Photochromic Snow Goggle Market Size

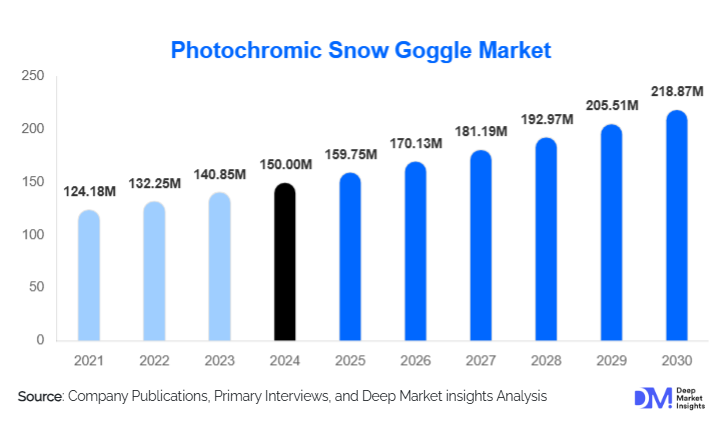

According to Deep Market Insights, the global Photochromic Snow Goggle Market was valued at USD 150 million in 2024 and is projected to grow from USD 159.75 million in 2025 to reach approximately USD 218.87 million by 2030, expanding at a CAGR of 6.5% during the forecast period (2025–2030). The market growth is driven by the rising popularity of winter sports, increasing consumer focus on UV and glare protection, and continuous advancements in adaptive lens technologies that enhance visibility and comfort in variable light conditions.

Key Market Insights

- North America dominates the global photochromic snow goggle market, supported by strong winter-sports participation and high per-capita spending on premium gear.

- Europe remains a core regional hub, with Alpine nations such as Switzerland, Austria, and France driving high-end demand through established ski tourism industries.

- Asia-Pacific is the fastest-growing region, driven by rising disposable incomes, new ski infrastructure in China and Japan, and increased winter-sports participation.

- Polycarbonate-based lenses account for over half of total production, favored for their lightweight, shatter-resistant, and cost-effective properties.

- Recreational users represent nearly 70% of total demand, as winter tourism and casual sports adoption expand beyond traditional alpine regions.

- Technological innovation, including faster transition photochromic lenses, enhanced anti-fog coatings, and integration with helmets and smart gear, is reshaping market competitiveness.

What are the latest trends in the Photochromic Snow Goggle Market?

Adaptive Lens Technology and Smart Integration

One of the most significant trends shaping the market is the continuous enhancement of photochromic lens technology. Manufacturers are developing lenses that transition faster between light and dark conditions, improving user safety and comfort during skiing or snowboarding. Some premium models integrate digital light sensors, anti-fog ventilation systems, and smart connectivity features such as temperature or UV monitoring. These innovations appeal to professional athletes and tech-oriented consumers seeking performance precision and personalization in their gear.

Rise of Rental and Subscription Models

Seasonal fluctuations in demand have prompted the emergence of rental and subscription-based business models. Resorts and gear retailers now offer premium photochromic snow goggles on short-term rental or membership plans, allowing travelers to access high-end products without upfront investment. This model benefits casual and occasional users, expanding product accessibility and supporting sustainable product lifecycle management through reuse and refurbishment initiatives.

Eco-friendly and Sustainable Manufacturing

Environmental consciousness is influencing material innovation, with brands adopting recyclable frames, bio-based coatings, and eco-certified packaging. European and North American manufacturers are particularly emphasizing sustainable production methods aligned with green sporting goods standards. As environmentally responsible tourism gains prominence, sustainability is becoming a key differentiator for photochromic snow goggle brands competing in the premium market.

What are the key drivers in the Photochromic Snow Goggle Market?

Growing Global Participation in Winter Sports

The increasing number of recreational and professional skiers, snowboarders, and mountaineers is fueling steady demand for adaptive eyewear. Government-supported initiatives promoting winter tourism in countries such as China, Japan, and South Korea are expanding the consumer base. The proliferation of indoor snow parks and artificial slopes further sustains year-round demand for photochromic snow goggles beyond traditional alpine regions.

Technological Advancements in Lens Materials

Ongoing R&D in photochromic lens materials has enhanced transition speed, optical clarity, and UV protection. Polycarbonate and Trivex lenses are gaining prominence due to their light weight and impact resistance. Premium models now combine anti-scratch, anti-fog, and hydrophobic coatings, improving durability and visual performance, thereby encouraging consumers to upgrade from conventional lenses.

Rising Health and Safety Awareness

Consumers are increasingly aware of the harmful effects of UV and glare exposure in snowy environments, including snow blindness and eye fatigue. As a result, there is a strong shift toward adaptive, protective eyewear that ensures consistent visibility in varying light conditions. This awareness, reinforced by brand marketing and ski resort safety campaigns, continues to drive global adoption of photochromic snow goggles.

What are the restraints for the global market?

High Product Costs and Limited Affordability

Photochromic snow goggles are significantly more expensive than traditional fixed-lens alternatives. For price-sensitive consumers, particularly in emerging markets, this premium limits mass adoption. The high cost of advanced coatings, R&D, and materials contributes to retail prices that remain out of reach for casual or infrequent skiers.

Seasonal Demand and Regional Dependence

Demand for snow goggles is heavily dependent on seasonal conditions and regional weather patterns. This cyclicality results in uneven production cycles and inventory challenges for manufacturers. Markets located outside primary snow-sport regions experience limited year-round sales, restricting broader market scalability.

What are the key opportunities in the Photochromic Snow Goggle Industry?

Expansion into Emerging Winter Sports Regions

Rapid growth in winter-sports infrastructure across Asia-Pacific and parts of Eastern Europe presents a lucrative opportunity. Governments are investing in ski resorts, training centers, and tourism campaigns that will increase equipment demand. Brands entering these new markets through partnerships with resorts, distributors, and online platforms can establish an early competitive advantage.

Integration of Smart and Connected Features

The convergence of sports technology and eyewear presents opportunities for innovation. Integration of light sensors, augmented reality displays, or connectivity with smartphones for performance tracking can redefine the user experience. Such advancements can open premium pricing segments while enhancing brand differentiation in a crowded market.

Growth of E-commerce and Direct-to-Consumer Channels

Digital retail expansion is reshaping sales strategies. Manufacturers are leveraging online platforms and direct brand websites to reach niche segments globally. This channel enables personalized marketing, faster product feedback, and streamlined distribution, helping brands capture tech-savvy consumers and reduce dependency on traditional retail stores.

Product Type Insights

Standard snow goggles (non-OTG) dominate the global market, accounting for approximately 70% of total revenue in 2024. They cater to the majority of users who do not wear prescription glasses and prioritize lightweight, comfort-oriented designs. Meanwhile, OTG (Over-The-Glasses) models are gaining traction among prescription users, supported by ergonomic innovations and rising demand for versatile fit options. Both segments benefit from ongoing design refinements, enhancing ventilation and anti-fog performance.

Application Insights

Skiing applications represent the largest share of the market at roughly 40% of global demand in 2024. The segment’s dominance stems from high global participation in skiing and the critical need for visibility and glare protection under rapidly changing alpine lighting conditions. Snowboarding and mountaineering follow closely, with adoption driven by increasing preference for high-performance adaptive lenses among younger, style-conscious consumers. Recreational snowmobiling and casual slope activities form an emerging niche contributing to additional market growth.

End-use Insights

The recreational and amateur segment commands nearly 65–70% of total market revenue. Growing winter tourism in emerging markets and the availability of affordable entry-level gear are expanding this user base. Professional athletes and competitive teams, although a smaller share, drive innovation and high-margin sales through the adoption of premium, specialized goggles with superior optical precision. Rental operators and tourism companies are increasingly contributing to demand through bulk purchases for equipment fleets, reinforcing export-driven growth for manufacturers in Europe and North America.

| By Lens Type | By Application | By Distribution Channel | By End-User | By Region |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America holds the largest market share at approximately 35% in 2024, equivalent to USD 50–55 million. The United States leads demand due to a mature ski industry, high consumer spending power, and a strong preference for premium brands. The region’s extensive resort network in Colorado, Utah, and British Columbia sustains consistent product turnover and replacement demand.

Europe

Europe follows closely with around 30% of global share, led by countries such as Switzerland, France, Austria, and Italy. Europe’s well-established alpine tourism and strong retail presence of premium eyewear brands make it a stable and lucrative market. Emphasis on sustainable and eco-certified manufacturing aligns with regional consumer preferences for quality and environmental responsibility.

Asia-Pacific

Asia-Pacific is the fastest-growing region, representing about 20% of the global market in 2024 and forecast to grow at a CAGR exceeding 8%. China, Japan, and South Korea are key growth engines, fueled by government-led investments in ski infrastructure and the rising popularity of winter sports among younger demographics. Expanding middle-class purchasing power and digital retail penetration further drive adoption.

Latin America

Latin America currently accounts for around 5–6% of the global market. While overall participation in snow sports remains limited, growing outbound tourism to North American and European ski destinations is gradually stimulating demand. Argentina and Chile, with localized ski resorts, offer modest domestic market opportunities.

Middle East & Africa

With a share of roughly 4–5% in 2024, this region’s demand is concentrated in high-income markets such as the UAE and Saudi Arabia, where artificial ski domes and luxury tourism projects are emerging. Africa’s participation is limited but steady, led by South Africa’s niche snow and mountain-sports community.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Global Photochromic Snow Goggle Market

- Oakley Inc.

- Smith Optics

- Uvex Sports GmbH & Co. KG

- Julbo Eyewear

- Bollé

- Giro Sport Design

- Scott Sports SA

- Dragon Alliance

- Zeal Optics

- Cebe

- Salomon Group

- Anon (Burton)

- Spy Optic

- POC Sports

- Ryders Eyewear

Recent Developments

- In May 2025, Oakley launched its latest high-speed transition lens technology for snow goggles, improving tint-change performance under low temperatures.

- In March 2025, Smith Optics partnered with ski resorts across Japan to supply rental fleets with eco-friendly, photochromic goggles made from recycled polymers.

- In January 2025, Julbo introduced its “REACTIV 2-4” lens series featuring enhanced anti-fog coatings and lightweight frames for professional athletes competing in alpine sports.