Plastic Furniture Market Size

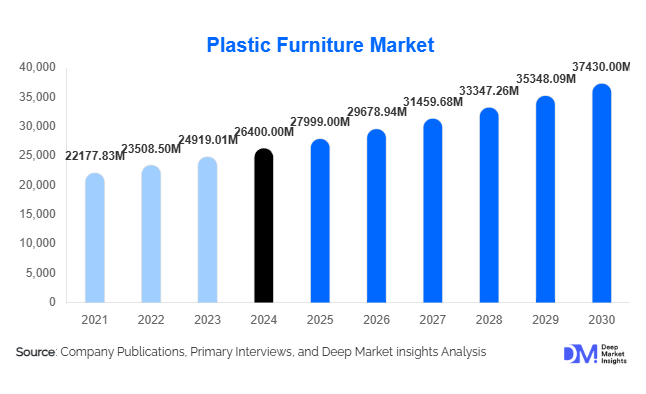

According to Deep Market Insights, the global plastic furniture market size was valued at USD 26,400 million in 2024 and is projected to grow from USD 27,999 million in 2025 to reach USD 37,430 million by 2030, expanding at a CAGR of 6.0% during the forecast period (2025–2030). The market growth is primarily driven by rapid urbanization, increasing demand for affordable and modular furniture solutions, rising adoption of recycled plastics, and expanding outdoor and hospitality infrastructure worldwide.

Key Market Insights

- Polypropylene (PP) remains the dominant material segment, accounting for 35% of the global market, due to its versatility, cost-effectiveness, and wide use across chairs, tables, and outdoor furniture.

- Chairs lead the product category, representing 40% of the market share in 2024, as stackable, foldable, and molded plastic chairs are widely adopted in residential, commercial, and institutional settings.

- Residential end-use dominates globally, contributing 60% of total market revenue, driven by urban households, smaller living spaces, and e-commerce penetration.

- Offline specialty stores currently lead distribution, holding a 55% share, though online/e-commerce channels are rapidly growing due to convenience and direct-to-consumer models.

- Asia-Pacific is the largest and fastest-growing region, accounting for 58% of the global market, with China, India, and Southeast Asia leading demand due to urbanization, middle-class growth, and export-oriented manufacturing.

- Technological integration, including recycled plastic adoption, modular designs, UV-resistant coatings, and smart outdoor furniture solutions, is reshaping product offerings and enhancing durability and consumer appeal.

Latest Market Trends

Sustainable and Recycled Plastic Furniture

Manufacturers are increasingly integrating recycled plastics and sustainable polymers into furniture production, addressing growing consumer environmental awareness and regulatory pressures. Circular economy initiatives, including furniture made from post-consumer plastics and design-for-recycling practices, are gaining traction in Europe and North America. These trends enhance brand differentiation and cater to environmentally conscious consumers, while simultaneously reducing dependency on virgin polymers and mitigating raw material price volatility.

Modular and Multi-Functional Furniture Designs

The demand for compact, modular, and multi-functional furniture is rising, particularly in urban apartments and smaller living spaces. Products such as foldable tables, stackable chairs, and modular storage solutions offer convenience, portability, and space optimization. This trend is expanding adoption among residential consumers and commercial/institutional buyers seeking flexible furnishing solutions.

Plastic Furniture Market Drivers

Urbanization and Growing Middle-Class Households

Rapid urbanization in Asia-Pacific, Latin America, and parts of Africa is creating demand for lightweight, affordable, and space-saving furniture solutions. Rising household formation in cities drives the need for modular and cost-effective plastic furniture, particularly in apartments and rental housing, making this segment a key growth driver.

Cost-Effectiveness and Low Maintenance

Plastic furniture is less expensive than wood or metal alternatives and offers resistance to moisture, pests, and corrosion. Its low maintenance and long lifespan make it ideal for outdoor, commercial, and residential applications. This cost-effectiveness enables broad market penetration and adoption across value-conscious consumer segments globally.

Hospitality and Outdoor Infrastructure Growth

Expansion of hotels, restaurants, cafes, and outdoor recreational spaces is driving demand for durable, weather-resistant, and lightweight furniture. Plastic chairs, tables, and outdoor sets are increasingly preferred for commercial projects, contributing significantly to market growth, especially in export-driven regions such as the Asia-Pacific.

Market Restraints

Environmental Concerns and Regulatory Pressure

Plastic furniture faces scrutiny due to environmental concerns, such as plastic waste and low recyclability. Regulatory restrictions on non-recyclable plastics in Europe and North America may increase production costs or limit market expansion. Manufacturers must adopt sustainable materials and recycling initiatives to comply with regulations.

Competition from Alternative Materials

Wood, metal, and engineered wood remain preferred options for premium furniture segments. Perceived lower quality of plastic furniture may restrict its adoption in high-end markets. This competition can limit market penetration in the luxury and designer furniture categories.

Plastic Furniture Market Opportunities

Emerging Geographies and Urban Middle-Class Expansion

Growing urban populations in India, Southeast Asia, and parts of Africa present significant opportunities. New households and rental apartments create demand for affordable, modular, and space-saving furniture. Localized manufacturing and distribution can allow companies to cater effectively to these rapidly growing markets.

Sustainability and Circular Economy Integration

The shift toward recycled plastics and sustainable furniture offers opportunities for differentiation. Companies adopting post-consumer plastics, bio-based polymers, and fully circular models can access premium segments and export markets, enhancing both environmental credibility and profit margins.

Smart and Multi-Functional Furniture

Increasing demand for foldable, stackable, modular, and outdoor furniture with integrated features (e.g., wireless charging, lighting) provides growth potential. Hospitality, residential, and commercial buyers are adopting these innovative designs, creating avenues for higher-margin offerings and market expansion.

Product Type Insights

Chairs continue to dominate the plastic furniture market due to their high-volume usage across residential, commercial, and institutional applications. Stackable, foldable, and ergonomic designs enhance multi-purpose usability, making them ideal for space-conscious urban homes, offices, and schools. Outdoor chairs are also increasingly exported from Asia-Pacific manufacturing hubs, benefiting from durable, weather-resistant designs. Tables, storage units, and complete outdoor sets follow closely, with modularity and resistance to environmental conditions driving adoption. The ongoing trend toward ergonomic, sustainable, and recycled plastic furniture is further stimulating growth, particularly in the residential segment, which is motivated by the demand for affordable and easy-to-maintain furniture solutions.

Application Insights

The residential sector accounts for the largest share of plastic furniture demand, driven by compact urban living spaces and the need for cost-effective, low-maintenance furniture. Meanwhile, commercial and institutional applications, including offices, hotels, restaurants, and educational institutions, are emerging as the fastest-growing segments, reflecting a strong need for durable, high-performance furniture in high-traffic areas. Outdoor furniture applications for leisure, hospitality, and public spaces are expanding, particularly in export markets. The growing popularity of outdoor living spaces is driving demand for weather-resistant furniture, including patio sets, garden chairs, and foldable tables. Additionally, multi-functional modular furniture and smart designs are creating new niches across both residential and commercial applications.

Distribution Channel Insights

Offline specialty stores currently hold the largest share of the market due to their strong presence, product variety, and ability to serve bulk buyers. However, e-commerce channels are rapidly expanding, offering consumers convenience, transparent pricing, and access to direct-to-consumer models. Direct B2B supply for commercial and institutional buyers is also significant, particularly for large-scale projects in hospitality and office sectors. Online platforms are accelerating the adoption of modular, multi-functional, and ergonomic furniture, especially among younger, urban consumers seeking affordable and sustainable solutions.

End-Use Insights

The residential segment accounts for approximately 60% of the global market, with urban households increasingly seeking lightweight, affordable, and low-maintenance furniture solutions. Commercial and institutional segments are expanding the fastest, driven by high demand from offices, hotels, schools, and hospitals that require durable and cost-effective furniture capable of withstanding heavy use. Export-driven demand, particularly from Asia-Pacific manufacturers to North America, Europe, and the Middle East, is further accelerating growth. Outdoor and multi-functional furniture remains a key contributor, with rising adoption for both leisure and commercial purposes. These trends highlight the convergence of affordability, durability, and innovation in driving end-use demand.

| By Product Type | By Application | By End-Use Segment | By Distribution Channel |

|---|---|---|---|

|

|

|

|

Regional Insights

Asia-Pacific

Asia-Pacific dominates the global plastic furniture market with a 58% share (USD 10.5 billion in 2024), led by China, India, and Southeast Asia. Rapid urbanization, rising disposable incomes, and a growing middle class drive residential demand. Additionally, large-scale manufacturing capabilities and the region’s status as an export hub enhance global market penetration. The segment-specific growth in residential and outdoor furniture is propelled by increasing urban apartment developments and the growing popularity of outdoor living spaces. The region is also the fastest-growing globally, with a CAGR of 6%, supported by investments in sustainable plastics, modular designs, and increasing adoption of ergonomic furniture in both domestic and international markets.

North America

North America accounts for 20–25% of the global market (USD 3.6–4.5 billion in 2024). Strong demand in urban areas for lightweight, durable, and low-maintenance furniture is a key regional driver. Growth is fueled by home renovation trends, increased adoption of outdoor living solutions, and commercial/institutional procurement in offices and educational institutions. Premium, ergonomic, and outdoor furniture segments are seeing steady growth due to high disposable income, lifestyle shifts, and consumer focus on sustainability and modular designs. Segment-specific drivers, such as residential demand for affordable and easy-to-maintain furniture, and commercial need for durable high-traffic solutions, reinforce North America’s market position.

Europe

Europe represents 15–20% of the global market, with Germany, the UK, France, Italy, and Spain as the leading countries. Strong consumer focus on sustainability and design innovation drives market adoption, particularly for recycled and eco-friendly plastics. Demand is also supported by urban living trends and an increasing preference for outdoor and leisure furniture in both residential and commercial spaces. Segment-specific drivers include residential demand for functional, low-maintenance solutions and commercial applications for durable, cost-effective furniture. Moderate but steady growth is expected, driven by premium and sustainable product segments that align with regulatory standards and environmentally conscious consumer behavior.

Latin America

Latin America accounts for 5–8% of the market, with Brazil, Mexico, and Argentina as key contributors. Market growth is driven by urbanization, expanding middle-class populations, and increasing demand in the hospitality and commercial sectors. Residential segment adoption is rising, particularly for lightweight and affordable furniture. Outdoor furniture demand is also growing, reflecting lifestyle changes and leisure-focused residential trends. Despite smaller volumes compared to Asia-Pacific or North America, the region presents opportunities in both urban residential and commercial applications.

Middle East & Africa

MEA holds 3–5% of the global market, with the UAE, Saudi Arabia, and South Africa as leading countries. Growth is fueled by high demand in outdoor and hospitality applications, luxury residences, and import-driven supply from Asia-Pacific manufacturers. Urban development, tourism, and hospitality infrastructure expansion drive both residential and commercial furniture consumption. Segment-specific demand is pronounced for outdoor and modular furniture due to climate conditions, high disposable income, and lifestyle trends favoring patio, garden, and leisure seating. Government-led urbanization projects and international trade links further support regional growth.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Plastic Furniture Market

- Nilkamal Limited

- Keter Group

- Inter IKEA Systems B.V.

- Ashley Furniture Industries, Inc.

- Tramontina

- The Supreme Industries Limited

- Cello Group

- PIL Italica Lifestyle Ltd.

- ScanCom International A/S

- Cosmoplast Industrial Company LLC

- Avro India Ltd.

- Vitra International AG

- Uma Plastics Limited

- Dorel Industries Inc.

- Grosfillex

Recent Developments

- In March 2025, Nilkamal Limited expanded its manufacturing capacity in India, integrating recycled PP materials for outdoor furniture production.

- In January 2025, Keter Group launched a new modular outdoor furniture line targeting e-commerce channels across Europe and North America.

- In February 2025, Tramontina introduced UV-resistant and ergonomic plastic chairs for hospitality and commercial sectors in Latin America.