Plastic Logistics Box Market Size

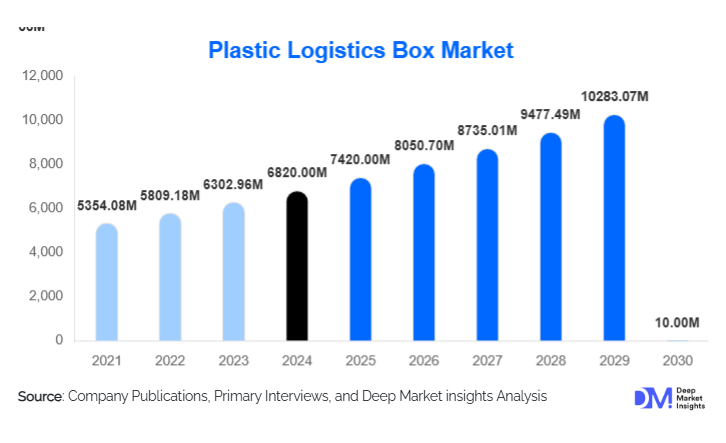

According to Deep Market Insights, the global plastic logistics box market size was valued at USD 6,820 million in 2024 and is projected to grow from USD 7,240 million in 2025 to reach USD 10,910 million by 2030, expanding at a CAGR of 8.5% during the forecast period (2025–2030). The growth of the plastic logistics box market is primarily driven by the increasing adoption of returnable and reusable packaging solutions across logistics, retail, and manufacturing industries, as well as a growing focus on supply chain efficiency, sustainability, and cost optimization in material handling operations.

Key Market Insights

- The rising shift toward circular logistics and reusable packaging solutions is propelling the adoption of durable plastic logistics boxes across industries.

- Manufacturing, food & beverage, and e-commerce sectors are the leading end users due to high dependency on organized storage and return logistics.

- Foldable and stackable plastic crates dominate due to their space efficiency and lower transport costs.

- Asia-Pacific leads the global market, supported by massive industrial output, expanding e-commerce, and the shift toward automation in warehousing.

- Smart and RFID-enabled plastic boxes are gaining popularity for real-time tracking and inventory management in logistics chains.

Latest Market Trends

Smart Logistics Packaging with IoT and RFID Integration

One of the most significant trends in the plastic logistics box market is the integration of RFID tags and IoT sensors for tracking and monitoring goods in transit. Smart packaging solutions provide real-time visibility, reduce loss and theft, and streamline warehouse operations. Logistics providers and retailers are deploying these smart boxes for temperature-sensitive goods, pharmaceuticals, and perishables. RFID-enabled boxes also help automate sorting, improve accuracy, and lower human dependency in distribution centers.

Growing Popularity of Foldable and Modular Designs

Foldable plastic logistics boxes are witnessing increasing demand due to their ability to minimize storage and transportation space when empty. Companies are adopting collapsible, modular, and stackable designs to optimize reverse logistics. These boxes are designed for long lifecycle use, offering a strong ROI compared to single-use cardboard packaging. The trend aligns with sustainability mandates and drives the transition from disposable to circular logistics systems, particularly across Europe and Asia.

Rising Demand for Sustainable and Recyclable Plastic Materials

Manufacturers are increasingly using high-density polyethylene (HDPE) and polypropylene (PP) with enhanced recyclability and durability. The move toward closed-loop systems, where damaged boxes are recycled to make new ones, is gaining momentum. Brands are also exploring bio-based plastics for logistics packaging to reduce carbon footprint, aligning with ESG objectives of global corporations and regulations promoting sustainable material use.

Plastic Logistics Box Market Drivers

Growth in E-commerce and 3PL Warehousing

The exponential rise of e-commerce and third-party logistics (3PL) services has intensified demand for durable, reusable, and stackable packaging solutions. Plastic logistics boxes help reduce packaging waste, streamline order fulfillment, and improve warehouse automation compatibility. As global e-commerce sales continue to grow at over 12% annually, the demand for standardized storage and transport containers across fulfillment centers is expected to surge significantly.

Shift Toward Returnable Transport Packaging (RTP)

Industries are moving away from one-way packaging systems toward reusable transport solutions to reduce costs and environmental impact. Plastic logistics boxes, being sturdy, lightweight, and weather-resistant, form a key component of RTP systems used by automotive, electronics, and retail sectors. This transition supports long-term cost savings and aligns with global sustainability targets.

Expansion of Automated Warehouses

The rapid adoption of robotics and automated storage & retrieval systems (AS/RS) in modern warehouses necessitates uniform, durable, and stackable plastic boxes compatible with conveyors and robotic handling. These standardized containers ensure operational consistency and reduce downtime. Companies investing in warehouse automation, especially in North America, China, and Germany, are significantly driving this segment’s growth.

Market Restraints

High Initial Investment and Material Costs

Although reusable boxes lower long-term expenses, their initial procurement cost is significantly higher than traditional packaging options like cardboard or wooden crates. Small-scale logistics operators and retailers often hesitate to adopt them due to limited capital expenditure flexibility. Volatility in polymer prices also impacts manufacturers’ profitability and end-user pricing.

Recycling Challenges and Plastic Regulations

Environmental concerns related to plastic waste management and stringent regulations on plastic production in Europe and parts of Asia pose challenges for manufacturers. The need for closed-loop recycling systems and compliance with extended producer responsibility (EPR) laws increases operational complexity. Additionally, the collection and cleaning logistics of returnable boxes can add to supply chain costs.

Plastic Logistics Box Market Opportunities

Integration of Smart Tracking Technologies

Opportunities abound in the integration of IoT, GPS, and RFID-based tracking into plastic logistics boxes. Smart boxes allow companies to monitor cargo conditions, enhance security, and improve supply chain transparency. As real-time data becomes critical in logistics operations, manufacturers investing in connected packaging technologies will gain a competitive advantage, particularly in pharmaceuticals, cold chain logistics, and high-value goods.

Expansion in Emerging Markets

Emerging economies in Asia-Pacific, Latin America, and the Middle East are witnessing a surge in industrialization, organized retail, and e-commerce penetration. This creates substantial demand for plastic logistics boxes for efficient goods movement and storage. Governments promoting manufacturing growth through initiatives like “Made in China 2025” and “Make in India” are boosting logistics infrastructure investments, opening new opportunities for plastic box manufacturers and suppliers.

Adoption of Circular Economy Models

The rising focus on circular logistics and ESG compliance presents long-term opportunities for closed-loop packaging solutions. Plastic logistics boxes can be reused hundreds of times, supporting zero-waste supply chains. Major corporations are partnering with packaging solution providers to deploy take-back and refurbishment programs, reducing landfill waste while enhancing brand sustainability credentials.

Segmentation Analysis

By Material Type

- High-Density Polyethylene (HDPE) – Holding a dominant 46% market share in 2024, HDPE remains the preferred material for plastic logistics boxes owing to its superior impact strength, excellent chemical resistance, and high load-bearing capacity. Its recyclability and environmental sustainability further enhance its popularity among manufacturers aiming to reduce carbon emissions and comply with green logistics policies. The material’s rigidity and long service life make it highly suitable for heavy-duty supply chain operations in industries such as automotive, food & beverage, and retail distribution.

- Polypropylene (PP) – Known for its lightweight structure and cost efficiency, PP is widely used in applications requiring flexibility and easy handling. It offers a good balance between mechanical performance and chemical resistance, making it suitable for packaging sensitive components in electronics and pharmaceuticals. PP-based logistics boxes are also favored in cold-chain applications due to their stability under varying temperature conditions.

- Polycarbonate (PC) – This material category serves niche applications that require high transparency, superior dimensional stability, and extreme durability. PC boxes are often used in precision logistics, laboratory handling, and healthcare operations where clarity and contamination resistance are critical.

- Other Engineering Plastics – Including ABS, PET, and reinforced composites, these materials are used for specialized boxes requiring specific performance attributes such as anti-static properties, high tensile strength, or temperature resistance. They cater to customized industrial applications, particularly in high-value electronics and chemical logistics.

By Product Type

- Stackable Boxes – Representing approximately 41% of the total market share in 2024, stackable boxes are the most widely adopted design type due to their compatibility with automated storage and retrieval systems (AS/RS) and efficient warehouse stacking capabilities. Their uniform dimensions and interlocking features help optimize vertical space in logistics facilities, reducing transportation and warehousing costs. The growing use of robotics and automation in material handling further supports their dominance.

- Foldable Boxes – Designed for space optimization during return logistics, foldable boxes have gained traction in closed-loop supply chains. They allow up to 70–80% volume reduction when collapsed, offering substantial savings in reverse logistics and storage space, particularly in e-commerce and retail distribution networks.

- Nestable Boxes – These boxes are ideal for applications requiring frequent handling and easy stacking without lids. Nestable boxes reduce space requirements during transport and are increasingly popular in short-distance logistics, agriculture, and supermarket distribution centers.

- Customized and Heavy-Duty Boxes – These are engineered for specific industrial requirements, including high-impact resistance, static control, and compatibility with conveyor systems. Customized boxes are particularly used in the automotive, aerospace, and electronics industries where product-specific protection is essential.

By Application

- Warehouse & Distribution – Accounting for about 38% of total revenue in 2024, this segment leads the global market, supported by the rapid expansion of third-party logistics (3PL) providers, industrial storage hubs, and automated warehouses. Plastic logistics boxes in this segment are used for sorting, picking, and bulk material handling. The shift toward modular warehouse infrastructure and digitalized inventory systems has further amplified the use of durable and RFID-compatible boxes.

- Retail – Retail chains and supermarkets increasingly rely on returnable plastic boxes for inventory replenishment, shelf stocking, and product protection. The push for sustainable packaging and waste reduction initiatives has boosted demand across the retail logistics chain.

- Manufacturing – Manufacturing facilities utilize plastic logistics boxes for internal material transport, component organization, and work-in-progress (WIP) storage. Their lightweight yet sturdy construction helps streamline lean manufacturing practices and just-in-sequence (JIS) operations.

- E-commerce Fulfillment – The rapid rise in online retail and last-mile delivery operations has led to an increase in the use of durable plastic boxes for order picking and shipping. E-commerce warehouses increasingly prefer standardized containers that can be reused for returns management and inter-facility transfers.

- Pharmaceutical Logistics – Plastic logistics boxes play a critical role in maintaining hygiene, contamination prevention, and product safety during the transport of pharmaceuticals, medical devices, and diagnostic kits. The industry’s stringent regulatory standards have accelerated the shift from cardboard to reusable plastic packaging.

By End-Use Industry

- Food & Beverage – Dominating the market with a 33% share in 2024, the food and beverage sector relies heavily on plastic logistics boxes for hygienic, reusable, and temperature-stable storage and transport solutions. These boxes are essential for handling perishable goods, beverages, and bakery items, with the growing adoption of returnable crate systems by global food processors and retailers. Compliance with food safety standards and the need for easy sanitation drive their continued preference.

- Automotive – The automotive sector utilizes durable, standardized plastic containers for transporting components across assembly lines and between suppliers. The shift toward electric vehicles (EVs) has increased logistics complexity, further emphasizing the need for reliable and reusable packaging.

- Electronics – Sensitive electronic components require anti-static, shock-resistant packaging. Plastic boxes with ESD protection are becoming a standard across electronics manufacturing hubs, especially in East Asia.

- Healthcare – Hospitals, pharmaceutical distributors, and laboratories increasingly use plastic boxes for sterile, traceable, and reusable logistics of medical supplies and specimens. The trend toward sustainable hospital supply chains further boosts demand.

- Consumer Goods – FMCG and retail brands adopt plastic logistics boxes to improve supply chain efficiency, reduce packaging waste, and enable automation-compatible handling for high-volume product movement.

End-Use Analysis

The food & beverage industry continues to lead global demand, accounting for around 33% of the total market share in 2024. Its dominance stems from the growing emphasis on hygiene, sustainability, and reusability within the food supply chain. Plastic logistics boxes ensure contamination-free transport for bakery goods, fruits, vegetables, meat, and beverages while minimizing waste generation. The adoption of returnable plastic crates (RPCs) by large retail chains and food processors further reinforces this trend.

The automotive and electronics sectors are emerging as high-growth end-use segments, driven by the adoption of just-in-time (JIT) and just-in-sequence (JIS) manufacturing models. These industries prioritize precision, safety, and reusability in logistics, making plastic boxes a critical part of their supply chain infrastructure. Furthermore, the e-commerce and retail sector is forecast to register a strong CAGR of 10.2% during 2025–2030, supported by the global expansion of omnichannel retailing, last-mile logistics, and warehouse automation. Online marketplaces and logistics providers increasingly use lightweight, collapsible plastic boxes to handle bulk returns and deliveries efficiently.

Export-oriented manufacturing hubs in Asia-Pacificnotably China, India, Vietnam, and Indonesia driving additional demand as they supply a wide range of industrial and consumer goods globally. These regions are investing in durable, cost-effective, and environmentally sustainable logistics containers to improve operational efficiency and reduce packaging waste. The convergence of smart warehousing, traceable logistics systems, and government-driven sustainability mandates will continue to fuel the global adoption of plastic logistics boxes over the forecast period.

| By Material Type | By Product Type | By Load Capacity | By Application | By End-Use Industry |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

Asia-Pacific (APAC)

Asia-Pacific dominates the global plastic logistics box market with a 41% share in 2024, led by China, Japan, India, and South Korea. Strong manufacturing bases, rapid growth in e-commerce, and rising investments in smart warehouses are key drivers. China alone accounts for nearly 24% of global production, supported by local manufacturers adopting automation and smart packaging solutions. India’s logistics modernization and government push under “Make in India” are further enhancing domestic production and export potential.

Europe

Europe holds a 27% share in 2024, driven by stringent sustainability regulations, widespread adoption of reusable packaging, and mature retail logistics infrastructure. Germany, France, and the U.K. lead demand, with Germany accounting for 9% of the global market. The EU’s green packaging directives and emphasis on circular economy practices continue to drive innovation in recycled plastic logistics boxes.

North America

North America represents around 22% of the market, supported by automation in warehousing, large-scale retail distribution networks, and sustainability initiatives. The U.S. dominates regional demand, while Mexico’s growing manufacturing exports to the U.S. are boosting cross-border logistics packaging demand. Adoption of RFID-integrated plastic crates in major 3PL hubs is on the rise.

Middle East & Africa

This region holds approximately 6% of the global market. The UAE, Saudi Arabia, and South Africa are leading adopters, driven by expanding logistics hubs, food distribution, and manufacturing diversification programs. Initiatives like “Saudi Vision 2030” are encouraging logistics automation and the reuse of packaging systems.

Latin America

Latin America accounts for 4% of the market, led by Brazil and Mexico. Expanding industrial and retail infrastructure and increasing focus on sustainable logistics solutions contribute to steady growth. Regional demand is expected to grow at a CAGR of 7.3% through 2030.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plastic Logistics Box Market

- Schoeller Allibert Group

- DS Smith Plc

- ORBIS Corporation (Menasha Corporation)

- Myers Industries, Inc.

- Mpact Limited

- Rehrig Pacific Company

- SSI Schaefer Group

- UTZ Group

- Brambles Limited (CHEP)

- NEFAB Group

- Greif, Inc.

- Craemer Group

- Plastor Ltd.

- WALTHER Faltsysteme GmbH

- AUER Packaging GmbH

Recent Developments

- In June 2025, Schoeller Allibert launched its new “SmartBox Series” featuring embedded IoT sensors for tracking reusable packaging in logistics chains.

- In April 2025, ORBIS Corporation announced a $40 million investment in its U.S. production facilities to expand returnable plastic container capacity.

- In January 2025, DS Smith introduced a 100% recyclable polypropylene logistics crate range aimed at retail and e-commerce clients.