Porcelain Tableware Market Size

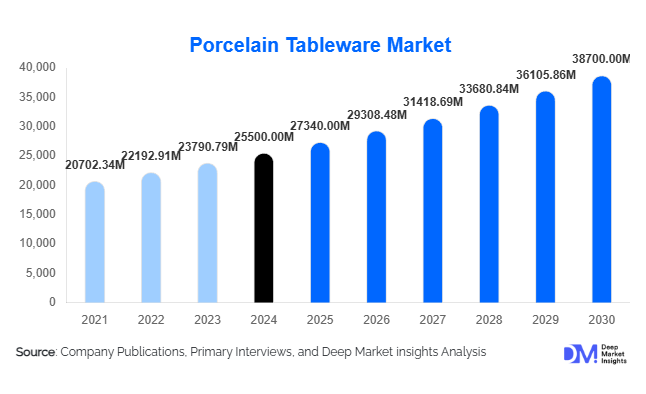

According to Deep Market Insights, the global porcelain tableware market size was valued at USD 25,500.00 million in 2024 and is projected to grow from USD 27,340.00 million in 2025 to reach USD 38,700.00 million by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). This growth is driven by rising disposable incomes, expanding hospitality and food-service sectors, and growing consumer inclination toward premium, sustainable, and design-centric dining solutions.

Key Market Insights

- Asia-Pacific dominates global production and is the fastest-growing consumption region, supported by rapid urbanization and expanding middle-class populations in China, India, and Southeast Asia.

- Premiumization and design-led differentiation are transforming consumer demand, with heritage and designer porcelain brands expanding their high-end offerings.

- Hospitality and commercial applications continue to generate strong demand, especially across hotels, restaurants, and catering services (HoReCa).

- E-commerce and direct-to-consumer (D2C) platforms are reshaping the distribution landscape, enabling personalized and customizable tableware sets.

- Sustainability is becoming a key purchasing criterion, as manufacturers adopt eco-friendly glazes, recycled porcelain, and energy-efficient production.

- The top 5 manufacturers account for roughly 25% of the global market, with competition intensifying from emerging Asian producers.

Latest Market Trends

Premium and Designer Collections Gain Popularity

Global consumers are increasingly treating porcelain tableware as an expression of lifestyle and home décor. Premium and limited-edition collections by luxury brands such as Villeroy & Boch, Rosenthal, and Bernardaud are witnessing rising adoption. The trend is particularly strong among urban professionals seeking to elevate home dining aesthetics. Collaborative collections with fashion designers and artists are also creating high-margin niches, while hand-painted and artisanal porcelain items are becoming coveted gifting options across Europe and Asia.

Sustainability and Eco-Friendly Manufacturing

The porcelain industry is moving toward sustainability-focused production. Manufacturers are investing in lead-free and non-toxic glazes, water recycling systems, and energy-efficient kilns to reduce environmental footprints. Some brands have launched circular initiatives to reclaim and recycle broken or outdated porcelain items. Consumers are rewarding brands that communicate transparency in sourcing and eco-production practices. This shift toward sustainability not only enhances brand image but also aligns with broader ESG investment trends influencing consumer goods industries worldwide.

Porcelain Tableware Market Drivers

Rising Disposable Incomes and Lifestyle Upgrades

The expanding global middle class, especially in Asia-Pacific and Latin America, is fueling demand for aesthetic and durable porcelain tableware. Consumers are increasingly prioritizing high-quality dining products that complement modern home interiors. The rise in urban housing and home renovation spending further drives replacement and upgrade cycles. As a result, mid-range and premium porcelain tableware are seeing steady demand growth, particularly in emerging markets.

Expansion of the Hospitality and Food-Service Industry

The rapid recovery and expansion of the global hospitality sector, including hotels, resorts, and restaurants, is a major growth catalyst. Porcelain remains the preferred material for its durability, hygiene, and premium appearance. HoReCa demand accounts for a significant share of bulk procurement globally, particularly in Asia-Pacific and the Middle East. As new restaurants and hotels continue to open worldwide, large-scale commercial orders for porcelain dinnerware, serveware, and drinkware are expected to grow consistently.

Technological Innovations and E-Commerce Growth

Manufacturers are leveraging digital glazing, automated molding, and smart manufacturing to enhance quality consistency and reduce costs. Simultaneously, the rise of e-commerce and D2C channels is enabling consumers to customize designs, select color palettes, and order personalized sets online. This direct engagement allows producers to build stronger brand equity while improving margins. Online sales now represent an estimated 20–25% of total market revenues, with rapid acceleration expected through 2030.

Market Restraints

Market Saturation and Long Replacement Cycles

Developed markets such as North America and Western Europe are approaching saturation, with most households already owning porcelain dinnerware sets. Replacement cycles in these regions can exceed five years, slowing overall market momentum. Growth opportunities in these markets are primarily tied to design refreshes, gifting occasions, or premium upgrades, requiring brands to innovate continuously.

Competition from Alternative Materials and Rising Costs

Porcelain faces stiff competition from alternative materials like stoneware, melamine, and tempered glass, which offer cost and durability advantages. Additionally, volatility in raw material and energy costs, particularly kaolin clay and kiln energy, adds margin pressure. These challenges are pushing manufacturers toward automation, regional sourcing, and supply chain optimization to maintain profitability.

Porcelain Tableware Market Opportunities

Premiumization and Design-Led Expansion

Luxury porcelain collections are gaining traction among global consumers seeking individuality and craftsmanship. Brands are expanding into limited-edition collaborations, bespoke monogramming, and artisanal finishes. These offerings attract higher margins and brand loyalty while tapping into the booming gifting and wedding markets. Design innovation remains a key differentiator as consumers associate porcelain tableware with art, culture, and refined dining experiences.

Emerging Market Demand and Hospitality Growth

Asia-Pacific and the Middle East are at the forefront of new demand. Rapid urbanization, rising hospitality infrastructure, and the expanding middle class are driving exponential consumption. Hotels, restaurants, and catering services in China, India, and the UAE are increasingly sourcing locally manufactured porcelain, reducing dependence on imports. This structural demand creates opportunities for local and regional producers to capture market share from traditional European brands.

Sustainable and Digital Manufacturing Practices

Eco-friendly manufacturing and automation are redefining competitive advantage. Producers adopting energy-efficient kilns, smart glazing technology, and 3D design printing can achieve lower operating costs and improved product uniformity. Digital manufacturing enables small-batch customization for online sales, allowing mass personalization without significant cost increases. These advancements align with global sustainability mandates and evolving consumer expectations for transparency and ethical production.

Product Type Insights

Dinnerware, comprising plates, bowls, and complete dinner sets, remains the dominant product category in the global porcelain tableware market, accounting for approximately 44% of the 2024 market share (valued at USD 11.4 billion). Its leadership is attributed to the universal necessity of dining sets across both residential and commercial settings. The segment benefits from regular replacement cycles, particularly in households and hospitality units, where product wear, breakage, and evolving design preferences fuel repeat purchases. In addition, dinnerware is central to coordinated dining aesthetics, encouraging consumers to upgrade to thematic or color-coordinated sets. This enduring demand reinforces the segment’s global leadership.

Serveware and drinkware segments are expanding rapidly, driven by a shift toward coordinated and aesthetic table presentations, especially in fine dining and luxury hospitality environments. The proliferation of social dining culture, culinary art displays, and designer collaborations has elevated serveware from functional to aspirational categories. Growth in specialty ceramics, including hand-glazed and embossed serveware, also underscores the market’s transition toward premiumization. Decorative porcelain items, although niche, are gaining popularity in home décor and gifting channels, adding incremental revenue streams for manufacturers.

Application Insights

Household and residential applications dominate the global porcelain tableware market, representing nearly 62% of total demand in 2024 (USD 16.1 billion). Rising global trends in home dining, home renovation, and social-media-driven interior aesthetics are fueling strong consumer spending. The “dine-at-home” and “home entertaining” movements, reinforced by e-commerce accessibility, are encouraging consumers to invest in stylish, high-quality dinnerware and serveware sets. Increasing preference for minimalist yet elegant table settings has particularly boosted the adoption of porcelain over metal or plastic alternatives.

The hospitality and HoReCa segment (Hotels, Restaurants, and Cafés) is the second-largest contributor to demand, driven by post-pandemic recovery in global tourism and restaurant refurbishments. Rising investments in boutique hotels, cruise liners, and catering companies are propelling large-volume procurement of high-durability porcelain products. Institutional applications such as corporate cafeterias, educational campuses, and airlines contribute modestly but offer steady, contract-based demand, especially for standardized and durable porcelain products used in bulk catering environments.

Distribution Channel Insights

Offline retail continues to dominate global porcelain tableware sales, with specialty stores, department stores, and hypermarkets comprising the majority share. Physical retail provides customers with tactile engagement and product comparison advantages, which are particularly valuable for high-end porcelain purchases. Many premium brands leverage exclusive in-store experiences and visual merchandising to communicate craftsmanship and authenticity.

Meanwhile, online retail is the fastest-growing distribution channel, currently accounting for 20–25% of total global sales. E-commerce growth is being accelerated by digital customization options, influencer-led product showcases, and the rise of direct-to-consumer (D2C) porcelain brands. Platforms such as Amazon, Alibaba, and Wayfair, along with official brand websites, are enabling consumers to access global design collections at competitive prices. For the B2B segment, bulk procurement remains dominated by trade shows, distributor partnerships, and dedicated supply contracts catering to the HoReCa and corporate sectors.

| By Product Type | By Application | By Distribution Channel | By End-User Industry |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds approximately 20–22% of the global porcelain tableware market, valued at USD 5.2–5.7 billion in 2024. The United States dominates the regional demand, supported by high consumer spending on premium home décor, frequent kitchen renovations, and a strong gifting culture. The growing popularity of celebrity-endorsed and designer tableware collections is enhancing product visibility in upscale retail chains and online stores. The Canadian market contributes steadily, driven by hospitality renovations and eco-friendly product adoption. Regional growth is further supported by the expansion of sustainable ceramic production in Mexico and increased demand from boutique dining establishments across the U.S., strong home décor and remodeling activity, increasing preference for locally designed artisan products, and the penetration of sustainable porcelain options in premium retail chains.

Europe

Europe represents about 25–28% of global market share (USD 6.5–7.3 billion in 2024), anchored by long-established porcelain traditions and heritage brands in Germany, France, Italy, and the U.K. European consumers prioritize craftsmanship, sustainability, and cultural authenticity, driving steady demand for handmade, eco-certified, and limited-edition porcelain collections. Export activities from European manufacturers to North America and Asia further enhance the region’s revenue contribution. High penetration of luxury hotels, gourmet dining establishments, and design-centric households continues to reinforce Europe’s leadership in premium tableware aesthetics. include strong manufacturing heritage, growing export volumes to North America and Asia, and rising demand for eco-conscious and artisanal porcelain. Government initiatives promoting sustainable production and circular design practices are further encouraging innovation across European factories.

Asia-Pacific

The Asia-Pacific (APAC) region is both the world’s largest porcelain production base and the fastest-growing consumption market, commanding approximately 30–32% of global share in 2024. The region is projected to grow at a CAGR of 7–9% through 2030. China leads in both production and exports, while Japan and South Korea continue to dominate in premium design innovation and heritage craftsmanship. India’s rising urban middle class, coupled with strong residential and hospitality expansion, is fueling rapid consumption growth. Additionally, increasing government support for domestic manufacturing under initiatives such as “Make in India” and “Made in China 2025” is strengthening regional capacity and export competitiveness. include rapid urbanization, rising disposable incomes, booming hospitality construction, and strong export demand from Europe and North America. The proliferation of e-commerce platforms such as Tmall, Rakuten, and Flipkart is also driving accessibility to premium porcelain products across emerging markets.

Latin America

Latin America accounts for approximately 8–10% of global porcelain tableware demand, led by Brazil, Mexico, and Argentina. The region is witnessing gradual but consistent growth due to expanding retail modernization, increasing middle-class consumption, and the flourishing hospitality sector. The surge in café culture, culinary tourism, and boutique restaurants in metropolitan cities is boosting demand for mid-range porcelain sets. Domestic manufacturers are also expanding capacity to meet growing regional needs while balancing imports from Asia and Europe. include modernization of the retail sector, hospitality investment linked to tourism recovery, and rising consumer inclination toward affordable, aesthetically designed tableware for both home and restaurant use.

Middle East & Africa

The Middle East & Africa (MEA) region contributes around 6–8% of total global demand. The Gulf Cooperation Council (GCC) countries, particularly the UAE, Saudi Arabia, and Qatar, are emerging as lucrative markets driven by rapid urban development and luxury hospitality projects. Initiatives such as Saudi Arabia’s Vision 2030 and the UAE’s tourism diversification programs are stimulating large-scale investments in fine dining and hotel infrastructure, significantly boosting porcelain tableware procurement. Africa’s demand, while smaller, is rising steadily, led by South Africa and Nigeria, where expanding urban middle-class populations are adopting modern dining lifestyles. include mega-hospitality projects, tourism diversification strategies, and the expansion of luxury hotel chains. Additionally, a growing preference for imported European and Asian porcelain brands in premium retail outlets is supporting regional market expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Porcelain Tableware Market

- Villeroy & Boch AG

- Rosenthal GmbH

- Fiskars Group

- Lenox Corporation

- Churchill China plc

- Noritake Co., Ltd.

- Vista Alegre Atlantis

- Haviland & Cie

- RAK Ceramics

- Songfa Porcelain

- BHS Tabletop AG

- Degrenne Paris

- Bernardaud S.A.

- Sitong Group

- Royal Worcester

Recent Developments

- In May 2025, Villeroy & Boch AG announced a new sustainable production line featuring low-emission kilns and recycled porcelain material integration at its Mettlach facility.

- In April 2025, RAK Ceramics launched its “Green Porcelain” range, incorporating lead-free glazes and digital-print surface designs aimed at eco-conscious hospitality clients.

- In February 2025, Rosenthal GmbH introduced its “Modern Heritage” collection in collaboration with European artists, blending traditional craftsmanship with minimalist design for younger consumers.