Pilates and Yoga Studios Market Size

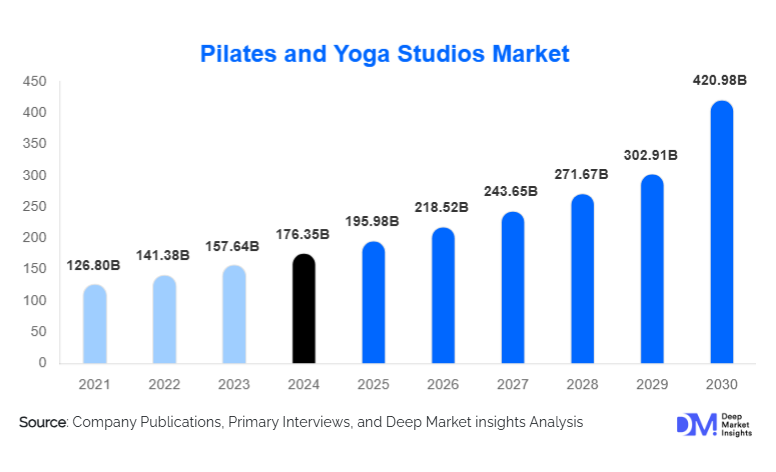

According to Deep Market Insights, the global Pilates and Yoga Studios market size was valued at USD 176.35 billion in 2024 and is projected to grow from USD 195.98 billion in 2025 to reach USD 420.98 billion by 2030, expanding at a CAGR of 11.5% during the forecast period (2025–2030). The market growth is primarily driven by rising health consciousness, increasing adoption of wellness routines, expansion of boutique fitness studios, and the integration of digital platforms providing virtual Pilates and yoga sessions to a global audience.

Key Market Insights

- Yoga remains the dominant activity type, accounting for a major share of the market due to its widespread accessibility, multiple styles, and holistic health benefits.

- Group classes are the leading service type, offering affordability, community engagement, and consistent participation among practitioners.

- North America holds the largest market share, with the U.S. leading due to high fitness awareness, disposable income, and an established wellness infrastructure.

- Asia-Pacific is the fastest-growing region, driven by rising middle-class affluence, urbanization, and increasing awareness of holistic health practices in countries like China and India.

- Technology integration, including virtual classes, app-based bookings, and online tutorials, is enhancing customer reach and engagement globally.

What are the latest trends in the Pilates and Yoga Studios market?

Digital Fitness and Virtual Classes

Adoption of technology-driven fitness platforms is transforming the Pilates and yoga market. Virtual classes, live streaming, and on-demand tutorials allow studios to expand beyond physical locations, catering to individuals unable to access traditional studios. Mobile apps provide personalized programs, progress tracking, and community forums, fostering loyalty and engagement. This trend has been accelerated by lifestyle shifts toward at-home fitness and convenience-focused solutions, particularly post-pandemic, and appeals strongly to tech-savvy consumers seeking flexible schedules and customized experiences.

Specialized Boutique Studios

Boutique Pilates and yoga studios offering specialized classes and personalized programs are gaining traction globally. These studios emphasize small-group or one-on-one sessions, tailored routines, premium equipment, and wellness-focused amenities. The boutique model attracts customers willing to pay higher premiums for quality, personalized attention, and community-oriented experiences. Many studios integrate complementary wellness services such as meditation, nutrition counseling, and holistic therapies, reinforcing the trend of combining fitness with overall mental and physical well-being.

What are the key drivers in the Pilates and Yoga Studios market?

Rising Health and Wellness Awareness

Increasing public awareness of the benefits of physical activity, flexibility, and mental health is a primary driver of market growth. Pilates and yoga are recognized for improving strength, posture, and stress management, motivating consumers across age groups to adopt these practices. Government health campaigns, wellness influencers, and social media exposure have contributed to a broader understanding of holistic fitness, directly boosting studio enrollments worldwide.

Expansion of Corporate Wellness Programs

Companies are increasingly integrating Pilates and yoga into employee wellness programs to reduce stress, improve productivity, and enhance employee satisfaction. Corporate partnerships with studios and digital platforms have emerged as a significant growth avenue, particularly in North America and Europe. By offering on-site or online classes, corporations are supporting long-term client retention and studio revenue diversification, creating a sustainable business model for service providers.

Influence of Social Media and Fitness Communities

Platforms like Instagram, YouTube, and TikTok play a pivotal role in popularizing Pilates and yoga. Fitness influencers, online challenges, and instructional content inspire participation and community-building. This trend drives both new client acquisition and retention by creating aspirational fitness narratives, increasing engagement with both in-studio and virtual offerings. Online communities encourage consistency and lifestyle integration, positioning Pilates and yoga as mainstream wellness activities.

What are the restraints for the global market?

High Operational Costs

Setting up and maintaining Pilates and yoga studios requires significant investment in physical infrastructure, equipment, and skilled instructors. High rental rates in urban areas, coupled with the cost of premium classes and wellness amenities, can limit profitability for new entrants and restrict market expansion in certain regions.

Market Saturation in Developed Regions

In countries such as the U.S., Canada, and Western Europe, a large number of established studios have intensified competition, making customer acquisition and retention more challenging. Studios must differentiate through niche offerings, technology adoption, or premium services to remain competitive, which can increase operational complexity and costs.

What are the key opportunities in the Pilates and Yoga Studios market?

Expansion in Emerging Markets

Regions such as Asia-Pacific and Latin America are witnessing rising middle-class affluence, urbanization, and health consciousness, presenting untapped growth potential. New entrants and existing studios can capitalize on these trends by establishing physical locations and offering localized digital solutions, tailored programs, and community-based wellness events.

Technology-Driven Business Models

Digital platforms, mobile apps, and online subscriptions offer significant opportunities to expand consumer reach beyond geographic limitations. Offering hybrid models combining in-studio and virtual classes allows studios to scale rapidly, improve engagement, and introduce subscription-based recurring revenue streams. AI-driven personalization and progress tracking further enhance customer satisfaction and loyalty.

Corporate and Institutional Wellness Programs

Growing recognition of the impact of workplace wellness on productivity creates opportunities for studios to collaborate with corporations, educational institutions, and healthcare providers. Custom wellness packages, on-site sessions, and partnerships with health insurance providers can generate stable revenue streams while enhancing brand credibility and visibility.

Product Type Insights

Yoga classes account for the largest segment globally, representing around 55% of the 2024 market. Its accessibility, wide variety of styles, and integration with holistic wellness practices drive adoption across diverse demographics. Pilates classes are growing steadily, particularly in boutique and premium segments, due to their focus on strength, flexibility, and rehabilitation. Group classes dominate service types, capturing approximately 60% of market share, thanks to affordability and social engagement, while one-on-one training and hybrid offerings are expanding in high-income urban areas.

Application Insights

The end-use market includes individual consumers, corporate wellness programs, and healthcare integration. Individual consumers form the bulk of demand, driven by personal fitness, mental health, and lifestyle management. Corporate programs are the fastest-growing segment, leveraging employee wellness initiatives. Hospitals and rehabilitation centers are exploring Pilates and yoga for therapeutic and physiotherapy applications. Increasing interest in preventive healthcare and lifestyle management further supports market expansion, with global demand for corporate wellness expected to grow at a 12% CAGR through 2030.

| By Activity Type | By Service Type | By End-Use |

|---|---|---|

|

|

|

Regional Insights

North America

North America holds the largest market share (approximately 35% in 2024), driven by the U.S. and Canada. High health awareness, disposable income, and mature fitness infrastructure contribute to robust demand. The corporate sector actively invests in wellness programs, and boutique studios are expanding in urban centers. Digital adoption for virtual classes and mobile subscriptions further fuels growth.

Europe

Europe accounts for nearly 28% of the global market, with Germany, the UK, and France leading demand. Rising wellness awareness, premium boutique offerings, and urban fitness culture underpin growth. Digital platforms are widely used for class bookings and virtual engagement, accelerating adoption. Europe is also focusing on integrating wellness in the corporate and healthcare sectors, increasing overall market penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing region, led by China, India, Japan, and Australia. Rapid urbanization, rising disposable income, and increasing health consciousness are driving adoption. Boutique and digital studios are expanding aggressively, with mobile apps and virtual classes enabling access to wider audiences. Government campaigns promoting healthy lifestyles also enhance growth opportunities.

Latin America

Brazil and Mexico are emerging markets for Pilates and yoga, with increasing urban fitness awareness. Boutique studios and digital solutions are attracting young professionals, while corporate wellness programs are slowly gaining traction.

Middle East & Africa

The UAE, Saudi Arabia, and South Africa are witnessing growing adoption of wellness-focused fitness. High-income populations, urban lifestyle trends, and increasing corporate wellness initiatives support market growth. Adoption of premium boutique studios and virtual platforms is also accelerating in these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pilates and Yoga Studios Market

- Equinox Group

- Life Time Fitness

- CorePower Yoga

- YogaWorks

- Orangetheory Fitness

- Barry's Bootcamp

- Club Pilates

- Pure Yoga

- Hot Yoga Company

- Flex Studios

- Zen Yoga

- Y7 Studio

- The Pilates Studio

- Body & Mind Studio

- Ashtanga Yoga Centers

Recent Developments

- In March 2025, Equinox Group launched an integrated digital platform for virtual Pilates and yoga classes across North America and Europe.

- In January 2025, CorePower Yoga expanded its boutique studio presence in Asia-Pacific, focusing on premium wellness experiences with hybrid digital options.

- In June 2024, Club Pilates introduced corporate wellness programs in collaboration with major U.S.-based companies, enhancing employee engagement and studio revenue streams.