibalization

The most significant challenge to PMP growth is that many consumers feel their smartphones are “good enough” for music and video. This overlap reduces the mass-market appeal of standalone players, especially in entry-level categories. As a result, many users do not see the need to carry an additional device just for media playback.

High Cost of Premium Components

High-end PMPs often require expensive DACs, high-capacity flash memory, and robust batteries, which significantly increase production costs. These costs are passed on to consumers, limiting adoption in price-sensitive markets. The premium nature of such devices means that only a relatively small niche can afford them, thus constraining volume growth.

What Are the Key Opportunities in the Portable Media Players Industry?

Growth in Premium and Audiophile Segment

There is a growing base of discerning users, audiophiles, and music purists who are willing to pay a premium for devices that deliver superior audio performance. By focusing R&D and marketing on high-fidelity DACs, high-performance storage, and lossless formats, manufacturers can capture this lucrative segment. These premium PMPs often command better margins and create strong brand loyalty.

Expansion into Specialized Vertical Use-Cases

Players can develop devices optimized for fitness enthusiasts (durable, sweatproof, lightweight), rugged outdoor adventurers (shock-resistant, long battery), and automotive users (in-car playlist capabilities, integration with infotainment). By addressing these verticals, companies can tap into specialized demand beyond traditional personal listening, differentiating themselves from smartphones.

Emerging Market Penetration & Local Manufacturing

Emerging economies such as India and Southeast Asian nations offer untapped potential. Companies can introduce tiered PMP lines from affordable to premium, suited to local income levels and preferences. By building or partnering for local production, firms can reduce costs, navigate import duties, and respond faster to regional trends. This also aligns with government initiatives promoting domestic manufacturing, enhancing competitiveness.

Product Type Insights

High-resolution audio portable media players dominate the market, catering to audiophiles and music enthusiasts seeking superior sound quality, lossless format support, and large storage capacity. These devices often include advanced DACs, high-capacity flash memory, and long-lasting batteries to enable uninterrupted high-fidelity playback. Mid-range players appeal to mainstream consumers who want reliable performance at an affordable price, often providing a balance between audio quality, connectivity features, and battery life. Budget players, typically targeting students and casual listeners, are gaining traction through portable, lightweight designs and simplified user interfaces. Specialized devices such as rugged or fitness-oriented PMPs are also emerging, offering water resistance, durability, and integration with workout apps, expanding the accessibility of PMPs beyond traditional audio use.

Application Insights

Personal music consumption remains the largest application of portable media players, accounting for the majority of market demand, as consumers increasingly prefer dedicated devices for offline listening, lossless audio, and extended battery life. Fitness and sports applications are growing rapidly, driven by demand for devices optimized for workouts, running, and outdoor activities. Professional and audiophile applications, including studio monitoring, sound engineering, and high-end audio playback, are also significant, fueled by the need for superior audio fidelity and specialized features. Emerging use cases include integration into automotive infotainment systems and educational or language-learning applications, further broadening the market scope.

Distribution Channel Insights

Offline retail channels, including electronics stores and specialty audio shops, remain the dominant distribution route for portable media players, offering customers the ability to test devices before purchase and receive expert guidance. Online platforms, including e-commerce marketplaces and direct-to-consumer (D2C) websites, are rapidly gaining traction due to convenience, competitive pricing, and broader product selection. Specialist retailers focusing on high-end or niche PMPs continue to thrive, catering to audiophiles and professional users. Subscription-based sales, bundles with headphones, and limited-edition device launches are emerging as innovative engagement strategies. Social media marketing, influencer reviews, and community-driven platforms are increasingly shaping consumer preferences, particularly among younger and tech-savvy demographics.

Traveler Type Insights

Individual users account for the largest share of portable media player consumption, drawn by personal audio experiences, portability, and offline music access. Group-oriented usage, such as fitness classes, shared playlists, or educational settings, also drives demand for mid-range devices. Professional users and audiophiles represent a high-value segment, prioritizing premium devices with superior audio fidelity, robust storage, and advanced features. Students and younger demographics gravitate toward budget and mid-tier devices, valuing portability, ease of use, and affordability. Families adopting PMPs for shared entertainment or children's educational content represent a growing niche, often favoring devices with parental controls and robust durability.

Age Group Insights

Consumers aged 25–45 years represent the largest segment for portable media players, combining disposable income with a preference for premium, experience-driven audio devices. The 18–24 age group drives growth in budget and entry-level devices, leveraging online platforms, social media, and portable designs suitable for daily commutes and fitness activities. Adults aged 46–60 are significant adopters of mid-range to premium PMPs, prioritizing high-quality playback, ease of use, and reliable battery life. Users above 60 years, while smaller in volume, form a niche for devices that offer simplicity, ergonomic design, and high audio clarity, often used for personal music enjoyment, language learning, or therapeutic audio applications.

| By Product Type | By Application | By Distribution Channel | By End-User / Traveler Type | By Age Group |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America is the largest region in the PMP market, holding roughly 30–31% of global revenue in 2024. The U.S. leads demand, with many consumers preferring premium players for high-fidelity audio listening, offline content storage, or specialized use. A well-developed electronics retail infrastructure, a vibrant audiophile community, and high disposable income underpin this market dominance.

Asia-Pacific (APAC)

The Asia-Pacific region is projected to be the fastest-growing, with an estimated CAGR above 4% through 2030. Key countries include China, where rising incomes and tech-savvy consumers drive PMP adoption, and India, where local manufacturing and “make in country” initiatives are fueling growth. Japan and South Korea also show robust demand, particularly for high-performance and premium PMPs. This regional momentum is fueled by increasing digital media consumption, a growing middle class, and strong e-commerce penetration.

Europe

Europe represents a mature, stable market for PMPs. Countries such as Germany, the UK, and France have a steady demand base for both mid-range and audiophile devices. Consumers in Europe often emphasize build quality, brand heritage, and sound fidelity, contributing to consistent sales of premium audio players. Offline retailers and specialist audio stores remain important distribution channels.

Latin America (LATAM)

In Latin America, key markets include Brazil and Mexico, where portable media players are primarily imported. Demand is rising for budget-to mid-tier models, driven by younger consumers and expanding digital media usage. Payment infrastructure, e-commerce growth, and rising digital content consumption support this upward trend, though price sensitivity remains a significant factor.

Middle East & Africa (MEA)

In the Middle East, countries such as the UAE, Saudi Arabia, and Qatar show increasing interest in premium consumer electronics, including PMPs, due to high disposable incomes and lifestyle-driven consumption. In Africa, urban centers (e.g., South Africa, Nigeria) are seeing gradual adoption, though price sensitivity and import dependence are challenges. Offline retail is still dominant, but e-commerce is gradually influencing buying behavior.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Media Players Market

- Sony Corporation

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Creative Technology Ltd.

- Koninklijke Philips N.V.

- Western Digital Corporation

- Archos

- Microsoft Corporation

- Astell & Kern

- Cowon

- SanDisk

- iRiver

- Transcend

- JBL (Harman/Kardon)

- Roku

Recent Developments

- In late 2024, leading PMP manufacturers introduced new high-resolution DAC-based players with greater than 256 GB of internal flash storage, targeting audiophiles wanting lossless and MQA playback.

- Throughout 2025, brands have launched rugged PMPs tailored for fitness and outdoor use, featuring IP-rated durability, long battery life, and integrated Bluetooth for gym and running use cases.

- Several companies are expanding their manufacturing footprints to Asia-Pacific (especially India), leveraging favorable government policies and lower costs to produce both entry-level and premium portable media players locally.