Plush Toy Market Size

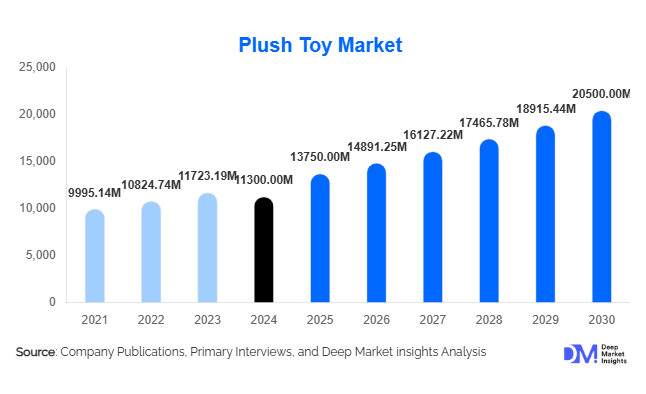

According to Deep Market Insights, the global plush toy market size was valued at USD 11,300 million in 2024 and is projected to grow from USD 13,750 million in 2025 to reach USD 20,500 million by 2030, expanding at a CAGR of 8.3% during the forecast period (2025–2030). The market growth is primarily driven by increasing demand for licensed character merchandise, rising popularity of collectible and interactive plush toys, and the growing adoption of eco-friendly and sustainable materials by manufacturers worldwide.

Key Market Insights

- Collectible plush toys are increasingly driving market demand, as limited editions and franchise-based characters attract both children and adult collectors globally.

- Sustainability is becoming a core factor, with consumers favoring plush toys made from recycled and eco-friendly materials.

- Online retail channels dominate distribution, as post-pandemic digital adoption continues to reshape purchase behaviors.

- North America and Europe represent the largest markets, with the U.S., Germany, and the U.K. leading demand for premium and licensed plush toys.

- Asia-Pacific is the fastest-growing region, with China and Japan driving growth due to high disposable income and the popularity of character-based plush toys.

- Technological integration, such as interactive plush toys with mobile apps or sound/lighting features, is transforming consumer engagement.

Latest Market Trends

Rise of Licensed and Collectible Plush Toys

Licensing agreements with popular entertainment franchises, movies, and gaming brands are fueling demand for plush toys. Collectors and fans are increasingly purchasing limited-edition and themed plush toys, creating a secondary market for rare items. This trend has encouraged manufacturers to frequently update product lines with new characters and themed collections. Online platforms and social media marketplaces have amplified visibility and access for global collectors, making franchise-based plush toys a major revenue contributor.

Eco-Friendly and Sustainable Materials

Consumer preference for eco-friendly products has prompted manufacturers to adopt recycled fabrics, organic cotton, and biodegradable stuffing. Sustainable plush toys appeal not only to environmentally conscious parents but also to retailers seeking to promote green product lines. This trend has led to new certifications and labeling standards, enhancing trust and market acceptance. Brands integrating sustainability into production are also differentiating themselves in a competitive market, gaining both market share and positive brand recognition.

Plush Toy Market Drivers

Popularity of Character-Based Merchandise

Plush toys featuring licensed characters from films, TV shows, and video games continue to dominate market growth. These toys appeal to a wide demographic, from children to adult collectors, creating strong brand loyalty and repeat purchase behavior. Global entertainment franchises are increasingly collaborating with plush toy manufacturers to create themed merchandise, boosting both visibility and sales.

Expanding Adult Collectible Segment

Adults are increasingly purchasing plush toys for nostalgic reasons, decor, gifting, and collectibles. Limited edition releases, pop culture tie-ins, and high-quality plush lines have attracted adult consumers willing to pay premium prices. This segment is projected to expand rapidly, particularly in North America, Europe, and the Asia-Pacific.

Growth of Online Retail Channels

Online platforms, including e-commerce marketplaces and D2C websites, provide convenient access to global consumers. The growth of digital retail channels has enabled manufacturers to target niche segments, such as collectors or fans of specific franchises, and offer customizable options. Online promotions, social media campaigns, and influencer endorsements have become critical in shaping purchasing decisions.

Market Restraints

Fluctuating Raw Material Costs

Changes in the prices of fabrics, synthetic stuffing, and packaging materials impact production costs and profit margins. Manufacturers must manage these fluctuations carefully to maintain competitive pricing without compromising quality.

Regulatory Compliance Challenges

Strict safety standards and regulations across regions, including ASTM, EN71, and CPSIA, create barriers for manufacturers exporting globally. Compliance with varying certification requirements increases costs and operational complexity, particularly for small and mid-sized players.

Plush Toy Market Opportunities

Integration of Interactive Technology

Adding interactive features, such as sound, motion, or mobile connectivity, allows plush toys to offer enhanced engagement for children. Tech-enabled plush toys can include educational apps, interactive storytelling, or responsive play, opening new revenue streams and appealing to digitally savvy families.

Expansion into Emerging Markets

Rapid urbanization, rising disposable income, and growing awareness of global toy brands in emerging markets such as India, Brazil, and Southeast Asia present strong growth opportunities. Entry into these regions allows manufacturers to diversify geographically and tap into a largely untapped consumer base.

Eco-Friendly Product Lines

With sustainability trends accelerating, there is an opportunity for brands to differentiate themselves through recycled materials, organic stuffing, and environmentally conscious packaging. Marketing plush toys as safe, eco-friendly options resonates with consumers and retailers, supporting long-term growth.

Product Type Insights

Stuffed animals dominate the plush toy market, accounting for approximately 45% of the global market in 2024. Their versatility, wide age appeal, and connection with franchise characters make them the leading segment. Over the years, the trend toward themed, collectible, and interactive stuffed animals has strengthened their dominance.

Application Insights

Children aged 3–12 years represent the largest end-use segment, contributing to nearly 50% of global plush toy sales in 2024. Parents increasingly purchase plush toys as educational, interactive, and gifting products. Additionally, therapeutic uses in hospitals and mental wellness applications are emerging as niche but growing applications.

Distribution Channel Insights

Online retail is the fastest-growing channel, driven by convenience, global accessibility, and direct-to-consumer customization. Brick-and-mortar stores continue to contribute significantly, particularly for impulse purchases and premium products. Specialty toy stores and mass retailers remain important for distribution, particularly in developed markets.

| By Product Type | By Application / End-Use | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America accounts for roughly 30% of the global plush toy market in 2024. The U.S. dominates due to high disposable incomes, strong brand presence, and preference for licensed products. Canada also shows steady growth, driven by retail and gifting demand.

Europe

Europe contributes about 25% of the market in 2024, led by Germany and the U.K. Consumers are increasingly favoring sustainable and collectible plush toys, driving demand. The region is also seeing a rise in adult collectors and specialty stores for licensed merchandise.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China and Japan. Rising disposable income, urbanization, and franchise licensing are boosting plush toy adoption. The region presents strong potential for tech-enabled and themed products targeting children and adult collectors.

Latin America

Brazil and Mexico are key markets, showing growing interest in both domestic and imported plush toys. Growth is primarily driven by urban retail expansion and increasing middle-class income.

Middle East & Africa

The UAE and South Africa are emerging markets, driven by affluent consumers and expanding retail infrastructure. Local preferences for gifting and collectibles are encouraging new product introductions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plush Toy Market

- Mattel

- Hasbro

- Build-A-Bear Workshop

- Gund

- Jellycat

- Ty Inc.

- Disney Consumer Products

- Funko

- Steiff

- Hape

- Melissa & Doug

- Fisher-Price

- VTech

- Kidz Inc.

- LeapFrog Enterprises

Recent Developments

- In March 2025, Build-A-Bear Workshop expanded its interactive plush toy line in North America, integrating app-based customization features.

- In January 2025, Mattel launched a sustainable plush toy collection made from recycled materials in Europe and North America.

- In December 2024, Hasbro introduced limited-edition franchise-based plush toys targeting adult collectors in Asia-Pacific and Europe.