Pet Treats Market Size

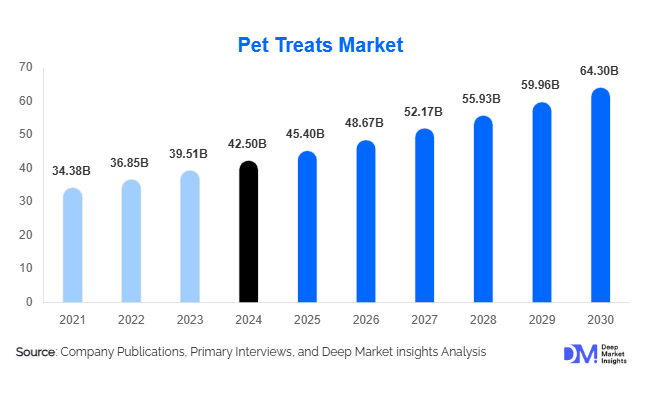

According to Deep Market Insights, the global pet treats market size was valued at USD 42.5 billion in 2024 and is projected to grow from USD 45.4 billion in 2025 to reach USD 64.3 billion by 2030, expanding at a CAGR of 7.2% during the forecast period (2025–2030). The pet treats market growth is primarily driven by rising pet ownership, increasing humanization of pets, growing demand for functional and premium treats, and the expansion of e-commerce channels facilitating direct-to-consumer sales of specialized products.

Key Market Insights

- Functional and health-oriented treats are gaining traction, as pet owners seek snacks that provide dental care, digestive health, joint support, and immunity enhancement for their pets.

- Premiumization is shaping consumer demand, with natural, organic, and high-protein treats preferred by pet owners in North America and Europe.

- Online retail is emerging as a dominant distribution channel, offering convenience, subscription models, and personalized recommendations to increase product penetration.

- Dogs continue to dominate the market, accounting for approximately 65% of the global market revenue in 2024, driven by higher spending and a larger population relative to other pets.

- Asia-Pacific is the fastest-growing region, fueled by urbanization, rising disposable incomes, and increased awareness of pet health and wellness.

- Technological adoption, including e-commerce platforms, personalized marketing, and AI-based product recommendations, is transforming consumer engagement and purchase behavior.

Latest Market Trends

Humanization and Premiumization of Pet Treats

Pet treats are increasingly being positioned as premium lifestyle products rather than mere snacks. Pet owners are demanding high-quality ingredients, natural and organic formulations, and functional benefits that align with human food trends. Products fortified with probiotics, vitamins, minerals, and other health-enhancing ingredients are rapidly gaining popularity. In addition, premium packaging, subscription models, and themed treat assortments are being introduced to appeal to a more sophisticated, experience-focused consumer base.

E-commerce and Digital Sales Channels

Online sales of pet treats are expanding rapidly, especially in developed markets such as the U.S., Germany, and the U.K. Digital platforms enable manufacturers to reach niche audiences, offer subscription-based delivery, and provide personalized recommendations. AI-powered systems help identify purchasing patterns, suggest appropriate treatment types, and optimize marketing strategies. Social media and influencer campaigns are increasingly shaping consumer preferences, particularly among younger pet owners who prioritize convenience, quality, and health-focused products.

Pet Treats Market Drivers

Rising Pet Ownership

The global increase in pet adoption, particularly for dogs and cats, is a key driver of market growth. Nuclear families, urban households, and millennials with disposable incomes are fueling higher demand for snacks and treats. Pet ownership growth is especially notable in North America and the Asia-Pacific region, creating sustained opportunities for both mass-market and premium products.

Health and Wellness Focus

Pet owners are increasingly prioritizing health and nutrition, leading to a surge in functional treats aimed at dental care, weight management, and immune support. Veterinarians and pet nutritionists are actively recommending such products, contributing to higher consumer trust and repeat purchases. Functional treats also appeal to pet owners seeking long-term wellness solutions rather than simple indulgence products.

Humanization of Pets

The growing perception of pets as family members drives demand for premium, organic, and natural treats. This trend encourages product innovation, including designer treats, holiday-themed offerings, and gourmet snack lines. Humanization also supports higher margins, as consumers are willing to pay a premium for products that enhance pet well-being and enjoyment.

Market Restraints

Raw Material Price Volatility

Fluctuating costs of meat, grains, and specialty ingredients affect profit margins and pricing strategies. Manufacturers must manage supply chains effectively and consider alternative sourcing to mitigate risk. Price sensitivity among certain consumer segments may limit growth in some regions.

Regulatory Challenges

Strict regulations on pet food safety, labeling, and ingredient standards, particularly in Europe and North America, can slow product launches and increase compliance costs. Navigating these regulations is essential for market entrants and existing players to maintain operational efficiency and consumer trust.

Pet Treats Market Opportunities

Functional and Health-Oriented Treats

Growing demand for functional treats offers manufacturers opportunities to introduce innovative products that improve pet health. Supplements for digestion, dental care, joint support, and immunity are increasingly popular, with strong potential for premiumization. Companies investing in R&D to develop scientifically-backed formulations can capture high-margin segments.

Emerging Markets Expansion

Asia-Pacific, Latin America, and the Middle East are witnessing rapid growth in pet ownership and disposable income, creating opportunities for new entrants. Tailoring products to local tastes, cultural preferences, and dietary habits can help brands capture market share. Strategic partnerships with local distributors and e-commerce platforms can further accelerate market penetration.

Digital Retail Growth

Online platforms and subscription models provide convenient access to specialized pet treats, enabling manufacturers to reach untapped customer segments. Integration of AI for personalized recommendations and targeted marketing increases consumer loyalty and encourages repeat purchases. Expanding digital presence is a key strategy to remain competitive in the modern pet treat landscape.

Product Type Insights

Chews and bones dominate the global pet treats market, accounting for approximately 30% of revenue in 2024. Their sustained popularity is driven by long-lasting usage, repeat purchase behavior, and functional benefits such as dental care, which makes them a preferred choice for dog owners seeking both entertainment and oral health. Biscuits and cookies closely follow, valued for their affordability, long shelf life, and ease of distribution, making them accessible to a broad consumer base. Soft treats are increasingly preferred for training, interaction, and positive reinforcement, particularly among cat owners, while jerky and functional/health-oriented treats are experiencing robust growth due to the rising demand for gourmet, wellness-focused, and high-protein options. Functional treats, emphasizing digestion, immunity, and joint health, are benefiting from pet owners’ growing awareness of preventive healthcare. Premium meat-based options and natural/organic formulations continue to gain traction, reflecting the broader humanization trend, as consumers increasingly seek high-quality, chemical-free treats for their pets.

Animal Type Insights

Dogs represent the largest segment, accounting for approximately 65% of global revenue in 2024. Growth in this segment is largely driven by high demand for dental and functional treats that promote overall wellness, reflecting both frequent purchase cycles and premiumization trends. Cats contribute around 20% of the market, with strong growth fueled by soft, palatable treats that support dietary preferences and digestive health. Small animals, birds, and exotic pets collectively make up the remaining 15%, representing a niche yet growing segment with specialty treats tailored for unique dietary and behavioral needs. These segments are increasingly targeted through customized formulations, limited-edition products, and specialized marketing campaigns, contributing to innovation across the industry.

Distribution Channel Insights

Online retail and e-commerce platforms account for roughly 25% of global pet treats sales, propelled by convenience, subscription models, and personalized recommendations that encourage repeat purchases. Supermarkets and hypermarkets remain vital for mass-market reach, offering widespread accessibility for mainstream products. Specialty pet stores and veterinary clinics are key channels for premium, functional, and therapeutic treats, providing personalized advice and curated selections. Convenience stores contribute to regional accessibility, particularly in emerging markets. The ongoing digital transformation, including mobile apps and AI-driven product suggestions, is reshaping distribution strategies and allowing brands to maintain direct engagement with increasingly health-conscious and tech-savvy pet owners.

| By Product Type | By Animal Type | By Distribution Channel | By Ingredient Type | By Price Segment |

|---|---|---|---|---|

|

|

|

|

|

Regional Insights

North America

North America dominates the global pet treats market with a 45% share in 2024. The U.S. leads adoption of premium and functional treats due to high pet ownership, rising discretionary spending on pet wellness, and extensive e-commerce penetration. Canada also demonstrates steady growth, particularly in urban centers with a strong preference for health-focused and natural/organic products. The region’s growth is strongly driven by rising consumer awareness of preventive pet healthcare and the willingness to invest in high-quality treats, supported by advanced retail infrastructure and specialty store networks.

Europe

Europe accounts for 22% of the global market, with Germany, the U.K., and France serving as major contributors. Stringent pet food regulations, coupled with health-conscious consumer behavior, are driving demand for natural, organic, and functional treats. The functional segment, including dental, immunity, and weight management products, is experiencing significant growth due to regulatory emphasis on pet food safety and quality assurance. Strong distribution networks, widespread adoption of e-commerce, and growing consumer preference for premiumization further support regional expansion. Additionally, rising interest in humanized pet products and sustainable ingredient sourcing continues to fuel product innovation and market penetration.

Asia-Pacific

Asia-Pacific is the fastest-growing region in the global pet treats market, primarily driven by rapid urbanization, the expansion of nuclear families, and increasing disposable income among pet-owning households. Countries like China, India, Japan, and Australia are key growth markets, with China and India showing double-digit growth in premium and functional segments. Rising pet adoption and awareness of pet health and wellness are boosting demand for specialized, high-quality treats. E-commerce adoption and digital marketing platforms are accelerating access to international brands and niche products, creating significant opportunities for both global and local manufacturers to expand their presence.

Latin America

Brazil and Mexico are the leading markets in Latin America, driven by growing pet ownership and heightened awareness of pet nutrition. Urbanization and increasing middle-class incomes are enabling broader access to premium and functional treats. Online retail is rapidly expanding, complementing traditional distribution channels and improving product accessibility. Regional growth is supported by consumer education on pet health, emerging veterinary channels, and adoption of functional products targeting dental, digestive, and immunity needs.

Middle East & Africa

Although smaller compared to other regions, the Middle East & Africa are an emerging market for pet treats. South Africa leads in premium and functional treat adoption, while the UAE and Saudi Arabia are key markets in the Middle East due to high-income populations and lifestyle-driven consumption. Growth is fueled by increasing disposable income, expansion of organized retail channels, and rising awareness of pet health and wellness. Urbanization and the humanization of pets are also contributing to a stronger demand for natural, organic, and functional treats across these regions.

| North America | Europe | APAC | Middle East and Africa | LATAM |

|---|---|---|---|---|

|

|

|

|

|

Key Players in the Pet Treats Market

- Mars Inc.

- Nestlé Purina

- Colgate-Palmolive

- Spectrum Brands

- WellPet LLC

- Hill's Pet Nutrition

- Blue Buffalo

- Diamond Pet Foods

- Big Heart Pet Brands

- Affinity Petcare

- Central Garden & Pet

- JM Smucker

- PetSmart (private label)

- Champion Petfoods

- Arden Grange

Recent Developments

- In March 2025, Mars Inc. launched a new line of functional dog treats focusing on joint health and digestive support in North America.

- In February 2025, Nestlé Purina introduced organic and natural cat treats in Europe, responding to rising demand for health-conscious pet products.

- In January 2025, Blue Buffalo expanded its online subscription model across Asia-Pacific, offering curated premium treat boxes for dogs and cats.