Polyester Duvet Market Size

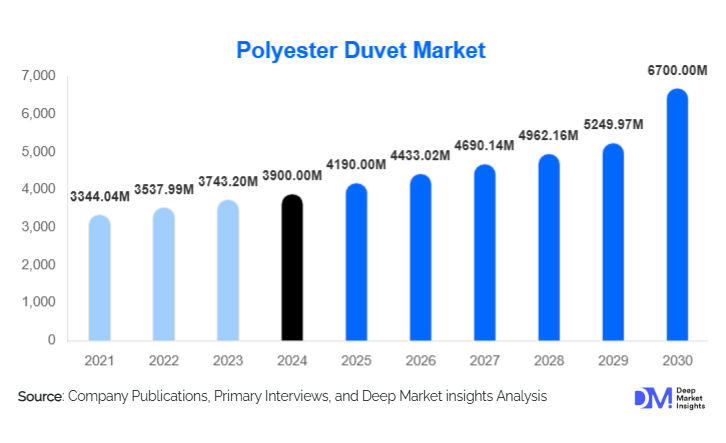

According to Deep Market Insights, the global polyester duvet market size was valued at USD 3,900 million in 2024 and is projected to grow from USD 4,190 million in 2025 to reach USD 6,700 million by 2030, expanding at a CAGR of 5.8 % during the forecast period (2025–2030). Demand is driven by affordable synthetic bedding, rising allergy awareness, expanding e-commerce reach, and consumer interest in sustainable variants of polyester duvets.

Key Market Insights

- Microfiber polyester dominates the fill segment globally, thanks to its soft feel, light weight, and wide acceptance in mid and premium product lines.

- The queen-size duvet is the most sold size globally, aided by its widespread adoption across apartments and master bedrooms in major markets.

- All-season / medium-weight duvets lead in terms of volume, as consumers prefer flexibility across temperature ranges rather than heavy seasonal options.

- Residential / home use accounts for the largest end-use share, making up the bulk of demand globally, with commercial (hospitality, healthcare) as the second major segment.

- E-commerce / online distribution is the fastest-growing channel, increasing convenience, customization, and geographical reach for brands and consumers alike.

- Asia-Pacific is the fastest-growing region, fuelled by rising incomes, urbanization, and increasing penetration of branded bedding in China, India, and Southeast Asia.

Latest Market Trends

Sustainable & Recycled Polyester Adoption

One of the most significant trends in the polyester duvet market is the shift toward recycled polyester (rPET) and more sustainable fiber processing. Brands are increasingly integrating recycled PET bottle feedstock, closed-loop recycling, and biodegradable blends in their duvets to appeal to environmentally conscious consumers. This trend is particularly pronounced in Europe and North America, where consumers demand eco-labels, lower carbon footprints, and microplastic mitigation. As regulation around synthetic textiles tightens, such sustainable products help differentiate brands and sustain higher margins.

Customization, Modular Tog & Multi-Season Options

Consumers are gravitating toward duvets that allow for modular warmth adjustment or multi-season use (e.g., two layers that can be snapped or zipped). This provides flexibility across climates and reduces the need to own multiple duvets. Coupled with online ordering interfaces, customers can choose size, fill weight, and design aesthetic, boosting satisfaction and reducing returns. This trend supports upselling and premium positioning.

Polyester Duvet Market Drivers

Cost Advantage & Maintenance Simplicity

Compared to down, natural fiber, or premium fills, polyester duvets are more affordable to produce and purchase. They withstand frequent washes, are less prone to clumping or feather migration, and don’t require specialized cleaning. This makes them highly attractive to middle-income households, student housing, and hospitality segments where durability and ease of care are important.

Health & Allergy Awareness

The growing prevalence of allergies, asthma, and respiratory sensitivities has reinforced demand for hypoallergenic bedding. Polyester duvets (especially those treated for anti-microbial or anti-dust‐mite performance) are perceived to be less hospitable to allergens compared to natural fills, which helps drive adoption in households with children, the elderly, or health-conscious buyers.

Rise of Home Décor & Consumer Willingness to Invest in Comfort

The pandemic and shifting lifestyle norms led more consumers to invest in improving their home environment. Bedding, including duvets, has become a key component of that. Attractive designs, color options, textures, and branding allow differentiation. Online platforms with visual merchandising amplify the visibility of premium duvets. This aesthetic + comfort demand is encouraging consumers to upgrade from basic comforters or quilts to polyester duvets.

Market Restraints

Environmental Backlash & Regulatory Pressure

Synthetic materials like polyester are under scrutiny for microplastic shedding, waste disposal, and carbon footprint. Several jurisdictions are beginning to regulate or promote restrictions on microplastic release, set minimum “recycled content” requirements, or enforce labeling. These factors may increase production costs, limit design options, or force reengineering of processes, especially for smaller players.

Volatile Raw Material & Supply Chain Costs

Polyester fiber is derived from petrochemical feedstocks (e.g., PTA, MEG). Fluctuations in crude oil prices, supply disruptions, tariffs, and logistic constraints can dramatically impact cost structures. For players unable to absorb costs or pass them to consumers, margin erosion is a significant risk. Further, global shipping and freight costs, import duties, and trade tensions can hinder smooth cross-border trade in duvets or components.

Polyester Duvet Market Opportunities

Expansion into Under-Penetrated Emerging Regions

Significant untapped demand exists in markets like India, Southeast Asia, Africa, and parts of Latin America, where the per-capita pedigree for premium bedding is low. As incomes rise, urban housing expands, and e-commerce infrastructure improves, local and international brands can enter with mid-premium polyester duvet offerings. Also, growth in tourism and hospitality in these regions spurs demand for commercial bedding supplies. Local manufacture or regional hubs can reduce cost and improve margin.

Technological Integration & Smart Textiles

Integration of temperature regulation, phase change materials, moisture-wicking fibers, or even embedded sensors (for monitoring sleep or humidity) opens new product dimensions. While nascent now, such advanced duvets can command premium pricing and differentiate brands. Partnerships with textile tech firms or startups can provide a competitive edge.

Service Models, Take-Back & Circular Business Models

Brands can introduce bedding-as-a-service, subscription upgrades, or take-back programs (e.g., recycling old duvets). This helps attract sustainability-conscious consumers and locks in repeat revenue. These initiatives can also enhance brand loyalty and enable differentiation in a crowded market. Additionally, institutional contracts (hotels, hospitals) for bulk supply and refurbishment cycles represent a sizable opportunity.

Product Type Insights

In the global polyester duvet market, microfiber fill duvets currently lead, being widely accepted for their softness, loft, and balance of cost and comfort. Hollow-fiber and siliconized polyester fills occupy secondary but growing niches where improved loft or enhanced insulation is needed. Recycled polyester fills are emerging rapidly, particularly in premium lines. On the design side, quilted and baffle-box constructions dominate for even fill distribution and stability. Premium lines may use channel stitching or decorative textures to enhance aesthetics and performance.

Application Insights

The residential / home segment remains the core application, contributing the largest share in unit and value terms. Within that, growing urban households and first-time mattress/bedding upgrades drive volume. Hospitality and commercial applications (hotels, resorts, serviced apartments) demand high durability, frequent laundering tolerance, and performance consistency, making polyester duvets attractive for large-scale procurement. Healthcare / institutional use is smaller but stable, where ease of sanitation and hypoallergenic properties matter. Newer applications in vacation rentals / short-stay industry and luxury lodging are growing, pushing demand for premium, design-forward polyester duvets.

Distribution Channel Insights

E-commerce / online channels have seen the fastest growth, offering a wide choice, customization, direct consumer reach, and efficient logistics. Specialty bedding and home décor stores remain important for consumers who prefer a tactile experience before purchase. Department stores / big box retail continue to contribute, especially in mature markets, offering bundling and brand visibility. Direct-to-consumer (D2C) brands are gaining traction by cutting intermediaries, offering better margins, and building brand relationships. Wholesale / export channels remain relevant for cross-border trade and institutional procurement.

| By Product Type | By Filling Weight / Season Type | By Size | By End-Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Region Insights

North America

North America commands a leading share of 30 % of the 2024 marketdriven by strong disposable income, bedding upgrade culture, awareness of allergy/health, and mature distribution (online + mass retail). The U.S. is the dominant country. Consumers demand sustainable credentials, ease of maintenance, and premium design. Replacement cycles are steady. Growth here is steady, with a CAGR of around 4–6 %.

Europe

Europe holds 28 % of the 2024 market. Germany, the UK, France, Italy, and Scandinavia are major consumers. Sustainability standards, regulations, eco-conscious buying, and a high willingness to pay for certified products elevate demand for recycled fills and eco-label bedding. Growth is moderate, 5–6 % CAGR.

Asia-Pacific

Asia-Pacific is the fastest growing region, with a 2024 share 22 %. China, India, Japan, South Korea, and Southeast Asia are key. Rising incomes, home ownership, rapid urbanization, and the expansion of e-commerce fuel demand. Local manufacturing is strong, enabling exports too. Forecast CAGR here is 7–8 %. China and India will contribute the bulk of incremental volume.

Latin America

Latin America holds 8 % share in 2024, with Brazil and Mexico leading. Demand is rising, but constraints like import duties and currency volatility weigh. Growth in high single digits is expected over the forecast.

Middle East & Africa

MEA holds 7 % share. GCC countries (UAE, Saudi Arabia, Qatar) and South Africa lead demand due to hospitality, tourism, and high-income segments. Intra-African demand is gradually rising. Growth is uneven: Gulf markets may see 6–7 % CAGR; Sub-Saharan Africa is slower.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Polyester Duvet Market

- Sleep Number

- Hilding Anders

- Corsicana

- Recticel

- Derucci

- Luolai Home Textile Co.

- FUANNA

- Shanghai Shuixing Home Textile Co.

- Hunan Mendale Hometextile

- Ruf-Betten

- Others with regional prominence

Recent Developments

- In 2025, several major bedding brands announced expanded product lines using recycled polyester fills and eco-certifications to capture the sustainability segment.

- In early 2025, some manufacturers introduced modular duvets (snap-together layers for climate control) marketed especially in temperate regions.

- In late 2024, a few players launched direct-to-consumer premium duvet subscription or replacement programs, offering trade-in of older duvets to foster customer loyalty.