Pico Projector Market Size

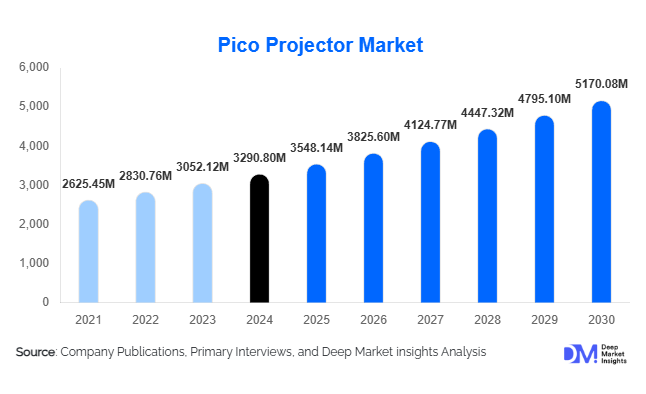

According to Deep Market Insights, the global pico projector market size was valued at USD 3,290.8 million in 2024 and is projected to grow from USD 3,548.14 million in 2025 to reach USD 5,170.08 million by 2030, expanding at a CAGR of 7.82% during the forecast period (2025–2030). The market growth is primarily driven by rising demand for compact, portable projection solutions, increasing smartphone and tablet integration, and growing adoption in education, business, and entertainment applications.

Key Market Insights

- Miniaturization and portability remain the key selling propositions of pico projectors, catering to mobile professionals and on-the-go consumers.

- LED and laser-based projectors are witnessing rapid adoption due to their longer lifespan, improved brightness, and energy efficiency.

- Consumer electronics integration—particularly with smartphones, AR/VR devices, and gaming consoles—is driving next-generation pico projector development.

- Asia-Pacific leads global production and consumption, supported by strong electronics manufacturing ecosystems in China, Japan, and South Korea.

- Wireless connectivity advancements, including Wi-Fi Direct, Bluetooth, and screen mirroring technologies, are expanding usability across multiple platforms.

- Corporate and educational digitization trends post-pandemic are significantly boosting the use of ultra-portable projection devices.

What are the latest trends in the pico projector market?

Integration with Smartphones and Smart Devices

The growing convergence of mobile technology and display systems is reshaping the pico projector industry. Manufacturers are integrating projection modules directly into smartphones and tablets or developing companion projectors optimized for mobile use. These devices enable users to stream, present, or share content wirelessly, eliminating traditional connectivity barriers. As 5G networks expand, the capability to stream high-definition and 4K content in real time via mobile pico projectors is expected to accelerate adoption among digital nomads and content creators.

Rise of Laser and LED-Based Projection

Laser and LED light sources are replacing traditional lamp-based projection technologies due to their durability, color accuracy, and reduced maintenance costs. Laser-based pico projectors, in particular, deliver superior brightness levels while maintaining ultra-compact form factors. This trend is further reinforced by the growing focus on eco-friendly and energy-efficient consumer electronics. Continuous improvements in DLP (Digital Light Processing) and LCOS (Liquid Crystal on Silicon) technologies are also enabling higher resolutions and contrast ratios in pocket-sized devices.

What are the key drivers in the pico projector market?

Increasing Demand for Portable and Wireless Display Solutions

Rising trends toward flexible work environments and mobile entertainment are driving strong demand for wireless, lightweight projectors. These devices enable instant setup for business presentations, classroom teaching, or outdoor viewing, appealing to both professionals and consumers. Enhanced battery life and compact designs are expanding market penetration in personal and enterprise segments alike. The ability to connect seamlessly with smartphones, laptops, and tablets through Bluetooth or Wi-Fi is further accelerating adoption.

Growing Adoption in Education and Corporate Sectors

Educational institutions are increasingly leveraging portable projectors for interactive learning, digital classrooms, and collaborative environments. Similarly, corporate users are adopting pico projectors for remote work setups, mobile presentations, and hybrid meeting spaces. These trends are being amplified by the ongoing digital transformation and increased preference for compact, cost-efficient display alternatives to traditional monitors and large projectors.

What are the restraints for the global market?

Limited Brightness and Image Quality in Ambient Light

Despite advancements in light source technologies, pico projectors still face performance limitations under high ambient light conditions. Their lower brightness levels compared to full-sized projectors restrict use in well-lit environments. This factor continues to hinder market penetration among professional users requiring consistent high-resolution displays in larger venues.

Short Battery Life and Connectivity Constraints

While portability remains a major advantage, shorter operational durations and dependency on external power sources limit usability for long sessions. Connectivity issues, including compatibility with specific operating systems and limited input options, also pose challenges for some consumer segments. Manufacturers are addressing these constraints through battery optimization and universal interface development, but adoption barriers remain in budget models.

What are the key opportunities in the pico projector industry?

Expansion in Gaming and Home Entertainment Applications

The growing global gaming and streaming culture presents significant opportunities for pico projectors as portable display alternatives. Compact projectors capable of projecting large screens anywhere are appealing to gamers, campers, and digital content creators. With improvements in resolution (up to 1080p and 4K) and low-latency performance, pico projectors are evolving into versatile personal entertainment hubs.

Integration with AR/VR and Wearable Devices

Emerging integration of pico projectors into augmented reality (AR) glasses, head-mounted displays, and wearable gadgets is opening new avenues for innovation. These systems use miniature projection engines to create immersive visual overlays and mixed-reality experiences. As consumer interest in AR/VR grows, component miniaturization and low-power projection technologies are expected to become critical growth enablers.

Product Type Insights

Embedded projectors (integrated into smartphones, cameras, and headsets) represent a rapidly growing segment, supported by the increasing demand for compact multimedia solutions. Standalone projectors continue to dominate market share, driven by their wide compatibility, enhanced brightness, and broader application range. Meanwhile, USB and HDMI pico projectors are preferred for plug-and-play functionality in educational and corporate setups.

Application Insights

Consumer electronics remain the leading application segment, with growing use for personal entertainment, gaming, and media sharing. Business and education segments are expanding steadily, as professionals and educators adopt portable projectors for dynamic visual communication. Healthcare and automotive sectors are emerging markets, utilizing pico projection for medical imaging displays, HUDs, and infotainment systems.

| By Product Type | By Application | By Distribution Channel | By Technology |

|---|---|---|---|

|

|

|

|

Regional Insights

North America

North America holds a significant share of the global pico projector market, supported by strong adoption in the U.S. business and education sectors. Early adoption of new consumer electronics, coupled with widespread digital infrastructure, is driving demand. The presence of key technology players and a mature retail ecosystem also strengthens market growth.

Europe

Europe’s market growth is driven by rising demand for wireless, energy-efficient projectors across corporate and educational applications. Countries such as Germany, the U.K., and France are leading adopters, emphasizing sustainability and technological innovation. The expanding hybrid work culture and smart home trends are further fueling adoption.

Asia-Pacific

Asia-Pacific dominates global production and consumption, accounting for the largest revenue share in 2024. Major manufacturing hubs such as China, Japan, and South Korea are home to leading OEMs producing low-cost, high-performance pico projectors. Rapid urbanization, growing smartphone penetration, and increased disposable incomes in emerging markets like India and Indonesia are accelerating growth.

Latin America

Latin America is witnessing gradual adoption, led by Brazil and Mexico, where educational modernization and small-business digitization are gaining momentum. Low-cost portable projectors are finding demand among freelancers and SMEs for mobile presentations and training purposes.

Middle East & Africa

The Middle East & Africa market is growing due to rising consumer electronics demand and government investments in digital education. The UAE, Saudi Arabia, and South Africa are key growth centers, driven by expanding corporate sectors and smart city initiatives.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pico Projector Market

- ASUS

- Sony Corporation

- LG Electronics

- Optoma Corporation

- AAXA Technologies Inc.

- Philips

- ViewSonic Corporation

- Anker Innovations

Recent Developments

- In October 2025, ASUS launched its latest ZenBeam L2 Mini Projector featuring Android TV integration and automatic keystone correction for seamless streaming.

- In August 2025, LG introduced a compact 4K laser pico projector with built-in AI voice control, targeting home cinema and travel segments.

- In March 2025, AAXA Technologies announced a partnership with Qualcomm to integrate Snapdragon-based processors for improved connectivity and battery efficiency in future projector models.