Portable Kitchen Filter Jug Market Size

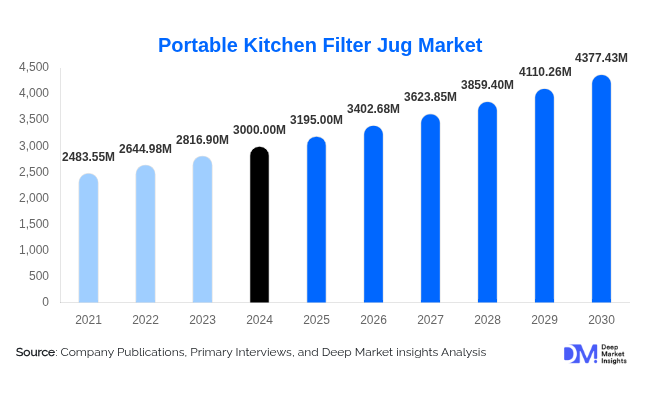

According to Deep Market Insights, the global portable kitchen filter jug market size was valued at USD 3,000 million in 2024 and is projected to grow from USD 3,195 million in 2025 to reach USD 4,377.43 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market’s growth is driven by rising global awareness of drinking water quality, increasing consumer preference for sustainable alternatives to bottled water, and expanding e-commerce access across developing regions.

Key Market Insights

- Activated carbon filter jugs dominate the market, accounting for about 50% of global revenue in 2024 due to their cost-effectiveness and reliable performance in removing chlorine and improving taste.

- Residential households represent nearly 70% of global demand, driven by increasing health consciousness and compact living trends in urban regions.

- Asia-Pacific is the fastest-growing region, expected to expand at over 7% CAGR through 2030, fueled by rapid urbanization and rising disposable incomes in China and India.

- Online distribution channels are growing rapidly, holding approximately 35% of total sales in 2024, supported by the convenience of digital purchasing and cartridge subscription models.

- Manufacturers are investing in sustainability, developing recyclable materials, eco-friendly cartridges, and smart filter jugs with digital indicators to attract environmentally conscious consumers.

Latest Market Trends

Smart and Connected Filter Jugs

Manufacturers are integrating smart technologies such as digital filter-life indicators, Bluetooth connectivity, and app-based monitoring to enhance consumer convenience. These innovations allow users to track water quality, receive cartridge replacement reminders, and analyze consumption data. The adoption of IoT-enabled jugs is particularly popular in North America and Europe, where tech-savvy consumers are willing to pay premium prices for connected home devices. This trend is expected to create new opportunities for recurring revenue through smart cartridge subscription programs.

Sustainability and Eco-Friendly Designs

As global awareness of plastic waste grows, consumers are increasingly seeking sustainable alternatives to bottled water. Portable filter jugs made with BPA-free, recyclable, or biodegradable materials are gaining preference. Companies are introducing filter recycling programs and partnering with retailers to offer eco-credits for used cartridges. The emphasis on reducing single-use plastic aligns with regulatory efforts in the EU and North America to encourage reusable household solutions. Sustainable product lines are projected to grow faster than traditional plastic jugs over the next five years.

Portable Kitchen Filter Jug Market Drivers

Rising Health Awareness and Water Quality Concerns

Growing public awareness of contaminants such as heavy metals, chlorine by-products, and microplastics in municipal water supplies has boosted consumer demand for household filtration products. Portable jugs offer an affordable and accessible solution for daily drinking water purification, especially in urban homes. This shift toward proactive health management continues to be one of the strongest market drivers globally.

Expansion of E-Commerce and Direct-to-Consumer Channels

The rise of online marketplaces and brand-owned digital stores has revolutionized product availability. Consumers can easily compare filtration technologies, pricing, and user reviews, driving conversion rates for both mid-range and premium models. Subscription-based cartridge replacement services are emerging as a new growth lever, enhancing brand loyalty while ensuring consistent recurring revenue streams.

Shift Toward Sustainable, Reusable Alternatives to Bottled Water

Environmental concerns and the high cost of bottled water are motivating consumers to switch to portable filtration systems. Filter jugs help reduce single-use plastic consumption while offering cost savings over time. This alignment with sustainability goals and circular economy initiatives is encouraging government support and corporate CSR collaborations, fueling steady adoption across developed and emerging markets alike.

Market Restraints

Maintenance and Cartridge Replacement Costs

Recurring cartridge replacement costs can deter long-term usage among price-sensitive consumers. Although initial jug prices are relatively low, high-frequency replacements increase the total cost of ownership. This challenge is especially prominent in developing markets, where lower household income may slow replacement rates and reduce recurring revenue for manufacturers.

Competition from Alternative Filtration Systems

Portable jugs face strong competition from under-sink filters, faucet-mounted purifiers, and bottled water. These alternatives often boast higher purification capabilities or convenience. Additionally, inconsistent certification claims can lead to consumer skepticism regarding jug efficacy, making it crucial for manufacturers to maintain transparency and third-party validation.

Portable Kitchen Filter Jug Market Opportunities

Premiumization and Smart Product Expansion

Rising disposable incomes and increased willingness to invest in high-end home appliances present opportunities for premium product expansion. Smart jugs featuring connectivity, advanced filtration layers, and aesthetic designs can command higher margins. Manufacturers are exploring partnerships with tech companies to integrate IoT features and app-controlled maintenance systems, targeting urban and health-conscious consumers.

Emerging Market Penetration

Untapped demand in Asia-Pacific, Latin America, and Africa offers significant growth potential. In regions where municipal water quality is inconsistent, portable filter jugs provide an affordable and reliable solution. Localized marketing strategies, region-specific cartridge pricing, and collaborations with NGOs promoting clean water access can accelerate market penetration.

Sustainability and Circular Economy Initiatives

Consumers and regulators are prioritizing sustainability, prompting manufacturers to launch recyclable cartridges, biodegradable jug components, and carbon-neutral manufacturing. Establishing closed-loop recycling programs and green certifications not only enhances brand reputation but also opens eligibility for eco-incentives and procurement contracts in environmentally regulated markets.

Product Type Insights

Activated carbon filter jugs dominate the market, accounting for around 50% of total sales in 2024. They are cost-effective, widely available, and effective in improving water taste and odor. The hybrid and multi-stage filter jug segment is growing fastest, driven by increasing consumer interest in advanced purification that removes heavy metals and microplastics. Ceramic and ion-exchange resin jugs occupy smaller but stable shares, primarily used in regions with specific contaminant concerns, such as hard water.

Capacity Insights

Jugs with a capacity of 1–2 liters hold approximately 40% of the global market share in 2024, appealing to small families and single-person households. The 2–3 liter category is growing steadily as larger households and small offices seek greater convenience with fewer refills. Compact jugs under 1 liter are primarily adopted by travelers or individuals with minimal space, while jugs above 3 liters cater to niche commercial applications.

Distribution Channel Insights

Online retail dominates the distribution landscape with a roughly 35% share in 2024, driven by convenience, global reach, and promotional offers. E-commerce channels allow manufacturers to directly engage customers and promote cartridge replacement subscriptions. Supermarkets and hypermarkets continue to serve as vital touchpoints for mainstream consumers, while specialty kitchenware stores cater to premium buyers seeking personalized recommendations.

End-User Insights

The residential segment remains the cornerstone of demand, accounting for around 70% of the total market. Growing health awareness and the rise of small urban households are the main drivers. The commercial segment, comprising offices, cafés, and hospitality establishments, is gaining traction as businesses emphasize sustainability and employee wellness. Emerging use cases include travel accommodations and outdoor events, where portable filtration offers convenience and hygiene assurance.

| By Product Type | By Capacity | By Material | By Technology | By Distribution Channel | By End-Use |

|---|---|---|---|---|---|

|

|

|

|

|

|

Regional Insights

North America

North America represents around 25% of the global market share in 2024. The U.S. leads adoption due to strong consumer focus on health and sustainability. Manufacturers are introducing smart and premium jugs, while government policies promoting reusable water solutions further support growth.

Europe

Europe accounts for approximately 20% of the market, led by Germany, the U.K., and France. Stringent EU sustainability regulations and consumer eco-consciousness drive demand for recyclable and BPA-free designs. Premium and design-focused models are particularly popular in Western Europe.

Asia-Pacific

Asia-Pacific holds about 30% of the market and is the fastest-growing region globally. China and India drive expansion through growing urban populations, improved water-quality awareness, and rising disposable income. Local manufacturing and affordable pricing strategies are improving market accessibility.

Latin America

Latin America captures nearly 10% of the market share, led by Brazil and Mexico. Growth is supported by increasing retail penetration and government campaigns promoting safe drinking water. However, economic volatility can influence replacement-cycle frequency in this region.

Middle East & Africa

The region contributes roughly 5–10% of global revenue in 2024, with strong growth in GCC nations and South Africa. Increasing water scarcity awareness and investments in sustainable consumer goods are expanding demand, particularly for premium imported brands.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Kitchen Filter Jug Market

- Brita GmbH

- PUR (Helen of Troy Limited)

- ZeroWater

- BWT AG

- Aqua Optima

- Laica S.p.A.

- Philips Domestic Appliances

- Electrolux AB

- Midea Group

- Tata Swach

- Cuckoo Electronics

- Invigorated Water

- Kenwood Ltd.

- Aquagear

- Amazon Basics (Private Label)

Recent Developments

- In May 2025, Brita launched a new line of smart filter jugs equipped with digital sensors and Bluetooth connectivity to monitor filter performance in real time.

- In March 2025, BWT introduced a recyclable cartridge initiative across Europe as part of its sustainability strategy.

- In January 2025, PUR expanded its e-commerce partnerships in North America to offer auto-replenishment cartridge services via subscription models.