Pool Loungers Market Size

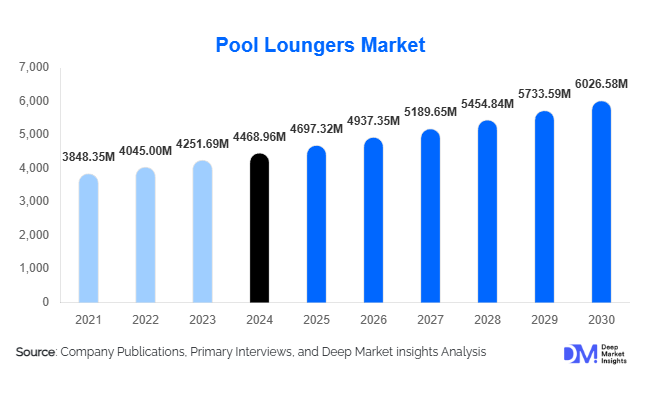

According to Deep Market Insights, the global pool loungers market size was valued at USD 4,468.96 million in 2024 and is projected to grow from USD 4,697.32 million in 2025 to reach USD 6,026.58 million by 2030, expanding at a CAGR of 5.11% during the forecast period (2025–2030). Market growth is primarily driven by the expansion of residential pool ownership, increasing investment in hospitality infrastructure, and the rising consumer preference for high-comfort, weather-resistant outdoor furniture.

Key Market Insights

- Rising demand for outdoor leisure and poolside living is propelling sales of durable, ergonomic loungers across both residential and commercial segments.

- Technological innovation in weather-resistant and sustainable materials is creating new value propositions for premium brands and resort suppliers.

- Commercial end-use dominates value share due to large-scale procurement by hotels, resorts, and clubs seeking design consistency and longevity.

- Asia-Pacific is the fastest-growing region, led by rapid urbanization, resort construction, and premium housing expansion in China, India, and Southeast Asia.

- Online retail and omnichannel distribution are expanding consumer access, especially in emerging economies.

- Eco-friendly, smart, and modular loungers are emerging as the next wave of differentiation among leading manufacturers.

What are the latest trends in the pool loungers market?

Smart and Sustainable Loungers

Manufacturers are increasingly incorporating sustainability and technology into product design. Solar-powered loungers, recycled polymer frames, and UV-resistant fabrics are gaining momentum, appealing to eco-conscious buyers and hospitality chains seeking green certifications. Smart loungers equipped with built-in charging ports, Bluetooth speakers, or lighting are redefining poolside comfort. This convergence of design and technology is expected to elevate average selling prices and foster brand differentiation in an otherwise price-sensitive market.

Hospitality Refurbishment and Premiumization

Resorts and hotels worldwide are upgrading outdoor spaces post-pandemic to attract travelers seeking open-air leisure. This refurbishment wave has increased demand for high-end loungers made of stainless steel, teak, and weather-proof resin wicker. Brands offering customized, stackable, and foldable options that complement architectural themes are winning bulk procurement contracts. The shift toward “experience-driven” hospitality, where design and comfort enhance guest satisfaction, is reinforcing premiumization trends across the commercial segment.

What are the key drivers in the pool loungers market?

Expansion of Residential Pool Ownership

Rising disposable incomes and urban affluence have increased the number of private pools globally, particularly in the United States, Australia, and parts of Asia. Homeowners are investing in luxury outdoor furniture to elevate aesthetics and comfort, making loungers an integral part of premium home landscaping. Manufacturers targeting mid-income households with cost-efficient polymer designs are seeing strong online traction.

Growth in the Hospitality and Tourism Sector

The global hospitality industry’s emphasis on enhancing outdoor guest experiences has become a key market driver. From boutique hotels to large resorts, properties are redesigning pool decks and wellness areas to include ergonomic loungers, cabanas, and daybeds. Bulk contracts and customized furniture lines have boosted manufacturer revenues, with the commercial segment accounting for nearly 45% of the 2024 market value.

Proliferation of E-Commerce and Direct-to-Consumer Channels

Digital retailing is transforming the way consumers purchase outdoor furniture. E-commerce giants and brand-owned websites offer customization, 3D visualization, and direct shipping, reducing dependency on traditional furniture retailers. The indirect distribution channel now represents around 55% of total global sales, reflecting growing online adoption.

What are the restraints for the global market?

High Material and Logistics Costs

Fluctuating prices of stainless steel, wood, and polymers significantly impact manufacturing costs. Additionally, high freight rates and import tariffs on bulky outdoor furniture raise end-user prices, compressing margins and limiting affordability in developing markets.

Seasonality and Maintenance Concerns

Pool loungers are seasonal purchases, with demand peaking in warmer months. Harsh weather exposure leads to wear-and-tear, making maintenance a key deterrent for some buyers. These factors restrict year-round sales consistency, especially in temperate climates.

What are the key opportunities in the pool loungers industry?

Emerging Market Penetration

Rising urbanization and luxury housing growth in emerging markets such as India, Vietnam, and Brazil create a lucrative opportunity for affordable yet stylish loungers. Localized production and partnerships with regional distributors can enable global brands to capture these high-potential markets.

Eco-Friendly Manufacturing and Material Innovation

Growing regulatory emphasis on sustainability and circular manufacturing presents a key opportunity. Producers using recycled plastics, FSC-certified wood, and biodegradable coatings are likely to attract eco-conscious consumers and institutional buyers. This transition aligns with broader ESG initiatives in the global furniture industry.

Integration of Smart Features

The addition of smart technologies, such as solar charging panels, adjustable reclining with sensors, and Wi-Fi-enabled entertainment systems, is redefining consumer expectations. Premium resorts and luxury home segments are expected to drive this niche, offering higher profit margins to innovators.

Product Type Insights

Fixed loungers lead the market, accounting for nearly 60% of total revenue in 2024. These models dominate due to their superior stability, aesthetic appeal, and integration into commercial poolside architecture. Foldable loungers are gaining traction among urban consumers for their portability and ease of storage, expected to grow at a faster rate through 2030.

Material Insights

Plastic and polymer loungers command approximately 35% of the global market share, supported by cost efficiency, weather resistance, and low maintenance. Wooden and metal loungers cater to the luxury segment, with teak and stainless steel remaining preferred materials in high-end resorts and villas.

Distribution Channel Insights

Indirect sales channels, including online retail and multi-brand stores, dominate with a 55% share in 2024. The rapid growth of e-commerce in emerging regions is making designer outdoor furniture accessible to mid-income consumers. Direct-to-consumer (D2C) models are expanding among premium brands offering customization and bundled outdoor sets.

End-User Insights

Commercial end-users, hotels, resorts, and clubs, represent around 45% of the market by value. Continuous refurbishment and expansion of hospitality infrastructure sustain steady demand. The residential segment is expanding rapidly, driven by online availability, home renovation trends, and the popularity of backyard leisure spaces post-pandemic.

| By Product Type | By Material | By Distribution Channel | By End User |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds roughly 30% of global revenue (USD 1.23 billion in 2024). The U.S. dominates regional demand, with high pool ownership and robust premium outdoor furniture spending. Market maturity limits growth to moderate levels (4% CAGR) but ensures consistent value demand.

Asia-Pacific

Asia-Pacific, valued at approximately USD 1.02 billion in 2024, is the fastest-growing region with a projected CAGR of 6-7%. Expanding hospitality projects, luxury housing, and urban pool installations in China, India, and Southeast Asia fuel strong momentum.

Europe

Europe contributes about 20% of the market (USD 820 million in 2024), led by Mediterranean resorts and high-income residential consumers. Sustainability and design aesthetics are key purchasing factors, supporting demand for FSC-certified wooden loungers and artisanal designs.

Middle East & Africa

With a 10% share (USD 410 million), MEA shows solid growth potential. Gulf countries such as the UAE and Saudi Arabia are investing heavily in resort development, luxury residences, and leisure complexes, boosting poolside furniture procurement.

Latin America

Latin America accounts for around 15% of global revenue (USD 615 million) in 2024. Tourism recovery and increasing villa development in Mexico and Brazil support a healthy future expansion.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pool Loungers Market

- Brown Jordan International

- Kettal SL

- Gloster Ltd.

- Kingsley Bate Inc.

- Tropitone Furniture Company

- Fermob SA

- Skyline Design Inc.

- Mey Furniture GmbH

- EMU Group S.p.A.

- Homecrest Outdoor Living LLC

- Sunset West Inc.

- JANUS et Cie

- Fast-Furniture Outdoor

- Riga-Ketch Inc.

- Zak & Fox Outdoor Furniture

Recent Developments

- In June 2025, Brown Jordan announced the expansion of its sustainable outdoor furniture line using recycled polymer composites and solar-charging accessories for smart loungers.

- In April 2025, Kettal launched an AI-aided configurator tool for customized poolside furniture, enhancing its digital D2C presence.

- In February 2025, Gloster Ltd. inaugurated a new manufacturing facility in Vietnam to meet growing Asia-Pacific demand and reduce logistics costs.