Police Body Cameras Market Size

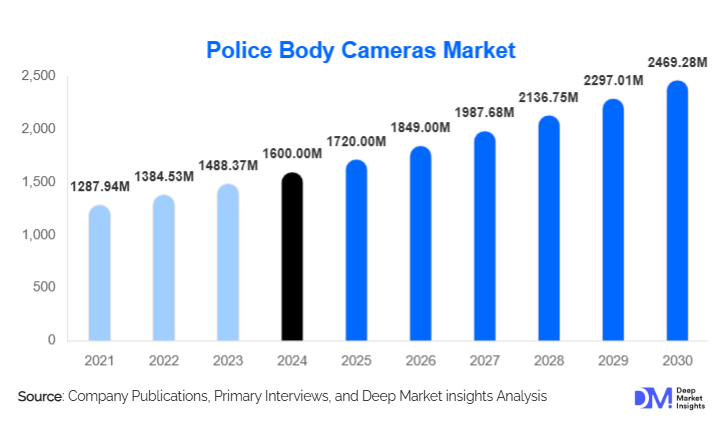

According to Deep Market Insights, the global police body cameras market size was valued at approximately USD 1,600 million in 2024 and is projected to grow from around USD 1,720.00 million in 2025 to reach about USD 2,469.28 million by 2030, expanding at a CAGR of 7.5 % during the forecast period (2025–2030). The market growth is primarily driven by increasing law-enforcement mandates for transparency, growth in emerging-market roll-outs of body-worn systems, and rising adoption of integrated systems (hardware + software + cloud evidence management) for public-safety agencies.

Key Market Insights

- Wearable on-officer body cameras dominate the hardware segment, as frontline patrol officers require compact, ruggedized, easily mountable devices that integrate with existing uniform systems and evidence workflows.

- Recording-only camera systems represent the largest technology share, since many agencies initially deploy simpler models (local storage) before upgrading to streaming/connected variants.

- Government law-enforcement agencies remain the primary end-users, procuring the majority of units through direct contracts, driven by public-safety budgets and regulatory requirements for accountability.

- North America leads in market size, exhibiting the largest installed base and procurement volumes, supported by mature infrastructure and high public-safety expenditure.

- Asia-Pacific is emerging as a growth hotspot, led by countries such as China and India that are increasingly rolling out body-worn camera programmes for police modernization.

- Technology integration is accelerating, including live-streaming, AI-enabled analytics (incident detection, redaction), cloud-based evidence platforms, and connectivity (4G/5G/Wi-Fi), which are reshaping traditional procurement and value models.

What are the latest trends in the police body cameras market?

Shift toward integrated systems with software and cloud services.

While earlier deployments of body-worn cameras focused purely on hardware (camera units with local storage), the current wave of buying is increasingly for end-to-end solutions: devices integrated with cloud evidence-management platforms, live-streaming capability, incident-trigger sensors, GPS tagging, and analytics modules. Agencies are realising that hardware alone is just the entry point; the value lies in managing, processing and retrieving video evidence, linking footage to digital records, and enabling command-centre oversight. Vendors offering bundled services (hardware + software + cloud) are gaining traction, and service-based pricing (subscription/licensing) is becoming more common. This trend increases the addressable value per deployment and drives upgrades among agencies with existing hardware. The move to connected systems also allows faster roll-out of capabilities like live-stream, remote monitoring, and real-time data feeds, which further boost demand among larger agencies with mission-critical visibility requirements.

Emerging market expansions and regional roll-outs

As mature markets (North America, Europe) reach high penetration with basic systems, growth is increasingly coming from emerging geographies such as Asia-Pacific, Latin America and the Middle East & Africa. Governments in these regions are initiating modernisation programmes for police forces, driven by public-safety reforms, transparency mandates, and international standards for law-enforcement behaviour. Local manufacturing and “Make in …”-type initiatives in countries like India also reduce unit cost and enable scale deployments. These regional roll-outs are significant because they convert the hardware-only market stage into a large volume replacement and upgrade cycle phase, thus boosting hardware, software, and services demand. Additionally, as units deployed earlier in these regions require maintenance, replacement, and feature upgrades, a second wave of procurement is unfolding.

Adjacency and multi-use cases beyond patrol law enforcement

While frontline police patrol remains the core market, there is growing uptake in adjacent applications: transit police, traffic patrol, correctional-facility officers, private-security firms, corporate enterprise security, border-control and emergency services (EMS/fire-rescue). These use-cases often require body-worn video for liability protection, workforce safety, incident documentation and remote supervision. Vendor offerings are increasingly customised for these sectors (e.g., lighter form-factors, private-security leasing models, enterprise-grade analytics). This broadens the addressable market and creates new growth pockets, especially in commercial and private-security domains where the growth rate tends to be faster (though starting from a smaller base).

What are the key drivers in the police body cameras market?

Rising demand for transparency and accountability in law enforcement

Public and governmental pressure for greater oversight of police actions, especially in the context of use-of-force incidents, citizen complaints, and legal evidence collection, has made body-worn cameras almost a standard procurement item for many agencies. These devices evidence interactions, deter improper behaviour, reduce complaints and support investigations. Accreditation bodies and public-safety policies increasingly include body-worn video as a requirement or best practice. This driver is a strong and underlying impetus for new procurement and upgrade cycles.

Government funding allocations and procurement programmes

Many national, state and municipal budgets include earmarked funding for body-worn camera programmes and associated infrastructure (data-storage, upload systems, software platforms). Grant programmes, law-enforcement modernisation schemes, subsidies and procurement incentives are enabling agencies to invest in hardware and supporting systems. This external funding helps overcome some cost barriers and accelerates roll-outs, especially in jurisdictions where budgets are otherwise constrained.

Technological advances and cost reduction

Hardware costs of body-worn cameras have declined over time, while capabilities have increased (higher resolution, live-streaming, connectivity, analytics). Improvements in battery life, ruggedisation, storage-compression, cloud-platform maturity and networking (4G/5G/Wi-Fi) make new systems more compelling. Agencies willing to upgrade are choosing more feature-rich units, which boosts average selling value. Vendors offering service models (hardware + software subscription) are unlocking recurring revenue and making procurement easier for agencies that prefer operational-expenditure models rather than large capital outlay.

Restraints

High total cost of ownership (TCO) and data-storage burden

Although the cost of hardware units has declined, the overall cost of deploying body-worn camera systems remains high: data upload architecture, cloud storage, evidence-management software, training, maintenance, footage retention policies, and system integration all add up. Many agencies delay roll-out or limit scale because of these hidden operational costs. Especially, smaller jurisdictions or developing-country agencies may face budget constraints for the backend infrastructure.

Privacy regulations, datagovernancee and system integration challenges

Deployment of body-worn cameras raises complex privacy, data-protection, video-retention and chain-of-custody issues. Legislations differ widely across countries and even states/provinces. Agencies must ensure compliance, establish policies for when to record or not, manage redaction of bystanders, handle data breaches and ensure admissibility of footage in legal proceedings. These regulatory, legal and integration hurdles slow procurement and full-scale adoption in some jurisdictions.

What are the key opportunities in the police body cameras industry?

Emerging-market roll-outs and upgrade waves

Many law-enforcement agencies in Asia-Pacific, Latin America and the Middle East & Africa are just beginning body-worn camera adoption or are deploying second-generation systems (live-streaming, analytics). This presents a sizeable growth window for suppliers. New entrants or incumbents who tailor cost-efficient, locally supported solutions can gain a first-mover advantage. Additionally, upgrade cycles in mature markets (replacing older hardware, adding connectivity or analytics) also generate incremental demand. By targeting both the “green-field” emerging agencies and “brown-field” upgrade programmes, vendors can significantly expand market reach.

Technology modularity and service monetisation (hardware + software + cloud)

As hardware becomes commoditised, the major value-growth lies in software, cloud evidence-management, video analytics (AI for incident detection, smart redaction, facial/object recognition), and recurring-service models. Vendors able to deliver software-as-a-service (SaaS) or hardware-plus-subscription models stand to increase lifetime value and differentiate from pure-hardware providers. There is also an opportunity for integration with body cameras and other systems (vehicle cameras, dispatch, telematics), offering cross-sell and value-added services. For agencies seeking end-to-end solutions, this is a compelling move.

Adjacent verticals and new applications beyond standard policing

While frontline uniformed law enforcement remains core, there is rising deployment in adjacent domains: transit/tunnel/rail police, correctional-facility officers, private-security firms, corporate security (retail, logistics), fire/EMS responders, and border-control. These sectors can absorb body-worn camera systems for liability mitigation, workforce safety, incident documentation and remote supervision. Vendors who tailor devices and services for these adjacent segments (e.g., simpler mounting, lower cost, leasing models) will capture incremental growth. Furthermore, export-driven demand (for peace-keeping missions, international training agencies) expands potential beyond domestic law-enforcement budgets.

Product Type Insights

Within hardware, the wearable on-officer body-worn camera remains the dominant form-factor, representing around 60–65 % of global market value in 2024, due to high volumes of procurement for frontline patrol programs. Other types, such as helmet/head-mounted and in-vehicle systems, are growing, but from a smaller base. On the technology side, the recording-only variant accounted for roughly 65 % of value in 2024, as many agencies still deploy simpler units first before upgrading to live-streaming models. Going forward, connected/livestream units and higher-resolution (4K) variants are expected to grow faster, providing value uplift for vendors.

Application Insights

The primary application remains patrol/uniformed law-enforcement officers, who held about 70–72 % of the market value in 2024. This dominance is because patrol officers generate the highest volume of interactions, require the widest deployment, and form the core of body-worn camera roll-outs. Other applications, special operations, traffic/highway patrol, correctional-facility officers, and private security are growing more rapidly but from smaller bases. For example, correctional-facility body-worn camera use is gaining as inmate-officer interaction documentation becomes standard, and private-security firms increasingly adopt body-worn video for staff accountability. These adjacent applications will gradually increase their share of the total market mix.

Distribution Channel Insights

Large government procurement via direct sales remains the dominant channel (often exceeding 50 % of value) because police agencies and public-safety departments purchase via tenders and contracts. However, value-added resellers/distributors are important for smaller agencies, adjacent commercial segments, a nd international roll-outs; they provide local support, installation services, and maintenance. Online/off-the-shelf sales are emerging in commercial/private-security segments where agencies purchase smaller volumes with less bureaucracy. Given the shift toward recurring-revenue software and cloud models, some vendors bundle installation, training, and maintenance services, thus increasing dependence on channel partners and service networks rather than pure hardware distribution alone.

End-Use Industry Insights

The end-use industry is dominated by government law-enforcement agencies, which accounted for approximately 75–80 % of the market value in 2024. This reflects the fact that public-safety budgets and procurement programmes are the main drivers of body-worn camera adoption. Growth in adjacent end-use segments (transit, corrections, private security, corporate enterprise) is faster than the core law-enforcement segment and is creating new demand beyond traditional policing. For instance, private security providers in logistics and retail are beginning to deploy body-worn cameras for incident documentation, workforce safety, and liability reduction. As these end-use industries expand, their body-worn-camera budgets grow, increasing the overall market’s springboard of demand.

| By Product Type | By Resolution | By Storage Type | By End Use | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America remains the largest regional market, with 43 % of the global market share in 2024. The United States leads procurement with well-funded law enforcement agencies, many of whom already deploy body-worn solutions and are now upgrading to feature-rich systems. Canada follows, albeit at a smaller scale. The region benefits from mature infrastructure, large budgets, regulatory mandates and high public-safety spending. Growth is moderate given high penetration, but value upgrades (live-stream, analytics, cloud services) sustain demand.

Europe

Europe holds approximately 25 % the global share in 2024. Countries such as the UK, Germany and France have mature body-worn camera programmes, though rollout rates vary due to privacy/regulatory issues (e.g., GDPR). Growth is steady: agencies are replacing older units and integrating advanced software systems. The UK remains a significant market; Germany and France are expanding. Europe is not the fastest-growing region, but it delivers stable value and upgrade demand.

Asia-Pacific

Asia-Pacific is the fastest-growing region, though its 2024 share is lower (e.g., 15–20 %). Growth is driven by large populous countries (China, India), government police modernisation initiatives, local manufacturing programmes (“Make in India”), emerging-market procurement and falling unit costs. As these countries transition from pilot projects to large-scale deployment, significant growth in both units and services is expected. This region thus represents the primary growth horizon for the global market.

Latin America

Latin America holds a smaller share (5–10 %) but is advancing. Markets like Brazil and Colombia are initiating procurement programmes for police body-worn cameras. Growth is aided by public-safety reforms, donor programmes and cost-effective solutions. While initial volumes are modest, the growth rate is above average given the current low base.

Middle East & Africa (MEA)

MEA also represents a smaller share (< 10 %) currently. Gulf states (UAE, Saudi Arabia) are deploying smart policing and body-worn camera solutions; African nations are gradually adopting the technology. The growth rate is potentially high, but budgets, infrastructure and procurement lead-times present constraints. Thus, the region offers medium-term upside rather than immediate large-volume demand.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Police Body Cameras Market

- Axon Enterprise

- Motorola Solutions

- Panasonic Corporation

- Digital Ally

- Reveal Media

- Wolfcom Enterprises

- Pinnacle Response

- PRO-VISION Video Systems

- VIEVU LLC

- TCL New Technology

- Shenzhen AEE Technology

- Safety Vision LLC

- GoPro Inc.

- Hikvision Digital Technology

- 10-8 Video Systems LLC

Recent Developments

- In 2025, several European police forces announced large-scale upgrades of body-worn camera systems, transitioning from recording-only units to live-streaming and cloud-connected devices.

- In 2025, multiple Asia-Pacific countries (notably India) initiated major procurement tenders for body-worn cameras as part of police modernization programmes, signalling strong regional demand.

- In 2024–25, leading market vendors expanded their service offerings by acquiring video analytics and evidence-management software firms, reinforcing the shift toward bundled hardware-software-cloud solutions.