Portable & Handheld TV Market Size

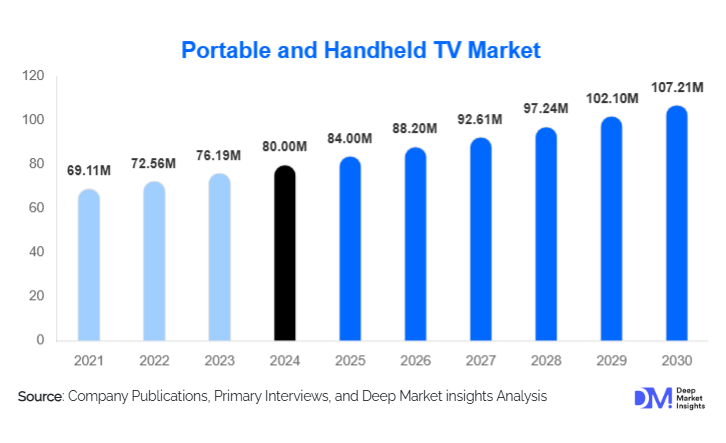

According to Deep Market Insights, the global portable & handheld TV market size was valued at USD 80 million in 2024 and is projected to grow from USD 84 million in 2025 to reach USD 107.21 million by 2030, expanding at a CAGR of 5.0% during the forecast period (2025–2030). Market growth is primarily driven by rising demand for on-the-go entertainment, technological advancements in lightweight display technologies, and expanding use cases across outdoor recreation, hospitality, and automotive sectors.

Key Market Insights

- LCD-based portable TVs dominate the global market, holding nearly 60% share in 2024, owing to cost-effectiveness and wide availability.

- Smart-connected handheld TVs are emerging rapidly, integrating Wi-Fi, Bluetooth, and streaming capabilities to meet modern consumer expectations.

- Asia-Pacific leads the global market, accounting for around 40% of total revenue, driven by strong manufacturing bases and growing demand in China and India.

- Outdoor and recreational applications are expanding, supported by the rise of camping, RV travel, and remote work lifestyles.

- Automotive and transport segments are key emerging niches, as portable displays become integral to in-vehicle entertainment systems.

- Technological innovation and regional manufacturing initiatives such as “Make in India” and “Made in China 2025” are fostering competitive production ecosystems.

What are the latest trends in the Portable & Handheld TV Market?

Smart Connectivity and Streaming Integration

The market is witnessing a strong shift toward smart-connected portable TVs that integrate wireless connectivity, app ecosystems, and streaming platforms. Consumers increasingly prefer devices capable of mirroring smartphones, accessing OTT services, and connecting to Wi-Fi or Bluetooth-enabled peripherals. Manufacturers are focusing on Android-based operating systems and app compatibility to enhance user experience. This trend is particularly pronounced in North America and East Asia, where portable entertainment and flexible viewing have become key lifestyle patterns.

Battery Efficiency and Outdoor Durability

Advancements in lithium-ion battery technology have enabled portable TVs with extended playback times and fast charging capabilities. Ruggedized and weatherproof models designed for camping, marine, and RV use are gaining traction, providing portability and durability. The growing outdoor leisure culture is pushing manufacturers to innovate in compact, shock-resistant, and energy-efficient designs that cater to users seeking entertainment on the move.

What are the key drivers in the Portable & Handheld TV Market?

Increasing Demand for On-the-Go Entertainment

Modern consumers increasingly seek mobile entertainment experiences beyond smartphones. Portable and handheld TVs cater to this demand by offering larger screens and broadcast reception in compact, lightweight formats. The growth of global travel, RV tourism, and camping activities continues to support adoption, particularly in North America and Europe.

Technological Advancements in Display and Power Management

Innovations in OLED, mini-LED, and LCD backlighting technologies have significantly improved brightness, energy efficiency, and viewing quality. Manufacturers are leveraging these advancements to design ultra-light, slim, and battery-efficient portable TVs. The integration of smart features such as Wi-Fi streaming and digital tuners adds multifunctionality, boosting consumer appeal and market competitiveness.

Diversification Across Commercial and Automotive Segments

Beyond residential use, portable TVs are being deployed in commercial spaces, hospitality environments, and vehicles. Portable display systems serve as flexible content tools in hotels, retail displays, and transportation hubs. Automotive manufacturers and aftermarket suppliers are integrating portable screens into vehicles for passenger entertainment, expanding end-use potential for portable TV vendors.

What are the restraints for the global market?

Substitution from Smartphones and Tablets

The most significant restraint is competition from multipurpose devices such as smartphones and tablets that already fulfill portable entertainment needs. As these devices continue to improve in screen quality and battery life, dedicated portable TVs must differentiate through unique use cases like broadcast tuning, outdoor durability, and extended display time.

Price Sensitivity and Limited Awareness

Consumers in developing regions often perceive portable TVs as non-essential electronics, limiting mass adoption. Additionally, balancing cost, weight, and performance remains challenging. Price-sensitive consumers may opt for cheaper, multi-use alternatives, constraining market expansion, especially in lower-income markets.

What are the key opportunities in the Portable & Handheld TV Industry?

Outdoor Recreation and Adventure Applications

The surge in outdoor lifestyle trends, camping, hiking, boating, and RV living, is creating a lucrative niche for rugged, battery-powered portable TVs. Compact and waterproof models designed for outdoor use can command premium pricing. As global participation in outdoor recreation rises, portable entertainment products have a strong opportunity to align with this trend.

Integration with Automotive and Transport Systems

Portable TVs are increasingly being adopted in automotive and public transport environments, offering flexible entertainment for passengers. This integration allows portable screens to function both as in-vehicle entertainment and detachable personal viewing devices. The rise of autonomous vehicles and smart cabins further enhances this opportunity by requiring compact, mobile display solutions.

Emerging Markets and Localized Manufacturing

Countries such as India, Brazil, and those in Southeast Asia present strong growth potential. Local assembly under initiatives like “Make in India” and “Made in China 2025” can lower costs and drive exports. Manufacturers can leverage affordable labor and strong regional supply chains to produce competitively priced portable TVs tailored for value-conscious consumers.

Product Type Insights

LCD-based models dominate the market with around 60% share in 2024 due to their cost-efficiency and mature supply chain. LED and OLED portable TVs are rapidly emerging, offering higher brightness and energy efficiency for outdoor and premium segments. Compact form factors (10–15 inch) remain the preferred size, balancing portability and screen comfort. Entry-level models cater to price-sensitive consumers, while premium smart-connected units appeal to tech-savvy users seeking hybrid broadcast and streaming capabilities.

Application Insights

The residential and personal use segment dominates with approximately 65% market share in 2024, driven by demand for portable entertainment at home, during travel, and in dormitories. Commercial and hospitality applications are growing rapidly as hotels and short-term rentals adopt portable TVs for flexible entertainment. Automotive and transport segments are emerging high-growth areas, projected to register the highest CAGR through 2030, driven by integration into RVs, buses, and passenger vehicles.

Distribution Channel Insights

Online retail platforms are the primary distribution channel, allowing consumers to compare specifications and prices easily. E-commerce sites such as Amazon, Walmart, and specialized consumer electronics portals dominate global sales. Offline retail remains relevant in emerging markets, where physical inspection drives purchasing. Manufacturers are enhancing D2C websites and partnering with online marketplaces to increase reach and brand visibility.

End-Use Insights

Outdoor recreation and hospitality are among the fastest-growing end-use sectors. The expansion of global tourism, RV rentals, and event-based entertainment boosts portable TV demand. In 2024, outdoor and commercial applications together represented around 25% of the total market value, expected to rise to over 35% by 2030. Export-led demand from Asia-Pacific suppliers serving Latin America, Africa, and Southeast Asia is also increasing, reinforcing global trade linkages in the portable electronics sector.

| By Product Type | By Connectivity | By Power Source | By Distribution Channel | By End-Use Application |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America accounted for around 30% of the global market in 2024 ( USD 24 million). The U.S. dominates the region with strong consumer adoption of smart and outdoor portable TVs. Growth is supported by a high preference for travel, recreational vehicles, and streaming-based entertainment. Canada follows with demand driven by outdoor leisure culture and digital connectivity.

Europe

Europe represents about 20% of the global share ( USD 16 million). Germany, the U.K., and France lead adoption due to compact living spaces and an aging population seeking small secondary screens. The region’s growth is steady, with smart-connected and energy-efficient models gaining traction under the EU’s sustainability and eco-design directives.

Asia-Pacific

Asia-Pacific leads globally with approximately 40% market share ( USD 32 million). China remains the manufacturing hub and largest consumer market, while India and Southeast Asia are the fastest-growing regions, supported by affordability and government-led manufacturing policies. Japan and South Korea contribute premium, high-tech models, reinforcing the region’s dominance in innovation and export strength.

Latin America

Latin America holds roughly 8% of the global market ( USD 6.5 million), led by Brazil and Mexico. Value-segment portable TVs appeal to cost-conscious consumers and hospitality businesses. Growth is moderate but supported by increasing e-commerce penetration and regional electronics distribution improvements.

Middle East & Africa

The Middle East & Africa collectively contribute around 7% ( USD 5.6 million) of the 2024 market value. GCC countries, particularly Saudi Arabia and the UAE, show rising demand from the luxury hospitality and tourism sectors. South Africa leads in African adoption due to established retail networks. The region’s growth outlook remains positive, fueled by tourism infrastructure development and increasing disposable incomes.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Portable & Handheld TV Market

- Tyler

- XORO

- SuperSonic, Inc.

- Pyle Audio

- Axess Products Corporation

- Naxa Electronics

- August International

- GJY

- Ematic

- Envizen Digital

- Haier

- RCA

- Sylvania

- Power Acoustik

- Philco

Recent Developments

- In May 2025, Tyler introduced a new line of solar-powered portable TVs designed for campers and off-grid applications, enhancing outdoor usability.

- In March 2025, XORO launched an OLED-based handheld TV with integrated Android streaming, offering high-resolution performance and voice control features.

- In January 2025, Naxa Electronics announced a partnership with U.S. retail chains to expand nationwide distribution for its connected portable TV range.