Pizza Oven Market Size

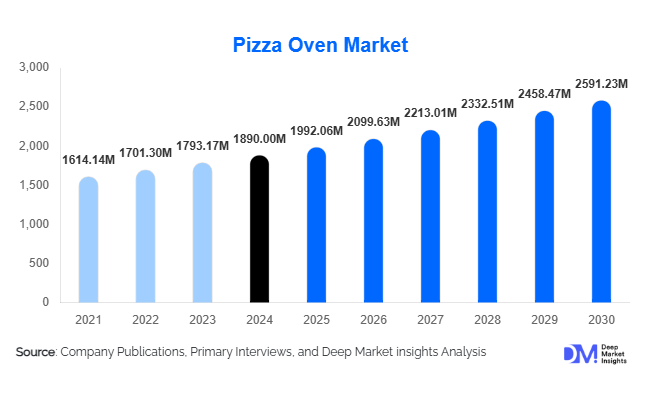

According to Deep Market Insights, the global pizza oven market size was valued at USD 1,890.00 million in 2024 and is projected to grow from USD 1,992.06 million in 2025 to reach USD 2,591.23 million by 2030, expanding at a CAGR of 5.4% during the forecast period (2025–2030). Market growth is primarily driven by the increasing global popularity of pizza consumption, the expansion of food-service chains, and the rising adoption of high-performance and smart cooking appliances for both commercial and residential use.

Key Market Insights

- Commercial demand dominates the pizza oven market, accounting for over 70% of global sales, fueled by quick-service restaurant and pizza chain expansion.

- Residential outdoor pizza ovens are witnessing robust growth as consumers invest in home-based gourmet cooking and outdoor kitchen setups.

- Gas-fuelled ovens lead the market with nearly 47% share due to operational convenience and compatibility with commercial kitchen infrastructure.

- North America holds the largest market share (around 43%), supported by strong food-service penetration and premium outdoor appliance trends.

- Asia-Pacific is the fastest-growing region, with forecast CAGR exceeding 11%, driven by urbanization, income growth, and Western food adoption in China and India.

- Technological innovations such as hybrid-fuel models, smart temperature control, and IoT-integrated ovens are enhancing product differentiation and profitability.

Latest Market Trends

Hybrid and Smart Pizza Ovens Gain Popularity

Hybrid-fuel pizza ovens that combine wood-fired flavor with gas or electric convenience are rapidly gaining traction. These systems allow flexibility in cooking styles, reduce emissions, and ensure faster preheating times. Additionally, smart connectivity features such as Wi-Fi control, temperature automation, and integrated digital thermometers are reshaping how both restaurants and homeowners use ovens. Manufacturers are emphasizing precision and energy efficiency, appealing to tech-savvy and eco-conscious consumers.

Outdoor Kitchen and Lifestyle Integration

Outdoor cooking is evolving from a seasonal activity to a lifestyle trend, especially in North America and Europe. Pizza ovens are becoming central to backyard kitchens and entertainment spaces. Portable and modular pizza ovens designed for patios and rooftops are driving residential sales. The shift toward outdoor living, complemented by online retail availability and home renovation investments, is expanding the market among mid- to high-income households.

Pizza Oven Market Drivers

Expansion of Food-Service and QSR Chains

Rapid global expansion of pizza-centric quick-service restaurants (QSRs) and delivery chains is a primary growth driver. With pizza ranking among the top five fast-food categories worldwide, commercial kitchens are investing in high-capacity conveyor and deck ovens to ensure consistent output and quality. Emerging chains in Asia and Latin America are adopting cost-efficient, gas-based pizza ovens, stimulating strong equipment demand.

Rising Residential Demand and Outdoor Living Trends

Homeowners are increasingly investing in premium appliances that replicate restaurant-grade performance. The surge in outdoor kitchen installations and cooking-as-entertainment trends, especially in the U.S., U.K., and Australia, is boosting sales of compact and portable pizza ovens. Social media and influencer marketing around home pizza-making have amplified product visibility among younger, experience-driven consumers.

Technological and Energy Efficiency Innovations

Continuous advancements in oven design, such as better insulation, multi-fuel flexibility, faster heat-up, and low energy consumption, are expanding the addressable market. Smart ovens with automated cooking cycles and energy-efficient designs appeal to both residential users and eco-conscious restaurants looking to lower operational costs and emissions.

Market Restraints

High Initial and Maintenance Costs

Premium pizza ovens, particularly wood-fired or hybrid commercial units, require significant upfront investment and periodic maintenance. Installation and ventilation needs increase costs for smaller establishments and residential buyers. The price-sensitive mid-tier segment often delays purchases due to these capital barriers.

Regulatory and Emission Compliance

Urban emission regulations and ventilation codes, especially affecting wood- and coal-fired ovens, present operational challenges for restaurateurs. Compliance with smoke and particulate standards adds to installation costs, limiting widespread adoption in densely populated areas.

Pizza Oven Market Opportunities

Emerging Regional Demand

Rising pizza consumption and QSR expansion across India, Southeast Asia, and Latin America are unlocking significant untapped potential. Manufacturers introducing cost-effective and energy-efficient ovens tailored for local conditions can secure first-mover advantages in these rapidly urbanizing regions.

Next-Generation Smart and Multi-Fuel Ovens

IoT integration, app-based control, and hybrid-fuel flexibility represent lucrative opportunities for differentiation. Manufacturers offering eco-friendly, automated, and user-friendly ovens will gain an edge as both commercial kitchens and households adopt technology-enhanced cooking solutions.

Integration with the Outdoor Living Segment

Pizza ovens are increasingly marketed as lifestyle products within the outdoor kitchen and leisure segment. Partnerships with home-improvement retailers, e-commerce platforms, and builders developing outdoor entertainment zones will create long-term growth avenues.

Product Type Insights

Product type demand is shaped by the balance between authenticity, performance, and cost efficiency. Innovations in materials, heat distribution, and automation are driving segmental differentiation. Among all product types, convection pizza ovens dominate the global market, accounting for approximately 34% share in 2024. Their superior energy efficiency, rapid cooking capability, and flexibility across commercial and residential settings make them the preferred choice for diverse users. Conveyor ovens follow closely, supported by the proliferation of QSR chains and delivery-oriented pizzerias that require consistent, high-throughput baking. Brick or masonry ovens continue to appeal to artisan restaurants emphasizing authenticity and theater, while deck ovens remain popular among traditional pizzerias for their batch consistency and superior crust control. Portable and countertop ovens are the fastest-growing category, boosted by outdoor living trends, e-commerce adoption, and demand for affordable, compact solutions for home use.

Fuel Type Insights

Fuel preferences are evolving with safety regulations, user convenience, and sustainability concerns influencing technology adoption. Gas-fuelled ovens lead the global market, representing roughly 47% share in 2024. They offer rapid heat-up times, precise temperature control, and compliance with emission norms, making them ideal for commercial kitchens. Wood-fired ovens maintain a strong presence in the artisanal and premium restaurant segment due to their authentic flavor and experiential appeal. Electric ovens are gaining popularity in residential and indoor settings, particularly in apartments and condos where gas or wood use is restricted. Dual-fuel ovens, combining gas or electric heating with wood-fired flavor, are emerging as an adaptive solution in regions with stringent fuel-use regulations, catering to hybrid needs in both residential and light commercial spaces.

End-Use Insights

Expanding QSR networks, rising consumer spending on dining experiences, and home gourmet cooking trends continue to define the end-user landscape. The commercial segment dominates the global pizza oven market, accounting for approximately 72% of total revenue in 2024. Key demand originates from QSR chains, independent pizzerias, hotels, and food-service establishments that prioritize performance, throughput, and consistency. Residential demand, although smaller in base, shows the highest growth trajectory with a forecast CAGR exceeding 8%. This surge is supported by the increasing adoption of compact outdoor ovens, home renovation projects, and rising interest in gourmet cooking. The emergence of ghost kitchens and mobile food trucks has further accelerated commercial demand, emphasizing compact, energy-efficient, and portable oven formats that fit diverse operational needs.

Distribution Channel Insights

Expanding e-commerce networks and specialized retail ecosystems are transforming pizza oven accessibility for both residential and professional buyers. Offline specialty stores continue to dominate global sales, accounting for approximately 34% of market revenue in 2024. Physical retail remains crucial for product demonstrations, installation assistance, and after-sales service, especially in commercial markets. However, online retail channels are rapidly gaining traction as manufacturers and OEMs enhance their digital presence, offering direct-to-consumer models through brand websites and global e-commerce platforms. These channels support wider price transparency, greater product variety, and improved distribution in emerging markets, particularly in Asia-Pacific and Latin America.

| By Product Type | Fuel Type | By End-Use | By Capacity / Installation Type | By Distribution Channel |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

Outdoor living and home improvement trends, combined with high disposable incomes and a vast QSR footprint, are fueling demand for both premium residential ovens and high-capacity commercial units. North America leads the global pizza oven market with an estimated 43% share in 2024 (approximately USD 766 million). The United States anchors regional dominance, supported by robust restaurant infrastructure, high pizza consumption per capita, and growing adoption of outdoor cooking spaces featuring gas and wood-fired ovens. Canada contributes through rising residential demand for compact and portable ovens for entertainment and outdoor use. Technological innovation, such as app-connected temperature control and faster preheating cycles, is further driving premium adoption across urban and suburban households. The expanding footprint of chain restaurants and cloud kitchens continues to reinforce commercial demand.

Europe

Strong artisan pizza culture and dense restaurant networks underpin demand for traditional brick and deck ovens, while stringent EU emission regulations accelerate gas and electric innovation. Europe accounts for roughly 29% of the global market share in 2024, dominated by Italy, the U.K., Germany, and France. The region’s deep-rooted culinary heritage sustains consistent demand for both traditional and modern oven formats. Artisan pizza establishments favor masonry and deck ovens for authenticity, while QSRs are increasingly transitioning toward energy-efficient electric and gas ovens to comply with environmental standards. The rise in outdoor dining culture, particularly in southern Europe, has boosted the popularity of compact, portable, and hybrid models. Additionally, ongoing hospitality sector modernization and the refurbishment of restaurant infrastructure across Western Europe further support steady market growth.

Asia-Pacific

Rapid expansion of QSR chains, growing disposable incomes, and urbanization are spurring strong demand for both commercial and residential ovens. Asia-Pacific is the fastest-growing regional market, expected to expand at a CAGR exceeding 11% from 2025 to 2030. Countries such as China, India, Japan, and Australia are key contributors. The proliferation of pizza-focused chains and the rising influence of Western food culture are transforming local consumption patterns. Increasing localization of oven manufacturing and distribution has improved affordability and reduced dependence on imports. Government support for small food entrepreneurs and café start-ups, coupled with strong e-commerce infrastructure, is accelerating access to modern cooking appliances. Urban residential buyers increasingly favor compact electric and dual-fuel ovens designed for limited kitchen spaces, while commercial demand is driven by chain expansions and mall-based eateries.

Latin America

High pizza consumption in urban centers and the growth of small-scale pizzeria entrepreneurship are fueling demand for affordable deck and compact commercial ovens. Latin America represents an emerging growth frontier, with Brazil, Mexico, and Argentina driving regional performance. Increasing urbanization, rising disposable income, and the expansion of restaurant franchises are stimulating demand for mid-range and portable ovens. Local distributors and regional importers are playing a crucial role in bridging supply gaps, while small entrepreneurs increasingly adopt electric and gas-based deck ovens for compact operations. The growing influence of North American brands and rising demand for home-based baking appliances also support steady market growth.

Middle East & Africa

Tourism, hospitality development, and retail expansion across GCC nations are key growth enablers, driving demand for premium commercial pizza ovens in hotels, resorts, and QSRs.The Middle East and Africa region exhibits stable growth, led by the UAE, Saudi Arabia, and South Africa. Rising tourism and hospitality projects, including luxury hotels and integrated retail complexes, are creating sustained demand for high-performance commercial ovens. The popularity of international pizza chains and expanding mall-based food courts is further supporting adoption. In Africa, increasing small-business participation in food services, especially in Nigeria and Kenya, is driving localized demand for affordable electric and gas ovens. Government-backed investments in hospitality infrastructure and retail expansion projects reinforce long-term regional potential.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pizza Oven Market

- Wood Stone Corporation

- Morello Forni Italia S.r.l.

- Ooni (Döferl Ltd)

- Gozney Group

- Fontana Forni USA

- Forno Bravo LLC

- BakerStone International LLC

- EarthStone Wood-Fire Ovens Inc

- Marra Forni

- Californo Inc

- Mugnaini Imports Inc

- Le Panyol (Fayol S.A.)

- Zanolli S.p.A.

- Marsal Pizza Ovens Inc

- Ali Group Srl

Recent Developments

- In May 2025, Gozney Group unveiled its latest hybrid-fuel oven line featuring smart temperature sensors and app-based controls aimed at professional and residential users alike.

- In April 2025, Ooni launched an upgraded outdoor oven series with improved insulation and faster heat-up times, targeting North American home users.

- In February 2025, Morello Forni Italia announced a partnership with commercial kitchen equipment distributors in Southeast Asia to expand regional presence and service capabilities.