Photography Equipment Market Size

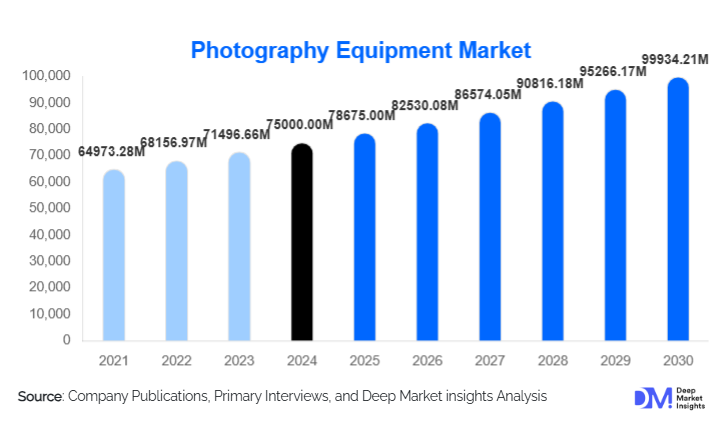

According to Deep Market Insights, the global photography equipment market size was valued at USD 75,000.00 million in 2024 and is projected to grow from USD 78,675.00 million in 2025 to reach USD 99,934.21 million by 2030, expanding at a CAGR of 4.9% during the forecast period (2025–2030). Market growth is primarily driven by the rapid rise of content creation, increasing adoption of mirrorless systems, and advancements in AI-enabled imaging technologies that enhance both photography and videography workflows.

Key Market Insights

- Mirrorless cameras continue to replace DSLRs, driven by superior autofocus, compact size, hybrid photo-video capabilities, and strong creator adoption.

- Content creation remains the fastest-growing demand segment, fueled by YouTubers, vloggers, influencers, and independent filmmakers.

- Asia-Pacific dominates global market share, supported by a large enthusiast base, rising disposable incomes, and strong local manufacturing ecosystems in Japan and China.

- North America remains a high-value market due to strong professional photography, commercial studios, and premium gear adoption.

- Online retail continues to expand its lead as the primary distribution channel for photography gear, benefiting from transparent pricing and broader product availability.

- AI-driven imaging technology, including predictive autofocus, scene recognition, and computational photography, is reshaping product development and consumer expectations.

What are the latest trends in the photography equipment market?

AI-Enhanced Imaging Systems Transforming Workflow

AI is becoming a central feature in next-generation camera systems. Manufacturers are integrating advanced algorithms for subject detection, real-time tracking, low-light optimization, and automatic scene interpretation. These improvements significantly reduce manual effort while delivering near-perfect consistency for both stills and video. AI upgrades via firmware are strengthening long-term customer loyalty and extending product lifecycles. Cameras are also increasingly supporting cloud-based workflows for automatic backup, collaboration, and remote operation, aligning photography equipment with professional digital production pipelines.

Rise of Hybrid Photo-Video Gear for Creators

The global boom in short-form content, streaming, and cinematic vlogging is pushing manufacturers to build hybrid systems optimized for both still photography and high-resolution video. Features such as 4K/8K recording, log profiles, in-body stabilization, and high dynamic range are now standard. New accessories, including compact LEDs, smartphone-linked monitors, and creator kits, are expanding the ecosystem supporting content creators. This trend appeals strongly to Gen Z and millennial consumers who rely on visual content creation as a professional or personal pursuit.

What are the key drivers in the photography equipment market?

Expansion of the Global Creator Economy

The creator economy, spanning YouTube, TikTok, Instagram, and freelance digital media production, is fueling unprecedented demand for professional-grade cameras, lenses, stabilizers, microphones, lighting, and mobile accessories. Creators prioritize high-quality optics, portability, and hybrid capabilities, encouraging frequent upgrades and device specialization. Rising numbers of independent filmmakers and commercial content creators, especially in emerging markets, further accelerate premium gear adoption.

Technological Advancements and Premiumization

Advances in sensor technology, image stabilization, AI autofocus, and real-time processing are driving consumers toward higher-end imaging systems. Full-frame and APS-C mirrorless cameras with advanced autofocus and high-resolution sensors are increasingly preferred by both professionals and enthusiasts. Premium accessories such as cine lenses, gimbals, and modular lighting kits contribute to ecosystem-driven revenue growth, while improved smartphone integration and wireless workflows expand the use cases for professional gear.

What are the restraints for the global market?

Competition from High-Performance Smartphone Cameras

Rapid improvements in smartphone imaging capabilities continue to threaten the compact and entry-level camera segments. Multi-lens arrays, computational photography, and AI-driven enhancements reduce the need for dedicated cameras among casual users. This substitution effect limits growth in lower-value segments and shifts consumer spending to mid- and high-tier devices only when specialized performance is required.

High Cost of Professional Imaging Equipment

Premium full-frame cameras, cine lenses, advanced lighting systems, and professional accessories remain expensive, restricting adoption among hobbyists and price-sensitive consumers. Economic fluctuations and inflationary pressures can further delay upgrade cycles. Developing markets experience additional challenges due to import duties, limited local distribution, and currency volatility, which increase retail prices and reduce accessibility.

What are the key opportunities in the photography equipment industry?

Creator-Centric Ecosystems and Subscription Models

Companies are increasingly offering product bundles tailored for creators, including cameras, lights, stabilizers, microphones, and editing software. Subscription-based acquisition models, providing cameras and accessories on a monthly fee, reduce upfront costs and expand access for aspiring creators. Software-enabled features, cloud platforms, and AI-assisted editing present additional recurring revenue opportunities, transforming photography equipment into a broader service ecosystem.

Expansion into Emerging Markets with Growing Middle-Class Demand

Rising incomes, digital adoption, and youth-driven creator communities in India, Southeast Asia, Latin America, and parts of Africa present major growth opportunities. These markets value affordable yet feature-rich cameras, offering room for mid-range APS-C and compact mirrorless systems. Local manufacturing partnerships and region-specific product strategies can help brands reduce costs and expand market penetration.

Product Type Insights

Mirrorless cameras dominate the photography equipment market due to their compact size, enhanced autofocus, and superior hybrid imaging capabilities. They are widely preferred by both professional photographers and content creators, making them the fastest-growing segment. DSLR cameras continue to decline but still maintain relevance among traditionalists and budget-conscious users. Lenses, including prime, zoom, and specialty optics, represent a high-margin segment with consistent demand, as users often upgrade optics more frequently than camera bodies. Accessories such as lighting systems, stabilizers, bags, and audio equipment are growing steadily as content creation expands. Action cameras and drones also contribute to the market, offering niche options for adventure and aerial photography.

Application Insights

Content creation and videography represent the fastest-growing application segment, driven by demand for high-quality video, live-streaming capabilities, and social media content production. Professional photography, including commercial, wedding, and portrait work, continues to hold a substantial share due to high equipment requirements and frequent upgrades. Amateur and hobbyist segments also contribute meaningfully, supported by the availability of mid-range mirrorless cameras and affordable lenses. Aerial photography through drones is expanding quickly, particularly in real estate, tourism marketing, and creative industries. Industrial, scientific, and medical imaging applications, while smaller, sustain demand for specialized cameras and sensors.

Distribution Channel Insights

Online retail channels dominate photography equipment sales, offering price transparency, a wider assortment, and direct-to-consumer efficiencies. E-commerce platforms such as Amazon, B&H, and manufacturer websites play a major role in global distribution. Offline specialty stores continue to thrive in major cities, providing hands-on experience, expert consultation, and premium product showcases. Rental platforms and subscription-based equipment providers are growing quickly, enabling creators and studios to access high-end gear without heavy upfront costs. Influencer-driven reviews and social media marketing are increasingly shaping purchase decisions, particularly among younger consumers.

End-User Insights

Enthusiast and hobbyist photographers represent a broad user base seeking affordable yet high-performance gear. Professional users, including commercial photographers, filmmakers, and studios, drive high-value purchases in cameras, lenses, and lighting systems. Content creators, vloggers, and independent filmmakers form the fastest-growing user group, emphasizing portability, hybrid functionality, and creator-focused accessories. Institutional users such as media houses, educational institutions, and scientific organizations contribute a stable demand for specialized imaging systems.

| By Product Type | By Application | By Distribution Channel |

|---|---|---|

|

|

|

Regional Insights

North America

North America remains a major market for photography equipment, supported by strong professional demand and a large creator ecosystem. The U.S. leads in commercial photography, film production, and YouTube content creation, driving adoption of premium mirrorless systems, cine lenses, and lighting rigs. Online sales are particularly strong in this region, with customers prioritizing brand reliability and advanced features such as AI autofocus and 8K video recording.

Europe

Europe exhibits steady demand, driven by professional studios, advertising agencies, and a robust enthusiast community. Key markets include Germany, the U.K., and France. Sustainability-conscious consumers are increasingly favoring durable, repairable equipment and eco-friendly accessories. European creators are strong adopters of mirrorless systems, especially for documentary, wedding, and travel photography. The region’s well-developed retail and distribution channels support stable growth.

Asia-Pacific

Asia-Pacific leads the global photography equipment market, supported by manufacturing hubs in Japan and China and expanding consumer markets in India and Southeast Asia. Rising social media activity, creator culture, and economic growth are major drivers. Japanese brands continue to dominate innovation, while China’s growing middle class is fueling demand for mid-range and premium camera gear. India and Southeast Asia are among the fastest-growing consumer bases for photography and videography equipment.

Latin America

Latin America is experiencing steady growth, with Brazil, Mexico, and Argentina leading adoption. Rising digital media consumption and the growth of influencer culture are encouraging purchases of compact mirrorless cameras, action cameras, and creator kits. Market challenges include price sensitivity and import duties, but increasing mobile creators and independent filmmakers are strengthening regional demand.

Middle East & Africa

Demand is rising in the Middle East, particularly in the UAE, Saudi Arabia, and Qatar, where high purchasing power supports premium photography gear adoption. Africa shows growing content creation activity, driven by Nigeria, South Africa, and Kenya, where filmmakers and influencers are adopting affordable mirrorless systems and drones. Regional photo and film industries are benefiting from government investments and expanding digital infrastructure.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Photography Equipment Market

- Canon

- Nikon

- Sony

- Fujifilm

- Panasonic

- DJI

- GoPro

- Leica

- Blackmagic Design

- Sigma

- Tamron

- OM System (Olympus)

- Hasselblad

- Ricoh (Pentax)

- Vitec Group (Manfrotto)

Recent Developments

- In March 2025, Sony introduced its next-generation AI autofocus system for mirrorless cameras, offering improved real-time tracking for wildlife, sports, and cinematic applications.

- In January 2025, Canon launched a new line of compact full-frame mirrorless cameras aimed at hybrid creators, featuring 8K video support and advanced computational imaging.

- In February 2025, DJI unveiled an upgraded drone-camera ecosystem with enhanced low-light performance, automated shot planning, and advanced safety features for aerial photographers.