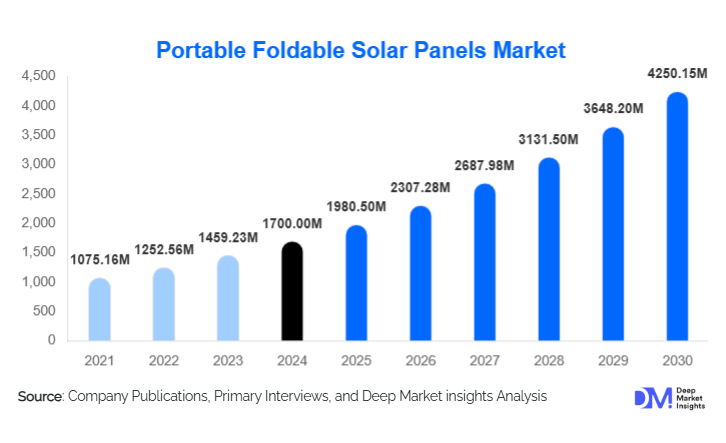

Portable Foldable Solar Panels Market Size

According to Deep Market Insights, the global portable foldable solar panels market size in 2024 is estimated at approximately USD 1,700 million, and it is expected to reach around USD 1,980.50 million in 2025. Over the forecast period (2025–2030), the market is projected to grow to about USD 4,250.15 million at a CAGR of 16.5%. This growth reflects strong demand from outdoor recreation, off-grid applications, and resilience/backup power use cases, supported by improvements in solar cell efficiency, declining costs, and rising awareness of portable renewable power solutions.

Key Market Insights

- Performance per weight is becoming a pivotal differentiator. Portable foldable panels that achieve high wattage output with minimal weight are commanding premium pricing.

- Bundled & integrated solutions are gaining traction, packages combining foldable solar panels with portable battery/power stations and smart monitoring are increasingly preferred by consumers for turnkey usability.

- North America retains dominance in the segment, driven by high outdoor recreation penetration, strong purchasing power, and established distribution channels.

- Asia-Pacific is the fastest-growing region, owing to large underserved rural and off-grid markets, along with expanding outdoor lifestyle adoption.

- Emerging applications in disaster preparedness and field operations are expanding addressable demand beyond just consumer recreation.

- Technological enhancements and ruggedization, waterproofing, durable hinges, and IoT connectivity are becoming decision criteria in buyer choices, especially in premium tiers.

Latest Market Trends

Rising Demand for Off-Grid Energy Solutions

Portable foldable solar panels are increasingly being adopted for off-grid applications, including camping, emergency backup, and remote industrial sites. The flexibility and portability of foldable designs make them ideal for users who need reliable energy without access to conventional power grids. Trends toward disaster preparedness and remote energy supply have further accelerated adoption, particularly in regions prone to natural disasters or limited electricity access.

Technological Advancements in Panel Efficiency

Monocrystalline and thin-film technologies are advancing, allowing higher energy output while reducing weight and improving portability. Manufacturers are integrating smart features such as mobile apps for monitoring, foldable designs with durable polymers, and solar panels that can charge multiple devices simultaneously. These innovations are attracting tech-savvy consumers and industrial users looking for efficient, reliable energy sources.

Market Drivers

Increasing Outdoor and Recreational Activities

The surge in outdoor tourism, camping, hiking, and boating is boosting demand for portable solar solutions. Consumers prefer lightweight, foldable panels for ease of transport and reliable device charging while off-grid. The trend is particularly strong in North America and Europe, where outdoor lifestyles are prominent.

Government Support and Renewable Energy Initiatives

Government incentives, subsidies, and policies promoting renewable energy are key growth drivers. Programs supporting rural electrification, emergency energy preparedness, and clean energy adoption create significant opportunities for market participants. Regional initiatives in APAC and Europe are particularly impactful, encouraging both residential and industrial adoption.

Environmental Awareness and Sustainable Energy Adoption

Increasing awareness of climate change and the need for sustainable energy solutions is driving consumers and businesses to adopt portable solar panels. Eco-conscious consumers prefer renewable energy options for outdoor recreation, residential backup, and industrial applications, expanding the market for high-efficiency and environmentally friendly solar solutions.

Market Restraints

High Initial Costs

Although portable foldable solar panels offer long-term benefits, the upfront cost, particularly for high-capacity monocrystalline panels, remains a barrier for price-sensitive markets. Consumers may hesitate to invest in premium panels despite potential energy savings and convenience.

Dependence on Weather Conditions

Solar panel performance is heavily dependent on sunlight availability. Cloudy, rainy, or low-light conditions reduce efficiency, which may limit adoption in certain geographies. Users in regions with variable weather may prefer hybrid or alternative energy solutions, constraining consistent market growth.

Market Opportunities

Expansion in Emerging Regions

APAC, Africa, and LATAM offer significant growth potential due to rising industrial, residential, and humanitarian demand. Rural electrification projects, disaster preparedness initiatives, and increasing outdoor activities are driving market adoption in these regions, creating opportunities for both new entrants and established players.

Technological Innovation and Smart Panels

Smart solar panels with IoT connectivity, high-capacity batteries, foldable thin-film materials, and multi-device charging features are creating new market segments. Companies that innovate in energy efficiency, portability, and usability can differentiate themselves and capture growing demand among tech-savvy consumers and industrial users.

Integration with Outdoor Lifestyle and Recreation

The growing outdoor tourism and recreational market provides a lucrative opportunity. Camping, RVing, boating, and hiking activities increasingly rely on portable solar panels, driving demand for durable, lightweight, and high-output designs. Combining solar solutions with outdoor gear and travel accessories can open cross-selling opportunities and enhance consumer adoption.

Product Type Insights

Monocrystalline portable foldable solar panels dominate the market due to higher efficiency and durability, representing 48% of the 2024 market. Polycrystalline panels offer a cost-effective option (30%), appealing to recreational users, while thin-film flexible panels (22%) are gaining popularity in lightweight, portable consumer electronics applications. Rising consumer preference for high-efficiency panels is reinforcing monocrystalline dominance.

Power Capacity Insights

The 51–100W segment leads globally, accounting for 35% of the 2024 market. This capacity is favored for outdoor activities and emergency applications as it balances portability with sufficient power output. Panels above 100W are increasingly used in industrial and commercial sectors, while small 50W panels are popular for personal electronic charging.

Application Insights

Recreational use remains the largest application (42%), driven by outdoor enthusiasts needing reliable off-grid energy. Emergency and backup applications are growing rapidly, especially in regions prone to natural disasters. Industrial applications, including remote construction sites and telecom operations, are also expanding. Consumer electronics charging is emerging as a niche but growing application.

Distribution Channel Insights

Online retail dominates (38% of the market), benefiting from convenience, global shipping, and a wide product range. Offline retail remains relevant for hands-on evaluation and immediate purchases. B2B channels are crucial for commercial and governmental procurement, particularly for disaster relief, industrial, and rural electrification projects.

| By Product Type | By Power Output | By Design Type | By End-Use Application | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America leads in 2024 with a 35–40% share, driven by the U.S. demand for portable power, outdoor recreation, RV culture, and high disposable incomes. Canada also contributes via remote communities and adventure travel markets. The region sees moderate but steady growth, fueled by upgrades, product refreshes, and increased adoption among nontraditional users (e.g., emergency kits, preparedness). The U.S. will remain the largest single-country market globally, with continued growth in residential, recreation, and resilience channels.

Europe

Europe accounts for 20–25% of the market in 2024. Countries such as Germany, the UK, France, and Scandinavian nations lead adoption via strong environmental consciousness, outdoor tourism, and favorable incentives. The growth is solid, but slightly lower than in Asia, constrained by higher average incomes but slower expansion of off-grid markets.

Asia-Pacific

Asia-Pacific has a 25–30% share in 2024 and is projected to be the fastest-growing region. India, China, Southeast Asia, and Australia drive growth. In India and Southeast Asia, rural/off-grid and disaster resilience needs create a growing base. In China, both domestic demand and export manufacturing scale help adoption. Australia and New Zealand lead in recreational take-up. This region’s CAGR is often projected above the global average.

Latin America

Latin America holds a smaller base (5–10%) but is growing. Brazil, Mexico, Colombia, and Argentina show rising usage in rural electrification, disaster relief, outdoor tourism, and small businesses. A lack of a stable grid in many areas gives foldables a natural role.

Middle East & Africa

MEA has a 5–10% share in 2024. In Africa, large off-grid populations, weak grid infrastructure, and humanitarian operations boost demand for portable solar. In the Middle East, high-income and infrastructure investment support premium foldables in desert, remote sites, and expedition use. Binding factors include import logistics, cost sensitivity, and local policy/regulation support. Overall, the Asia-Pacific is the fastest-growing region; India and China lead growth. North America remains the dominant region by absolute revenue.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable Foldable Solar Panels Market

- Jackery

- Bluetti

- EcoFlow

- Goal Zero

- Renogy

- Anker (in solar / energy accessories)

- ALLPOWERS

- Rockpals

- SolPro

- SunPower (in portable category)

- BioLite (solar Accessories)

- Voltaic Systems

- Powertraveller

- Suaoki

- RAVPower (or its successor brands)

Recent Developments

- In early 2025, Bluetti launched a new origami-style foldable solar kit with integrated controllers and IoT monitoring, enabling users to expand modularly.

- In mid-2025, EcoFlow announced a partnership to bundle its foldable panels with high-capacity portable battery systems in emerging markets to drive adoption in rural off-grid regions.

- In late 2024, Jackery introduced a premium foldable module with improved hinge durability and IP-rated sealing aimed at expedition and military customers.